Part

01

of one

Part

01

X-to-Earn Models - Market Overview

Key Takeaways

- The learn-to-earn concept is still out of mainstream adoption at this point in time with questions of sustainability in the model still lingering. Many companies are still in funding and development phases with businesses like Stemuli raising $3.25 million to develop its metaverse and Proof of Learn raising $15 million to develop its educational platform.

- The market development space for Web3.0 gaming and the play-to-earn model is considered to be "extremely huge" and to be the largest of the money-making models in the X2E industry. Even so, one author commented on Web3.0 and play-to-earn games saying that he thinks "it will be a long time before the mainstream gaming industry adopts Web3 in any meaningful way."

- The play-to-earn gaming model is focused on adults and rewards gamers with cryptocurrency or NFTs for playing a game that most users would already play for free. The CEO of Gallant Token, Steven Walters, says "that regular gaming could go the way of the dinosaur due to the play-to-earn gaming model." He also stated: "Mass adoption is underway, and major players in the gaming industry have begun to lay the groundwork for this new era of gaming."

- X2E models, including the play-to-earn model, are often criticized in the mainstream media as being Ponzi or pyramid schemes. The economic principles behind the projects are often called into question. This type of messaging does little to help the credibility of the models.

Introduction

This research provides an overview of the X-to-earn (X2E) markets. Included are case studies of the learn-to-earn and move-to-earn segments of the market. Following this, an examination is given of the growth drivers affecting the X2E market along with some challenges facing the market.

Case Studies on X2E

- This section examines two X2E models: learn-to-earn and move-to-earn. The learn-to-earn market is relatively sparse and still being developed and therefore lacks many metrics. Companies such as Coinbase, Rabbithole, CoinmarketCap, and Bitdegree, among others all offer learn-to-earn opportunities. The move-to-earn segment has experienced much more rapid growth and we have included STEPN and Step App as part of our case study for this model.

- Coinbase offers users the opportunity to earn cryptocurrency in exchange for engaging with short learning modules. The aim is to help users to discover and start using new digital assets. Coinbase profits from this model by receiving earnings from the issuer of the digital asset that the users are learning about.

- Edverse offers opportunities for both learners and educators to earn on the platform. The company aims to have the "most interactive, immersive, and insightful education metaverse." Edverse generates revenue from NFT sales and from promotors driving traffic to the platform to sell and rent digital learning spaces.

- Edverse offers a unique opportunity in addition to the learn-to-earn offering: wear to earn. Avatars within the metaverse can wear apparel from their favorite brands and earn credits and tokens.

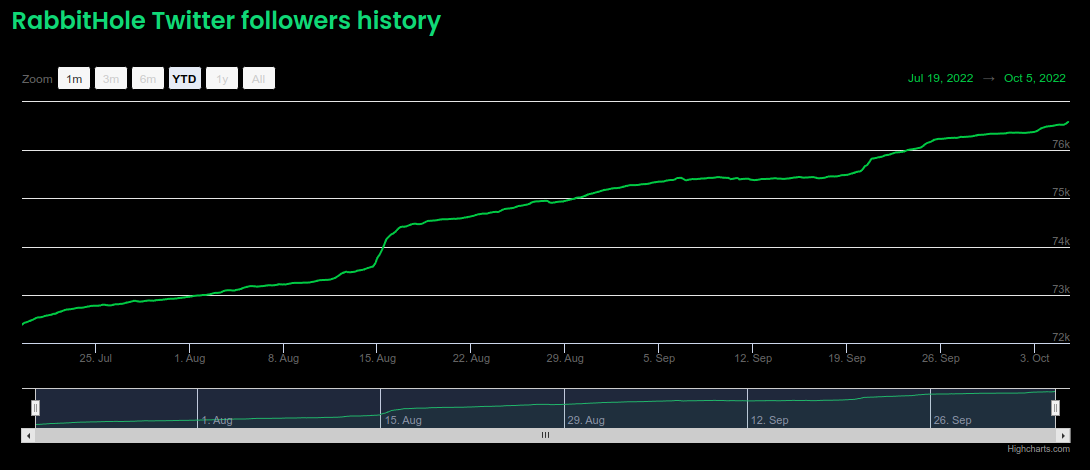

- Rabbithole provides users with a way to learn about Web3 protocols and systems while earning at the same time. Additionally, Rabbithole allows users to demonstrate their knowledge by completing tasks and having these written to the blockchain. The company generates revenue by receiving a percentage of tokens distributed by the asset providers users are learning about.

