Part

01

of three

Part

01

Which subscription pricing model is the most effective for streamers?

Key Takeaways

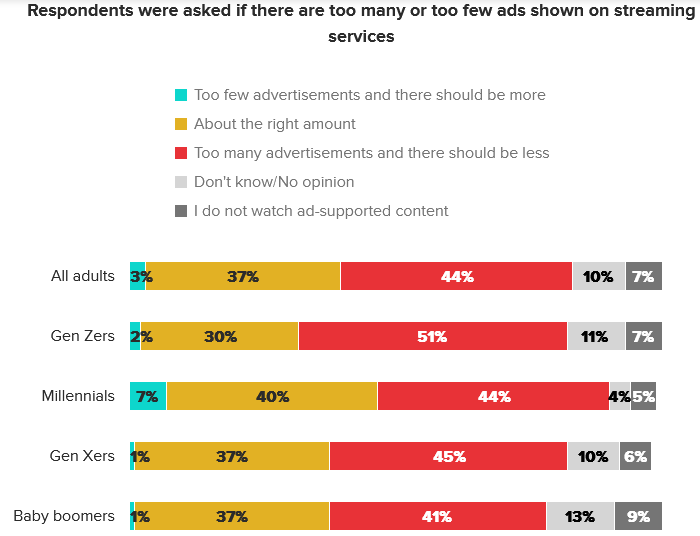

- According to a recent Morning Consult survey, 44% of US adults are of the opinion that there are too many ads on streaming services. A further 69% and 64% of them think the ads are repetitive and invasive, respectively. Additionally, the survey found that in every 5 consumers, 4 of them (79%) are annoyed not only by the number of ads but also how often they are replayed on streaming platforms.

- However, out of 2,000 US consumers that participated in a Deloitte survey, 34% of them said they would watch 12 minutes of ads per hour for a free streaming service while 25% of them said they would consume 6 minutes of ads per hour for a $6/month subscription. This is attributed to the rising cost of living.

- In 2022, Reed Hastings, co-chief executive at Netflix, stated, “Those who have followed Netflix know that I have been against the complexity of advertising, and a big fan of the simplicity of subscription. But as much as I am a fan of that, I am a bigger fan of consumer choice. And allowing consumers who would like to have a lower price, and are advertising-tolerant, get what they want makes a lot of sense.”

Introduction

While consumers have hated ads for years now, the rising cost of living might just be forcing them to rethink their choices. This report provides insights into how consumers feel about ads during their streaming experience and how Netflix is now following the footsteps of streaming services that offer ad-supported plans like Hulu.

How Consumers Feel About Ads

- According to a recent Morning Consult survey, 44% of US adults are of the opinion that there are too many ads on streaming services. A further 69% and 64% of them think the ads are repetitive and invasive, respectively. Additionally, the survey found that in every 5 consumers, 4 of them (79%) are annoyed not only by the number of ads but also how often they are replayed on streaming platforms.

- Nevertheless, although consumers hate ads, the recent rise in prices has forced them to reconsider their options. According to a survey by The NPD Group, cost moved from the number four reason why users cancel their SVOD services to the number 2 reason between October 2021 and April 2022. As such, most consumers are signing up for services that offer promotional or discount offers.

- The executive director and industry analyst at NPD, John Buffone, said: “For some consumers, ad-supported tiers can be a way to cut costs without losing access to content. As we look to the future – including potential AVOD offerings from Netflix and Disney – understanding the differing consumer value propositions will be key in determining tier structure and pricing strategies.”

