Part

01

of fourteen

Part

01

Which countries have had the most recessions and what’s the typical lifecycle of those recessions? (Part 1)

Key Takeaways

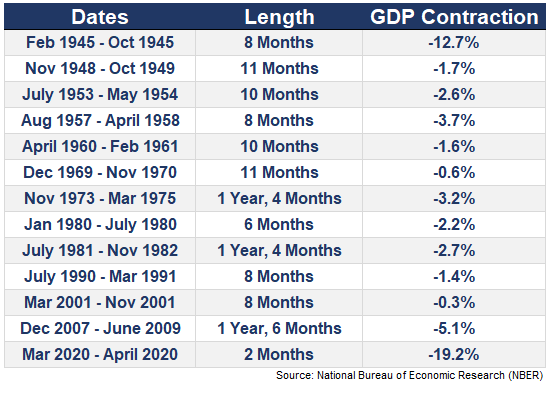

- Since the Own Goal Recession of 1937-1938, the US has suffered 14 official recessions, making it the country with the highest number of recessions.

- Canada comes second with 11 recessions, excluding the Great Depression, since November 1937. Since 1970, recessions in Canada have occurred at the same time as recessions in the US.

- Since the end of the Great Depression, the UK has had eight recession periods from 1956 to 2020.

Introduction

The report contains a list of the top three countries with the highest number of recessions and two with the highest cumulative number of years spent in recessions. There is no precompiled public or paywalled report listing countries with the highest number of recessions in recent times. Therefore, we compiled a list comprising countries that have had seven or more recessions in the last century and included two countries with the longest time in recession so far, Libya and Iraq. More information on the strategy employed is available in the Research Strategy section.

United States of America

- Following the Great Depression, the US suffered 14 recessions between 1937 and 2021. The average length of its recessions is 10.4 months.

- The length of recessions in the US has fallen since the Gulf War recession of 1990-1991. However, the Great Recession of 2007-2009 took its toll and stretched over 18 months. The US has had only one recession since then, which lasted only two months.

- Of all 14 recessions, the 2-month COVID-19 recession caused the highest unemployment rate in the US. Unemployment hit 14.7% in April 2020, up from 3.5% in February 2020.

- By December 2021, the US had spent $5 trillion on pandemic relief, bringing the unemployment rate down to less than 4%.

- The V-Day Recession of February 1945-October 1945 caused the worst GDP decline. In the eight-month duration of the recession, the US GDP dropped by 10.9%.

