Part

01

of one

Part

01

Cannabis Retailer Scorecard: Ajax / Napanee (2)

Key Takeaways

- Drinking and tobacco usage for Ajax and Napanee is higher than average usage in Ontario.

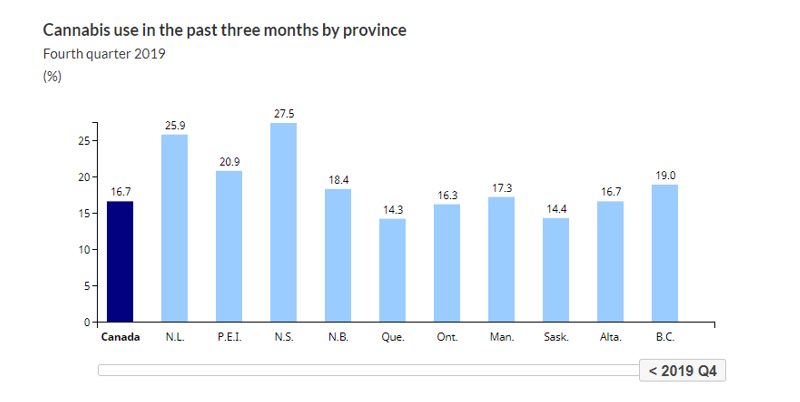

- KFL&A's most recent cannabis figures are from 2012, it is realized they may not be the most useful numbers, and that current Ontario statistics will be more relevant. They are shared to show that statistically, Cannabis consumption in Ajax in considerably higher. 47.5% of adults had used cannabis. This is statistically higher than in Ontario at 42.8%.

- Canadian Millennials that consume cannabis are far more tech-forward than Millennials who do not partake. "They are more likely to use smart watches, smart speakers, and mobile wallets. And they're more involved in digital media like social networks and online streaming services."

Introduction

A comprehensive psychographic profile of residents of Ajax and Napanee in Canada has been provided in the below research.

Ajax is part of the Durham region, and Durham lies within Ontario. Therefore, statistical information for Ajax is taken from Durham. Napanee is served by Napanee is served by KFL&A for their health services (Kingston, Frontenac and Lennox & Addington area). Napanee is also within Ontario. Therefore, statistical information for Napanee is taken from KFL&A.

For each category, separate information is provided for Ajax and Napanee. Due to the date of the most recent information for these areas, a third section has been added for Ontario, since they have more current information.