- Rabbithole has seen a steady increase in the number of its Twitter followers over the past year.

- Demy Games is looking to seize an opportunity by combining the play-to-earn and learn-to-earn models together. It is currently demoing a "Questions Game" that is built off NFT cards that can be traded and give gamers an advantage over others.

- The founder of Web3Nest, Manish Patel, stated: "With the advent of people growing in the Internet Age, in the future, it’s more than obvious that that the average person will not work for a company. Instead, people will earn income in non-traditional ways by taking actions such as playing games, learning new skills, creating art, or curating content. This kind of shift in how we work is not unusual or unexpected — the idea that most people would be employed by large corporations would have seemed crazy to someone in the year 1800 but now its common to everyone."

- The learn-to-earn concept is still out of mainstream adoption at this point in time with questions of sustainability in the model still lingering. Many companies are still in the funding and development phases with businesses like Stemuli raising $3.25 million to develop its metaverse and Proof of Learn raising $15 million to develop its educational platform.

- The move-to-earn category of X2E space offer users cryptocurrency, NFTs, or points as a reward for working out or simply moving and being active. While this concept is becoming more popular, mainstream media still paints the idea as being "obscure." Most move-to-earn games include an initial investment by the user by purchasing NFTs or a utility token.

- STEPN established itself as the first project in the move-to-earn space. The app rewards users for completing workouts which can include cycling, running, walking, and other activities. Users earn tokens (GMT) which can be used to purchase upgrades and avatars within the STEPN ecosystem or can be traded on exchanges for other cryptocurrencies.

