Part

01

of one

Part

01

Student Loan Financing - Market Size

Key Takeaways

- The total United States student loan financing market was worth $1.75 trillion USD in 2022.

- The United State student loan financing market is expected to grow to $2 trillion USD by 2023.

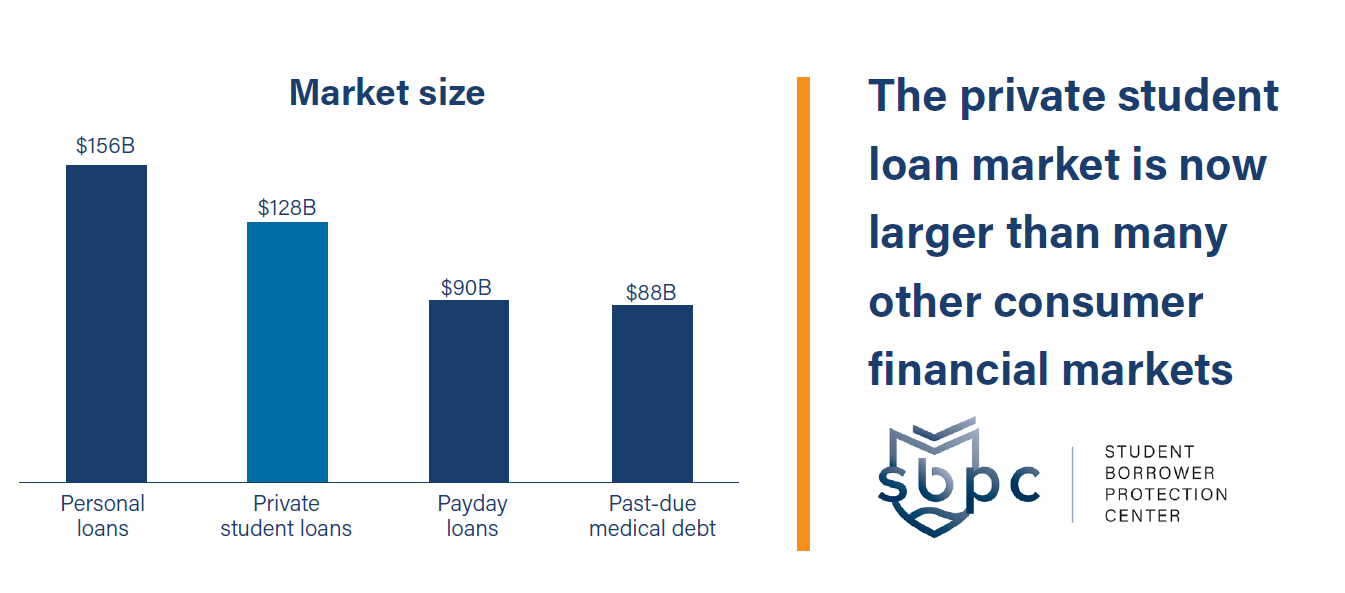

- The private student loan financing market in the United States is worth $130 billion USD as of 2020 growing to $136 billion USD in 2022.

Introduction

In 2022, the student loan financing market in the United States was valued at $1.75 trillion USD with federal financing accounting for 92% of the market. Details of our findings have been provided below.

United States Student Loan Financing Market Size

- The total United States student loan financing market was worth $1.75 trillion USD in 2022.

- The United States Department of Education owns approximately 92% of all student loans.

- There are a total of 43.4 million federal student loan borrowers in the United States,

- The market is expected to grow to $2 trillion USD by 2023 with a CAGR of 14.29%.

Market Drivers

- The state of the housing market is one of the main drivers of the growth in the student loan financing market. It is common for parents to use a home equity line of credit to help pay for college. Research shows a direct correlation between the housing market and the student loan financing market. In fact, in 2008, a 30% decline in the housing market resulted in an average increase of $1,300 in student loans per borrower.