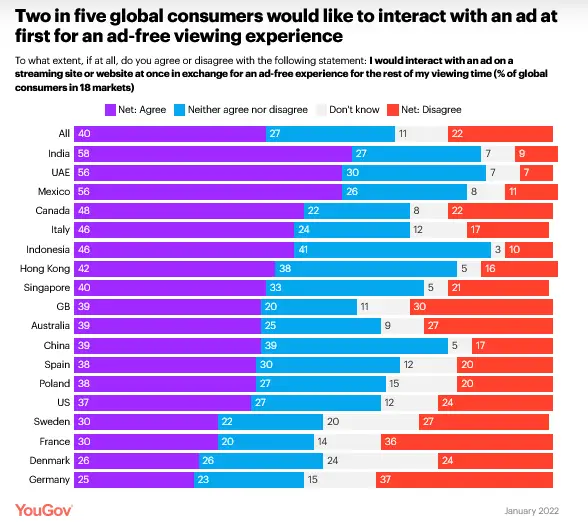

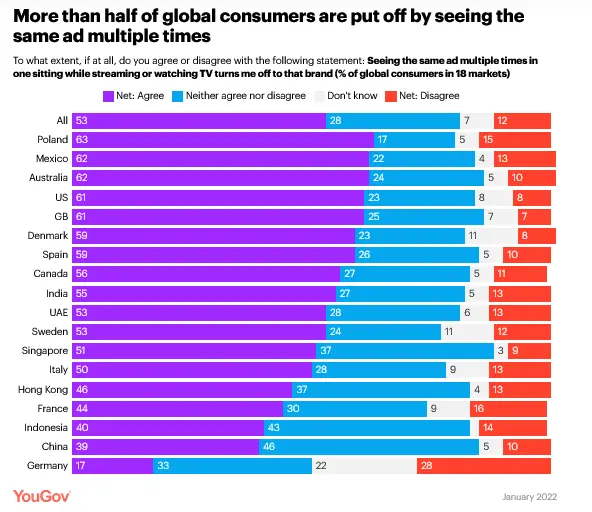

- Another survey by YouGov asked consumers across 18 markets whether they would “prefer to interact with ads immediately in exchange for an ad-free viewing experience” and according to the results, 37% of US consumers said they would. However, 61% of the US respondents also stated that they would be turned off by seeing the same ad multiple times.

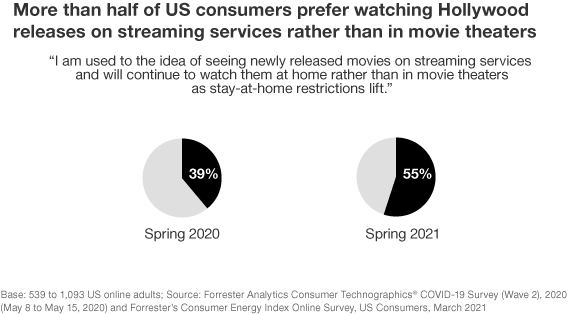

- A Deloitte report also stated that while people, especially young ones, are normally attracted to SVOD platforms by the content offered, they often leave due to subscription costs. Some of them admit to routinely canceling and resubscribing to manage costs. As such, streaming services are now looking for ways to keep their subscribers around, and offering cheaper plans might be the best path to achieve that. Especially since data shows that subscription plans that allow consumers to watch ads in exchange for lower costs or for free are now the most popular.

- Out of 2,000 US consumers that took part in the Deloitte survey, 34% of them said they would watch 12 minutes of ads per hour for a free streaming service while 25% of them said they would consume 6 minutes of ads per hour for a $6/month subscription.

