Part

01

of one

Part

01

Restaurant Marketing Software

Available data suggests that independent and full-service restaurants may be particularly receptive to restaurant marketing software products.

Independent Restaurants

- Although there is limited, publicly available information related to the marketing needs, budgets or behaviors of independent restaurant operators, several recent reports suggest that this segment of the restaurant industry may have a more urgent need and/or interest in software that helps automate their advertising activities.

- Notably, a 2018 survey of restaurant operators by SevenRooms found that almost all (87%) of restaurants view marketing automation tools in a positive light.

- However, more recent research (2019) by US Foods reported that independent restaurant operators are particularly interested in expanding their visibility with customers through enhanced advertising tools and methods.

- Overall, US Foods found that independent restaurants have to "work harder and spend more" to attract customers.

- Moreover, 25% of decision makers at these venues report that attracting customers has become even more difficult in just the past year.

- In response to this increasing competitive pressure, many independent restaurants report enhancing their advertising efforts through more digital ad spending (over 2/3 of independent restaurants), offering more specials (3/4 of independent restaurants) and/or engaging third-party services to "solicit customers" (over 1/2 of independent restaurants).

- Most recently, the Independent Restaurant Coalition reported this past June of 2020 that 85% of independent restaurants could close without some form of aid or support given to the pressures of the coronavirus pandemic.

- As such, these restaurant operators have an even more urgent incentive to find ways to expand and maintain their customer base through creative advertising strategies and tools.

Full-Service Restaurants

- Industry experts (e.g., Grand View Research) and relatively recent restaurant industry surveys (e.g., TouchBistro) also suggest that full-services restaurants may be more receptive and likely to benefit from restaurant management software such as advertising tools and products.

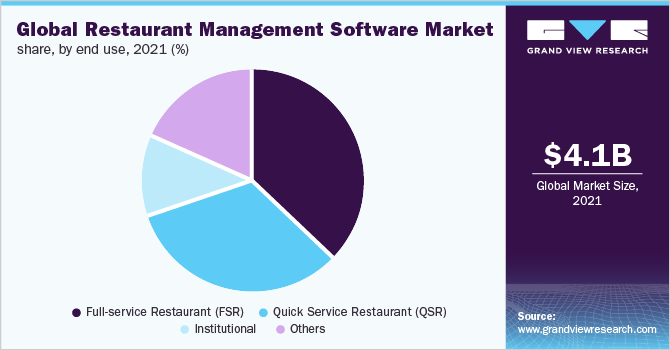

- Notably, the latest available (May of 2018) reporting by Grand View Research found that full-service restaurants represent the largest customer group for restaurant management software overall, as highlighted within the below graphic.

- Additionally, Grand View Research asserts that full-service restaurants are at the "forefront of growth" for restaurant software products because they are "early adopters of any advanced technology" that will give them a competitive advantage.

- In parallel, a relatively recent (June of 2017) survey of restaurants by TouchBistro found that full-service restaurants are more likely to benefit from restaurant management software than counterparts such as quick service restaurants.

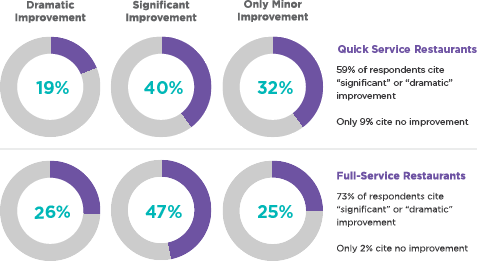

- Specifically, the large majority (73%) of full-service restaurants report that enhancements to restaurant software have a "significant" or "dramatic improvement" on their business results, compared to just over half (59%) of quick service restaurants.

- Details regarding how full-service restaurants view the performance and business improvement benefits of restaurant software are further highlighted within the following graphic.

- Overall, available data suggests that full-service restaurants may be more receptive to restaurant marketing software because these types of restaurants are more likely to adopt as well as benefit from new technology tools.

Two of the most important features that restaurants look for when purchasing marketing software and other restaurant management tools are ease of use and the ability to integrate a product with other software/systems.

