Part

01

of one

Part

01

Watching Videos by Car Buyers

The automotive purchase journey has increasingly shifted online, with this trend accelerating as a result of the COVID-19 pandemic. As consumers spend significant time conducting online research during the car buying process, online video communication has continued to be an important information source for prospective car buyers, influencing their purchase and driving them to dealerships. More advanced video technology, leveraging AR and VR, has also been well-received by consumers who are looking to gather detailed information about car features, learn about new automobiles offered by a dealership or manufacturer, and even test drive automobiles virtually from their homes. While research indicated less than half of dealerships currently leverage product-focused video on their website, case studies reveal some dealerships and manufacturers are seeing positive results from the use of online video on their websites and other social channels.

Automotive Customer Journey

- Automotive consultancy, GSM, provides an omnichannel automotive customer journey framework, starting with consideration (research and test drive), followed by purchase, service, conquest, and repurchase. The company notes that most initial research is conducted online.

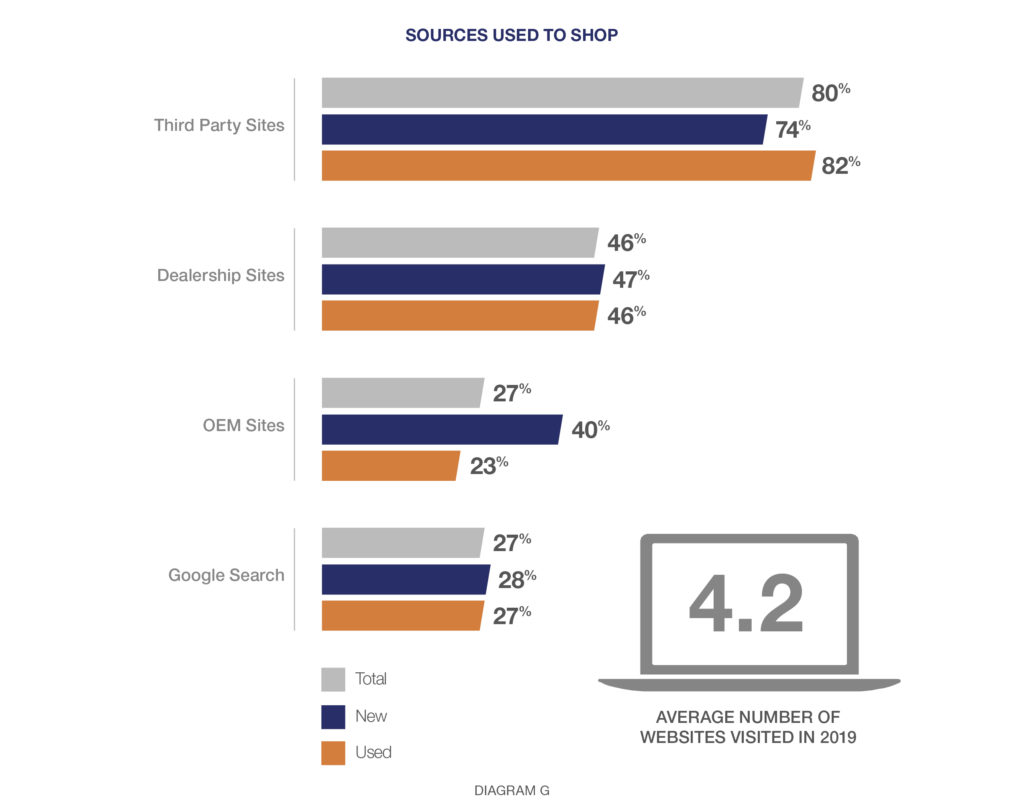

- A 2019 Cox automotive study found that 83% of automobile shoppers researched their vehicles online, spending just under 14 hours during the online research process. Dealership websites were used as an information source by 46% of those shopping for cars.

- The COVID pandemic has moved even more of the car-shopping process online, with 66% of prospective car buyers saying they would be "comfortable experiencing the vehicle (feature highlights, walkarounds) completely online or with a mix of online and offline."

- A Cox 2021 predictions survey found that 84% of franchised automotive dealers expect their customers to complete more of the purchase process online than ever before.

Role of Video in Automotive Purchase Process

- Online car experiences delivered through video, digital showrooms, and VR test drives, were ranked highly by car shoppers as "good alternatives to a dealer visit" in a 2020 Google survey and as one of 5 trends in the evolving automotive purchase process.

- 40% of prospective auto shoppers in a US Google/IPSOS survey noted that videos helped them "discover a vehicle they weren't previously aware of or considering," while more than half of auto shoppers said that online videos during the research process helped them "learn more about vehicles they were considering."