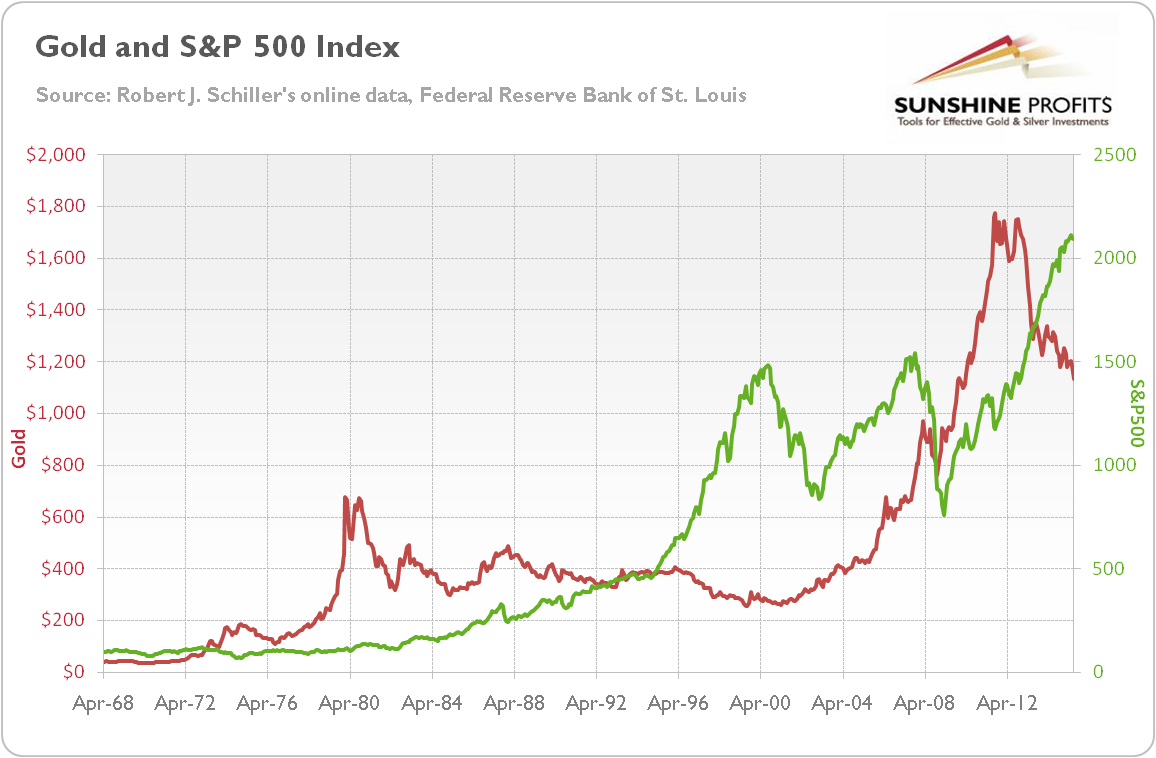

- All recessions listed in this report, excluding the COVID-19 recession, coincided with 14 bear markets in the US. The bear market refers to a “sustained drop of 20% or more from a market peak.”

Canada

- Canada has suffered 11 recessions since 1937 and five since 1970, eight of which coincided with recessions in the US. Since 1970, recessions in both countries have happened around the same period, showing that both economies are “highly synchronized.”

- The average length of Canada's recessions is 10.2 months. The length of recessions in the country became shorter during the 1974 – 1975 recession. However, The 1990-1992 recession took its toll and spread over 27 months.

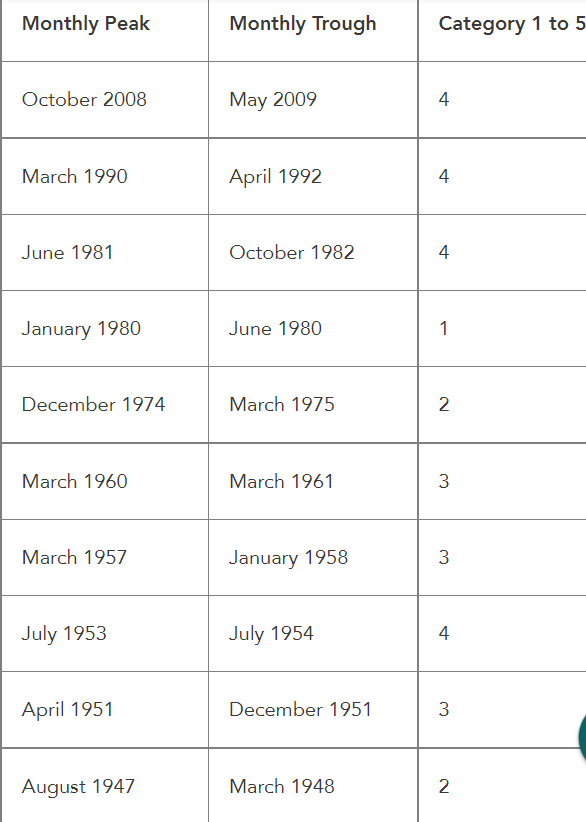

- Based on the classification system developed by the C.D. Howe Institute’s Business Cycle Council, the January 1980-June 1980 recession is the only Category 1 recession in Canada's history. It had only a “mild drop in GDP and no decline in quarterly employment.”

- There was also a recession between 2014 and 2015 due to the oil price crash. This led to a 0.1% shrinkage in the country's GDP in the second quarter of 2015.

- According to C.D. Howe, Canada also went into recession in 2020. As of March 2020, over a million jobs were lost.