Ease of Use

- A tool's simplicity and overall ease of use was identified as one of the most important features that restaurants look for when purchasing restaurant software based on the fact that a preponderance of industry experts (e.g., Toast, Chef's Resources, Harbor Touch, POS USA, Finances Online, Restaurant Den, TouchBistro, Shopkeep) highlight a tool's usability as a critical feature for restaurants when making these selections.

- As evidence of the importance of ease of use, Toast found that 58% of restaurants are currently upgrading their restaurant software in order to benefit from the "simplicity" of the latest tools.

- Additionally, Merchant Maverick reports that one of the main reasons restaurants find restaurant marketing software attractive is that it is generally "very quick and easy" to set up and start using.

- According to Shopkeep, Chef's Resources and Restaurant Den, a software tool's ease of use is primarily defined by its "intuitive layout" as well as the ability for a user to implement a simple change within five minutes.

- Shopkeep adds that this ability for a restaurant operator to quickly and seamlessly engage with a software tool is essential because the restaurant business is inherently "one that requires speed."

- Meanwhile, Chef's Resources, POS USA, Toast and TouchBistro also report that the ability to configure or customize a restaurant software product further adds to its usability.

Integration

- Whether restaurant software is "open and connected" was similarly selected as one of the most important features for restaurants when choosing a software tool based on the guidance of industry experts (e.g., SevenRooms, Finances Online, Harbor Touch) as well as corroborating restaurant survey information.

- Notably, Merchant Maverick and Modern Restaurant Management report that restaurant marketing software in particular is more attractive and beneficial for customers if it can integrate with a central POS system and help centralize overall management capabilities.

- This is likely due to the fact that 80% of restaurants are currently using various technologies (e.g., online reservation tools, ordering and inventory software, analytics) to help manage their business, according to the National Restaurant Association.

- In parallel, a survey by software research firm Software Advice found that 61% of restaurant operators are interested in restaurant software products only if they can operate as an "integrated suite."

- Ultimately, SevenRooms and Finances Online recommend that restaurants carefully consider whether a product can integrate with other restaurant management software tools before making a purchase, given that restaurants generally "rely on multiple systems" to run their business.

The majority of the identified providers of restaurant marketing software appear to be generalists that offer marketing products as part of a larger suite of management tools and/or provide advertising services to industries beyond the restaurant business. Among those competitors identified, only Eateria is a pure-play provider of marketing software that is specifically designed for restaurants.

Belly

Overview

- Chicago, Illinois-based Belly (website link here) is currently the "leader in loyalty" programs for small-to-medium-sized businesses across a range of industries.

- Notably, Belly has received widespread recognition from experts including National Best and Brightest, Chicago Innovation Awards, Moxie Awards and StreetFight.

Revenue

- Although Belly does not publicly report its annual revenue as a privately held company, business data aggregators (e.g., Zoominfo, Owler) estimate the company's annual revenue between $4 million and $10 million.

- Additionally, Craft reports that the company has raised $25 million in funding to date.

Current Customer Base

- Belly currently serves a wide variety of customers across the restaurant industry (over 4,400), including D Brian's Kitchen & Catering, The Bagelry Deli & Catering, Polka Dot Bakery and Butcher & The Burger.

- Overall, the company has a total user base of over 8,500 clients and over 7 million members across the restaurant, retail, salon & spa, convenience & gas, auto repair, pet store, grocery store and health & fitness industries.

Restaurant Marketing Services

- The foundation of Belly's portfolio of restaurant marketing services is the company's proprietary app, which supports restaurants in establishing branded loyalty programs.

- Belly also offers accompanying marketing services including:

- Collecting customer emails and creating customer lists

- Generating email, social and other digital marketing messages

- Designing custom consumer rewards

- Tracking customer activity

- Generating word of mouth through integrations with Facebook, Twitter and Yelp.

- Meanwhile, Belly reports that its suite of marketing services enables restaurants and other businesses to increase customer visits by "up to 148%".

LevelUp

Overview

- Boston, Massachusetts-based LevelUp (website link here) is a "best-in-class" ordering, payments and loyalty software program specifically designed for restaurants.

Revenue

- Although LevelUp does not publicly report its annual revenue as a privately held company, financial trades (e.g., The Wall Street Journal) and business data aggregators (e.g., Zoominfo) estimate the company's annual revenue between $28 million and $40 million.