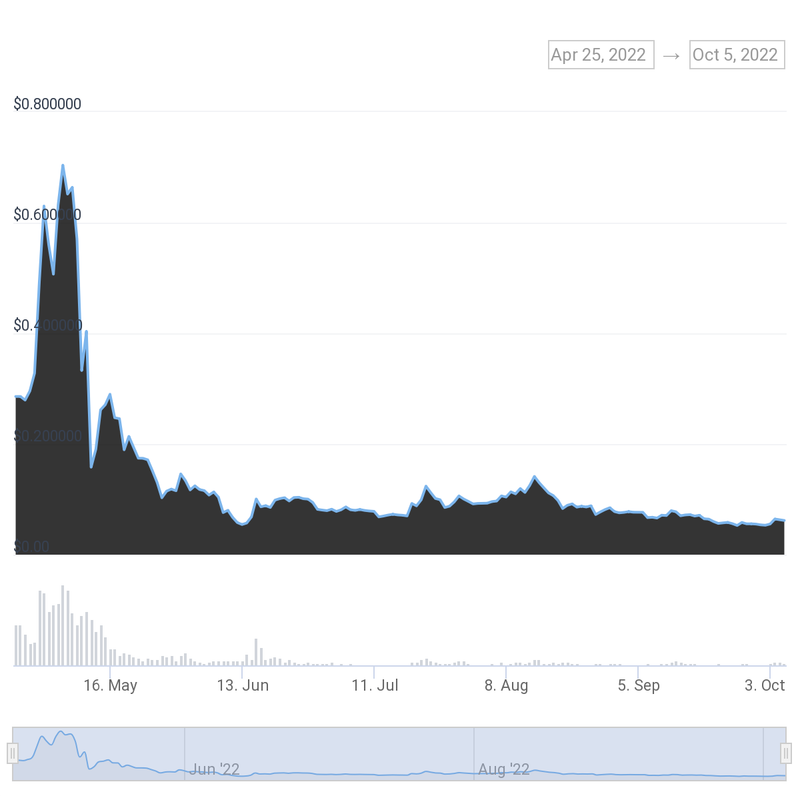

- STEPN experienced a strong start and initial success. Since May 2022, the value of its token has decreased dramatically, but the app remains one of the top move-to-earn ecosystems. It currently has 4.72 million worldwide users. STEPN's model for generating revenue involves a dual-token (GST + GSM) setup where users earn or buy GST and can spend this on upgrades within the app.

- Step App is another popular move-to-earn app and ecosystem. This fitness app has users compete inside the metaverse through augmented reality and rewards users with an in-game currency (KCALS). The company generates revenue with in-game tokens and in-app microtransactions where users can purchase NFTs and upgrades or alternative skins for their in-game character.

- Similar to STEPN, Step App enjoyed initial success but also experienced a crash in mid-2022 with the collapse of LUNA and other stablecoin disruptions that shook the cryptocurrency market.

- The co-founder of STEPN, Jerry Huang, said: "Crypto's presence on the global stage has expanded exponentially since its inception, and new use cases for the asset class are continuing to present themselves. STEPN is continuing to bridge the world between web2 and web3 and by bringing crypto and NFTs to a wider audience we are able to do just that. Our platform enables users to experience the world of crypto in a simplistic and straightforward manner, while allowing them to earn rewards for simply moving. STEPN is dedicated to driving innovation in the web3 space, and we are poised to improve upon our existing offerings while also deploying new features in the coming months."

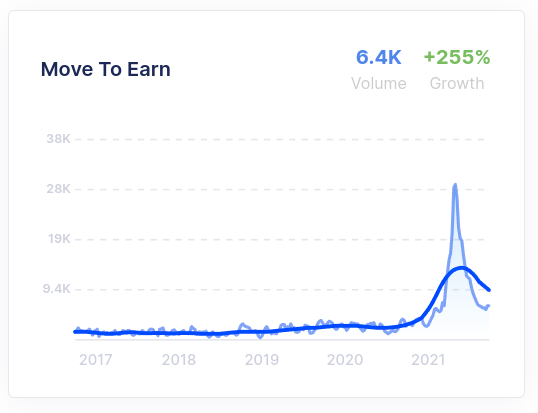

- Interest in the move-to-earn market has grown over 225% in the past year. However, the interest has declined in terms of internet searches and it is no longer considered a crypto trend by Glimpse.

- Professor Katherine Milkman, who specializes in behavioral change and economics says: "When you’re already motivated to achieve some sort of goal, gamification seems to layer on extra motivation. That’s true even if you’re just earning points, and there’s literally no value. Even symbolic rewards work." She further elaborates on the future of these apps by saying that health insurers might pursue incentives for physical activity and that "offering small rewards for something that’s so good for you and that should reduce costs seems like an obvious win."

Learn-to-Earn

Move-to-Earn

Growth Drivers for X2E

- Drivers of growth for the X2E sector included the increased interest and potential of the play-to-earn segment/model, the increased adoption by pioneering companies such as TIA, and using X2E models as marketing tools. These factors are outlined in the following research.

- The play-to-earn gaming model is focused on adults and rewards gamers with cryptocurrency or NFTs for playing a game that most users would already play for free. The CEO of Gallant Token, Steven Walters, says "that regular gaming could go the way of the dinosaur due to the play-to-earn gaming model." He also stated: "Mass adoption is underway, and major players in the gaming industry have begun to lay the groundwork for this new era of gaming."

- For the period of 2022-2028, the NFT play-to-earn market is expected to grow at a CAGR of 20.4% and be worth a total of $2,845.1 million in 2028. In 2021, the market size is estimated to be at $776.9 million.

