Part

01

of one

Part

01

The Fitness and Wellness Online Training Market

We are researching the online-virtual fitness and wellness market by activity categories such as mindfulness (including yoga and meditation), fitness (including gym, home workout, athletics, sports, etc.), and weight loss (including healthy eating and nutrition/dietetics), followed by an analysis of emerging software, apps, and wearable devices trends.

The Global Fitness and Wellness Industry

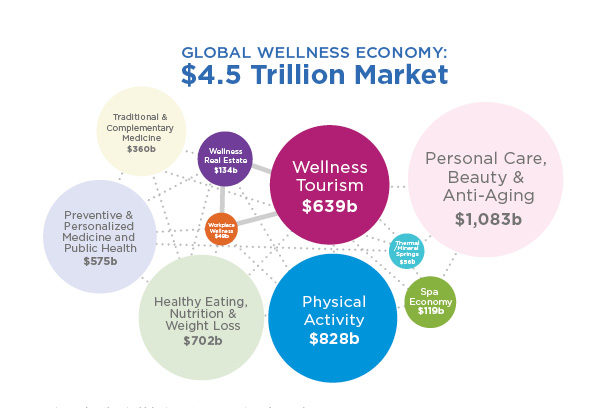

- In 2018, The global wellness industry represented a total $4.5 trillion market. The industry has grown at an annual rate of 6.4% (CAGR 2015–2017), from $3.7 trillion to $4.2 trillion, and nearly twice as fast as the growth of the global economy (estimated at 3.6% annual rate).

- The wellness industry represented 5.3% of the global economy, and wellness expenditures ($4.2 trillion) represented more than half as global health expenditures (estimated $7.3 trillion).

Annual Revenue Growth by Market Activity/Category (in descending order 2015–2017)(FOTO)

The Rising Popularity of Yoga

- A significant portion of the growth in yoga practice worldwide is online and at home, which is expanding access and lowering the cost to boost participation.

- During the past decade, the U.S. has been the epicenter of transforming yoga from a relatively small group of New Age people into a mainstream exercise activity that is offered at comprehensive gyms, small independent studios, franchised facilities, community recreation centers, online streaming, and yoga apps. The adoption of yoga by the fitness industry has transformed both yoga and fitness. With the Westernization and mainstreaming of yoga, most North American consumers no longer associate yoga with a specific spiritual practice but as an exercise with a mindfulness component. The rising popularity of yoga is also influencing the direction of fitness, evolving from physical workouts toward incorporating more deliberate and mindful touches focused on toning, balance, flexibility, alignment, and breath. Yoga ranks among the most popular exercise trends in the U.S., and participants and offerings have expanded from women in prosperous and educated urban areas to complete demographics and regions (men, smaller towns, rural areas, etc.). The yoga philosophy of supporting communities has also sparked interest in bringing the practice to under served areas and groups. For example, through organizations such as Yoga to the People and the Prison Yoga Project, yoga is reaching people in inner cities, prisons, and schools.

Other Interesting Findings

- About 103.2 million people work out independently or at home, using treadmills, stationary bikes, weights, other home-based fitness equipment, as well as books, videos, and other technologies. Note that many gym members also workout at home. Among people working out at-home, an estimated 28.8 million are on-demand and streaming fitness services subscribers via online platforms and/or mobile apps.

- Online and app-based streaming/ on-demand exercise classes and workouts were a $6.1 billion market globally in 2018 (4.4% of the global consumer spending on fitness and mindful movement activities). Options include every exercise (spin, running, boxing, dance cardio, yoga, barre, ballet, etc.), as a subscription, pay-as-you-go, or free option; live-streamed and on-demand/recorded classes; equipment-linked services (e.g., Peloton, Mirror); gym/studio spin-offs (e.g., Exhale On Demand); celebrity/ influencer-based workouts (e.g., AKT On Demand, TA Online Studio); online-only services (e.g., Daily Burn, Keep); and virtual personal training (e.g., Aaptiv Coach). Most streaming/ on-demand services were U.S.-based, although China and the U.K. are growing fast.

- In terms of content, global trends and fitness innovations have been quickly incorporated into new offerings such as online classes, virtual personal coaching, and personalized workouts, while entrepreneurs are developing apps, platforms, and intermediaries to bring new services and offerings to an expanding market.

- Weight Management Market Size, Share & Trends Analysis By Diet, Equipment, Services, Region, Segment (2018 – 2025)