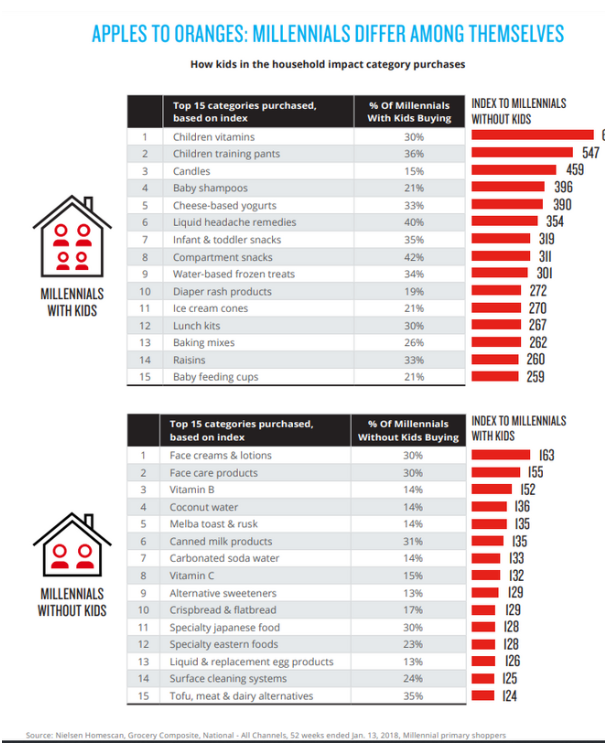

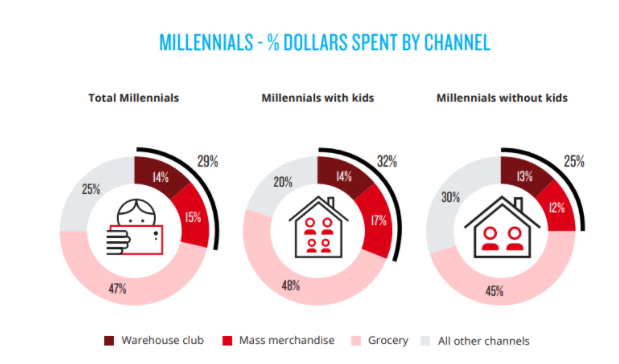

Since the average resident in Ajax, as taken from the demographics, is a Millennial that is married, research also focused on psychographics that dealt with Millennials in Canada. Marketing research, which provides much of the behavioral characteristics in a psychographic focuses on a much larger demographic than the government does, which makes sense, because they are focused on making a profit. Therefore, behavioral statistics like beliefs, spending, and hobbies are for Canadian Millennials, since this is the best group to use as a proxy for the demographic.

For general interests in Napanee, research focused on Canadian Gen Xers since the average age in this area is 49.

Ajax Demographics Used

To develop a psychographic profile, an average individual was developed that represented Ottawa from demographics compiled of completed Wonder research and Statistics Canada. They are as follows:

- Gender: Female

- Age: 37.6

- Children: Yes

- Marital Status: married

- Education: Completed High School

- Income: $95,949

Napanee Demographics Used

To develop a psychographic profile, an average individual was developed that represented Ottawa from demographics compiled of completed Wonder research and Statistics Canada. They are as follows:

- Gender: Female

- Age: 49

- Children: Yes

- Marital Status: married

- Education: Completed High School

- Income: $64,213

Psychographics

Alcohol Use- Ajax

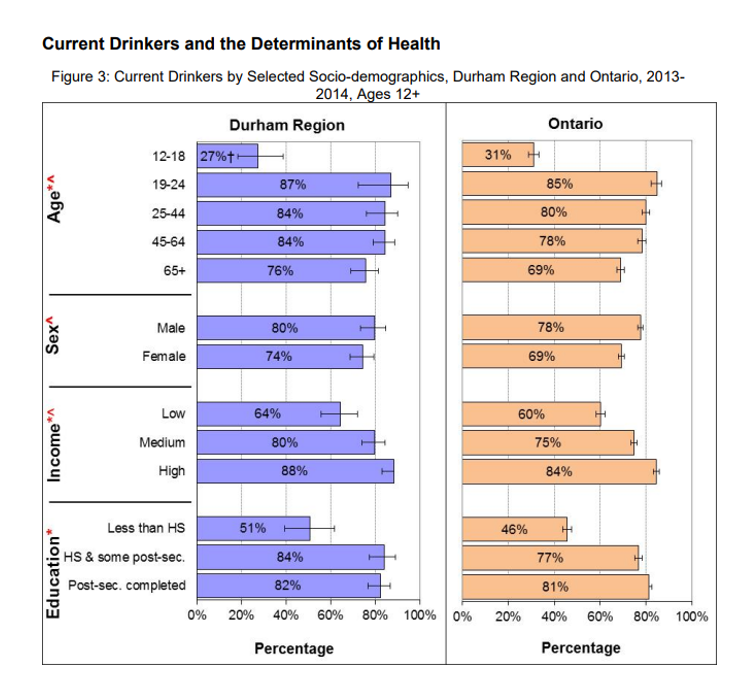

- According to the Durham Region Health Department's most current data, 76% of the residents in Durham aged 12 and over were current drinkers, reporting they have had a drink in the last year. "Those 19 to 64 years old, especially 19 to 24 year olds, males, as well as people with higher income and education were more likely to be current drinkers."

- 23.9% reported heavy drinking at least once per month.

Alcohol Use- Napanee

- According to KFLA's most recent data from 2014, 70.9% of males, and 61% of females reported having at least one drink in the last 12 months.

- Heavy drinking rates for males are higher for Napanee when compared to Ontario:

Alcohol Use- Ontario

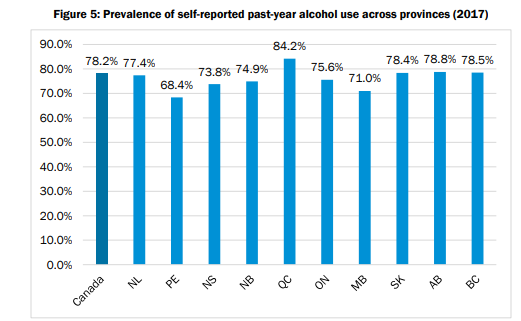

- Prevalence of alcohol consumption in Ontario during 2017 was at 75.6%.