- The Covid-19 pandemic is another driver to the growth of the market. The temporary measures that were put into place during the pandemic led to many individuals letting their loans go into forbearance.

- According to Federal Reserve data:

- "Student debt growth slowed during the pandemic; debt increased by $75,837.63 million in 2019, while it increased by only $56,222.29 million in 2020. In 2021, it grew by only $44,662.11."

- "In the third quarter of 2020, 0.66 percent of private student loan balances were more than 90 days delinquent. By the third quarter of 2021, that percentage rose to 0.94 percent."

Private Student Loan Finance Segment

- The private student loan financing market in the United States is worth $130 billion USD as of 2020 growing to $136 billion USD in 2022.

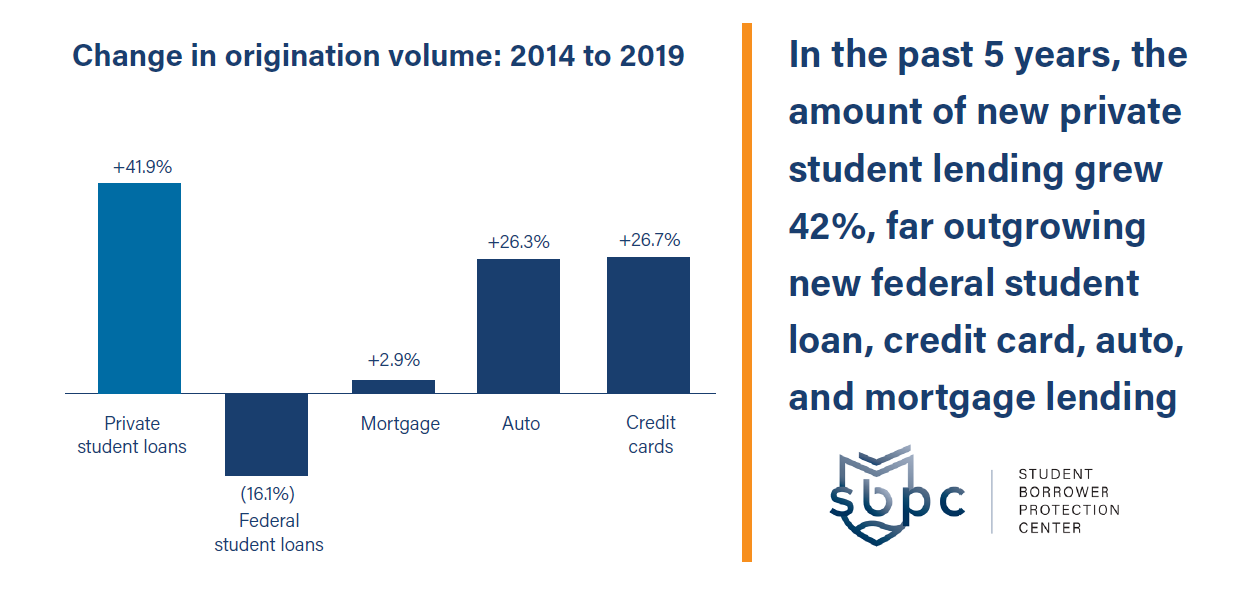

- Over the past 5 years, the segment has grown 42%.

