Part

01

of one

Part

01

US Planned Giving Economic Data and Competitive Landscape

Key Takeaways

- Types of planned giving products in the U.S. include: bequests, charitable gift annuities, revocable living trusts, qualified charitable distributions, and charitable remainder trusts.

- Key providers of planned giving consultancy services in the U.S. include: Planned Giving Advisors, LLC., The Curtis Group, Veritus Group, Sharpe Group, and Planned Giving Marketing Solutions.

- 85% of all planned gifts are charitable bequests.

- Since its founding, Planned Giving Advisors LLC has served over 300 organizations, resulting in more than $250 million in closed gifts. The company also runs The Planned Giving Blog, which has over 1,500 subscribers and has received over 145,000 visitors since its launch.

Introduction

This report provides an overview of planned giving product types available in the U.S., along with an overview of key planned giving consulting firms operating in the U.S.

Planned Giving Product Types: U.S. Market

1: Bequest

- According to Investopedia, "a bequest is a financial term describing the act of giving assets such as stocks, bonds, jewelry, and cash, to individuals or organizations, through the provisions of a will or an estate plan. Bequests can be made to family members, friends, institutions, or charities." This does not include real estate (as the provision of real estate left via a will is called a 'devise').

- There are four types of bequests: general bequests, demonstrative bequests, specific bequests, and residuary gifts. An individual will may contain more than one type of bequests.

- General Bequests: These types of bequests are gifts of property. The property is gifted from the estate's general assets.

- Demonstrative Bequests: These types of bequests are gifts that are sourced from a designated set of assets (e.g. a specific bank account).

- Specific Bequests: These types of bequests are gifts that are specific items (e.g. jewelry items, a car) or a specific amount of money (e.g. $10,000 of the total assets left to a nephew).

- Residuary Gifts: These types of bequests are a percentage of assets that are left over after the total assets are used to pay off debts, expenses, and taxes.

- The average bequest is $78,630, according to a 2019 survey of wills belonging to 'everyday donors.'

- 85% of all planned gifts are charitable bequests.

- Bequests accounted for 9% of all charitable donations in 2017, equating to a value of $35.7 billion. This figure increased from $12.3 billion in 2012.

- In August 2020, FreeWill reported a 295.21% YoY increase in charitable bequests.

- Since its founding, Planned Giving Advisors, LLC has served over 300 organizations, resulting in more than $250 million in closed gifts. The company also runs The Planned Giving Blog, which has over 1,500 subscribers and has received over 145,000 visitors since its launch.

