Part

01

of one

Part

01

Taxes on the Rich

Summary and Key Takeaways

- High-income individuals in the U.S. pay the large majority of taxes. When simply expressing 'taxes paid' as a percentage of income, those who regularly compute these figures, such as the Congressional Budget Office invariably find that wealthy, high income and high-net-worth individuals pay a higher share of their income in taxes.

- While high-income U.S. individuals and households do pay the majority income taxes, the wider debate is whether they pay what is considered to be a fair share. The gap between the wealthiest and the poorest individuals is increasing and many believe the taxation system promotes inequality and benefits the wealthiest individuals. Ideas about increasing tax on high-income and high-net-worth individuals have been suggested, but critics claim they will be counter-productive, leading to reduced investment, and increased tax avoidance measures.

- The various complex details of specific taxes present significant difficulties. Known as 'tax incidence' to economists, and due to the different aspects and intricacies of the tax system, the answer to the question of how much do different groups pay in taxes is not clear-cut and unambiguous.

- Some scholars claim that high-net-worth individuals do in fact pay lower rates of tax. However, critics claim that the basis for their beliefs are not factual, and instead stem from opinions in support of levying so-called 'wealth-taxes' on large fortunes.

- One of the key issues regarding the debate on taxes, is that some figures do not take into account 'transfer payments'. These are government benefits designed to help lower-income households, and include social security, food stamps, and others similar items. When included in tax and income analysis, transfers often reduce the gap between pre-tax and post-tax income for lower income families.

- The rates of tax paid by the richest 1% of U.S. households has not changed since the 1940s and 1950s, and this facilitates a system which benefits the most wealthy individuals in society.

Taxes Paid By High-Income Individuals as a Percentage of all Taxes and Income

- According to IRS data for 2018, the top 1% of U.S. tax payers accounted for $616 billion in income taxes. This amounted to 40% of income taxes paid, and this was a larger share than the bottom 90% of taxpayers contributions combined (a number representing 130 million taxpayers).

- The Heritage Foundation, reporting on the same 2018 U.S. government data, showed the top 1% of income earners, those who earned more than $540,000 annually, earned 21% of all U.S. income, while paying 40% of all federal income taxes. Further to this, the top 10% earned 48% of the total U.S. income, while paying 71% of federal income taxes.

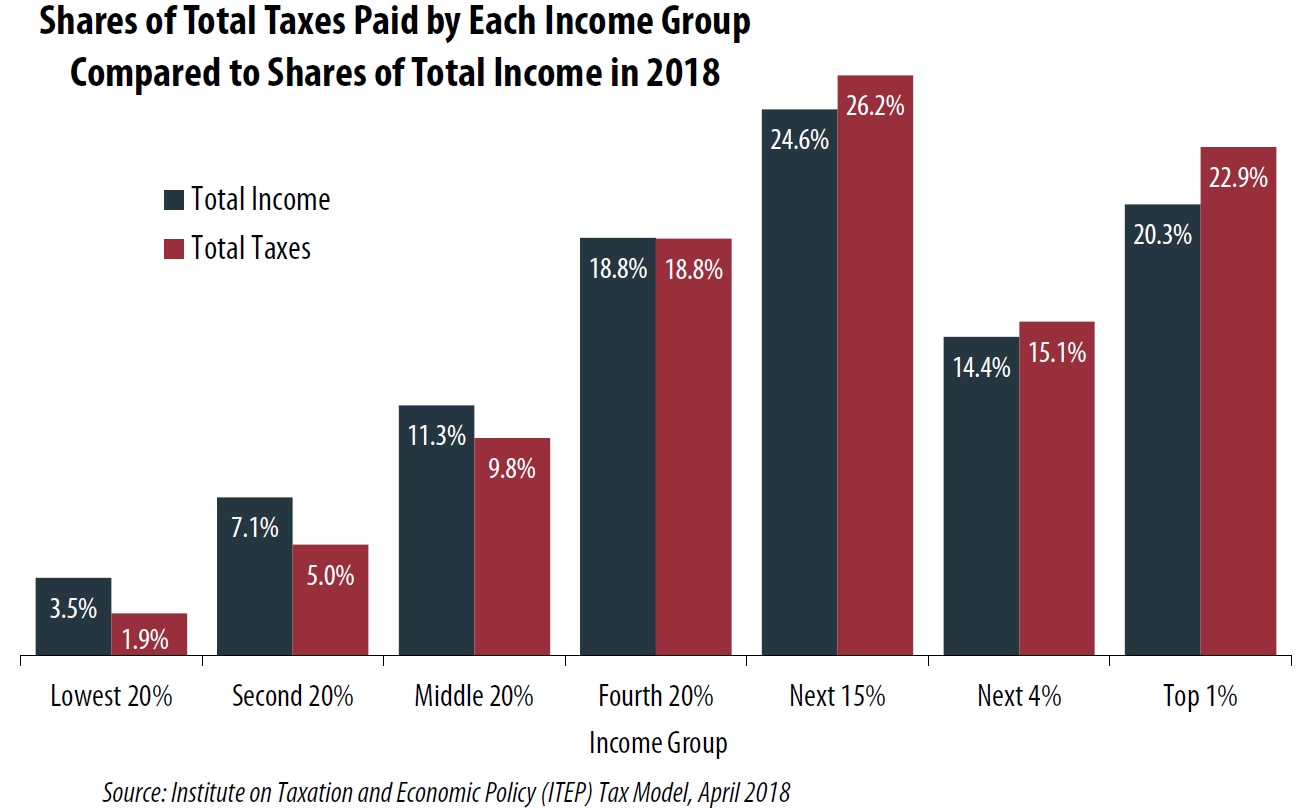

- The Institute on Taxation and Economic Policy released a 2018 report on all taxes paid, finding that the top 1% of U.S. earners paid 22.9% of all U.S. taxes, while receiving 20.3% of all income. The lowest fifth of U.S. earners paid 1.9% of all taxes, while receiving only 3.5% of all income.

- Congressional Budget Office Statistics for 2016 showed that the top fifth of households (by income) received 54% of all U.S. income and paid 69% of federal taxes. Their calculations suggested the top 1% of earners received 16% of all income and paid 25% of federal taxes.

Do Wealthy People Pay Their Fair Share of Taxes?

- A study by the Tax Policy Center (TPC) concluded that the effective federal tax rates from the lowest 20% of households by income were 2.9% and this compared to 30.6% for the top 0.1% (approximately 120,000 households). The TPC's analysis includes transfers, in the form of refundable tax credits such as income tax credit and child tax credit, which are typically provided to lower-income households and therefore help to offset the burden of payroll taxes.

- Data from 2017 on the average tax rates by pre-tax income groups showed that the top 1% of earners paid on average proportionally more tax as a percentage of their income than the bottom 50%, although the trend over the past half-century shows the gap is narrowing.

/media/img/posts/2019/01/taxIncidence/original.png)