- The rise of digital fitness

- Fitness industry works up a sweat in the internet age

Software, Apps, and Other Online Services

APPS

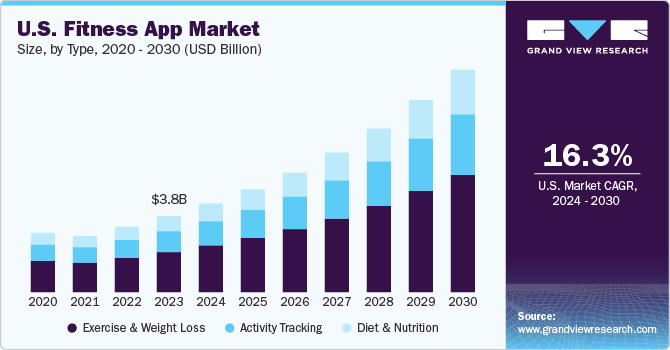

- The first fitness apps were launched in 2008, right after the introduction of the iPhone and the Apple App Store. By 2018, there were an estimated 250k-300k+ fitness and health apps available for download, generating an estimated $2.4 billion in user revenues (from downloads, upgrades, and in-app purchases). Most fitness apps focus on tracking, measuring, and analyzing various fitness and health metrics (e.g., tracking workouts, counting steps, monitoring fitness goals, counting calories consumed and burned, etc.). Some of the most popular apps in this category are free (e.g., My Fitness Pal, Samsung Health, Pacer), although many are paid or offer a premium/paid upgrade option. Apps are increasingly adding a social and community dimension (e.g., Runtastic, Joyrun), or a gaming component, competition, and rewards (e.g., Fitocracy, Yodo Run, Nexercise). Some include informational/educational tutorials, while others provide personalized music and workout playlists (e.g., RockMyRun, Fit Radio). Some popular apps are connected with wearable devices (e.g., Fitbit, Codoon), and others are connected with major fitness brands (e.g., Nike Run Club, UA Record).

- Fitness App Market Size, Share and Trends Analysis by type, platform, device, region, and segment (2019 – 2026)

- In 2018, estimated at $1.4 billion globally, a wide variety of software and online services and platforms were streamlining management, booking, and customer-facing functions related to all types of physical activities. The appearance of class-finders and booking intermediaries has been a major driver for gyms and fitness studios in the last years (ClassPass is the largest player, although there are many other competitors in different regions, such as Singapore-based GuavaPass (recently acquired by ClassPass), UK-based PayAsUGym, Gympass (focused on the corporate market), India based FitPass, FitReserve, and others. The other major segment in this sector is booking, scheduling, billing, and back-office management software and systems. Mindbody is the most recognized player in this segment, but there are dozens of other services focusing on different types of businesses, such as gyms (e.g., Virtuagym), sports and active recreation providers and nonprofits (e.g., ACTIVE Network, PerfectMind), yoga studios (e.g., TULA), dance studios (e.g., The Studio Director), martial arts (e.g., Kicksite), personal trainers (e.g., My PT Hub), etc. The U.S. holds the largest number of exercise-related software services and platforms, although other countries that have sizable technology and software industries also have many companies and start-ups such as the U.K., Canada, India, China.

APPS/SOFTWARE/PLATFORMS BY CATEGORY

- Tracking, analyzing, learning, and sharing activities and achievements (e.g., My Fitness Pal, Samsung Health, Google Fit, Runtastic, Pacer, Yodo Run).

- Streaming and on-demand fitness workout/class services (e.g., Peloton, Mirror, Keep, Beachbody On Demand, Daily Burn, Daily Yoga).

- Fitness, sports, and recreation intermediary, booking, management, and marketing software, apps, and platforms (e.g., ClassPass, Mindbody, Active Network, Daxko, My PT Hub).

WEARABLES AND TRACKERS

- In 2018, at $14.7 billion, wearables represented over half the technology market. This category includes fitness bands (e.g., Fitbit, Garmin, Polar, Huawei Band, Xiaomi Mi Band) and other types of activity trackers that range from simple pedometers to high-tech devices. Other types of sensor-embedded trackers and fitness wearables have emerged in recent years including smart jewelry (e.g., Bellabeat Leaf, Misfit Shine); smart clothing (e.g., Hexoskin, Sensoria fitness socks, Nadi X yoga pants, SUPA Powered sports bra); smart footwear (e.g., UA HOVR shoes, Altra IQ shoes, Digitsoles, Lechal smart insoles); and smart eyewear (e.g., Recon Jet, Vue, Level, Solos AR smart glasses).

- Interestingly, the top key players in the online-virtual fitness market are also engaged in the production of sportswear and sports footwear, fitness bracelets, and other gadgets that generate the main revenue. In addition, all companies have their own apps for Google Play and the App Store, which also produce additional proceeds.

OTHER TECHNOLOGIES

Other Interesting Findings Regarding New Technologies

- The use of fitness wearables, trackers, apps, and games is particularly widespread. In 2016, 33% of people in 16 countries were using an app or wearable device to track or monitor their health and fitness, while an additional 18% did so in the past (but not tracking at that moment).

- The health and fitness app category grew by over 330% in a 3 years period, although growth has slowed in recent years along with the overall apps industry.

- China is the top regional leader, with a $6.6 billion physical activity technology market. Fitness apps are wildly popular in China, where an estimated 68.5 million people actively use apps and online platforms to support their fitness and healthy lifestyles (from walking, running, and fitness to guangchang wu, cycling, and yoga).

- China has its own huge Chinese-language industry of apps and streaming services, and it is home to some of the world’s largest apps for streaming workouts, such as Keep, Daily Yoga, and Hotbody.

- Analysis of fitness and health apps and wearables/trackers in the U.S. indicates that more women are using these services than men.

- Fitness apps, fitness games, and streaming/on-demand services are opening access to new types of exercise, often at a lower price, to demographic groups and regional populations who have not previously had access to these options (or could not afford them).

Final Thoughts

- Online-virtual fitness and wellness is a current market trend based on delivering physical training sessions online. These training sessions are beneficial for people who can not easily enroll in physical classes. These sessions are conducted are usually pre-scheduled or time slot. The market is driven by the need for advanced online-virtual fitness sessions due to increased stress environment, lack of time, sedentary lifestyle, and other reasons. However, low awareness about these services hinders market growth. Nonetheless, the growing popularity of the online-virtual fitness concept in developing countries represents a lucrative opportunity for market players in the near future.