Smoking Use- Ajax

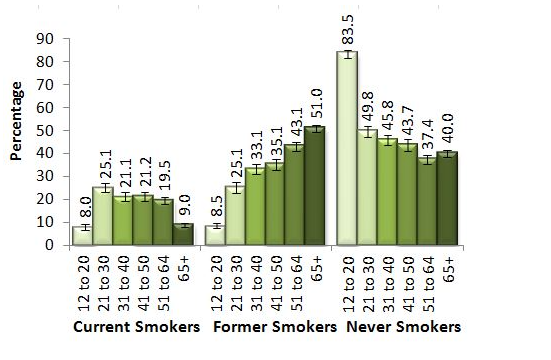

- In 2018, 14% of Durham's residents were smokers.

- Adults aged 25-44 had the highest smoking rate (21%), followed by those aged 45-64 (16%).

- The smoking rate is higher for males (19%) than females (11%).

Smoking Use- Napanee

- In 2014, 20.7% were smokers. 39.3% smoked 10 cigarettes per day or less, while 30.5% smoked 20-25 per day.

Smoking Use- Ontario

- In 2019, 13.87% reported they smoked occasionally. This is lower than the national average of 14.8%.

- In 2017, 18% of those 12 and older reported using tobacco in the last 30 days.

Recreational Drug Use- Ajax

- Durham did not report recreational drug use except for hospitalizations.

- Cannabis related hospitalizations in Ajax are higher than in other areas in Ontario. "One-in-ten (10%) of the hospitalizations was due to cannabis poisoning while 14% were due to mental and behavior disorders related to cannabis use, such as intoxication, harmful use and dependence. In the remaining 76% of hospitalizations, cannabis was not the most responsible diagnosis for the hospitalization but was listed as a comorbidity."

Recreational Drug Use- Napanee

- KFLA's most recent cannabis figures are from 2012, it is realized they may not be the most useful numbers, and that current Ontario statistics will be more relevant. They are shared to show that statistically, Cannabis consumption in Ajax in considerably higher. 47.5% of adults had used cannabis. This is statistically higher than in Ontario at 42.8%.

- 2012 Consumption during the past 12 months:

- Illicit drug use by drug type:

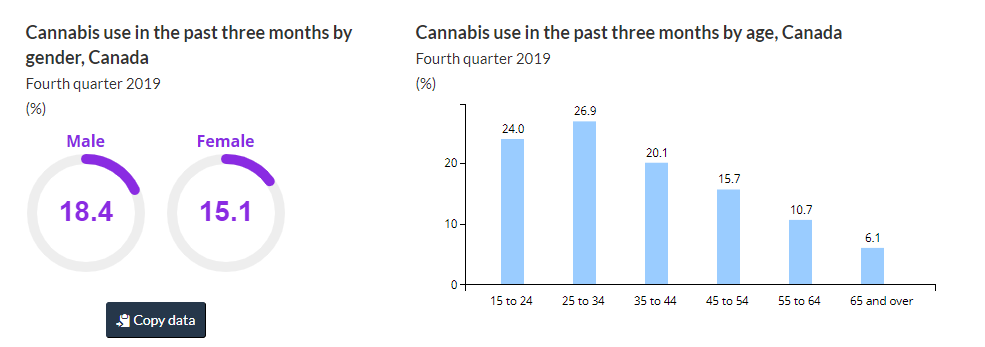

Recreational Drug Use- Ontario

- The number and percentage of consumers that accessed cannabis from each source in Ontario (2019): grown by the user (5.5%), illegal (40.1%), only legal (34.3%), and friends and family (31.4%).

General Health- Ajax

- In 2014, the most current data available, 58% reported they were active or moderately active during their leisure time.

- 57% were overweight or obese.

- 12% had consulted with a mental health professional in the last year. Of all the public health units in Ontario this number ranged from 8-18%.

- 19% reported they felt stressed on most days in the past year.

General Health- Napanee

- In 2014, 29% of adults considered themselves active and 46% considered themselves inactive.

