Part

01

of one

Part

01

Singapore Design in Southeast Asia

Introduction & Research Strategy

Design services in Thailand and Indonesia are extremely developed and diverse. Government agencies and local organizations associated with these industries often refer to them as “creative” as opposed to “design,” as they consider design products and services to be a sub-sector within the creative category. As a means to detail these markets in both Indonesia and Thailand, two historical trends and two predicted future trends have been detailed below. Each of these trends is kept relatively broad to encompass the design and creative markets as a whole.

Following this, we have also located two key drivers that are encouraging market growth in Thailand and Indonesia. Drivers constitute external, nationwide factors that are either increasing demand for design products and services or encouraging growth of related business’. Social media and internet access were notable drivers for both Indonesia and Thailand.

This research then transitions into key cities within each country that are driving growth of the creative/design markets. For Indonesia, we were able to identify Bandung as a major hub for fashion and related manufacturing, while Bangkok and Chiang Mai were relevant for Thailand. For each of these cities, an analysis of what design elements are prevalent and how the city is encouraging growth has been provided. This led us to then determine and discuss the competitive advantage that each country has over the global design services market. For Indonesia, the advantage was associated with the handicraft and wooden furniture market, while Thailand’s advantage aligns with the nation’s skilled labor force and low material costs.

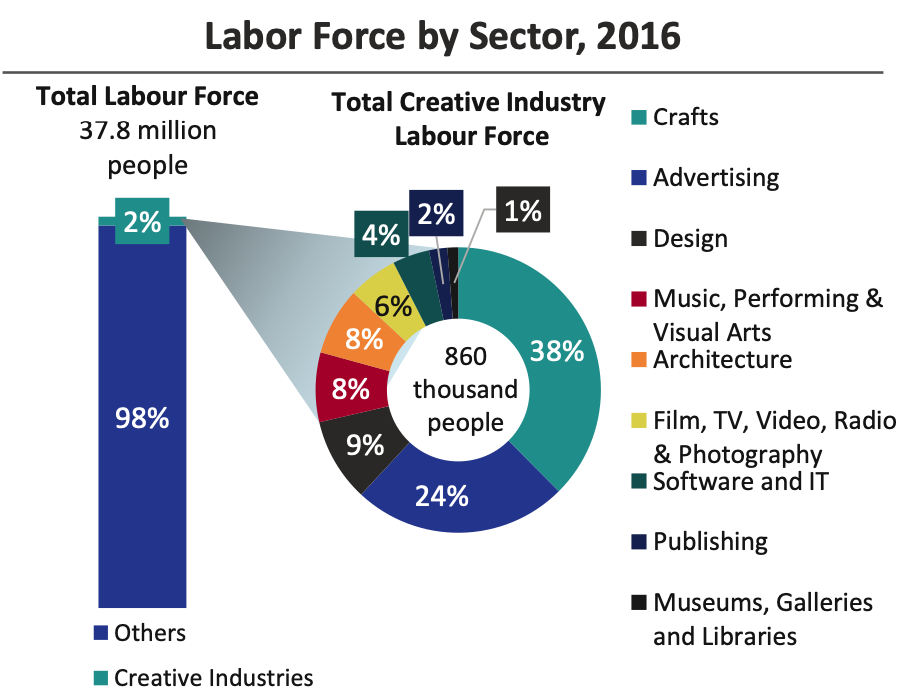

Next we delved into the talent pool for design services in both Indonesia and Thailand. Data was more readily available for this demographic in Thailand, allowing us to determine the percentage of the country’s labor force that is employed in various creative sectors, geographic locations, age brackets, and educational backgrounds. Indonesian demographics, on the other hand, were slightly more limited. While we were unable to determine age or employment statistics, we did locate data that depicts the various types of creative businesses by legal form (ex. LLCs, foundations, limited partnerships), followed by the percentages of various creative businesses by sector, geographic locations, gender, and funding.

After constructing the demographics for the creative industries, we located two strategies for each country that are currently in use to grow the talent pool of design and creative workers, as well as increase the presence of creative businesses as a whole.

The final portion of this research addresses the respective market sizes and growth rates of design services markets in Indonesia and Thailand. This data was sourced directly from government organizations for each country. While the market sizes — in terms of labor force employed or GDP contributed — were publicly available, the growth rates of various services were limited. Data available for Indonesia listed the four fastest growing design industries, while Thai sources only discussed the growth of the overall market and the total addressable market.

Throughout the compilation of this research, we have incorporated a wide array of hard data and statistics from credible organizations and research studies to define the impact and relevance of the trends, drivers, and demographics located. We have also included commentary and quotes from notable industry professionals for a first-hand perspective on the relevance of trends identified. We did locate a number of resources that appeared to contain useful graphics and data. However, these publications were printed in Thai and Indonesian, and we were unable to translate the imaging. Where applicable, we have included links to these sources for reference. We also implemented visual graphics to better depict this data where possible.

------------------------------------------------------------------------------------------------------------

------------------------------------------------------------------------------------------------------------

Historical Trends in Design Services in Indonesia

Emergence of Graphic Design

- Graphic design being viewed as a design methodology did not begin to arise in Indonesia until 1972 when the first formal education program in graphic design in Indonesia was implemented at the Bandung Institute of Technology (ITB). During this time, the focus on graphic design was limited to branding and marketing, with little emphasis on graphic design as an art form.

- In 2007, the Desain Grafis Indonesia (DGI) organization was formed. This group collected notes and work from Indonesian graphic designers that was then compiled into a book to showcase how graphic design has developed in Indonesia. This publication highlighted the benefits of graphic design programs for educational institutions and the benefits businesses could reap from employing skilled workers.

- Andi Rahmat, principal designer for Nusae in Indonesia, suggests that graphic design has had a rocky uprising in the region due to its historical association with the advertising industry. Transitioning from graphic design being used for consumerism purposes to graphic design as an art form is driven only by the acceptance of modern design.

- In recent years, local graphic designers, including one from Blackhand Design studio in Bandung, have designed notable imaging and logos for national Indonesian celebrations and organizations. The design for the Indonesian Independence Day, the Asian Games logo, and Jakarta MRT logo were all created by Indonesian graphic designers. These creations are driving the influence of acceptance of graphic design as an art form in the nation.

- As graphic design became more popular in Indonesia, more events and opportunities emerged that encouraged graphic designers to showcase their work and abilities. In 2014, for example, 99designs Cafe sponsored weekly events at local coffee shops in Jakarta and Surabaya where graphic designers could congregate to share ideas, learn new skills, and work on projects together. These events even attracted professional graphic designers to come speak about their position in the industry, furthering the acceptance of graphic design.

Exportation of Design Goods

- Many of the design goods produced by Indonesia, as well as design services available via the skilled labor force, often end up being exported or outsourced. Between 2010-2015, the total value of exports from Indonesia decreased by 7.18% year-on-year. At the same time, however, exports from the Indonesian creative industry continued to increase by 7.67% annually.

- In 2013, exports from the creative market in Indonesia brought in 119 trillion RP, up 8% from the previous year. According to Statistics Indonesia (BPS), the majority of these exports were from the fashion, handicraft, and furniture markets.

- According to the Embassy of the Republic of Indonesia in Washington, D.C., more than 60% of Indonesia's apparel and textile goods are exported internationally each year.

