Part

01

of one

Part

01

Venture Capital Distribution

Key Takeaways

- In 2021, an estimated 3.84%, 1.46%, and 0.42% of VC deals went to black founders at the 'angel-seed,' 'early,' and 'late' stages, respectively.

- Black-founded startups received an estimated 2% of funding at the 'angel-seed' stage as of 2022.

- Black startups received approximately 2.13% and 1.1% of VC investment funds during the 'early' and 'late' stages, respectively, as of 2021.

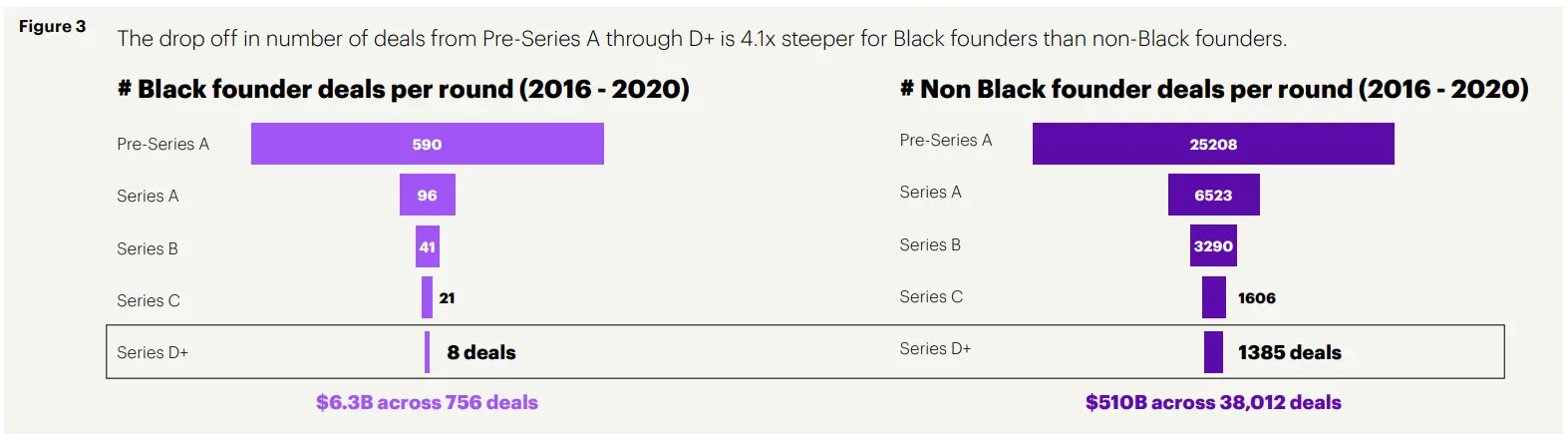

- According to Accenture, "the drop-off in the number of deals from Pre-Series A through D+ is 4.1x steeper for Black founders than non-Black founders," with non-whites getting approximately 1,385 deals compared to only 8 deals for Black founders in series D+.

Introduction

The research provided insights on the diversity of venture capital funding by funding type/round and race. These included identifying the percentage (by the number of deals & the dollar value) of venture funding that goes to Black founders, broken down by type of funding, and any comparisons available between venture funding to Black founders and other races e.g. White, Asian, etc. We focused on the racial diversity of startup founders receiving funding as opposed to the diversity of venture capitalists who give out funds.

Following our search, precompiled data on the percentage of venture funding that goes to Black founders broken down by type of funding was unavailable, we resorted to triangulation. During our search, it emerged that angel investors could be used interchangeably with seed investors; thus, we merged data points for angel and seed funding stages during our calculations. Moreover, given that a majority of data available combined angel and seed rounds and that Series A and B were also combined under 'early stage' VC funding, we resorted to providing data by 'angel-seed, early stage, and late stage categories as the types of funding instead of angel & seed and Series A & Series B, respectively. We used an online scientific calculator to complete all our computations. Details about our logic can be found in the research strategy section.

% of Venture Funding to Black Founders by Type of Funding

[I] By Number of Deals

- This year (2022), Black-founded startups received 1.9% of all deals, down from the 2.3% recorded in 2021.

- An estimated 3.84% [(255 deals/6,649 deals)*100] of 'angel-seed' VC deals went to black founders in 2021.

- Black-founded US companies secured roughly 1.46% [(78 deals/5,351 deals)*100] of VC deals at the 'early stage' in 2021.

