Part

01

of one

Part

01

In Vitro Diagnostics Market

The global market size of the in vitro diagnostics market was $83.4 billion in 2020 and it is calculated at $87.15 for 2021. It is expected to have a compound annual growth of 4.5% between 2021 and 2027. The United States comprises a large share of this market, with a market size estimated at $27.92 billion in 2021. The global reagents segment has a market size estimated at $55.3 billion in 2021 and it is the largest segment both worldwide and in the United States. Increasing growth of the geriatric population and the development of new diagnostic tools are some main growth drivers in the global market. Challenges for the United States market involve the high costs of equipment and maintenance and the lack of clarity in the context of reimbursement.

Global Market Size and Predicted Growth Rate

- Market Size and CAGR

- According to a January 2021 market analysis report performed by Grand Review Research, the global market size for in vitro diagnostics (IVD) in 2020 was $83.4 billion.

- In addition, the compound annual growth rate (CAGR) between 2021 and 2027 would be 4.5%. This means that the market size for 2021 would be $87.15 billion.

- Using this same CAGR, the market size for 2022 will be $91.07 billion, for 2023 it will be $95.17 billion, $99.46 billion for 2024, and $103.93 billion for 2025.

- Breakdown by Products

- The reagents segment accounted for 63.5% of the market revenue, which corresponds to $52.9 billion of the $83.4 billion estimated for 2020 and $55.3 billion for 2021.

- This corresponds with what has been reported by Allied Market Research, establishing that the reagents segment has been growing steadily, amassing the majority of the market share.

- A report using 2019 data estimated that the services segment accounted for 10.5% of the total market. Assuming this percentage holds true for 2020, this would represent $8.7 billion and it would correspond to 9.1% of the 2021 total.

- Both the reagents and the instruments segments are expected to have rapid growth. This report by Allied Marekt Research appears to provide the market size of all three product segments; however, the information is behind a paywall.

- These growth trends are supported by a second report by Market Data Forecast, according to which the instruments segment will continue to grow in the upcoming years. Additional market size information specific to these products is similarly behind a paywall.

- A third report by fortune Business Insights provides similar information, stating that the instruments segment will continue to grow steadily in the near future. Specific market size estimates can only be accessed through a paywall.

United States Market Size and Predicted CAGR

- Market Size and CAGR

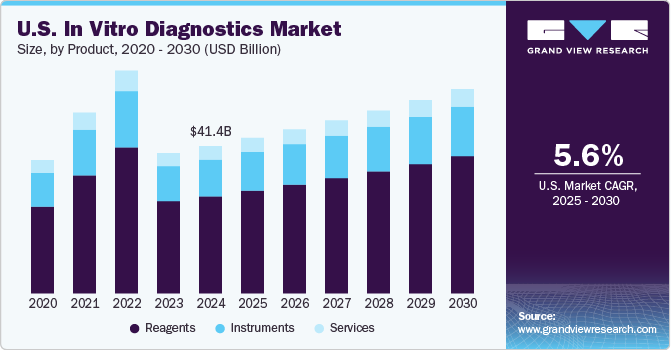

- The market size of the United States in vitro diagnostics industry was $25.32 billion in 2019 according to a Grand View Research report.

- With a CAGR estimated at 5% during the 2020 to 2027 period, this would mean that the market size for 2020 was $26.5 billion and the market size for 2021 is estimated at $27.92 billion.

- Using this same CAGR, the market size would be $29.3 billion by 2022, $30.78 billion by 2023, and $32.3 billion by 2024.

- Breakdown by Products

- Similar to the global market, the reagents segment represented 64.88% of the total share in 2019. Assuming this holds true for 2020, this would represent $17.1 billion, and $18 billion in 2021. This prevalence over the other two segments has been a constant during the past years.

- This same report by Grand View Research places the instruments segment as the second-fastest regarding growth. More detailed information regarding this segment and the services segment is only available behind a paywall.

- A second report by Market Data Forecast provides information focused on the entire North American market. Information regarding reagents, instruments, and services segments appears to be provided in detail. However, access is restricted through a paywall.

- A third report by consulting company Industry Arc also appears to provide detailed information corresponding to the aforementioned segments for North America. That said, information can only be accessed through a paywall.

Primary Growth Drivers in the In Vitro Diagnostics Market

Global

- Increased Geriatric Population

- According to a report by the United Nations, 727 million people were aged 65 years or older in 2020. This number is expected to at least double by 2050, which is mainly driven by decreasing fertility levels and increased life expectancy.