- In 2018, the greatest imports from Indonesia to the U.S. included knit and crochet apparel and accessories ($2.3 billion), woven apparel and accessories ($2.2 billion), rubber ($1.8 billion), and footwear ($1.5 billion).

- From 2005-2014, the value of creative industries exports increased from US $2.4 million to US $5.2 million. The UNCTAD Creative Economy Outlook publication from this time frame indicates that many of the exported goods included jewelry, natural resources, furniture, and handicrafts.

Future Trends in Design Services in Indonesia

Continued Development of Graphic Design

- According to Islamuddin Rusmin Reka, the Executive Director of Marketing for the Creative Economy Agency in Indonesia, the development of graphic and visual communications design is likely to be driven by younger generations — especially Millennials.

- Rege Indrastudianto, the Co-Founder & Design Director of Visious Studio and Chair of the ADGI suggests that the graphic design sector is limited in the current ecosystem and lack of designated space for work. However, Indrastudianto also suggests that graphic design will grow in importance alongside product design as consumers begin to use it to construct a visual product identity and judge quality.

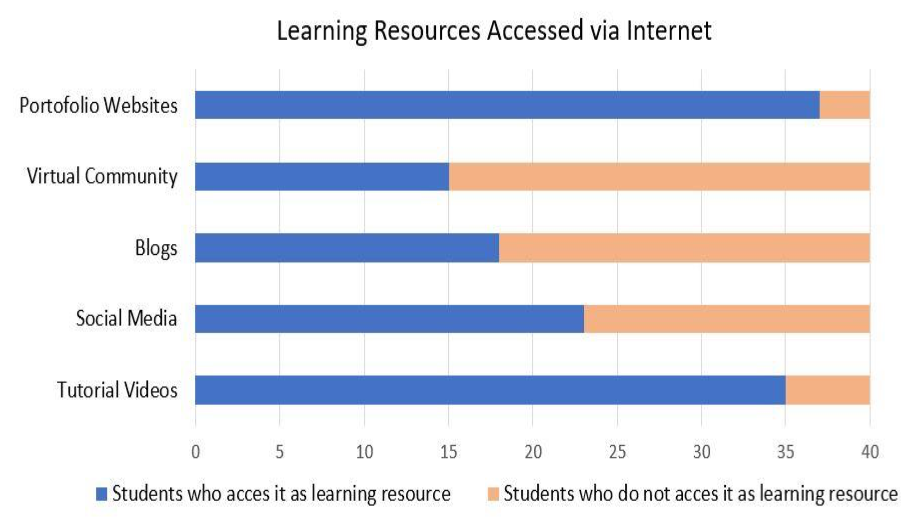

- As technology becomes more accessible to consumers in Indonesia, the Global Research & Development Services organization found that graphic design students in Indonesia are utilizing the following learning resources online to reference and produce their own work:

- Graphic design students are also using the following portals to book professional projects:

Prioritization of Film Industry

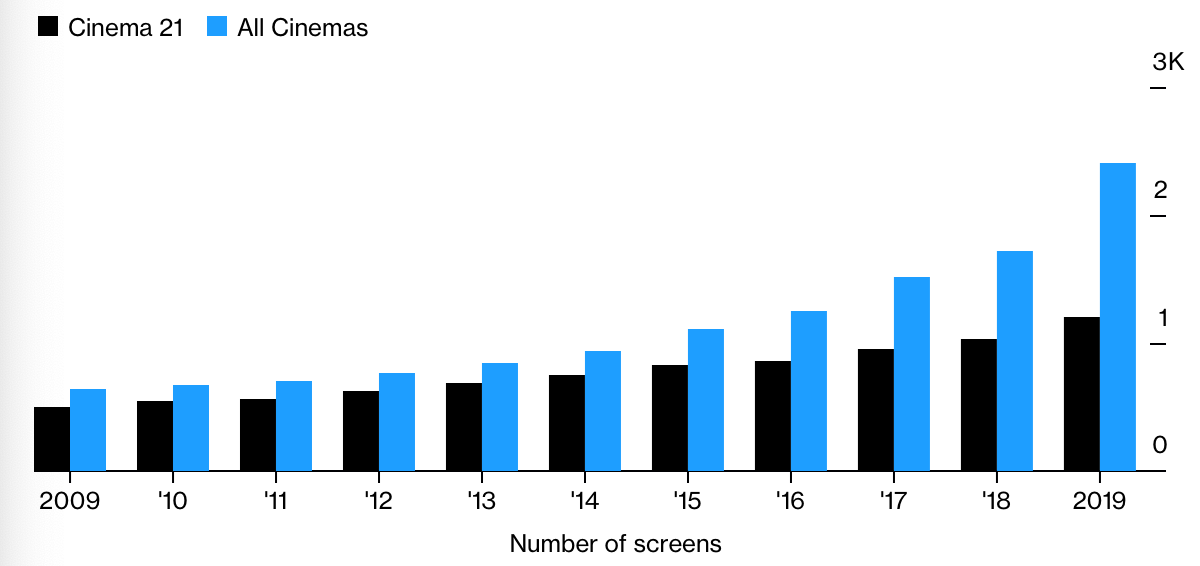

- Between 2014-2019, the number of films released annually in Jakarta increased from 106 to 230, as the number of viewers grew from 16 million to 52 million. While a majority of films shown at these theaters are imported, the Indonesian government is beginning to prioritize local film.

- To date, the Indonesian film industry contributes 0.18% or 1.78 billion rupiahs to the country's total creative GDP. However, the film, animation, and video industry in Indonesia is the second fastest-growing creative sub-sector, growing at an annual rate of 10.30%.

- The Ministry of Education and Culture in Indonesia has set a goal for national films to constitute 50% of the domestic film market, which they intend to achieve via government-sponsored advertisements and international actors.

- This graph from Cinema 21 depicts historical cinema growth in Indonesia, a trend which experts expect to continue in future years:

- Cinemaxx predicts that Indonesia could become a 500 million admissions market as international buyers seek investments and the government promotes the local industry.

Drivers of Design Services in Indonesia

Internet & Social Media

- According to Denny R. Priyatna, Principal of AIEVL in Indonesia, "A lot of styles are becoming more familiar and the public are getting smarter in recognizing design, all thanks to social media."

- Hidajat Endramukti, Principal of Endramukti Designs, further confirms this driver, indicating that interior design in Indonesia is progressing towards modern styles, and this can be attributed the number of references to this style on social media today. Endramukti expects demand for modern designs to continue for at least the next five years, if not longer.

- The Digital 2020 Indonesia report published by Data Reportal found that there were 175.4 million internet users in Indonesia as of January 2020, an increase of 17% from 2019. This represents 64% of Indonesia's total population. Furthermore, 160.0 million (59% of Indonesia's population) of these users are on social media, up 8.1% from 2019.

- From the business perspective, McKinsey explains that social media and digital technology encourage small- and medium-sized businesses in Indonesia to develop digital storefronts, use graphic design for brand development, and market their products to a wider audience.

- McKinsey further notes that BEKRAF and the Kementarian Badan Usaha Milik Negara organizations are driving digitization in the creative economy. Kementarian is currently constructing "creative houses" throughout Indonesia for small- and medium-sized creative businesses to learn new digital strategies for success online.

