Part

01

of three

Part

01

Housing Market Demographics: Vancouver, Canada

According to the 2016 Census, Metro Vancouver's population was 2.5 million. The City of Vancouver, which occupies 4% of the larger Vancouver region, has approximately 640,000 people. The larger Vancouver region's housing trends are dictated by deep-seated factors that have defined Canada's socioeconomic profile for years. This research identified five trends that continue to influence homeownership and renting trends in Vancouver. First, first-time owners are much older compared to previous generations. Second, young homeowners mostly rely on parents to afford their new acquisitions. Third, Vancouver has the widest gap between home values and income. For millennials, the dream of owning a home is more realistic in Toronto compared to Vancouver. Lastly, renting to save is "increasingly a failing strategy" for those seeking to buy homes.

Vancouver Housing Trends — Overview

- In Vancouver, the homeownership rate stood at 64% in 2018, 4% less than the national average (68%).

- The percentage of house renters is rising as homeownership continues to get out of reach of many Canadians living in Vancouver.

- This trend is partly due to Vancouver's high value-to-income ratio (9.1). This ratio reflects the relationship between property values and average income. The higher the value, the higher the property values.

- The rule of thumb is that the value-to-income ratio should not be more than 4. Any figure above four reflects unaffordability.

- According to a March 2019 survey, 45% of renters in Vancouver are aged between 25 and 34, while 19% are between 35 and 44.

- According to the survey, females are renting more than males — 56% to 44% respectively.

- The decision to rent furnished or unfurnished is a "value assumption equation." The average rent for a one-bedroom unfurnished apartment in March 2019 was $1,682 per month. For a similar but furnished apartment, the average rent was $1,930 per month.

- Surrey appears to have the lowest rental figures in Vancouver ($1,371 per month for a 1-bedroom apartment). Downtown Vancouver is the most expensive ($2,076 per month for a 1-bedroom apartment).

Vancouver Rental Data

- In Vancouver city, 53% of households rent compared to the Metro Vancouver area where 36% of households rent. This implies 47% of the city houses are owned compared to 64% in the larger Metro Vancouver region.

- The majority of renter households are couples without kids (29,680), while households with kids were 13,930. The estimated number of households with children is 30%.

- The number of renter households stood at 591,550.

- Moreover, the median income for a renter household was $45,979, while the average renter household income was $58,698.

- The average renter income for a 'couple with kids' household was $105,450, while 'couple without kids' households was $94,098.

Population & Income Distribution in Vancouver

- The 25 – 29 age bracket comprises the largest population age bracket in Vancouver. The 30 – 34 age group follows it.

- The least populated age bracket is 80 – 84 years. Seventy-four percent of the population belongs to the working class (15 – 64 years).

- Most of Vancouver's residents live above the low-income cut-off. This means they earn above the 2016 national annual median income ($65,327).

A breakdown of the household income is as shown below

- A 2016 social profile report showed income distribution in Vancouver among four main age groups, i.e., < 24 years, 25 – 44 years, 45 – 64 years, and > 65.

- It revealed that 41% of persons < 25 years were in the bottom 30% of Canada-wide income, 32% in the middle 40% of Canada-wide income, and 35% in the top 30% of Canada-wide income.

- For persons between 25 – 44 years, 30% were in the bottom 30% of Canada-wide income, 35% in the middle 40% of Canada-wide income, and 35% in the top 30% of Canada-wide income.

- For individuals aged 45 – 64 years, 31% were in the bottom 30% of Canada-wide income, 32% were in the middle 40% of Canada-wide income, while 37% were in the top 30% of the country's highest income.

Homeowners

- According to the 2016 Census data, homeownership in British Columbia (which contains Vancouver) was more concentrated among the older population.

- The median age of a homeowner was 55 years old, while that of individuals who did not own homes was 37 years old.

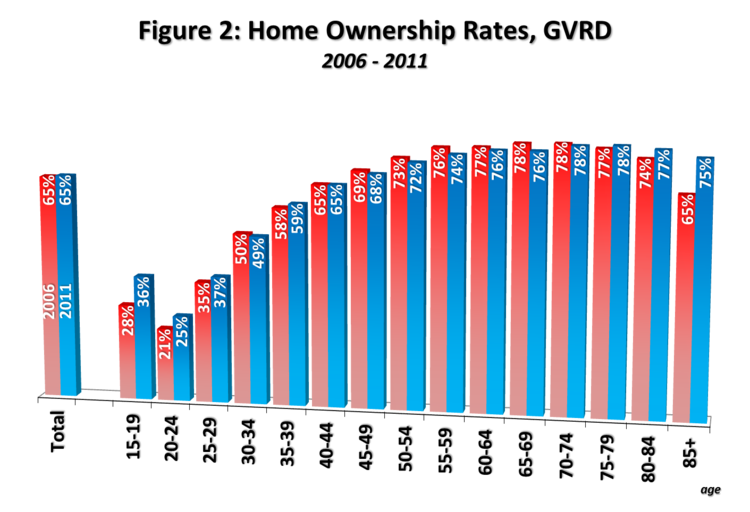

- A 2011 Homeownership profile in the Greater Vancouver area showed that most homeowners were over 44 years old.

- Today, owning a home in Vancouver is much harder than it was a decade ago, with statistics indicating that only 7% of Vancouver families can afford homeownership.

- According to the real estate website Zoocasa, a prospective homeowner in Vancouver should earn roughly $205,475 annually. This puts them in the top 2.5% highest earners in the country.

- The current benchmark price for a single-family dwelling is $1.441 million.

- Condominiums that were typically regarded as entry-level housing for first-time homeowners go for $656,900, well out of reach for most Vancouverites earning anything less than $93,527.

- According to the 2016 Census, the median household income is $65,327 per year.

Income distribution by age

- 16 – 24 years — average income is $16,100, median income is $12,000

- 25 – 34 years — average income is $45,000, median income is $40,300

- 35 – 44 years — average income is $62,500, median income is $50,600

- 45 – 54 years — average income is $63,600, median income is $53,700

- 55 – 64 years — average income is $57,700, median income is $44,700

- 65+ years — average income is $45,300, median income is $32,500

Homeownership and Renters by age group

- Recent trends (2016 onward) show that homeownership is skewed toward high-income earners (people earning at least $100,000).

- From the income distribution trend in Vancouver, top income earners are likely to be in the 35 – 39 and up to the 45 – 54 age brackets with an income of at least $93,527.

- Renters are likely to fall in the 25 – 34 age group and have an average income of $45,000.

- Going by data obtained from Statistics Canada, 43.5% of persons between 20 and 34 own homes, fewer than the 2011 averages.

- However, 79% of homeowners are 65 years and above.