- Different In Vitro Diagnostics (IVD) market reports place this as one of the main growth drivers in the upcoming years. There is a high prevalence of chronic conditions among the geriatric population, which need to be diagnosed and monitored.

- Some of the most common chronic diseases suffered by this age group include cardiovascular disease, type 2 diabetes mellitus, and cancer.

- In addition, the immune system becomes more vulnerable with age; therefore, there is an increased risk of suffering infectious diseases.

- The growth of the elderly population consequently leads to an increase in the prevalence of these infectious diseases, which need to be diagnosed.

- New Technology Advances

- Advanced technologies are being quickly developed and adopted in the IVD market. Gene level diagnostics have become increasingly popular as has awareness of these tests among the medical community and the general population.

- These advances have also been reached at the molecular and proteomic levels, with the discovery of new biomarkers that could be used to diagnose and monitor chronic diseases, further fueling the growth of this market.

- The inclusion of polymerase chain reaction (PCR) diagnostics, as well as next-generation sequencing, are also part of the technological advances driving the market.

- In addition, there has been an increase in automation at the laboratory level, which streamlines the production of these tests. This is considered one of the main drivers of technological advances in this context.

- These devices are easier to use, which would increase demand from laboratories as well as hospitals. Hospitals hold the largest share in the market, and their demand for automated IVD tools is expected to continue to drive the growth of the market.

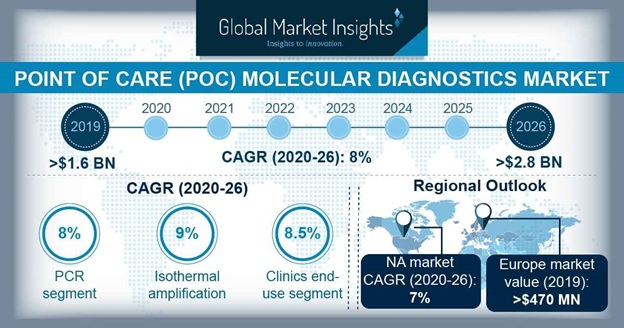

- Increased Demand for Point-of-Care Diagnostics

- Point-of-care (POC) diagnostics refer to tests made close to the patient, being at their bedside during a medical consult, hospitalization, or at their home.

- These tests have become an important part of expedient healthcare and they are more widely accepted than ever as the focus changes from centralized testing to POC testing.

- This increased adoption of point-of-care tests is what has led it to become a growth driver of the IVD market.

- Continued launch of new POC devices and advancements in making them as easy to use as possible is expected to continue in the upcoming years. There have already been advances in optimizing these types of tests to make them as small and practical as possible.

- Increased demand for these tests has been observed worldwide, with hospitals and medical practitioners in emergency rooms leading the adoption of this technology.

- Furthermore, this driver is additionally fueled by the growing interest in personalized medicine, which is all the more possible with the use of rapid and efficient POC tests.

United States

- Increase of Chronic Diseases

- The prevalence and incidence of chronic diseases in the United States have been rising continuously. The American Cancer Society reported that approximately 1.9 million new cancer cases would be diagnosed during 2021, with over 600,000 cancer deaths taking place.

- In addition, 60% of adults in the United States suffer from a chronic disease. Alarmingly, 40% of them suffer from two or more chronic illnesses.

- This drives the demand for IVD as the diagnosis and monitoring of these illnesses as soon as possible is what can make the difference between timely healthcare intervention and late diagnosis and management.

- Furthermore, there is growing awareness regarding the importance of early diagnosis not only among healthcare practitioners but also the growing population, which is expected to continue driving demand.

- As research on this topic continues, new IVD tools are expected to be launched, which would further fuel the growth of this market in the United States.

- Presence of Key Market Players

- The local presence of some of the biggest players in the market has been considered one of the key growth drivers in the United States.

- Some top global players that are located in the country include Abbott Laboratories, Danaher Corporation, Thermo Fisher Scientific, LabCorp, and Genomic Health. In addition, foreign companies also market their IVD products in the United States.

- Therefore, this leads to a higher rate of local development and product launches, which further fuels the growth of the market in the country.

- In addition, due to how highly competitive this market is and how difficult it is for new players to enter and establish themselves, these big laboratories are expected to continue to hold large shares of the market.

- Increased partnerships between key players could also be one of the growth drivers in the upcoming years. These partnerships extend beyond collaborations between key players.