- Additionally, Crunchbase reports that the company has raised $107.8 million in funding to date.

Current Customer Base

- Although LevelUp does not publicly share information about the company's total number of clients, the company has a number of prominent customers including Just Salad, DIG, CAVA, Protein Bar & Kitchen, Pokeworks, BurgerFi, Gregorys Coffee, Wayback Burgers, Pita Pit, Scooter's Coffee, Juice It Up!, Pret, Caffe Nero, La Madeline, Taco Time, Hale & Hearty, TCBY, Dunn Brother's Coffee, CHOPT, Sweetgreen, Tropical Smoothie Cafe, Potbelly, Zaxby's, Smoothie King.

- Notably, these clients appear to be largely quick service and/or chain restaurants.

- Additionally, slightly dated reporting by CNBC (May of 2017) notes that LevelUp has over one million app users.

Restaurant Marketing Services

- LevelUp's marketing services for restaurants are centered around the company's customer loyalty and rewards program.

- According to HubWorks, LevelUp's loyalty program is differentiated by the fact that it enables restaurants to design and implement highly customized rewards programs.

- Some examples of reward customization include the options to "reward repeat business" with points and/or gift cards and "eliminate wait times for loyal customers."

- In addition to these customer reward program options, LevelUp offers restaurants a variety of accompanying marketing services, including:

- Enabling a variety of marketing campaigns, including, BOGO (Buy One, Get One Free), first visit, dollar amount and item-based discount programs

- Creating segmented customer lists

- Generating email alerts to customers

- Automating performance analysis.

- LevelUp adds that its loyalty program alone enabled VERTS Mediterranean Grill to increase its monthly revenue from under $80 thousand to over $240 thousand in under six months.

The Fork

Overview

- Paris, France-based The Fork (website link here) is the "leading online restaurants reservation platform" in Europe, Australia and Latin America.

Revenue

- Although The Fork does not publicly report its annual revenue as a privately held company, business data aggregators (e.g., Zoominfo) estimate the company's annual revenue at approximately $3 million.

Current Customer Base

- According to The Fork, the company has a network of over 80,000 restaurants in more than 22 countries and 1,000 cities globally.

- Notably, a review of the most prominently advertised restaurants on The Fork's website suggests that the company primarily caters to independent, full-service restaurants.

- Meanwhile, The Fork's website and app are visited over 30.5 million times per month.

- Additionally, The Fork and its parent company TripAdvisor report that the companies influence approximately $8 billion in diner spending per year worldwide.

Restaurant Marketing Services

- In a fashion similar to LevelUp, The Fork's restaurant marketing services largely accompany the company's customer loyalty and rewards program.

- Notably, the company's reward program allows customers to earn points after meals and/or providing restaurant feedback, which later convert into restaurant discounts.

- Although HubWorks reports that restaurant operators are primarily attracted to The Fork because of its wide variety of features (e.g., online booking), the industry expert adds that The Fork is particularly useful for restaurant marketing activities.

- Key advertising functions supported by The Fork beyond its loyalty program include the following:

- Capturing customer information (including from every order)

- Generating targeted email marketing campaigns

- Sending customized SMS messages to customers

- Distributing satisfaction surveys to customers

- Publishing and/or responding to customer feedback

- Rewarding customers for their feedback.

Perka

Overview

- Portland, Oregon-based Perka (website link here) is a subscription-based, cardless loyalty program for small businesses and other local merchants.

- Notably, Perka was acquired by First Data (now Fiserve) in 2013, and currently operates as a product under Native Merchant Services.

Revenue

- The latest quarterly and annual financial reporting by Perka's parent company, Fiserve, does not include details related to the annual revenue for Perka or Native Merchant Services.

- However, business data aggregators (e.g., Owler) estimate Perka's annual revenue at approximately $2 million.

Current Customer Base

- An extensive review of Perka's owned media channels (e.g., corporate website) as well as information published by restaurant trades (e.g., QSR Web), business data aggregators (e.g., Crunchbase) and software review websites (e.g., Capterra) indicates that there is no publicly available information related to Perka's historic or current number of customers.