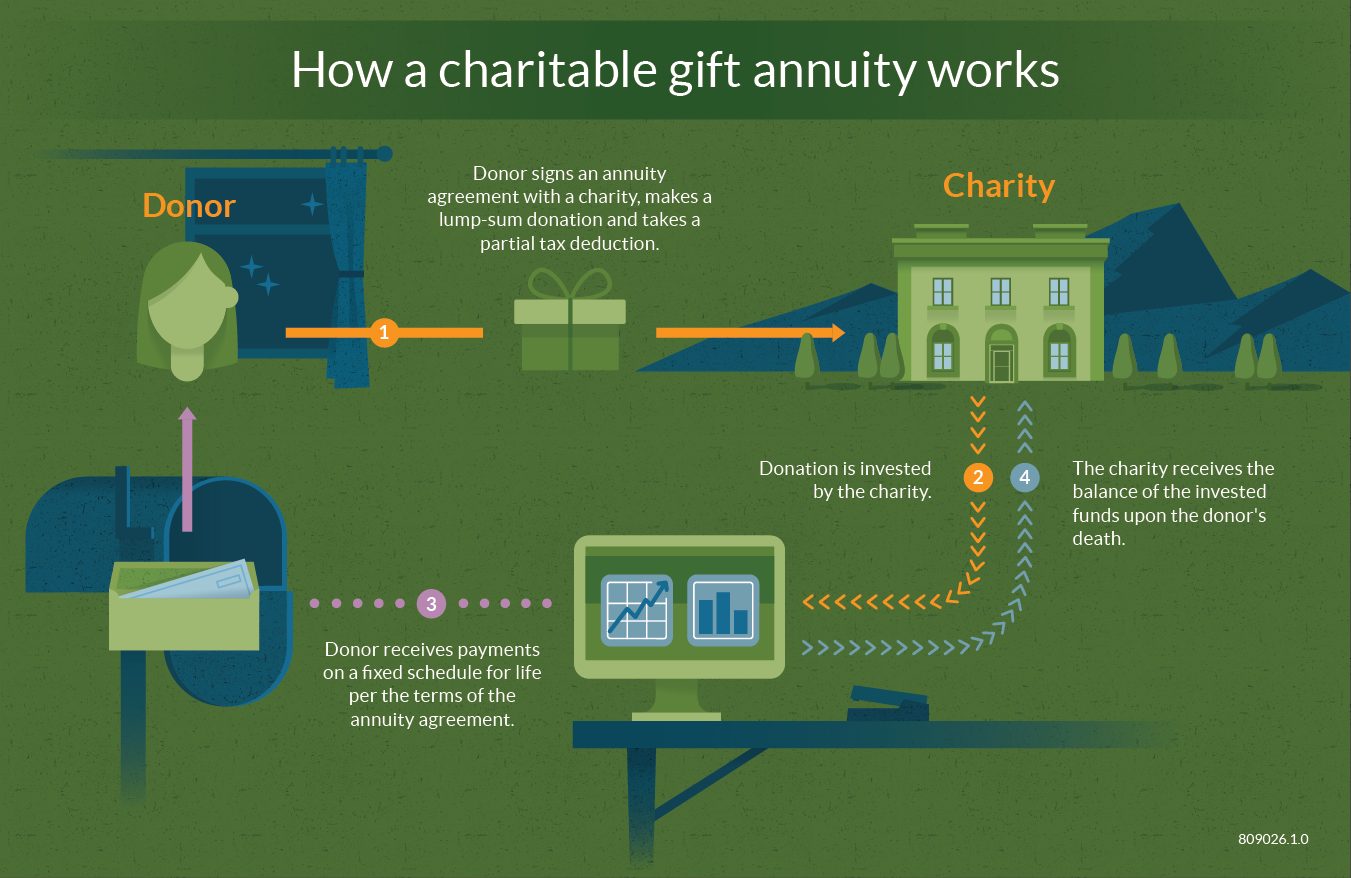

2: Charitable Gift Annuities (CGA)

- According to Investopedia, "A charitable gift annuity is an arrangement between a donor and a non-profit organization in which the donor receives a regular payment for life based on the value of assets transferred to the organization. After the donor's death, the assets are retained by the organization. [...] Such annuities are set up by an agreement between the charity and the individual annuitant or couple. The annuities simultaneously provide a charitable donation, a partial income tax deduction for the donation, and a guaranteed lifetime income stream to the annuitant and sometimes a spouse or other beneficiary."

- There are three types of charitable gift annuities: immediate gift annuity, deferred gift annuity, and flexible gift annuity. The availability of these options varies state-to-state.

- Immediate Gift Annuity: With this type of annuity, the annuitant begins receiving payments immediately, once the gift has been presented. The payments can be made quarterly, monthly, semi-annually, or annually.

- Deferred Gift Annuity: With this type of annuity, the annuitant will receive payments at a later date, as chosen by the donor (no sooner than one year after the date the gift was given). Once the payments begin they can be set up as quarterly, monthly, semi-annually, or annually.

- Flexible Gift Annuity: With this type of annuity, the annuitant does not select a payment starting date immediately. The start date is left open to be decided at a later date (for example, upon retirement). The older the annuitant at the payment start date, the larger the payments will be.

- In 2019, the average value of new charitable gift annuities increased by 56%.