- Global Business Guide Indonesia further explains that the growth of Indonesia's creative industry is positively correlated with the growth of its e-commerce industry

Entrance of Young Creators

- By the year 2030, Indonesia's government expects to have more than 180 million new entrants into the workforce, many of which are likely to create startups in the creative industry.

- Reka of the Creative Economy Agency further explains that, "With a large market potential, as well as the emergence of the millennial generation, the visual communication design sub-sector has the potential to drive economic growth which is also considered capable of having a large impact on other Bekraf subsectors."

- Joshua Simandjuntak, the Deputy Chairman of Marketing at Bekraf and one of the top industrial designers in Indonesia notes that young designers in Jakarta and Bandung are restructuring the design market in Indonesia with a popular new technique of manipulation.

- A popular business strategy Simandjuntak keeps seeing is young designers transforming traditional designs and materials into contemporary products that are then sold as souvenirs to tourists.

- Simandjuntak also explains that, "The main trigger today comes from the art schools. In Jakarta there are a lot of design schools, resources and capital."

- Many new young designers from Indonesia, especially those from Jakarta and Bandung, are expected to focus on digital design, UI and UX, and traditional product redesign.

Cities Driving Growth of Design Services in Indonesia

Bandung

- Bandung is the third largest city in Indonesia and located only 129 km outside of the capital, Jakarta. Bandung is known for its population of natural material producers and craftsmen, making it a hub for handcrafts, product design, and fabric manufacturing.

- Many apparel companies opened shops in Bandung because of easy access to materials and skilled labor. For tourists, Bandung became a popular travel destination as the number of retailers available, especially independently-owned, presented the opportunity to express themselves.

- In 2014, the Bandung Creative Economy Committee was created to encourage the development of the local creative economy by implementing new policies and opening access to government resources.

- Today, shopping in Bandung is known as the Distro market, and more than 1,300 companies and retailers — of which many are apparel-related — are housed there.

- Globally speaking, Indonesia as a whole contributes 18.01% to the world fashion industry.

- According to Kenny Dew Kaniasari — the Head of the Tourism and Culture Division in Bandung's city administration, "Bandung is a comprehensive fashion ecosystem... In this city, we have textile factories, garment factories, fashion designers and a lot of very stylish people."

Competitive Advantage of Design Services Market in Indonesia

Handicraft & Wooden Furniture

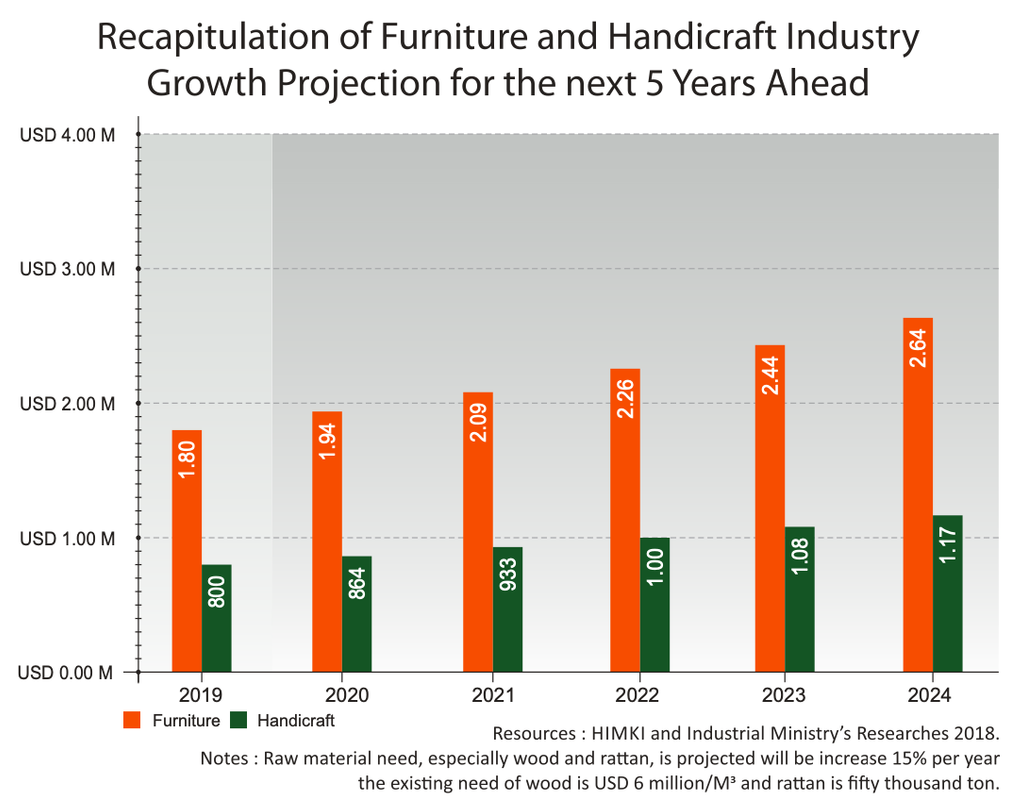

- Handicraft in Indonesia remains popular today due to its extensive history and relation to Indonesian culture. Woodcarving is one of the most popular handicraft mediums due to the nation's access to unique timbers, including Teakwood and Mahogany. Countries from around the world are interested in wooden furniture products from Indonesia, especially from Bali and Java.

- Indonesia boasts the third largest availability of forest raw material in the world. HIMKI suggests that the country has the chance to be the largest manufacturer of furniture and handicrafts worldwide, especially for timber and rattan, if taken advantage of successfully.

- Today, handcrafts contribute 15% to Indonesia's total creative GDP, falling only behind fashion.

- Demand for Indonesian wood products is high throughout Asia, particularly in India, Taiwan, and Turkey. The Ministry of Trade's Directorate General of National Export Development expects handicraft exports to bring in between US $721-728 million each year for Indonesia.

- Between 2009-2013, export of Balinese handicraft to ASEAN countries increased by 11.35% year-on-year. In 2018, Indonesian government predicted that handicraft product exports would grow by at least 10% due to Bekraf's emphasis on creative marketing and exhibitions.

- According to the Ministry of Industry, there are some 140,000 businesses in Indonesia working in the furniture industry, employing approximately 437,000 workers. For every USD $1 billion investment received, the furniture industry can generate an additional 500,000 jobs in Indonesia.

- As part of the Indonesia Furniture and Craft Industry Association (HIMKI) plan to grow to USD $4 billion by 2024, HIMKI is working with the Indonesian government to organize international furniture exhibitions, new training programs, and implement new manufacturing equipment.

