Part

01

of one

Part

01

Small City Co-Working Space

The average price of co-working space in the US is between $185 and $387 per month, depending on the subscription package. In small cities, co-working space subscription is generally between $47 and $150 per month. Co-working trends include an increasing focus on wellness and health, a smarter designed working space, and an expected increase in demand, and a more stable occupancy rate.

Average Co-Working Space Price in The USA

- The average price of a co-working space with a permanent desk with 24/7 access in the US is $387 a month.

- The average price of a co-working space with a flexible desk during business hours, which requires co-workers to pack up their things at the end of each day is $185.

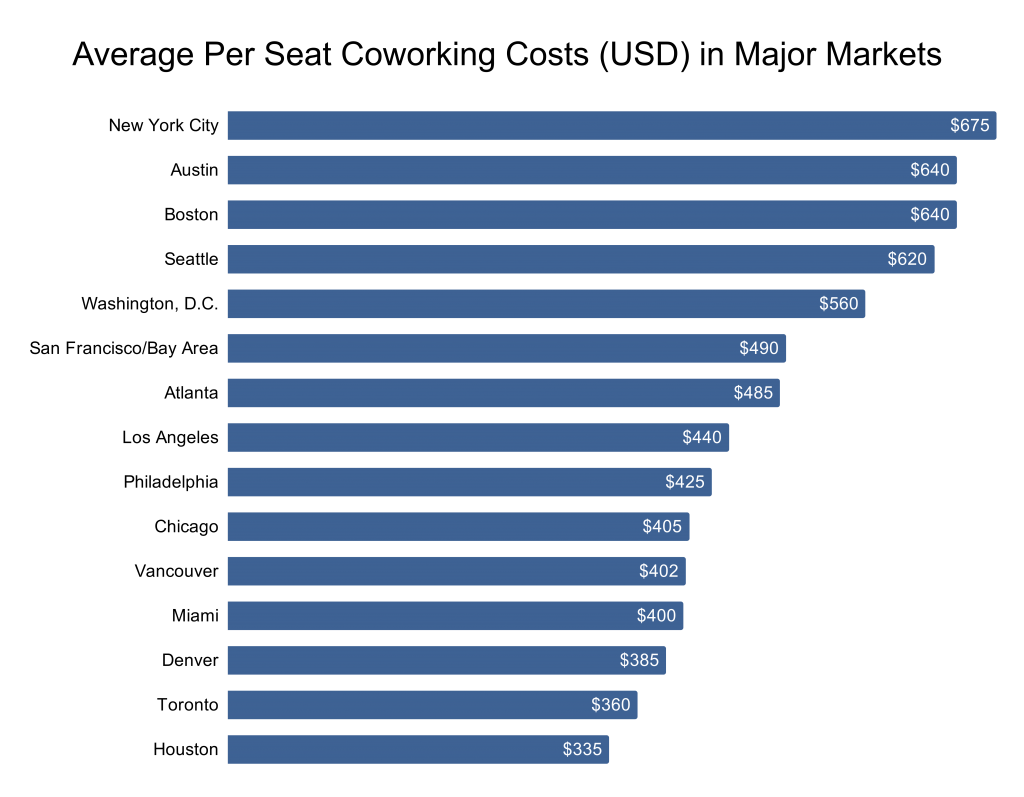

- The average price of co-working space in some select cities are shown in the picture below:

Co-Working Space Price in Small Cities

- The co-working space rate in small cities varies widely.

- The rate Think Tank, a co-working space provider in Portland, Maine (a city of about 66,735 inhabitants), charges is $150 per month for basic membership.

- The rate Local Works, a co-working space provider in Charleston, South Carolina (a city of 133,762 inhabitants), charges is $150 per month for membership.

- The Hatchery, a co-working space provider in Columbia, Missouri (a city of 120,248 inhabitants), charges is $20 per month for part-time membership.

- FLDWRK, a co-working space provider in Fullerton, California (a city of 139,866 inhabitants), charges $47 per month for membership.

- Fellow Coworking, a co-working space provider in Spokane, Washington (a city of 214,804 inhabitants), charges $49 per month for membership.

Economics of Coworking Space

- Globally, about 43% of co-working spaces generate profit directly from their operation, 33% break even, and 25% operate at a loss.

- In the US, 52% of co-working spaces generate a profit directly, while 13% operate at a loss.

- About "72% of all co-working spaces become profitable after more than two years in operation."

- "The average size of a co-working space in North America is 9,799 sq./ft., with an average capacity of 100 people. This equates to roughly 100 sq./ft. per person."

- Researchers found that "90% of co-working spaces generate a profit if they meet at least four conditions: they have more than 200 members, are older than one year, are profit-oriented and do not subsidize their operation through other businesses."

- About 60% of co-working spaces surveyed said that attracting new members is their biggest challenge.

Trends in Co-Working Space

Focus on Health and Wellness

- Co-working space operators are increasingly prioritizing wellness and health offerings to attract and retain co-workers.

- This is because health and hygiene have become key issues for professionals in the wake of the COVID-19 pandemic.

- In addition, co-working space brands are finding that marketing themselves as a brand that cares about work-life balance and wellness enables them to differentiate themselves from the competition.

- Companies keying into this trend include The Soma Vida, WeWork, New Love City, and Flow Yoga Center.

Smarter Designed Spaces

- Smarter designs that will prioritize touch-free features, physical distancing, and more workspaces will include open-air areas in their facilities. "More premises will be focused on what people are looking to accomplish, like telecon rooms, project rooms, and team collaboration rooms."

- Demand for private office offerings is also growing exponentially compared to shared co-working space and open-style office layouts that are becoming increasingly outmoded.

- The spaces will also look to improve air systems and monitor temperature and air quality.

- This also includes providing the latest technologies, IoT, automation, artificial intelligence, new wireless devices, effective software combos, virtual meeting amenities, and a fully tech-enabled workspace.

- Smartly designed space will also be about what the co-workers prefer, not what the co-working brand offers. "Co-working spaces will need to be flexible in terms of both space and timings; occupants will have the upper hand to demand for a safe and tech-enabled workspace while paying only for the number of hours they use the space."

- Geekdom, Impact Guild, and Key CoWorking are examples of a co-working space brand keying into the trend.

Increased and More Stable Occupancy

- Following the disruptions last year and a decline in the use of co-working spaces due to the COVID-19 pandemic, analysts expect occupancy rates to increase and stabilize in 2021.

- This is because demand from remote teams is expected to gradually increase.

- Big businesses and corporations are also expected to increasingly key into the use of co-working spaces. Businesses such as Salesforce, Starbucks, Ernest & Young, HSBC, Microsoft, Facebook, and Bank of America have co-working space subscriptions.

- In fact, 25% of WeWork's revenue is from companies with over 1,000 staff in 2018. In 2020, they accounted for 65% of WeWork's revenue, and the trend is expected to continue as more companies increasingly offer flexible work arrangements for their staff.