- One of the drivers of this segment is the ability to own the assets of the game a player is playing. In contrast, a private company owns the skins of Fortnite whereas, with play-to-earn games, users own the NFTs and assets they engage with. Taking the concept further, the player has the possibility of making a living in the metaverse generating economic value as they interact with it. The ability to earn money from gaming is allowing some people to make a side income and others in developing countries can "earn a respectable wage" by playing games as a full-time career.

- Triple A game maker Ubisoft has been in the blockchain space for years and is looking to increase its offerings in the play-to-earn space. In contrast, Steam has taken a clear stance against all NFT and blockchain-based games.

- The current market capitalization on the top three play-to-earn game tokens (Decentraland, The Sandbox, and Axie Infinity) is at over one billion dollars per game. The sector of play-to-earn games is expected to have a huge impact on gaming and will continue to legitimize gaming as a form of income.

- TIA is considered a pioneer of X2E and is also at the forefront of transitioning from Web2.0 to Web3.0. The Token2049 event held in September 2022 has provided several opportunities for TIA to network and collaborate with other gaming companies to aid in this transition.

- TIA currently owns 18 Web2.0 games that it intends to transition to the Web3.0 framework. Just one of the company's games has an active user base of 1.2 million monthly global users and has been downloaded more than 30 million times. Additionally, the company has plans to transform "hyper-casual games" onto the blockchain by means of its TNT platform.

- The company also has a confidential project called G2E-D2E which it states will "drastically change the X2E model."

- Euychul Shin, CEO of TIA, said "With the advent of Cryptowinter, players who chase short-term profits will disappear, and genuinely prepared projects will most definitely survive. TIA will work closely with our reliable partners to bring new experiences to global users through collaboration."

- The market development space for Web3.0 gaming and the play-to-earn model is considered to be "extremely huge" and to be the largest of the money-making models in the X2E industry. Even so, one author commented on Web3.0 and play-to-earn games saying that he thinks "it will be a long time before the mainstream gaming industry adopts Web3 in any meaningful way."

Play-to-Earn Growth & Potential

Transition from Web2.0 to Web3.0

- Emerging startups frequently use X2E solutions as marketing tools. This strategy may be effective in generating the initial buzz and user interest in the project.

- Incentivizing engagement is "a classic tactic from the Web3 marketing playbook." This can be done through play-to-earn, as well as NFT airdrops and L1 protocols that offer validators a percentage of the transaction fees.

- The usage of these models goes beyond web3. According to InsideTelecom, "The X-to-Earn profit models are gaining major traction as traditional web2 applications, services and sites explore new ways to incentivize users to use their services. Sites like Brave Browser are even rewarding users just for using the search platform."

- Forbes notes that businesses across industries are likely to start incentivizing users with models similar to play-to-earn because financial rewards serve as effective emotional triggers and potential drivers of customer loyalty.

- While not specifically focusing on x-to-earn, a different Forbes article states that web2 changed marketing in ways that were previously difficult to imagine, and web3 is likely to achieve the same. It already calls web3 "the latest marketing craze."

X2E as a Marketing Tool

Challenges To The Growth of X2E Models

- The X2E models face numerous challenges. These challenges have been grouped together in broader headings due to the difficulty of addressing each of them specifically. The first broad grouping is the challenge of being taken seriously and viewed as sustainable and trustworthy. Secondly, X2E models face the challenge of the volatility of the overall cryptocurrency market.

- X2E models, including the play-to-earn model, are often criticized in the mainstream media as being Ponzi or pyramid schemes. The economic principles behind the projects are often called into question. This type of messaging does little to help the credibility of the models.

- In some instances, fatigue from similarity and lack of innovation has caused P2E games, in particular, to fail. Questions have arisen as to if the model is sustainable or if there is a better "offline" scenario in which to make profits, such as the move-to-earn model.

- The lack of a solid economic system and real value underlying the blockchain assets leaves some projects in a "death spiral".