- 52.9% reported having a strong sense of community belonging, while 18.5% reported having a very strong sense.

- 44% reported they were in very good health, while 11.9% reported they were in fair or poor health.

- 70.8% reported their mental health was excellent or very good. 7.3% reported their mental health was fair or poor.

General Health- Ontario /Canada

- In Canada, those with fair or poor mental health are more likely to report an increased use of cannabis, alcohol, or tobacco.

General Psychographics- Ajax (Canadian Millennials)

Beliefs/Values

- More than half of Canadians are Christians, and 29% are unaffiliated, according to Pew Research. 64% stated that research had a less important role in their life than it did 20 years ago.

- According to Ipsos, Millennials want to feel like they are unique and appreciate personalized communications.

- 81% are proud to be Canadian because it is multiculturally diverse. 76% state that it is accepting, and 69% cited how compassionate their country was.

- The Canadian Millennial is, for the most part, socially conscious and appreciates when a brand takes a stand.

- 49% of Canadian Millennial cannabis users buy brands that show others they are successful, compared to 40% of non partakers.

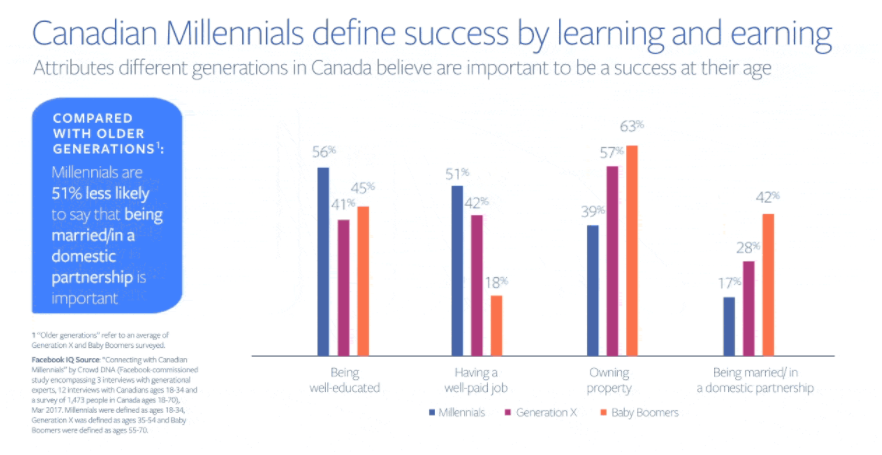

- This group defines success by learning and earning:

Media Habits

- More than 33% reported in an Ipsos Quebec survey of all Canadians that they had purchased something using their mobile phone in the last month.

- 46% of Millennials in Canada will use an ad blocker.

- 91% read business reviews online.

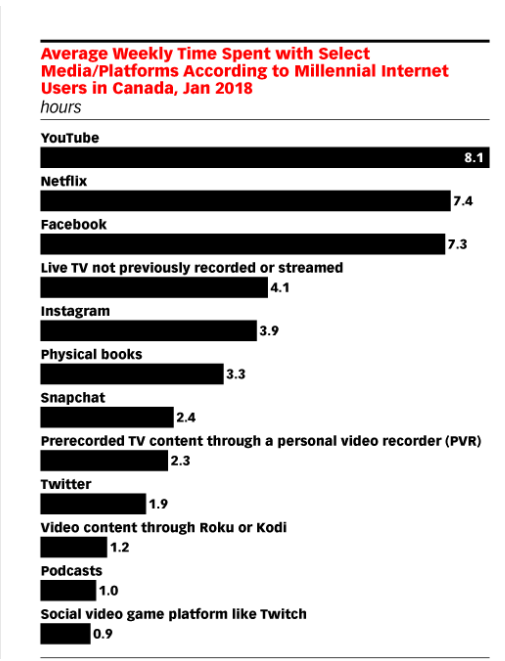

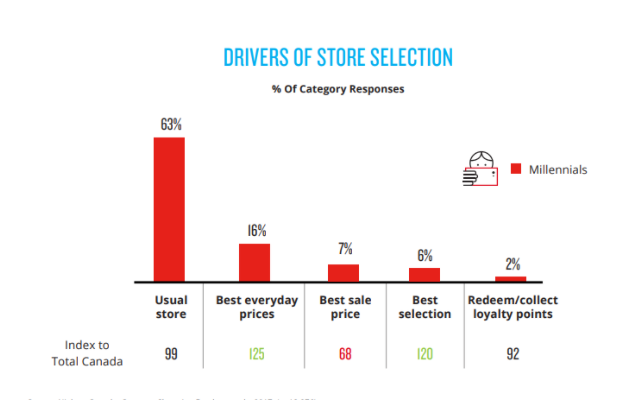

- Canadian Millennials that consume cannabis are far more tech-forward than Millennials who do not partake. "They are more likely to use smart watches, smart speakers, and mobile wallets. And they're more involved in digital media like social networks and online streaming services."