- Dealer Inspire, a dealership-focused analytics platform, notes that since the COVID pandemic, the average car buyer watches 19 videos prior to making an automobile purchase. The majority of videos are "walkaround" or review videos.

- The Cox survey found that "browsing vehicle images, pictures, and videos" were far more common on third-party sites (45%) compared to dealer sites (20%).

- An April 2020 Cox consumer and dealership pulse survey found that 42% of dealerships had noted an increase in consumer demand for "video deliveries or product demonstrations" from March to April 2020, though less than half (45%) of dealerships said they already offered these services.

Importance and Influence of Online Video in Automotive Purchase Process

- 2018 research by IPSOS/Google found that 60% of prospective car buyers in the US said they visited a car dealership after viewing a video of a vehicle online and 75% of car shoppers noted that online videos influenced their purchase.

- Dealer.com reports video as the second-most preferred format for shoppers learning about vehicles.

- Research conducted by Millward Brown/Google found that 70% of automobile shoppers who used YouTube as part of their car buying process were influenced by the content viewed, which included "test drives, features, and walk-throughs."

- Reinforcing the importance of video in the customer auto purchasing journey, the dealership marketing agency, L2TMedia reported 64 million test drives on YouTube versus 29 million on dealership lots. The agency also found that 64% of prospective car buyers who "watch online videos before purchasing say that new formats like 360° video would convince them to buy a car without an initial test drive."

- A 2019 Google study found that the "watch time" of automotive test drive videos on YouTube grew 65% from 2017-2018.

- While commercial automobile-focused video generated the most YouTube views between 2017 and 2018 (11 million), 7.0 million car shoppers watched automotive highlight videos and 6.3 million viewed auto-focused digital film videos.

- FlowFound, a company offering 360 video production for dealerships, has experienced a 600% increase in sales since the pandemic due to growing dealership use of 360 video and virtual reality to offer virtual test drives.

Demographic-Specific Influence of Online Video in the Automotive Purchase Process

- A 2020 Nielsen study found that Hispanic audiences are even more responsive to online video in their automobile purchase journey, with heavy online video users (4+ hours per day) considering 5.2 automotive brands in their purchase process compared to 3.7 brands considered among light users.

- A Facebook study of the automotive path to purchase noted that men were more likely than women to consider automobile videos the most useful content type when considering a car purchase.

Online Video Case Studies: Automotive Manufacturers and Dealerships

- A Ford dealership realized a 38% increase in in-store visits while leveraging FlowFound 360 online video technology on their website and Connected TV +in-store augmented reality technology to track visits.

- While not dealership-specific, Hyundai Germany leveraged a Facebook and Instagram video campaign to drive awareness of its overall brand as well as its "greener" models, reaching an audience of 12.6 million, increasing awareness by 4.6 points, and lifting ad recall by 11 points.

- Kansas-based dealership, Mel Hambelton Ford, experienced an 82% increase in-store traffic from a YouTube and display ad campaign featuring "specific videos targeting Ford shoppers, specific bodystyles & competing OEMs."

- Ford (the manufacturer) also leveraged 360-degree video technology to showcase their 2018 Ford Expedition on Ford.com, along with related video content on YouTube, with a goal of strengthening engagement with the brand and driving shoppers to dealerships.

- Ford had conducted their own research prior to the campaign, suggesting 84% of prospective auto buyers planned to watch auto videos when shopping for their next vehicle and "shopping for their next vehicle via video walkarounds, test-drives, and owner overviews was as useful as visiting the original equipment manufacturer’s site." The research also indicated that greater immersion in the product online resulted in consumers being"more excited than they would be in visiting a dealer on their own."

- Ford "created a 360-degree VR video feature that resided on Ford.com and allowed shoppers to educate themselves about the vehicle, explore each of its three rows, and virtually test drive it from their couches. In addition, “hotspots” in the content allowed users to access additional information on amenities."

- The company found that shoppers who engaged with the VR feature on the website were more than twice as likely to conduct additional research on the automobile.

Research Strategy

We reviewed surveys (e.g., Google, Millward-Brown, IPSOS), automotive-specific research agency studies (Cox, Nielsen), automotive-focused analytics and digital marketing agency insights, and dealership and auto manufacturer case studies to provide information and statistics showcasing the relevance, importance, and impact of online videos to consumers during the research and purchasing stages of the automotive customer journey. Case studies provided a sampling of business results from car dealerships and automotive manufacturers to further highlight the relevance and impact of videos in the consumer car buying process. We primarily relied on research from 2019-present in this research, though some survey information from 2018 was included given its usefulness and consistency with more recent findings. Much of the research uncovered was US-specific, though we included global information (such as "5 Trends Shaping the Auto Industry Approach to a New Normal") when relevant.