- An analysis of 106 nonprofit organizations recorded 617 charitable gift annuities in 2019 with a total gift amount of $67.9 million, with annual payments amounting to $4.4 million. The median gift size was $30,000 and the average gift size was $110,000. The average donor age was 77.

- Among new CGAs in 2019, 35% were gifts over $1 million, 12% were between $500,000 and $1 million, 35% were between $100,000 and $500,000, 9% were between $50,000 and $100,000, and 8% were between $10,000 and $50,000.

3: Revocable Living Trust

- According to Investopedia, "A revocable living trust is a trust document created by an individual that can be changed over time. Revocable living trusts are used to avoid probate and to protect the privacy of the trust owner and beneficiaries of the trust as well as minimize estate taxes. Revocable trusts, however, have several limitations including the expense to have them written up, and they lack features of an irrevocable trust."

- Sometimes referred to simply as 'living' trusts, revocable living trusts can be changed, modified, or revoked entirely.

- The trust is made while the trust maker is still living. In doing so, the maker of the trust transfers property titles into the trust and serves as the initial trustee, but can name a successor if they so choose. The trustmaker can remove property from the trust during their lifetime if they choose.

- A revocable living trust is not to be confused with an irrevocable trust, which cannot be changed, modified, or revoked once it's created.

- During this research, hard data statistics regarding revocable living trusts were found to be largely unavailable after analysis of surveys, industry reports, articles written by lawyers and industry experts, market reports, and infographics. However, at least one piece of relevant data was found; according to a survey conducted in 2020, 13% of respondents have a living trust.

4: Qualified Charitable Distributions (QCD)

- According to PlannedGiving, "A QCD (also referred to as an IRA Rollover) allows donors 70½ or older to make tax-free IRA charitable rollover gifts of up to $100,000 per year directly from their Individual Retirement Accounts to eligible nonprofits. The funds must be transferred directly to the charity; withdrawing them first will result in a tax penalty."

- QCDs are considered to be one of the most tax-efficient ways to make a charitable gift, particularly for older donors.

- Many QCDs are driven by the need for IRA owners to make Required Minimum Distributions (RMDs). An RMD is an amount that IRA owners are required to withdraw from their account past a certain age. If the IRA owner does not meet their RMDs, they are subject to significant tax penalties. If they withdraw the money and keep it for themselves, they increase their taxable income. A QCD provides them with the option to roll over the RMD as a charitable donation which helps to avoid these taxation pitfalls.

- There is no minimum gift requirement for QCDs, however, the maximum gift allowance is $100,000 per year.

- In 2020, 50% of nonprofits surveyed said the average size of QCD gifts increased YoY, while 20% said they stayed the same. Only 12% reported a decrease.

- In 2019, the average QCD gift size was $7,900.

- Higher Ed receives the largest share of QCD donations:

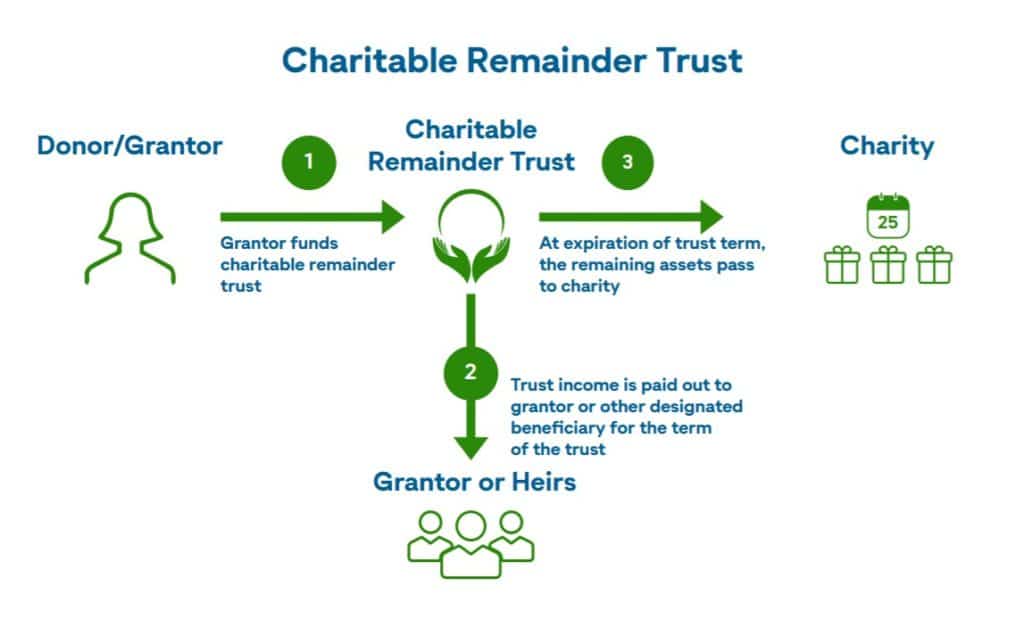

5: Charitable Remainder Trusts

- According to Investopedia, "a charitable remainder trust is a tax-exempt irrevocable trust designed to reduce the taxable income of individuals by first dispersing income to the beneficiaries of the trust for a specified period of time and then donating the remainder of the trust to the designated charity. This is a 'split-interest' giving vehicle that allows a trustor to make contributions, be eligible for a partial tax deduction, and donate remaining assets."

- A key benefit of charitable remainder trusts is that they can be used to reduce taxes. This is achieved by donating assets into the trust and then having the trust pay the beneficiary for a set amount of time; once this time is up, the remainder of the assets in the trust is transferred to charities.

- Charitable remainder trusts are a type of irrevocable trust.

- There are two main types of charitable remainder trusts: charitable remainder unitrusts (CRUT) and charitable remainder annuity trust (CRAT).

- Charitable Remainder Unitrust: According to insights published by Wheaton College, a charitable remainder unitrust "provides that a fixed percentage (at least 5% of the fair market value of the assets in the trust, computed annually) be paid to the income beneficiaries at least once per year for their lifetime or for a term of up to 20 years. The amount paid out each year will fluctuate according to the annual valuation of the trust principal."

- Charitable Remainder Annuity Trust: According to insights published by Wheaton College, a charitable remainder annuity trust "provides that a specified dollar amount (at least 5% of the fair market value of the trust assets valued at the time the trust is created) be paid out at least once per year to the income beneficiaries for their lifetime or a term of up to 20 years. The amount paid out each year does not change and is paid out regardless of the value of the trust assets."

- A 2019 analysis of 106 nonprofit organizations found that new charitable remainder trusts amounted to $18.2 million for that year. Unitrusts were the most popular type of charitable remainder trust, accounting for $11.1 million.

- The average gift value of a charitable remainder trust was $400,000 in 2019.

Key Providers of Planned Giving Consultancy Services: U.S. Market

1: Planned Giving Advisors LLC

- About: Planned Giving Advisors was founded in 2011. The company was founded by attorney, Jonathan Gudema. The company provides nonprofit organizations with resources and expert guidance for running a successful planned giving program, regardless of the organizations' resource limitations. Since its founding, the company has served over 300 organizations, resulting in more than $250 million in closed gifts. The company also runs The Planned Giving Blog, which has over 1,500 subscribers and has received over 145,000 visitors since its launch.

- Offerings: The company offers clients services on an annual, flat fee basis, which includes guidance regarding any aspect of gift planning programs. This fee also includes access to a comprehensive suite of fundraising support tools, which features a web-based education program, a library of marketing and legal documents, and up-to-date information regarding laws and regulations. The company's Planned Giving Boot Camp is a 6-part webinar series that has served over 2,000 fundraisers and provides educational content about planned giving basics, as well as training on more advanced topics.