Spending- Cannabis

- Millennials are the largest consumer base of cannabis. When it comes to selecting their products they are highly educated when it comes to what they want and consider cannabis to be a wellness product.

- They appreciate an experience and cannabis shopping is no exception. 40% state that bud tender recommendations were influential in their purchases.

- Half of Canadian cannabis smokers spend $100 a week, on average.

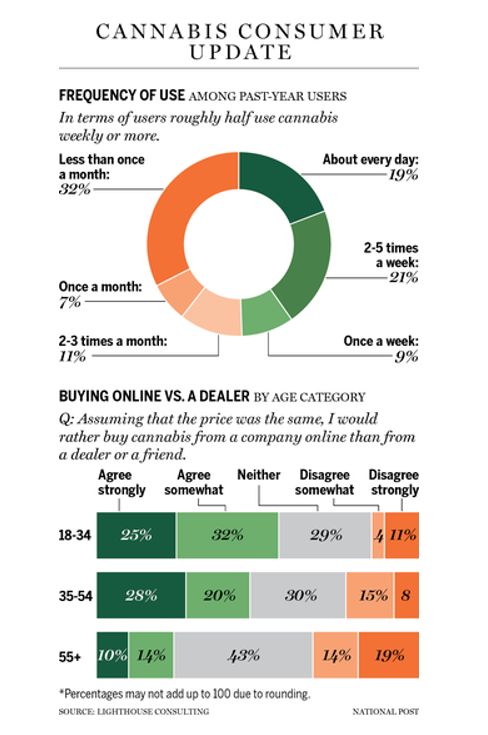

- 54%, according to Deloitte, purchase from legal sources, but the graph below shows a strong preference for buying from a dealer or a friend:

- For those that do buy from a friend or a dealer, they do so because it is cheaper (76%), more convenient (37%), better quality (32%), more trusted (32%), and more options (21%).

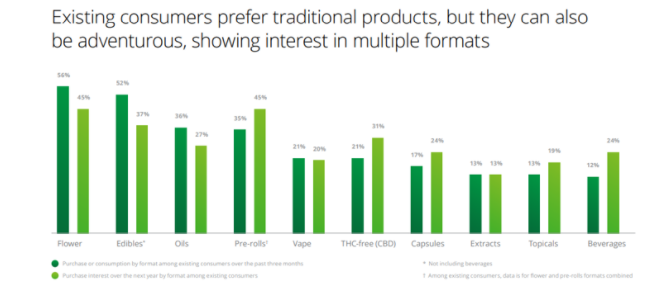

- Dried flower (56%) and edibles (52%) are the most popular options for the Canadian Millennial that consumes cannabis.

Spending

- Over 66% of Millennials in Canada will spend more on traveling than they do on exercise, wellness, health, or clothing.

- They spend approximately $55.45 per shopping trip. This is $7 more than the Canadian average.

- This group spends more than other Canadians on comfort purchases like clothing, steaming services and going out to eat.

Hobbies / Leisure Activities

- 55% of Millennial Canadian cannabis consumers keep up with the latest food trends.

- Some things that the female Millennial in Canada is interested in are cooking, pop culture, and beauty. 9.8% state they go to music festivals and nightclubs. Some of her favorite brands are Sephora and Nutella.

- Males, on the other hand, "are interested in ice hockey and basketball. This signifies that they have a strong passion for sports and like to keep up with business industry trends. The Canadian Millennial male enjoys drinking Red Bull and Coors Light. Eminem, Lil Wayne, and Kanye West are their most listened to music artists which express their interest in music genres similar to hip-hop."

General Psychographics- Napanee (Canadian Gen X)

Beliefs/Values

- 64% feel it will be their responsibility to take care of their aging parents.