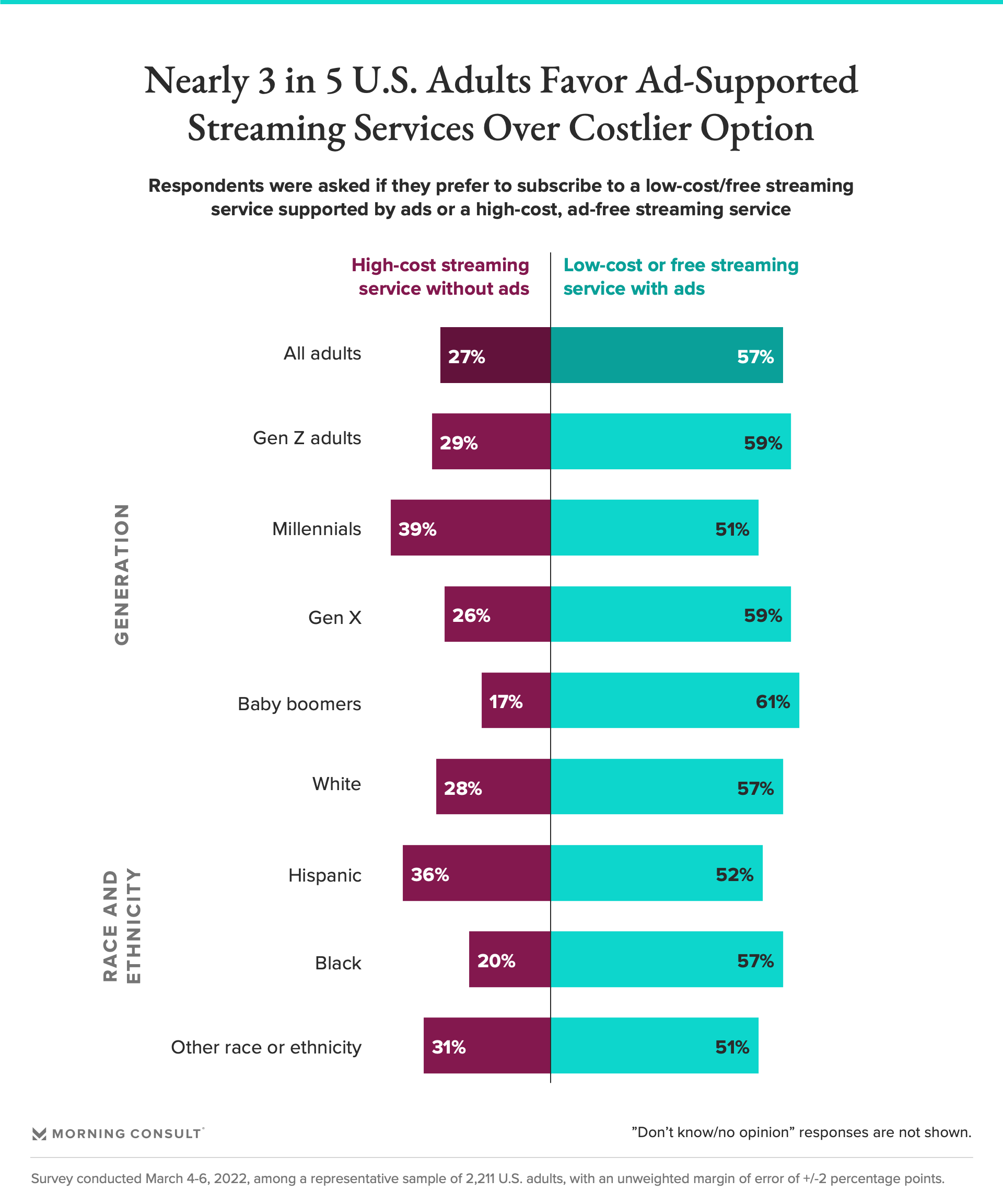

- Another poll conducted between March 4-6, 2022 by Morning Consult supports the statement that ad-supported streaming services are now becoming popular. Out of the 2,211 US adults surveyed, almost 3 in 5 now lean toward ad-supported streaming services over costlier options.

Shift Towards Ad-Supported Tiers?