- Only 0.42% [(21 deals/5,000 deals)*100] of the deals at the late stage of VC funding. This shows that VC funding deals are relatively many in 2021 at early stages than at late stages.

[II] By Dollar Value

- Crunchbase's data shows that this year (2022), Black startup entrepreneurs have received 1.2% of all US venture dollars investment, down from 1.3% in 2021.

- Black-founded startups received an estimated 2% [(0.1 billion/$5 billion)*100] of funding at the 'angel-seed' stage as of 2022. This was a decline from the approximately 7.04% [($0.2 billion/$2.84 billion)*100] figure in 2020.

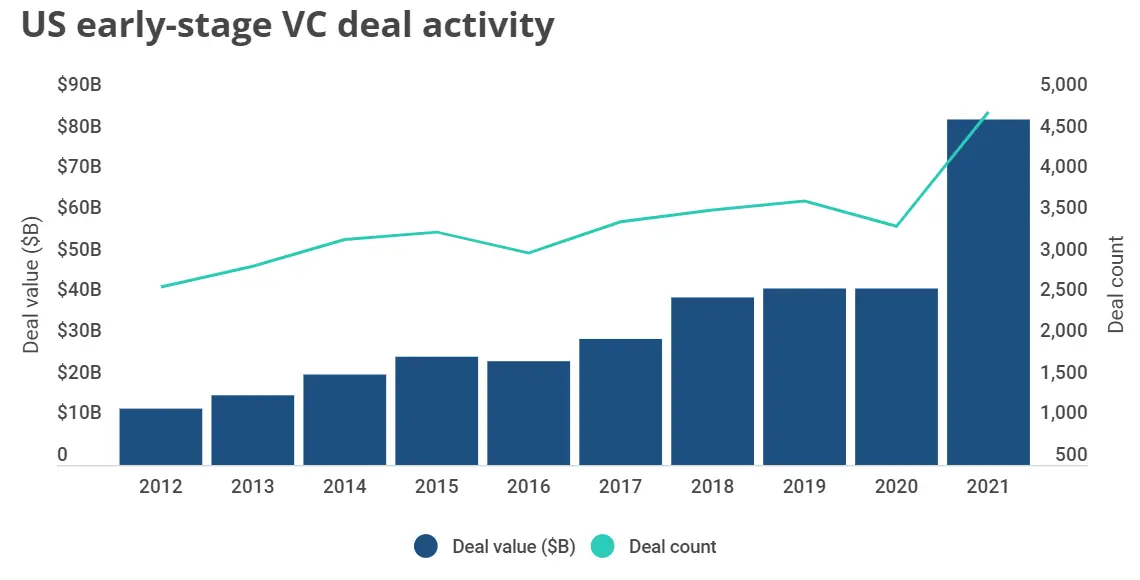

- An estimated 2.13% [($1.7 billion/$80 billion)*100] of the overall early-stage VC investment fund was received by Black startups as of 2021.

- In 2021, approximately 1.1% [($2.4 billion/$220 billion)*100] of late-startup funding went to black founders in their late stage.

Comparisons Between Venture Funding to Black Founders and Other Races

- According to Accenture, "the drop-off in the number of deals from Pre-Series A through D+ is 4.1x steeper for Black founders than non-Black founders."

- Between 2016 and 2020, non-whites got approximately 1,385 deals, compared to only 8 for Black founders in series D+.

- Unlike non-black founders with over $510 billion in VC funds received between 2016 and 2020, black founders only received $6.3 billion across 756 deals in VC funding during the same period.

Research Strategy

To provide the requested insights on the diversity of venture capital funding by funding type/round and race, we leveraged the most reputable sources of information available in the public domain, including Accenture, Investopedia, Quartz, Pitchbook, and Crunchbase, among others.

To meet research expectations, we focused on the racial diversity of startup founders receiving funding instead of the diversity of venture capitalists who gave out funds. Following our search, precompiled data on the percentage of venture funding that goes to Black founders broken down by type of funding was unavailable, we resorted to triangulation. Thus, we calculated the percentages with the data for the dollar value & deal counts for black investors and the overall US economy. During our search, it emerged that angel investors could be used interchangeably with seed investors; thus, we merged data points for angel and seed funding stages during our calculations. Moreover, given that a majority of data available combined angel and seed rounds and that Series A and B were also combined under 'early stage' VC funding, we resorted to providing data by 'angel-seed, early stage, and late stage categories as the types of funding instead of angel & seed and Series A & Series B, respectively. We used an online scientific calculator to complete all our computations.