- Entity/Legal Requirements: None found to be publicly available. Exhaustive research of the company's official website did not reveal any insights into the company's entity or legal requirements. The company encourages contacting them to learn more about their company. Their contact information is as follows: jonathan@plannedgivingadvisors.com / 973-732-2455

- Key Clients: Binghamton University , Albert Einstein College of Medicine , Saint Joseph’s University , La Salle University, Benedictine Health Foundation , Montefiore Medical Center , Juvenile Diabetes Research Foundation, Environmental Defense Fund, Intrepid Sea, Air & Space Museum , National Audubon Society , The Innocence Project, American Society for Yad Vashem , Dominican Friars of the Province of St. Joseph , Episcopal Charities of the Episcopal Diocese of New York, among others.

2: The Curtis Group

- About: Founded in 1989, The Curtis Group exists to serve nonprofits by helping them with planning, awareness building, and fundraising. The company has worked with about 200 nonprofits across a wide variety of sectors, including arts and cultural, educational, environment and animals, civic and public affairs, human services, and health care. According to the company's LinkedIn profile, the company has "met the rigorous standards of the prestigious Giving Institute, an organization composed of nearly 50 of North America’s leading fundraising consulting firms. As a Giving Institute member, [the company] is involved in Giving USA, the annual report on philanthropy; contributes to ongoing thought leadership on philanthropy; and has access to important statistics, reports, and projections on giving and fundraising."

- Offerings: With regard to planned giving consulting, the company helps nonprofit organizations design and implement their planned giving program. In doing so, The Curtis Group assists clients with end-to-end guidance, including program set-up, planning, implementation, and promotion. The company also provides education and training services related to planned giving; these services are intended for the staff and board of the nonprofit organization. Further, the company assists with lead generation and marketing for the planned giving group. Overall the company's services include: campaign planning services, campaign consulting and management, capacity-building assessments and consulting, development assessments, board and staff development, planned giving consulting services, and fundraising marketing and communications consulting.

- Entity/Legal Requirements: None found to be publicly available. Exhaustive research of the company's official website did not reveal any insights into the company's entity or legal requirements. To contact the company to learn more about their entity and legal requirements, the company's contact information is info@curtisgroupconsultants.com / 804-510-4934

- Key Clients: Arts Center of Coastal Carolina, Cape Charles Rosenwald School Restoration Initiative , Chincoteague Natural History Association, American Academy of Audiology Foundation , American Intellectual Property Law Association , Dental Trade Alliance, Chesapeake Humane Society , Congressional Sportsmen’s Foundation, The Virginia Zoological Society, Independent Schools Association of the Southwest , John Tyler Community College, Alzheimer’s Association, Southeastern VA Chapter, among others.

3: Veritus Group

- About: Veritus Group is a major gift and planned giving fundraising agency. The company specializes in helping nonprofits develop, build, and manage fundraising programs while fostering relationships and leads with donors. They currently have 2,605 followers on LinkedIn. Veritus Group was founded in 2009. The group's client list consists of some of the most recognizable nonprofits in the U.S. including the American Cancer Society, March of Dimes, Feeding America, and The Salvation Army.

- Offerings: Planning, development, and management of major gift programs; mid-level gift management and consulting; donor impact portfolios; strategic planning and organizational development; planned giving management and consulting. With regard to planned giving management and consulting, the company helps clients understand their current planned giving status, generate planned giving leads, planned giving headhunting, donor-specific goal setting and planning, KPI development, best practice insights, accountability management, trend insights, and strategic development.

- Entity/Legal Requirements: None found to be publicly available. Exhaustive research of the company's official website did not reveal any insights into the company's entity or legal requirements. To contact the company to learn more about their entity and legal requirements, the company's contact information is 215-514-0600 / achapman@veritusgroup.com (Amy Chapman, Director of Client Engagement).

- Key Clients: American Cancer Society, San Diego Rescue Mission, The Salvation Army, Colorado Public Radio, Seattle Opera, March of Dimes, Market Street Mission, K9s for Warriors, Glaad, Redeemer University College, Holt International, Ascension Wisconsin Foundation, Carnegie Museums of Pittsburgh, Feeding America, Greenpeace, among others.