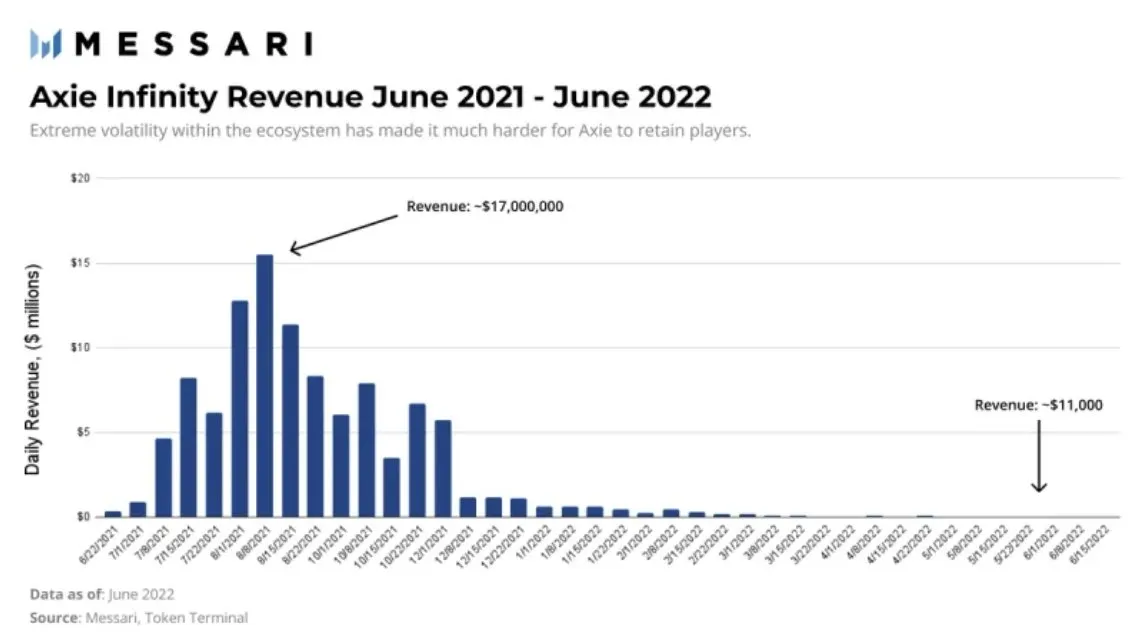

- The popular P2E game Axie Infinity acknowledges this challenge of sustainability in its whitepaper. It states: "Axie population growth is a major factor within the Axie ecosystem. At any given moment, there exists some ideal inflation rate that allows us to grow to our maximum potential. Too slow and Axie prices are too high for everyday people to join; especially competitive Axies. Too fast and you get unhealthy inflation. AXS / SLP tokens face similar economic forces that need to be managed."

- The most recent crash of the crypto market has made it increasingly difficult to measure the success of X2E projects.

- In addition to Axie Infinity failing to retain players and attract new gamers, it became the victim of the crypto bear market where NFTs plummeted from the peak of $16.54 million in transaction volume to just $4 million in only 5 months' time. Axie's token, AXS, lost 91% of its value this year.

- The Kickstarter project Untamed Isles, in development since 2020, was initially slated to launch with play-to-earn capabilities on October 6, 2022. The project has been put on indefinite hold due to the cryptocurrency market crash. This event has led to the inability to refund investors or continue development.

- Economic considerations aren't the only challenge to the cryptocurrency market. There are also governmental policy factors to consider that cause instability. An example is the cessation of STEPN's operation in mainland China due to data compliance issues with China's governmental regulations. Announcements and changes such as these can cause shop drops in the value of X2E assets.

Questions of Sustainability and Trustworthiness

Instability in the Overall Cryptocurrency Market

Research Strategy

For this research on the X2E market models, we leveraged the most reputable sources of information that were available in the public domain, including mainstream media sources such as Time and CNBC, along with technology-centric resources such as CoinMarketCap, CryptoNews, NullTx, CoinGecko, and many others.