United Kingdom

- Between 1956 and 2020, the UK suffered eight recessions, the first of which was caused by rising inflation, high bank rates, and major political ructions.

- The average lifecycle of its recessions is 9.75 months. The longest of these are the recessions of the early 1980s, early 1990s, and the Great Recession.

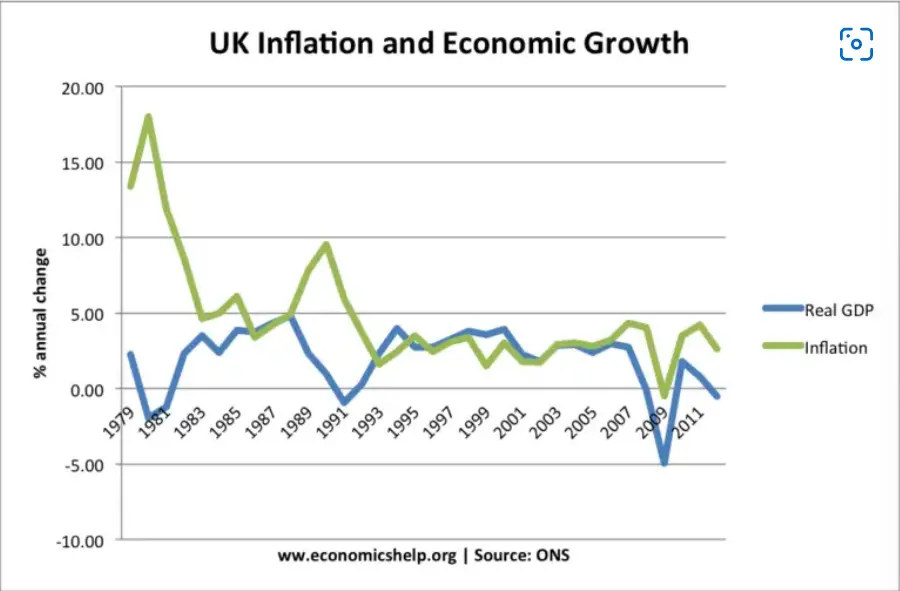

- The early 1980s recession, which lasted from 1980 to 1981, caused a five-quarter contraction in the country's GDP. In 1980, the economy contracted by 2%.

- The recession in the early 1990s raised the country's inflation rate to almost 10%. The UK also suffered rising unemployment and interest rates.

- The COVID-19 pandemic caused its GDP to fall by 2.2% in the first quarter of 2020. Between April and June in the same year, it shrank further by 19.4%.

Libya

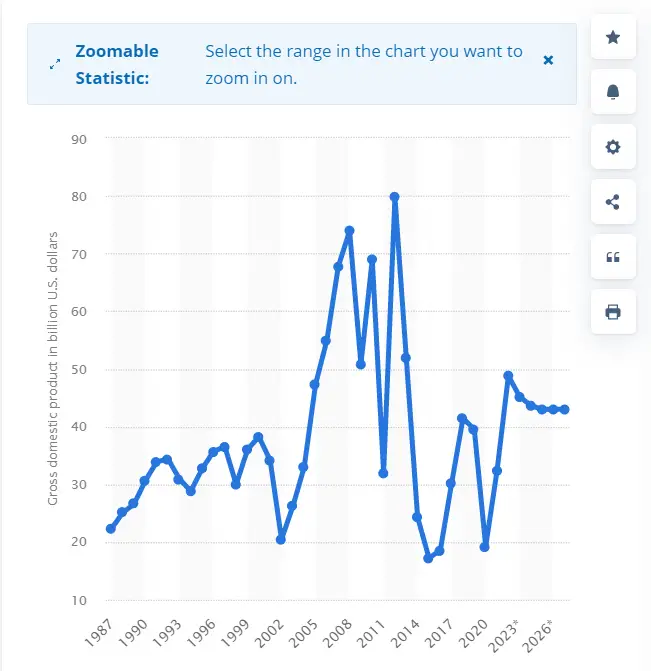

- Libya has the highest number of years spent in recession. It has posted the highest number of years of negative GDP growth since 1951.