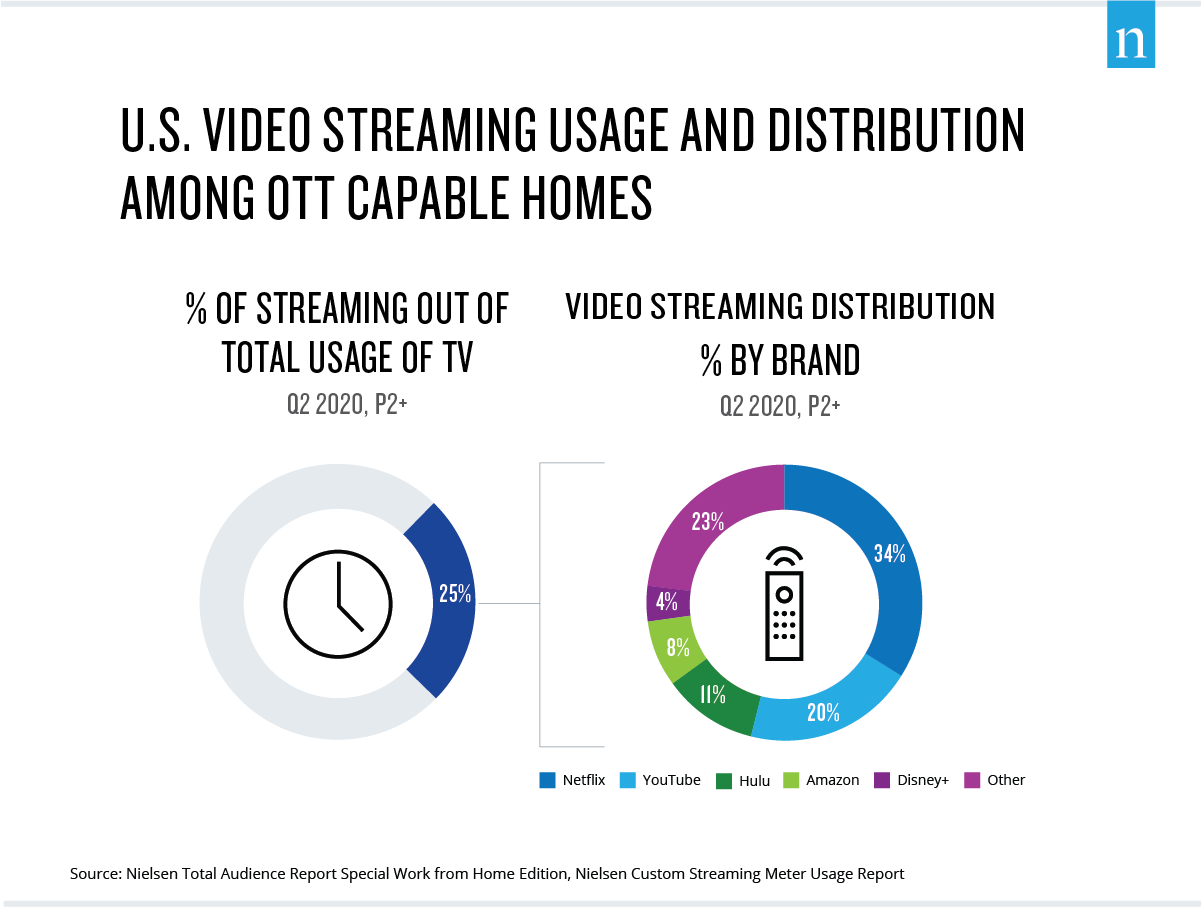

- Netflix ended 2020 with approximately 200 million subscribers for the first time, with 37 million of them having been added in 2020. According to The Drum, while the pandemic definitely played a role in this surge of subscribers, Netflix also cited its ad-free model as one of the contributing factors. However, while the company has been adamant about adding commercials to its platform for years, it is now planning to move to ad-supported tiers.

- Following a hard first quarter in 2022, where Netflix lost 200,000 subscribers for the first time in a decade, one of its co-chief executives, Reed Hastings, stated that the company is now considering a lower-priced tier supported by ads in the next year or two. He said, “Those who have followed Netflix know that I have been against the complexity of advertising, and a big fan of the simplicity of subscription. But as much as I am a fan of that, I am a bigger fan of consumer choice. And allowing consumers who would like to have a lower price, and are advertising-tolerant, get what they want makes a lot of sense.”

- The company lost a further 970,000 subscribers in the second quarter of 2022 and its head of product and chief operating officer, Greg Peters, revealed that by gaining more subscribers who will be lured by lower price points, Netflix will prosper. Peters further said that they expect the tiers to be up and running by 2023 and that over the next coming years, the company “will be able to develop an ad offering that is fundamentally different from traditional linear TV.”

- While someone might argue and say Peters' words were just meant to calm investors, ad-supported tiers might indeed be good for Netflix. Other streaming services that offer ad-supported tiers at a lower cost such as Hulu are doing well.

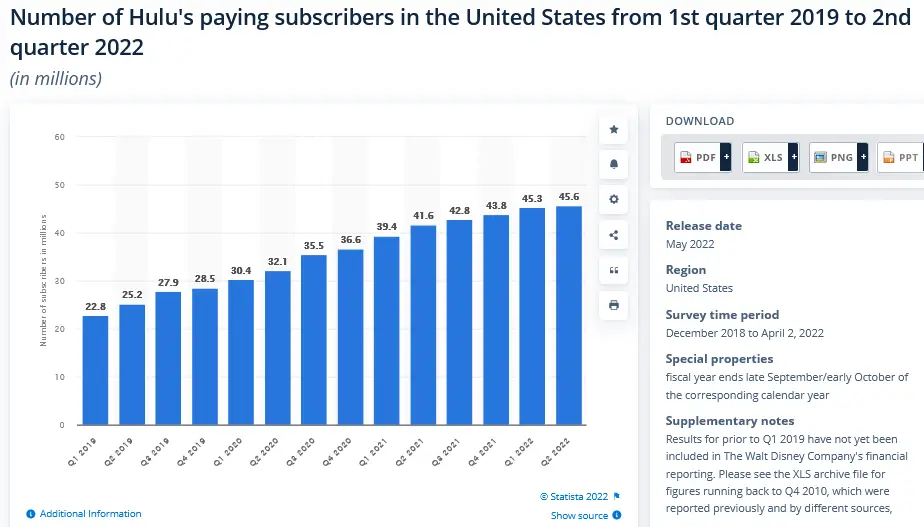

- According to Statista, Hulu’s subscribers increased to 45.6 million in the second quarter of 2022 from 41.6 million during the same period last year. Moreover, Hulu’s growth has been constant over the last few years, and its success can be attributed to the fact that it offers a variety of pricing plans that cater to different customer needs. Its most basic plan costs $6.99/month.

Research Strategy

For this research on the most effective subscription pricing models for streamers, we leveraged the most reputable sources available in the public domain, including the Wall Street Journal, Deloitte, Morning Consult, Statista, and The New York Times among others.