- This image from HIMKI depicts the predicted potential growth of Indonesia's furniture and handicraft market if utilized successfully:

Talent Pool of Design Services in Indonesia

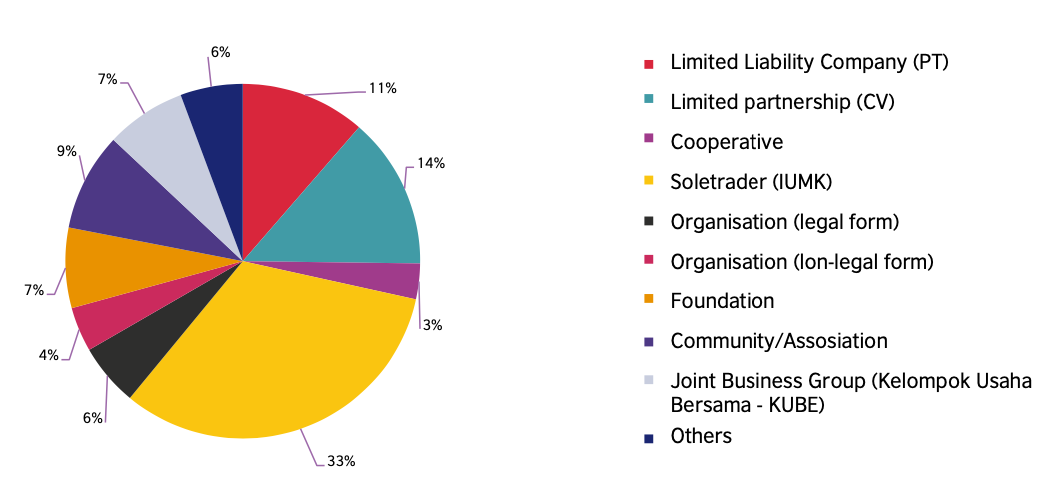

- According to the Creative and Social Enterprises in Indonesia report published by British Council in late 2020, creative social enterprises in Indonesia costs of the following business types:

- The creative economy in Indonesia constitutes the following 16 sub-sectors:

- More than 70% of businesses in Indonesia that fall under the creative and social enterprises' category were established within the past five years. The most common sectors for creative businesses includes:

- Culinary

- Fashion

- Crafts

- Eco and Education Tourism

- Approximately 77% of creative businesses in Indonesia are located in urban areas, while 23% can be found in rural locations. 88% of creative social enterprises are found in urban areas, compared to only 12% in rural regions.

- By design sector, creative businesses in Indonesia are located in the following sub-sectors:

- Culinary: 32.7%

- Fashion: 23.0%

- Craft: 8.85%

- Product Design: 5.31%

- Art, Television, and Radio: 5.31%

- Interior Design: 3.54%

- Press and Publication: 3.10%

- Game & App Design: 2.65%

- Visual Communication Design/Graphic Design: 2.65%

- Performance Art: 2.21%

- Animation & Video: 2.21%

- Eco-Tourism, Edu-Tourism, Tourism, & Education: 1.77%

- Music: 1.77%

- Photography: 1.33%

- Film: 0.88%

- IT-based E-commerce: 0.88%

- Advertising: 0.44%

- Other: 1.33%

- Data from BEKRAF and BPS in 2017 found that 92.37% of creative industry players in Indonesia are entirely self-funded. These businesses, regardless of size or legal form, have not received any funding from banks or governments. Also, 88.95% of design products made in Indonesia's creative market do not have any intellectual property rights.

- On average, creative enterprises in Indonesia employ 1.37 females and 1.68 employees under the age of 35.

- According to the United Nations ESCAP, 55% of entrepreneurs in the creative economy in Indonesia are women. Also, the average creative economy entrepreneur has achieved a post-secondary education.

Strategies for Growing Talent Pool in Indonesia

Indonesia Creative Economy Agency (BEKRAF)

- The Indonesia Creative Economy Agency, also known as BEKRAF, was established in 2016 with three goals in mind:

- To increase and optimize marketing opportunities for creative services and products

- To provide funding, education, and growth opportunities for the creative industry

- To increase public awareness and appreciation of the creative industry

- The Department of Research, Education and Development at BEKRAF created the Innovative and Creative through Collaboration of Archipelago (IKKON) program as a means to connect local and experienced designers in Indonesia with sustainable resources. As part of this program, creative participants received the opportunity to collaborate with urban and traditional artists across Indonesia, while also learning about design material history, sourcing, marketing, and barriers.

- According to Jennifer Isaacson, international curator for Indonesia Pavilion, "BEKRAF has put the most effective strategies to nurture and curate the best artists with phenomenal artisanal products, that are rich in tradition and Indonesian craftsmanship."

- In 2016 alone, BEKRAF helped more than 2,600 creative entrepreneurs in Indonesia obtain bank loans and investments totaling 4.2 trillion IDR and 96.75 billion IDR, respectively. A majority of these businesses were in the culinary, fashion, and digital sectors.

Government Initiatives and Support

- President Joko Widodo of Indonesia has set a goal for Indonesia to be an established global creative player by the year 2030. The creation of BEKRAF is a part of this initiative.

- In May 2019, BEKRAF entered into a collaboration agreement with the Thailand Creative and Design Center (TCDC). Together, these agencies are working to grow economic contributions from the creative industry in Indonesia, particularly within the fields of design, photography, music, and animation.

- As part of this goal, Indonesia is set to host the World Conference on Creative Economy in Bali in November 2021.

- The United Nations announced that 2021 is the International Year of Creative Economy for Sustainable Development. To show their support, Indonesia is sponsoring this initiative and suggesting a major theme be "Inclusively Creative: A Global Recovery" as the creative economy works to recover from the COVID-19 pandemic.

Growth of Design Services in Indonesia

- According to the most recent data published by the Central Statistics Agency and Creative Economy Agency in Indonesia, the creative industry contributed 989 trillion rupiahs, or 7.44%, to the country's total GDP in 2017. This market grew by approximately 11.4% between 2017-2018, closing out the year with 1.102 trillion rupiahs towards the total GDP in 2018.

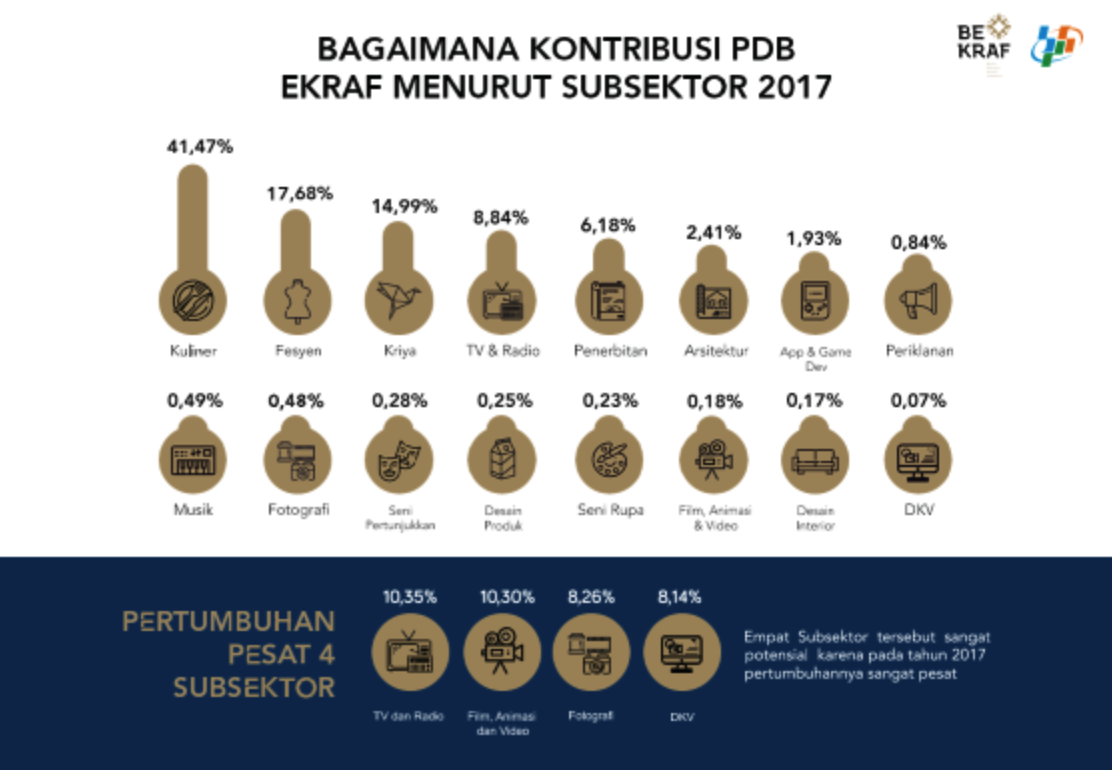

- Broken down by design type, each of the following design sub-sectors in Indonesia contribute the following percentages to the country's creative GDP:

- Culinary: 41.47%

- Fashion: 17.68%

- Craft: 14.99%

- TV & Radio: 8.84%

- Publishing: 6.18%

- Architecture: 2.41%

- App & Game Development: 1.93%

- Advertising: 0.84%

- Music: 0.49%

- Photography: 0.48%

- Performing Arts: 0.28%

- Product Design: 0.25%

- Visual Arts: 0.23%

- Films, Animations, & Videos: 0.18%

- Interior Design: 0.17%

- Visual Communication Design (DKV)/Graphic Design: 0.07%

- The fastest growing creative design types in Indonesia and their respective annual growth rates from 2016-2017 include:

- TV & Radio: +10.35%

- Film, Animations, & Video: +10.30%

- Photography: +8.26%

- Visual Communication Design (DKV)/Graphic Design: +8.14%

- This data is also presented in the following graphic (note: the graphic is displayed in Indonesian):

------------------------------------------------------------------------------------------------------------

------------------------------------------------------------------------------------------------------------

Historical Trends in Design Services in Thailand

Local Products = Luxurious & High-Quality

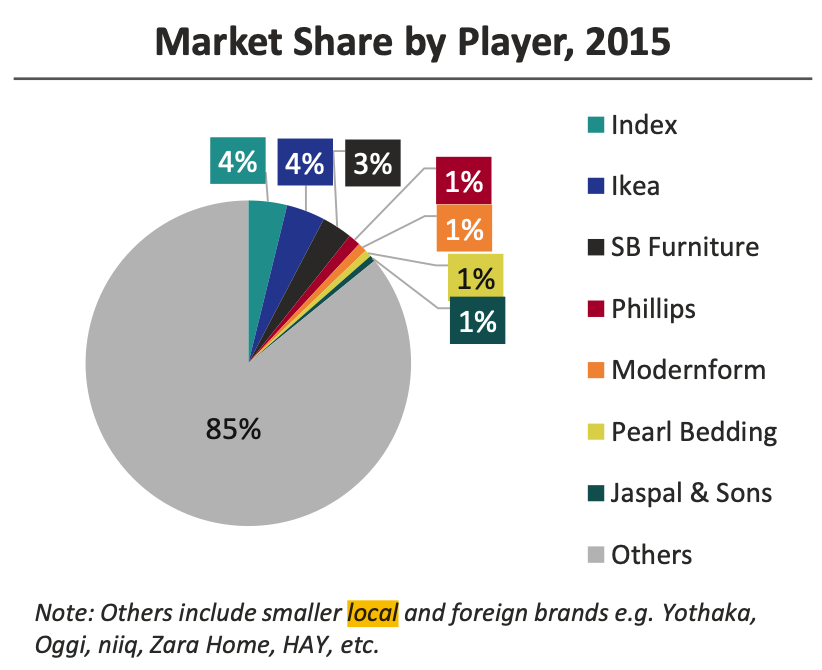

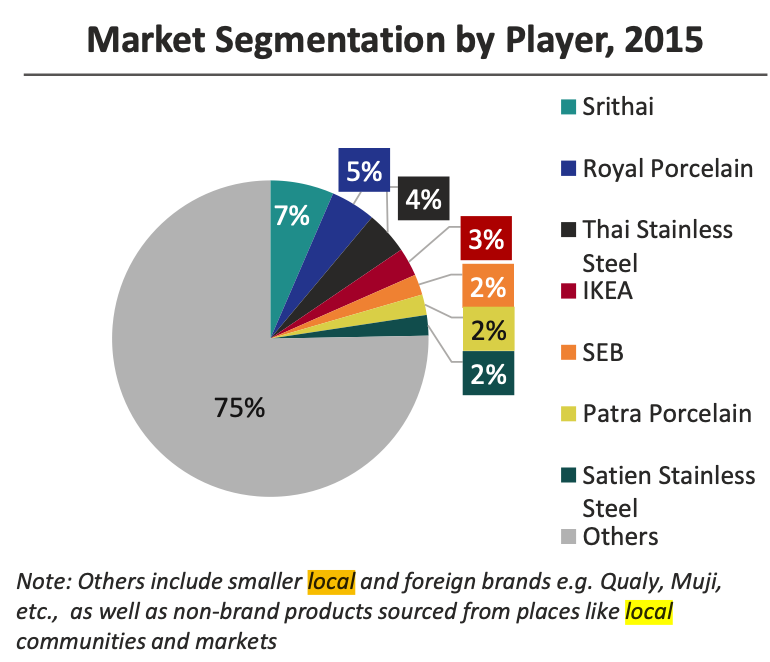

- Local brands, businesses, and design products constitute the majority of the creative industry in Thailand. According to Ipsos, the most popular home furnishing brands in Thailand in 2015 were as follows:

- For homeware and home decor, the key players in Thailand include:

- International design companies that have a preference in Thailand, such as Philips, will often utilize local design service providers so as to create products that align with local culture and preferences to increase buyer value. Manufacturing products inland also helps minimize fees associated with the design and creation process.

- Since 2005, top local brands at Siam Paragon and Siam Center — luxury shopping and recreation facilities in Thailand — have consistently reported the highest sales per square foot amongst all locations in the country.

- Stakeholder interviews conducted by Ipsos Business Consulting suggest that products designed and manufactured in a brand's same country of origin are perceived as being of higher quality, despite being more expensive and sometimes requiring a longer lead time.

Combining Traditional & Contemporary Materials & Techniques

- Traditional Thai designs and crafting techniques hold significant value to Thai consumers, as it is a way to pay respect to the country's heritage and evolution. However, as the middle class in Thailand continues to expand and grow, consumers are interested in a way to express their individuality. Brands that use a combination of traditional and modern materials and design techniques are considered unique and attractive to Thai buyers.

- The physical climate of Thailand allows easy access to natural resources for design, including silk, bamboo, rattan, cotton, and more. Traditional crafts designed with these materials are not limited to baskets, weaving, and carvings.

- In architecture and interior design, Thai designers will utilize traditional Thai materials to create a modern atmosphere. This is commonly done via outdoor materials being used in indoor spaces, utilizing bamboo and wood (as opposed to brick, stone, and cement) for building structures, and adding large windows.

- In the fashion industry, Bangkok designers have been showcasing traditional and locally produced Thai fabrics, including silk and linens, and cottons. Between 2016-2017, designers Atelier Pichita and Pichitra Boonyarataphan released new luxury collections that incorporated Thai fabrics from the North and Northeast borders of Thailand. While these clothing lines were geared towards the upper income populations, they also provided an opportunity to small Thai businesses that create these linens by hand.