- 18% have the pressure of raising kids while looking after their parents.

- 48% feel they are part of a vanishing middle class.

- 80% state that a work life balance is important.

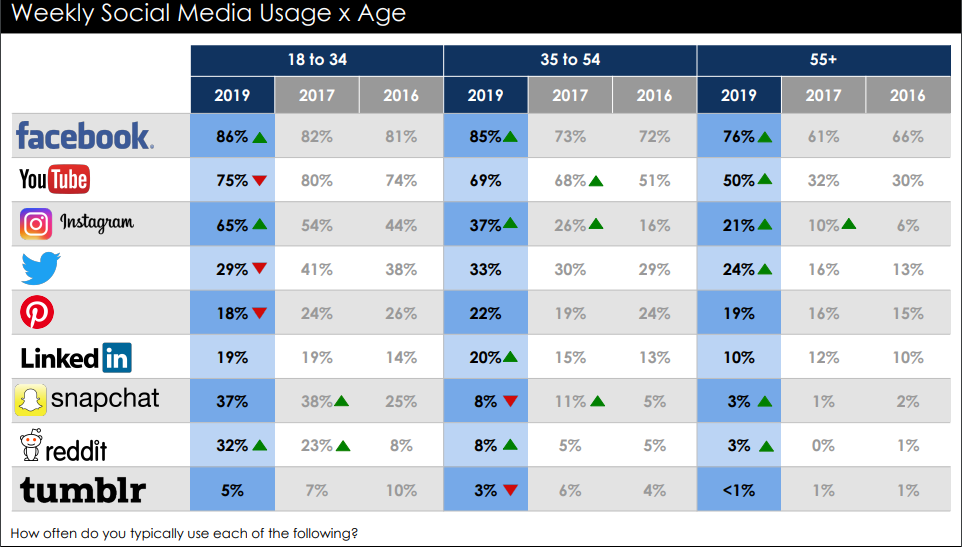

Media

- 31% use wearable tech.

- 66% report they own a tablet.

- 81% have Facebook accounts.

- 71% subscribe to traditional television.

- 90% listen to the radio.

- According to Yahoo, online topics that are most consumed are: weather (68%), news (62%), music (50%), travel (39%), sports (35%) and finance (33%).

- Canadian media usage by age:

Spending/Usage- Cannabis

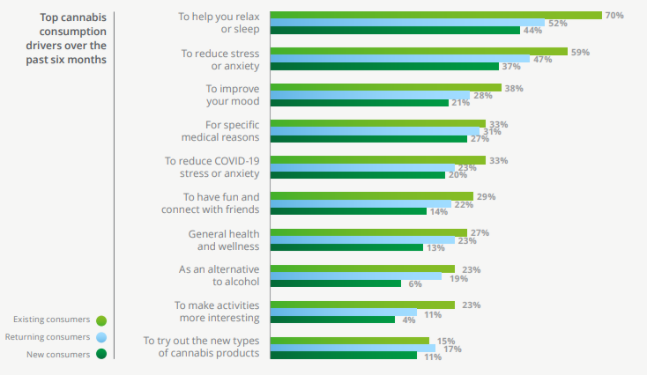

- 70% that use cannabis state that it helps them relax.

- 19% have increased their cannabis budget during the pandemic.

- 30% prefer to buy their cannabis online.

Spending

- 27% believe that advertising is not aimed towards them and does not reflect their experiences. This means they have a difficult time connecting to brand or product.

- 68% want to see the merchandise when they are visiting a store.

- "58% are more likely to buy from a retailer or brand that offers customized products. 49% are tempted by limited edition products and 34% by collaborations with influencers.

- 44% prefer to shop in a physical store.

- 68% are more likely to shop from a store or company with a rewards program.

- 42% state they are more likely to buy from a brand that offers a charitable donation with their purchase.

Hobbies/Leisure

- This group has a strong interest in DIY projects.

- They spend over 12 hours per week watching traditional and streaming television.

Research Strategy

For this research on Cannabis Retailer Scorecard: Ajax/Napanee, we leveraged the most reputable sources of information that were available in the public domain, including public health department statistics, Statistics Canada, Deloitte, and Pew Research. Please note, some sources were used that were from 2016-2018 because they were the most current statistics available.