4: Sharpe Group

- About: Sharpe Group was founded in 1963 and serves nonprofits by assisting them with gift and estate planning communications for donors. According to the company's official website, "Sharpe Group delivers training, consulting and a complete package of donor communication support offerings, including print and digital communications, to charities and nonprofits throughout the United States of America." The company's team of consultants have been featured in leading nationally-consumed publications, including The Wall Street Journal, The New York Times, Newsweek, Forbes, and CBS MarketWatch. Since the company was founded, they have worked with over 15,000 nonprofits across all sectors.

- Offerings: Sharpe provides planned giving program assessments, which seek to identify the strengths and weaknesses of a nonprofit's planned giving program. The assessment can also show the results of past marketing efforts, provide benchmarking against industry standards, and paints an accurate, overall picture of the nonprofit's program. Based on the assessment, Sharpe provides nonprofits with insights and facts that are then used to help develop the nonprofit's strategy with regard to their planned giving program. The company also offers an online academy focused on planned giving.

- Entity/Legal Requirements: None found to be publicly available. Exhaustive research of the company's official website did not reveal any insights into the company's entity or legal requirements. To contact the company to learn more about their entity and legal requirements, the company's contact information is info@sharpenet.com / 800-342-2375

- Key Clients: Public Broadcasting Service (PBS), San Francisco Ballet, U.S. Holocaust Memorial Museum, Animal Legal Defense Fund, American Diabetes Association, American Heart Association, St. Jude Children's Research Hospital, Bronx High School of Science, Rotary International, among others.

5: Planned Giving Marketing Solutions

- About: Planned Giving Marketing Solutions provides products and services to nonprofits relevant to planned giving marketing, consulting, and program development. Planned Giving Marketing Solutions is operated by highly experienced program advisers, including James Eckel, CLU, CFP, J.D. (former President of the Partnership in Philanthropic Planning Orange County), Cynder Sinclair, D.M. (30 years of nonprofit executive leadership experience, a doctorate in organizational leadership, master's in organizational development, CEO of Nonprofit Kinect), Craig Zimmerman, CPA (20 years of experience in investment management, former SVP of major global alternative investment management firm with over $100 billion AUM).

- Offerings: The companies core services include custom website design for major and planned gifts, gift acceptance policy development, donor database installation, donor client networking, donor marketing content development, board and staff training relevant to major gifts, marketing management consulting, donor database management, gift administration development and management, and bequest and beneficiary designation consulting.

- Entity/Legal Requirements: None found to be publicly available. Exhaustive research of the company's official website did not reveal any insights into the company's entity or legal requirements. To contact the company to learn more about their entity and legal requirements, the company's contact information is 800-579-4707 / contact form here.

- Key Clients: Big Brothers, Big Sisters, Santa Barbara Education Foundation, Rotary Club of Carpinteria, USS Midway Museum, among others.

Research Strategy

To conduct this research, our team used sources published by industry authorities and experts to collect definitions and descriptive information about types of planned giving. For each type of planned giving, we included hard data metrics sourced from surveys and industry reports. To identify key providers of planned giving consultancy services in the U.S. market, we analyzed dozens of potential companies and worked to narrow down the key providers based on those that were most directly specializing in planned giving consulting, and who either had a robust number of clients and/or had very well-known nonprofit clients (i.e. household names) and/or has a vast amount of experience in terms of number of years in the industry. The company's websites and LinkedIn profiles were then used to compile information about each one. It should be noted here that no entity/legal requirements were found to be publicly available for any of these companies. This was determined after exhaustive research of their company websites, as well as an effort to find any ancillary annual reports or publicly available registration documents for these companies. None of the companies analyzed have provided any type of information about their legal or entity requirements upfront. In all cases, the information these companies have made public is largely high-level information about their products, services, and clients. In lieu of this missing data, we have provided contact information for each company as supplementary information and to help facilitate contact with the companies to inquire about this information.