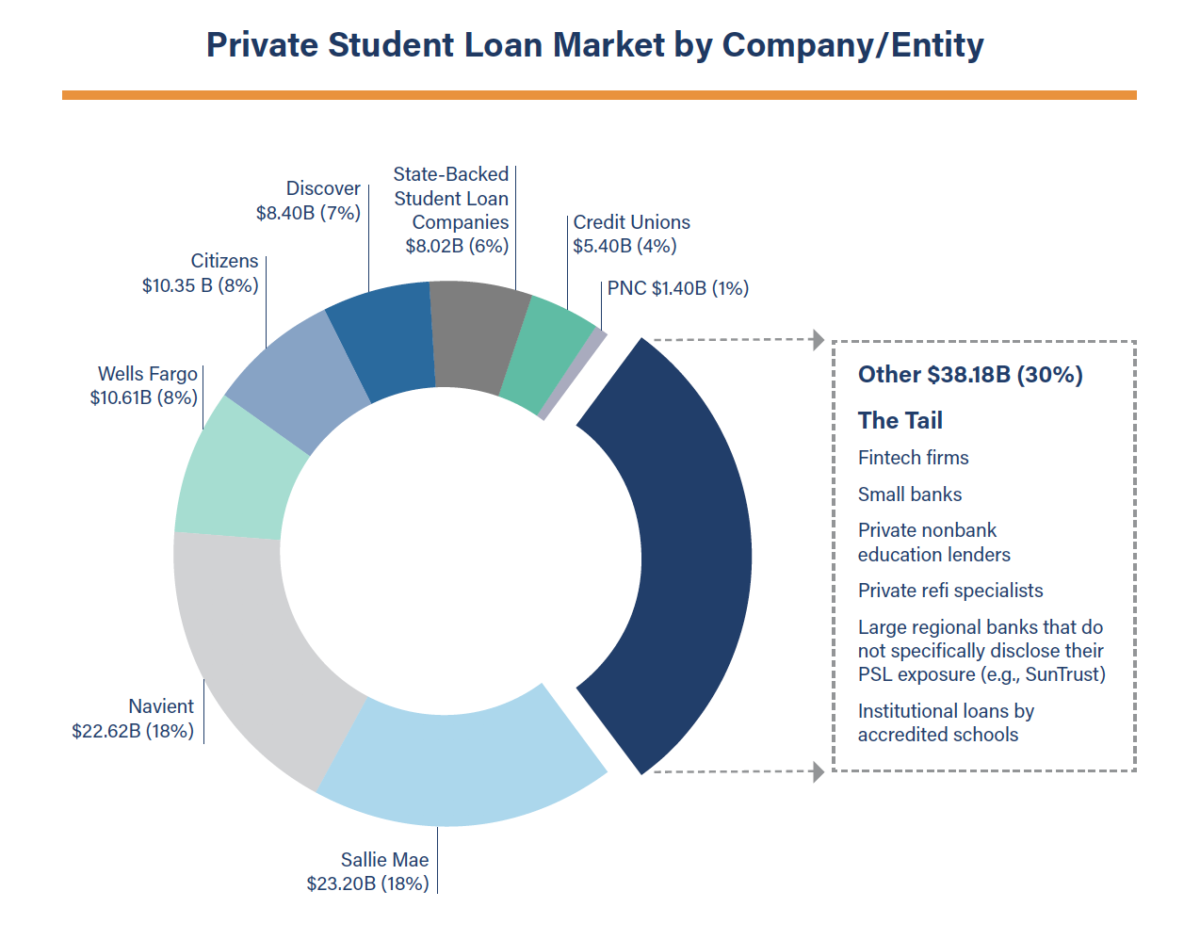

- Key Players

Additional United States Student Loan Market Statistics and Facts

- The average debt from student loans that Bachelor's (55%) graduates finish school with is $28,000 USD as of 2022.

- The total student loan debt that United States citizens owe was valued at $1.75 trillion USD in 2022.

- The average monthly payment for student loans in the United States is $300.

- 62% of college graduates in 2019 owed money due to student loans.

- Federal borrow statistics:

- borrowers in school: 6.42 million

- borrowers in grace period: 1.17 million

- borrowers in repayment: 460,000

- borrowers in deferment: 3.05 million

- borrowers in forbearance: 26.78 million

Research Strategy

For this research on the United States student loan financing market, we leveraged the most reputable sources of information that were available in the public domain, including Forbes, Bankrate, IBIS World, Consumer Finance.Gov, and more.