- Similarly, searches for the total customer count of Native Merchant Services failed to yield quantitative details related to the subsidiary's customer base.

- However, Perka's website indicates that the company targets small businesses as its primary customer base.

Restaurant Marketing Services

- Notably, Perka offers several standard marketing services for its restaurant customers, including the following:

- Access to Perka's "mobile punch card" loyalty program, which allows customers to collect rewards for restaurant visits

- Use of social media outreach tools

- Access to business analytics dashboards.

- Additionally, HubWorks reports that Perka integrates with Clover POS to support a greater variety of marketing functions, including:

- Automating SMS messaging to customers

- Automating email messaging to customers

- Geo-targeting customers

- Re-posting of deals/offers to social media.

Flok

Overview

- New York, New York-based Flok (website link here) was a customer communication platform for merchants, which offered a wide variety of services including chatbots, "human-assisted AI chat," automated messaging services, proximity advertising campaigns and customer relationship management services.

- Notably, Flok officially ceased operations this past April of 2020 for reasons that appear to be unrelated to the coronavirus pandemic.

- Additionally, Flok appeared to enjoy reasonably positive reviews across industry trades (e.g., E-commerce Platforms, HubWorks) and customer review aggregators (e.g., Merchant Maverick, Trustpilot).

Revenue

- Although Flok did not publicly report its annual revenue as a privately held company, business data aggregators (e.g., Zoominfo, Owler) estimated the company's annual revenue at between $1 million and $3.5 million at the time of its closure.

- Additionally, Zoominfo reports that Flok earned annual revenue of nearly $6 million as recently as early 2019.

- Meanwhile, Craft reports that the company raised $18.9 million in funding during its operation.

Current Customer Base

- Flok no longer offers information about its past customer base or business model on its corporate website.

- Additionally, industry trades (e.g., E-commerce Platforms, HubWorks) and Flok's historic social media posts offer little insight into the company's target demographic.

- However, it appears that Flok may have struggled to acquire customers, as evidenced by its relatively limited web traffic as of late 2019 (6.7 thousand monthly visits) and limited following on social media (e.g., 99,002 followers on Facebook, 1,448 followers on Twitter).

Restaurant Marketing Services

- Similar to Perka, Flok was known for offering merchants a digital punch card loyalty program that could be "set up and designed within minutes."

- Additionally, HubWorks asserts that Flok's marketing services for restaurants were differentiated by its use of "beacon technology," which enabled Flok clients to create and send targeted customer messages.

- In addition to Flok's loyalty program and push notification features, Flok offered a number of other marketing products:

- An email marketing tool to enable the fast design and distribution of messages

- Person-to-person chatting between merchants and customer through the Flok app

- AI-enabled Flok chatbots.

Eateria

Overview

- St. Louis, Missouri-based Eateria (website link here) describes itself as the "best resource for restaurant marketing," adding that it offers an "all-in-one" suite of marketing and sales products designed specifically for the restaurant industry.

Revenue

- Although Eateria does not publicly report its annual revenue as a privately held company, business data aggregators (e.g., Zoominfo, Owler) estimate the company's annual sales between $1 million and $4.2 million.

Current Customer Base

- Some of Eateria's most prominent customers include restaurant operators such as Tap House Grill, Bulerias Tapas Bar, Robus Wine Bar & Catering and Le Peep Cafe & Grill.

- Although Eateria does not publicly share information about its total customer count, available information indicates that Eateria's customer base is primarily composed of independent, full-service restaurants.

Restaurant Marketing Services

- As highlighted by the following infographic, Eateria offers its restaurant merchants an extensive range of marketing-focused services.

- In addition to this comprehensive suite of offerings, which includes a loyalty program, email marketing and SMS services, Eateria differentiates the delivery of these products in several ways:

- Every member of the Eateria team has "worked in the food industry" and offers a "deeper understanding" of the needs of restaurants when it comes to marketing

- Eateria has a "hands-on approach" for onboarding its clients and customizing its range of product offerings to meet their needs

- The company offers an "all-in-one" suite of marketing offerings that do not need to be supplemented by other advertising tools or POS system services.

- Meanwhile, Eateria promises that its range of services enables restaurants to increase their "foot traffic by 38%."