Part

01

of one

Part

01

Scandinavian Payment Service Market Analysis

Key Takeaways

- Sweden aims to become the world's first cashless society by March 2023. At that point in time, cash will no longer be accepted as a means of payment and all payments will need to be made electronically.

- In 2020, three out of every four card transactions conducted in Norway were contactless.

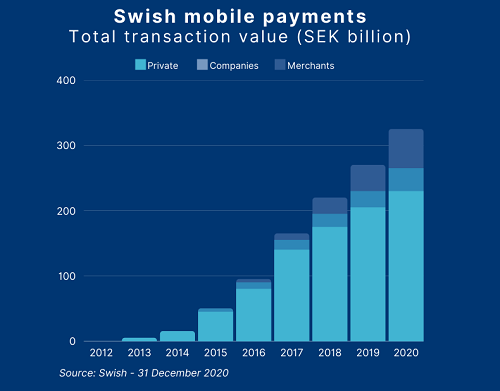

- Mobile applications are driving digital/contactless payments in Nordic countries. In 2020, Swedes transacted more than 300 billion kronor via the Swish app which is more than three times the amount of cash withdrawn from Swedish ATMs in 2019.

- Sweden is the largest e-commerce market in the Nordic countries and credit and debit cards consist of 38% of sales in the country making them the most popular online payment method. It is expected that, in time, bank transfers will replace cards as the top payment method.

- Cards are the prominent payment method in Norway, making up 50% of all e-commerce transactions. The mobile app Vipps was originally developed for P2P transactions (akin to Swish in Sweden) and currently sees 69% of the country's population using it to purchase online products.

Introduction

This research covers the forward-thinking Scandinavian payment service market. The market overview includes information concerning a shift towards a cashless society, cryptocurrency, the Buy Now Pay Later markets, and more.

Shift Toward Cashless Societies

- Norway, Finland, Sweden, and Denmark make up four out of the ten most cashless countries in Europe.

- Sweden aims to become the world's first cashless society by March 2023. At that point in time, cash will no longer be accepted as a means of payment and all payments will need to be made electronically.

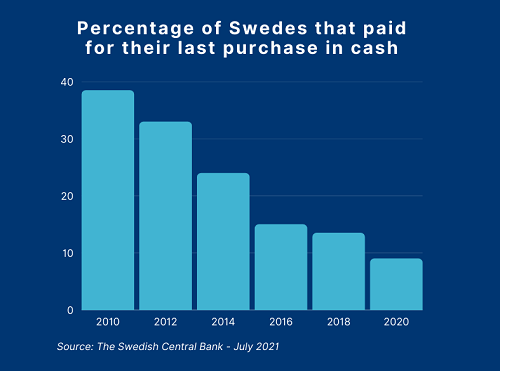

- According to the Swedish Central Bank, only 6% of payments are being made in cash with about 80% of Swedes using cards for payment. Cash transactions are heavily discouraged and account for less than one percent of the total transactions in Sweden. The central bank of Norway reports that coins and banknotes make up only three or four percent of financial transactions.

- The countries at the forefront of cashless societies are China, Sweden, and Finland. Finland has one of the biggest smartphone penetration levels in conjunction with internet banking penetration levels in the world.

Increase in Contactless Forms of Payment

- In 2020, three out of every four card transactions conducted in Norway were contactless.

- Thousands of individuals across Sweden have opted to insert microchips into their hands in the flesh just above the thumb. The chip can be used for IDs, access, contactless payment, and more.

- Finland boasts 98% of the population owning a debit card and Denmark isn't far behind with 97% of citizens owning a debit card. Denmark also notes that 86% of store payments are now contactless.

- Mobile applications are driving digital/contactless payments in Nordic countries. In 2020, Swedes transacted more than 300 billion kronor via the Swish app which is more than three times the amount of cash withdrawn from Swedish ATMs in 2019.

- The Netherlands leads Europe in cashless smartwatch payments with the country conducting 33% of the total smartwatch transactions across Europe.

- Deloitte reports that 90% of Scandinavian consumers have used their mobile phone to transfer money to another person domestically.

Digital Payments and Cryptocurrencies

- Sweden’s Riksbank announced in 2017 the idea of creating a Central Bank Digital Currency called the e-krona. The most recent reporting states that the initial integration tests are a success but more research into the benefits of the technology needs to be conducted. Additionally, more consideration must be given to ensure compliance with the privacy laws set out in the EU's General Data Protection Regulation.

- Riksbank outlines that during 2022, further investigation will be conducted as to the need for and effects of an e-krona on the country's economy and that it will conduct comparisons for technical solutions and models for an e-krona. These tests are being done in association with Accenture.

- The Nordic Fintech company Lunar raised $77 million for its crypto trading platform that will aim to establish a link between the platform and the user's bank account making it a one-stop-shop for banking and crypto. The company is 100% digital and has no physical branches.

- An open-source alternative to the e-krona is Kryptokrona. The currency is designed for Nordic users and keeps transactions anonymous and out of a central bank, thus removing the privacy concerns from the proposed e-krona idea of Sweden's Riksbank.

Growth Rates of the Buy Now, Pay Later Markets

- The Buy Now Pay Later market in Sweden is expected to grow by 33.8% and eventually reach $20,207 million in 2022.

- The payment method has a 22.8% penetration rate in Sweden, much higher than the already mature market in the United States.

- Norway expects a 39.8% growth rate for the Buy Now Pay Later market. In 2022, the country should see the market reach $6358.9 million.

- Both medium-term and long-term growth in the industry appears to be strong in Norway with an expected CAGR of 17.5% through 2028.

- Denmark is expected to have a 20.8% CAGR for the period of 2022-2028. The Buy Now Pay Later market is expected to grow by 42.1% and is estimated to be worth $4762.9 million in 2022.

Most Popular Payment Methods

- Sweden is the largest e-commerce market in the Nordic countries and credit and debit cards consist of 38% of sales in the country making them the most popular online payment method. It is expected that, in time, bank transfers will replace cards as the top payment method.

- Swedish shoppers have enthusiastically embraced mobile apps for shopping but 58% of sales are still completed in web browsers.

- By 2023, it is anticipated that bank transfers will become the dominant payment method. The utilization of Swish, a mobile payment app by Swiss Banks, is the driving factor behind this trend. The payment method has become so ingrained in the culture that "swisha" is slang for making a payment. The app was originally intended for P2P transactions and quickly got adopted into online shopping and other transaction methods.

- Danish online shoppers prefer to shop on a computer (55%) and another 45% prefer mobile commerce. 80% of Danes use MobilePay, an app developed by Danske Bank.

- Cards are the prominent payment method in Norway, making up 50% of all e-commerce transactions. The mobile app Vipps was originally developed for P2P transactions (akin to Swish in Sweden) and currently sees 69% of the country's population using it to purchase online products.

Research Strategy

For this research on the Scandinavia payment service market, we leveraged the most reputable sources of information that were available in the public domain, including Sweden's Riksbank, Coindesk, market reports, Deloitte, and JP Morgan.