- Some of these key players have started to partner with healthcare systems in the country to provide access to IVD in hospital settings, looking to provide more cost-effective alternatives, which will continue to drive growth in this market.

- Increased Healthcare Expenditure

- Another driver of growth in the United States IVD market is the increased expenditure in healthcare, which originates at different levels.

- The government, NGOs, and the general population are increasing their healthcare investment, leading to a higher demand for new healthcare technology at all levels, including IVD.

- In addition, this is a healthcare system that is well-established, which allows for a more streamlined process of new IVD tool deployment.

- Furthermore, there has been a larger investment in hospital infrastructure, which is also expected to increase IVD demand in the country.

- Lastly, as demand for IVD among older adults and patients suffering from chronic diseases increases, funding provided by the United States to cover the healthcare needs of these patients allows for further growth of the market.

Challenges Faced by the In Vitro Diagnostics Market

Global

- Regulatory Considerations

- One of the main challenges faced by this market is the regulatory processes involved in the approval and use of new IVD tests.

- The approval process is considered stringent in most cases. In addition, regulation varies from country to country, making this an even more complex scenario for the IVD market.

- In addition, there are aftermarket regulatory concerns. As this fast-moving market evolves, the regulations regarding the use and monitoring of IVD technology will evolve as well.

- Furthermore, it has been observed that there are constant changes to these regulations, making it more difficult for players in the market to achieve full compliance.

- In Europe, what used to be directives have now changed and become regulations. While this change was first issued in 2017, the deadline for compliance approaches. Furthermore, new changes could be suggested after the 2022 deadline established by the European Commission.

- Achieving compliance with these new European regulations has also been more difficult due to the COVID-19 pandemic, which could lead to key players falling behind or the extension of the period of grace if the European Commission determines it is needed.

- Shortage of Skilled Personnel

- The need for skilled people that understand and can innovate in this highly technological market is also a challenge to overcome.

- According to a report by Research and Markets, the lack of sufficiently skilled personnel at laboratories is bound to affect the growth of the market.

- This has been observed as a challenge at all levels of the IVD market, including instrument automation in laboratories and point-of-care diagnostics.

- This has led to companies outsourcing their search for skilled personnel to be able to keep up with the fast growth of the market.

- Deficits in the education of physicians in the context of biomarkers have become a challenging aspect both for the development of this technology and for its adoption.

United States

- High Costs

- These tests are usually high cost, and installation of equipment also comes with a hefty price which is a limiting factor for the growth of the IVD market in the United States.

- Plus, maintenance of the equipment is also costly, which has become a challenge at the regional level. This is also compounded by the lack of skilled workers, a phenomenon that affects the global market and also has an impact on the regional market.

- In addition, fluctuation of economic strategies has been seen in the entire North American region, which is also a challenging scenario for players in the market.

- That said, there's an argument for the future cost-effectiveness of POC tests as the market continues to grow and more products are launched.

- Therefore, it becomes a matter of the key players overcoming the initial challenge of costly IVD tests and pushing through research and development to continue to the next stage in which more cost-effective options are provided.

- Unfavorable reimbursement

- Reimbursement considerations have become a challenge for this market, as unfavorable reimbursement could directly obstruct its growth.

- Medicare has recently changed its reimbursement system for IVD tests. Plus, the United States reimbursement system is the one that establishes what will be reimbursed.

- It has been determined that only commercial IVD tests are eligible for reimbursement, which is a problem for the market because due to the innovative nature of this technology, many of these tests are used for research and development purposes.

- This adds to the already existing uncertainty regarding IVD testing reimbursement, which, unlike other diagnostics, is rarely automatic with payers examining closely the purpose and use of the test in question.

- Unfavorable reimbursement and the high costs of IVD both lead to an important economic challenge that needs to be addressed at all levels.

Research Strategy

We have used a market size calculator to estimate the current and future market sizes of the in vitro diagnostics industry based on the 2020 market size and the estimated CAGR between the 2021 and 2027 period. A percentage calculator has been used to determine the market size of segments when only a percentage was provided by the identified reports. We searched through numerous market reports assessing the availability of a market size breakdown by product at the global and US level. However, no report provided complete details in this regard. In addition, we searched for information specific to the market share of reagents, instruments, and services without any positive results. We also searched through the annual reports of main US companies (e.g. Abbott, Danaher, ThermoFisher) looking for a breakdown of their sales and revenue that would allow for a partial triangulation with no positive results. Lastly, we focused on the entire North American region. While numerous reports mention these segments, additional information is only accessible through a paywall.