- According to an analysis of the Thai furniture industry, consumer preferences are driving demand for eco-friendly designs. This demand is driving the continuation of traditional elements, materials, and techniques in Thai design today.

Future Trends in Design Services in Thailand

Automation & Digital Technology Design

- According to the Deloitte Thailand Digital Transformation Survey Report 2020, many businesses in Thailand — even those outside of the creative and design industry — are beginning to prioritize user experience design to operate more efficiently and reach more customers.

- This prioritization is increasing the demand for User Experience Designers in Thailand, which are perceived as "very important" to businesses in the technology, media, and telecom markets.

- In the coming years, 32% of businesses in Thailand intend to outsource work to compensate for digital design skills and needs, while 24% will hire new permanent staff with relevant skills, and 23% intend to retrain existing employees. Nearly 16% of companies are expected to hire freelancers.

- As part of Thailand government's Thailand 4.0 plan to encourage innovation in the economy in the design industry (as well as others), the Thailand Board of Investment (BOI) is offering incentive packages for businesses that use robotics and automation technologies in the design and creative industries. These technologies include but are not limited to conceptual design solutions and engineering designs and system integration, among others.

Designs that Express Consumers' Identity

- As the middle class in Thailand continues to expand and grow, Ipsos expects demand for unique product designs with a strong story to become more popular with consumers.

- Brands with an established social identity are more likely to grasp the attention of Thai consumers, particularly those in younger generations.

- HKTDC Research noted that 86% of Thai consumers intend to spend more or the same as they currently do on fashion apparel between 2021-2024, as they feel confident in what they feel matches their personality, identity, and mood.

- In the 2020-2022 Thailand Industry Outlook report published by Krungsri Research, experts expect 3D printing technology to develop quickly in the creative and design industries, as it offers a convenient solution to supply chain issues associated with the growing middle class interested in customized items. 3D printing is expected to be relevant in the fashion, auto parts, electronics, and machinery/equipment design segments.

Drivers of Design Services in Thailand

Growing Middle Class

- Between 2010-2015, the average household's disposable income in Thailand grew at a CAGR of 6.5%, resulting in an increase in size of the middle-income population.

- According to the BCGs Center for Customer Insight survey, more than 50% of Thailand's population is considered part of the middle and affluent class (MAC) based on household income. These consumers earn between THB 15,000-50,000+ per year.

- Since 2006, the purchasing power of Thai consumers has risen by 47%, leading the World Bank to consider Thailand an upper-middle income economy. According to the Ministry of Foreign Affairs of Denmark in Thailand, the increase in purchasing power ignites a demand for unique design product, with Danish and Dutch designs being of particular interest amongst richer Thai populations.

- The Ipsos report suggests that "With changing lifestyle and growing middle-income population, an increasing number of people are developing a taste for products with unique design to differentiate themselves from others."

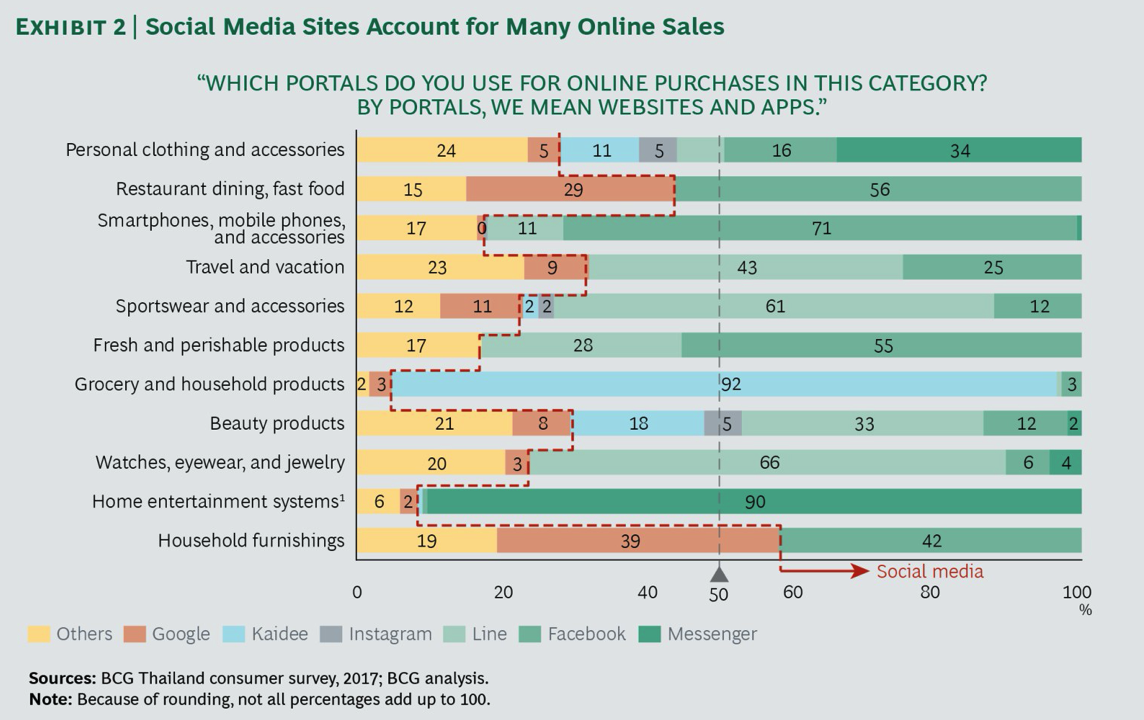

Access to Social Media

- An estimated 40% of all purchases made by Thai consumers are influenced digitally. Between 50-60% of research for products and goods is conducted via popular social media channels, including Facebook, Facebook Messenger, Instagram, Line, and Kaidee.

- For the following design-related product categories, Thai consumers utilize the following online portals to purchase items (note: not all categories listed in the image below are design-related):

- The Hong Kong Trade Development Council (HKTDC) Research predicts that between 2016-2021, the e-commerce market for fashion and furniture in Thailand will grow by 27% and 17%, respectively, as a result of greater use of social media and mobile devices.

- From a business perspective, social media has also made it possible for companies in the creative industry in Thailand to learn about their audiences and reach out to new ones, particularly as more data becomes available on consumers and their expectations. PwC suggests that designers and creative players in Thailand who wish to remain relevant must take advantage of consumer access and usage of the internet.

- According to the Ipsos report, "Social network has not only led to consumers having higher awareness of design products, but also it has enabled design product suppliers to execute more influential advertisements and marketing campaigns that positively affect consumers' purchasing decisions."