- Regarded as a failed state, Libya has had negative GDP growth for 27 of its 75 independent years.

- Since the fall of the Muammar Gaddafi regime, the country has been in constant conflict. The war has caused the nation 783.2 billion Libyan dinars from 2011 to 2021.

- In 2020, according to IMF estimates, the country's GDP shrank by 66.7%. The economy has since shown signs of recovery.

- Since the Great Recession of 2008-2009, Libya has had negative GDP growth in 2011, 2013, 2014, 2015, 2019, 2020, and 2021.

- Based on the image above, the lifecycle of its recessions is getting longer.

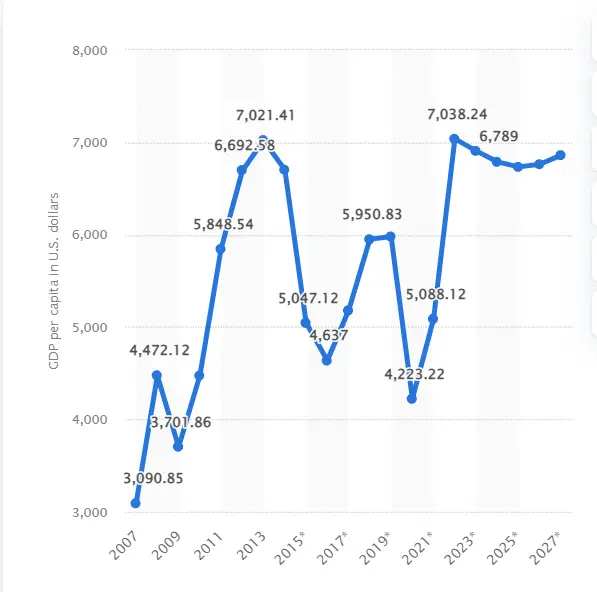

Iraq

- Coming after Libya, Iraq has suffered 24 years of recession. Regarded as a failed state, Iraq has had negative GDP growth for 24 of its 64 independent years.

- It suffered one of its longest recessions between 2014 and 2016. Since recovering from the COVID-19 pandemic, the country has shown signs of recovery.

- Considering that the COVID-19 recession is one of its shortest in a while, the lifecycle of recessions in Iraq is getting shorter.

Calculations

Average Length of Recessions in the US in Months

13+8+11+10+8+10+11+16+6+16+8+8+18+2= 145 months

145 months / 14 recessions = 10.4 months

Average Length of Recessions in Canada in Months

8+8+9+13+11+13+4+6+5+27+8= 112 months

112 months / 11 recessions = 10.2 months

Average Length of Recessions in Canada in Months

6+6+9+6+15+15+15+6= 78 months

78 months / 8 recessions = 9.75 months

Research Strategy

In answering this request, the research team searched reputable databases on world economies, including the World Bank, IMF, and The Conference Board, among others. However, we found that there is no public or paywalled report containing the number of recessions faced by countries around the world. No news report, article, research paper, or publication has counted the number of recessions in each country of the world and ranked them accordingly.

We developed a creative strategy to compile a list of the top five countries with the highest number of recessions. We attempted to count the number of recessions in as many countries as we could within the time scope of this research. First, we set a benchmark of seven recessions in the last century. Then, starting from 1900, we counted the number of recessions faced by over 30 countries. This strategy produced the first three countries mentioned in this research, including the US, Canada, and the UK. These were the only countries that met the set benchmark.

Further research revealed a report from Statista ranking the countries which have spent the longest time in recession. Libya and Iraq, which topped this list, were included as the fourth and fifth countries in this research. We could not determine the number of recessions both countries have had due to limited information on the peak and through of past recessions. We also explored dated sources for historical data on recessions in various countries.

:max_bytes(150000):strip_icc():format(webp)/recessionsfigure-032522-b91ba309d29f4688ad1abc4d934eb496.jpg)

:max_bytes(150000):strip_icc():format(webp)/bear-markets-recessions-12-26-18-5c537d3546e0fb00012b984a.png)