Cities Driving Growth of Design Services in Thailand

Bangkok

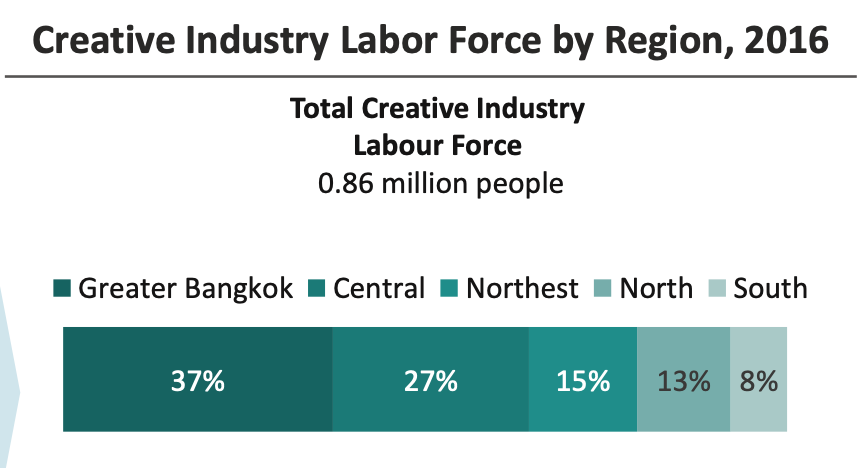

- The majority of design workers in Thailand are employed directly in Greater Bangkok (37%) and Central Thailand (27%). Most of these creative workers are employed in crafts, music, art and performing/visual arts, and museums/galleries/libraries.

- The Charoenkrung-Khlongsan and Chulalongkorn University areas of Bangkok have been designated as commercial districts in the Thailand 4.0 plans for creative business, trade, service, and recreational activities. As part of this plan, creative businesses are encouraged to set up shop in these areas through incentive programs.

- Architectural and urban design are the primary design services of focus in Bangkok right now as the city works to redevelop for optimized operations and economic growth. This is being emphasized through a number of ongoing projects, including:

- Bangkok 250

- Rattanakosin Island conservation and development master plan

- Phra Pok Klao Sky Park project

- Kadeejeen-Khlong San rehabilitation project

- Yannawa Riverwalk regeneration project

- As a result of these efforts, the number of abandoned establishments in the Charoenkrung creative districts decreased by 62% between 2015-2017.

Chiang Mai

- The CEA has implemented a Creative Economy Promotion Plan 2018-2022 in Chiang Mai Old City that is aimed at growing the creative industry through four key strategies:

- Composition of physical space (physical appeal of area)

- Creative economy components (creative businesses, labor skill, etc.)

- Elements of cultural dynamics (placement and art and cultural activities for visitors)

- Elements of creative environment (transportation routes to area to connect cultures)

- The 2019-2020 Chiang Mai Creative Mapping report discusses how various businesses and initiatives located within Chiang, Mai are encouraging and utilizing design and creativity. The report is broken down into the following categories, under which various businesses and their impacts are discussed:

- Architecture and Urban Design

- Culture and Art

- Craft

- Co-working and Creative Spaces

- Cross-Functional

- Functional Design and Packaging

- Galleries and Art Spaces

- New Media, IT, Film and Photo

- Lifestyles/What Else in Chiang Mai

- The city of Chiang Mai also hosts an annual event — Chiang Mai Design Week — which typically features hundreds of local artists, designers, and entrepreneurs in the Thailand design market.

Competitive Advantage of Design Services Market in Thailand

Low Costs & Highly Skilled Labor Force

- Compared to other countries in the APAC that Western civilization typically outsources work to and imports material from, Thailand is one of the most competitive options when considering associated costs, product availability, and the skill levels of the labor force.

- On the Logisitics Performance Index (LPI) from World Bank which measures trade performance, Thailand ranked 32nd out of 160 countries globally, eighth in Asia, and second in Southeast Asia (only behind Singapore).

- For the World Bank's Ease of Doing Business (DB) index, Thailand ranked 27th in the world, sixth in Asia, and second in Southeast Asia (only behind Malaysia). Even compared to China, Thailand offers a stronger border rank, significantly lower taxes, easier access to electricity, and notable protection for minority investors.

- In terms of the labor force, Thailand also boasts low unemployment rates and highly educated workers. An estimated 68.38% of creative workers in Thailand with design professions have at least a Bachelor's degree.

- As part of the Thailand 4.0 economic plan, Thailand government is pushing for reduced operating costs and improved efficiency in the design industry, resulting in an increase in employment in the sector.

- According to Ipsos, Thai consumers tend to view design products that have been manufactured by Thai brands in-house as being more luxurious and of higher quality, as well.

Talent Pool of Design Services in Thailand

- According to a report published by Ipsos Business Consulting in April 2017 detailing the design sector in Thailand, 2% of Thailand's labor force works in the creative/design industry.

- Broken down by design type, these people work in the following areas:

- By geographic region, Thailand design workers are employed in the following locations:

- Based on data collected by the CEA, creative workers in Thailand fell within the following age brackets in 2018:

- Ages 20-24: 12.23%

- Ages 25-29: 20.53%

- Ages 30-34: 16.59%

- Ages 35-39: 15.41%

- Ages 40-49: 22.01%

- Ages 50-59: 12.54%

- Ages 60+: 0.70%

- An estimated 68.38% of creative workers in Thailand with design professions have at least a Bachelor's degree.

Strategies for Growing Talent Pool in Thailand

Thailand 4.0 Policy

- Thailand 4.0 is a new economic model that the government is working to implement over a 20-year period to address productivity issues and reduce economic and income disparities. This new model is referenced as being "innovation-driven," with a special focus on the creative and digital industries, among others.

- As part of the Thailand 4.0 strategy, the Thailand Board of Investment (BOI) is prioritizing the 20 provinces with the lowest per capita income, EEC and SEZ provinces, and border provinces in Southern Thailand. Within these areas, the Thailand 4.0 plan will work to increase productivity — particularly with small- and medium-sized businesses — to cover IP licensing fees, offer advanced technology training, promote R&D, and enhance product and packaging design.

- Businesses that participate in the Thailand 4.0 program are offered technology- and activity-based incentives, including but not limited to exemptions on taxes and import duties, and increased investment and expenditure caps up to 300%.

Thailand Creative & Design Center (TCDC) & Creative Economy Agency (CEA)

- The TCDC opened in November 2005 as a specialized unit of the Office of Knowledge Management and Development.

- In 2018, the TCDC established the Creative Economy Promotion Agency (CEA), a public agency geared towards developing the creative economy in Thailand.

- The CEA promotes businesses and services within the creative industries in Thailand in particular metro areas, including Bangkok, Chiang Mai, and Khon Kaen. This process helps to attract new investments (both locally and internationally) and share knowledge and opportunities in the design industry.

Metrics of Talent Pool Growth

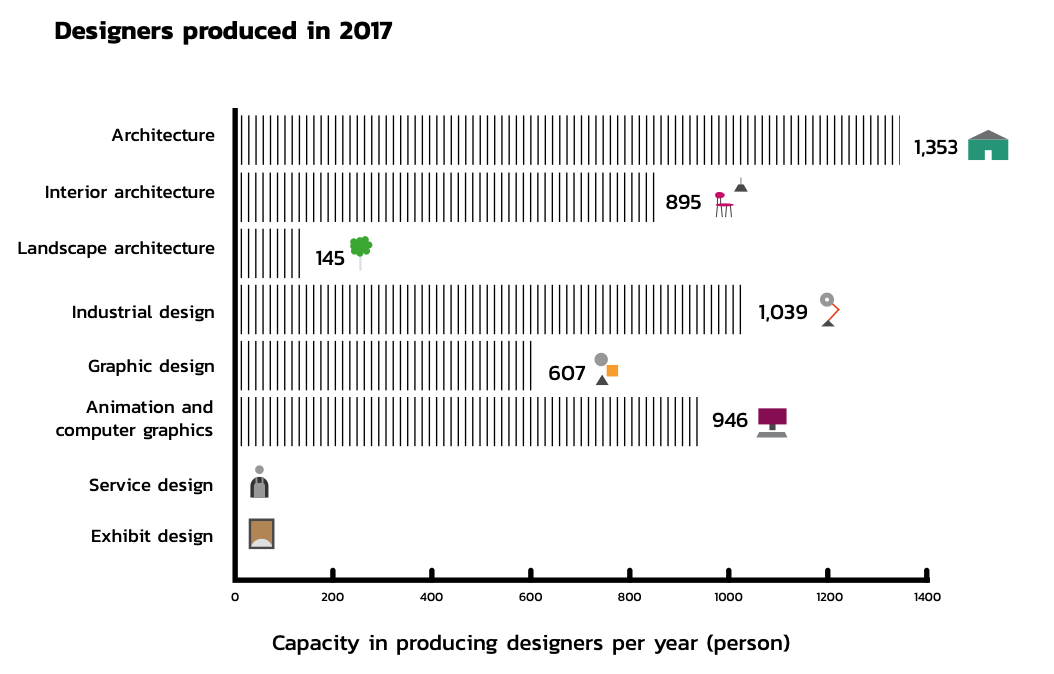

- As of 2017, there were a total of 125 educational institutions under the Office of Higher Education Commission in Thailand that offered design courses. These same institutions offered a total of 128 design-related Bachelor's programs, 44 design-related Master's programs, and 12 design-related PhD programs.

- These programs all fall within the following design categories:

- Exterior Architecture

- Interior Architecture

- Landscape Architecture

- Industrial Design

- Graphic Design

- Animation & Computer Graphics

- Exhibit Design

- As of 2017, these educational programs in Thailand have increased the talent pool as follows:

Growth of Design Services in Thailand

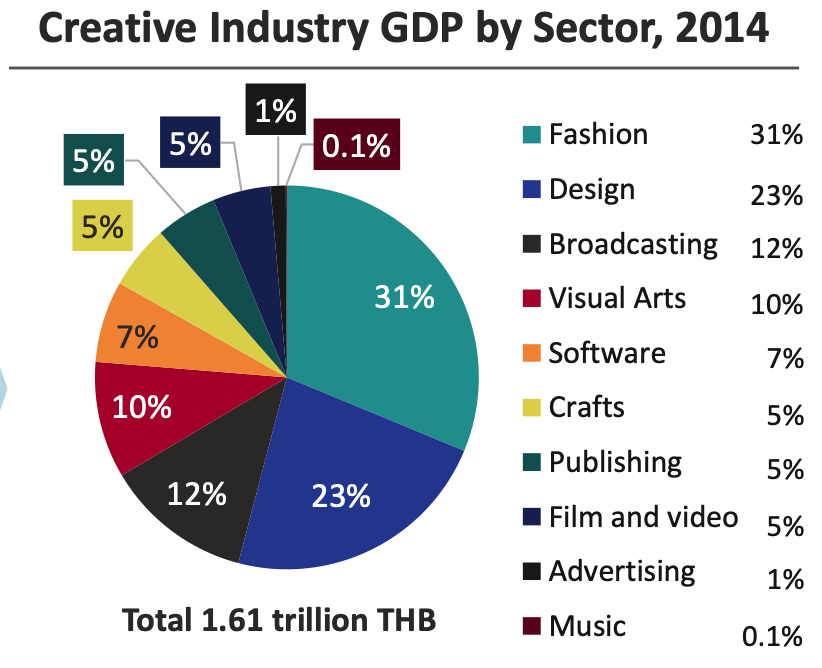

- According to a report published by Ipsos Business Consulting in April 2017 detailing the design sector in Thailand, design constitutes approximately THB 13.3 billion or 13% of the country's total GDP.

- Broken down by design type, the following creative genres make up the creative industry in Thailand:

- The home furnishings and home decor markets in specifically are growing at a CAGR of 5.9% and 4.4%, respectively, in Thailand.

- Between 2012-2017, the creative market in Thailand grew at a CAGR of 3.1%. Ipsos estimates that this growth rate will likely continue in future years, considering that its share of the total economy has remained relatively stable for the past 10 years.

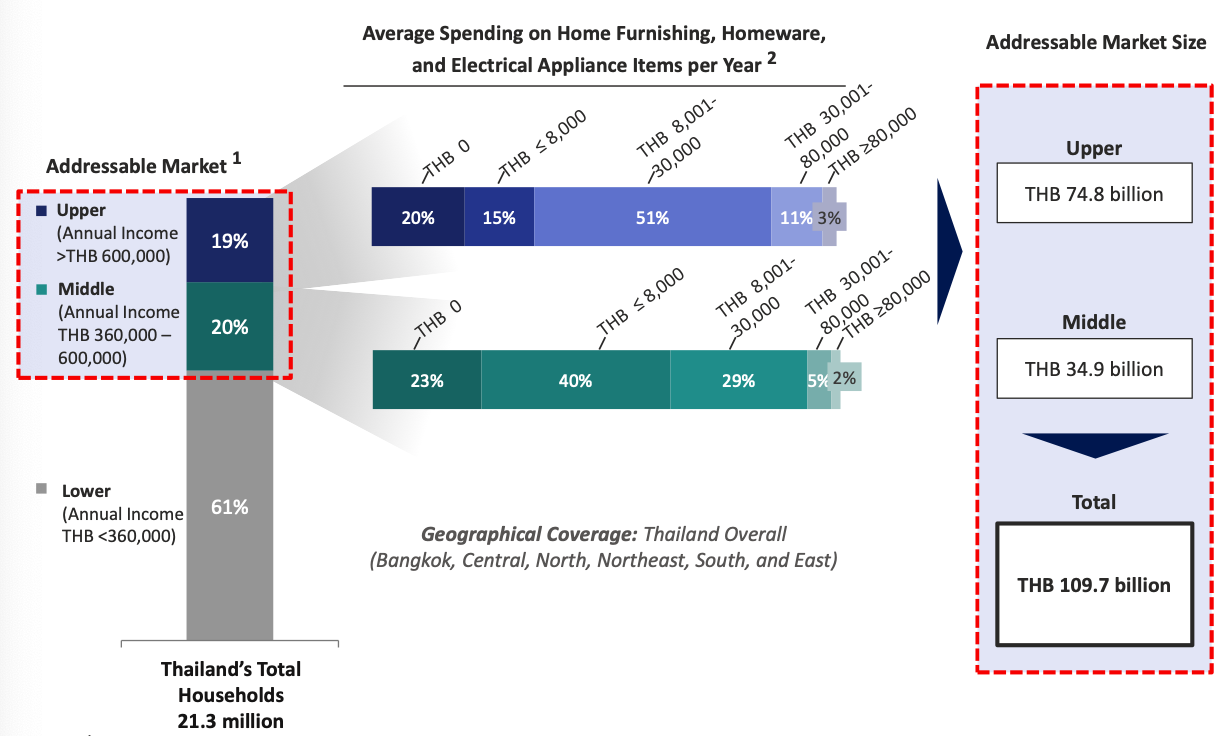

- Ipsos suggests that the total addressable market (TAM) for design products in Thailand is worth approximately THB 109.7 billion. Broken down by household income brackets, this equates to: