Part

01

of one

Part

01

Electric Vehicles - Laws and Subsidies

Key Takeaways

- One of the key ways governments are supporting the EV industry is through subsidies or rebates on sales prices, which increase sales. Some governments, such as Canada, are also providing direct funding to auto makers to build EV plants, while others provide tax incentives and cost credit.

- France has a law which obliges an end to the sale of new passenger cars and light commercial vehicles using fossil fuels .

- Some 22 countries have targets to transition to EVs within the next few decades.

Introduction

This research brief lists five countries with EFV legislation or regulations, though in the UK's case, some of these policies or bans are integrated into plans but still under consultation in terms of legal enforcement. We have also listed ten countries which have significant financial incentives in place for the EV industry. We focused on those countries with specific support for companies and manufacturers, but as those are limited, we also included countries whose subsidies are so huge, they are promoting sales, and supporting the EV industry through those.

EV LEGISLATION

Overview

- Many countries have declared EV targets, or targets to reduce vehicle contamination, but haven't necessarily accompanied the targets by passing legislation. France (covered below), for example, was the first European country to pass a legal framework for its carbon neutrality goals for transport. Slovenia has a policy plan (called Market Development Strategy for the Establishment of Adequate Alternative Fuel Infrastructure in the Transport Sector in the Republic of Slovenia - 2017) which will limit the registration of cars which have a higher share of CO2 than 100 g/km, but no new law as such. Ireland has a climate action plan, and the Netherlands has an agreement reached by its coalition government, called, Mission Zero. There is a commitment to a target, but not an actual law. Costa Rica has a National Decarbonization Plan with a goal that "100% of sales of light vehicles will be zero emission vehicles by 2050 at the latest."

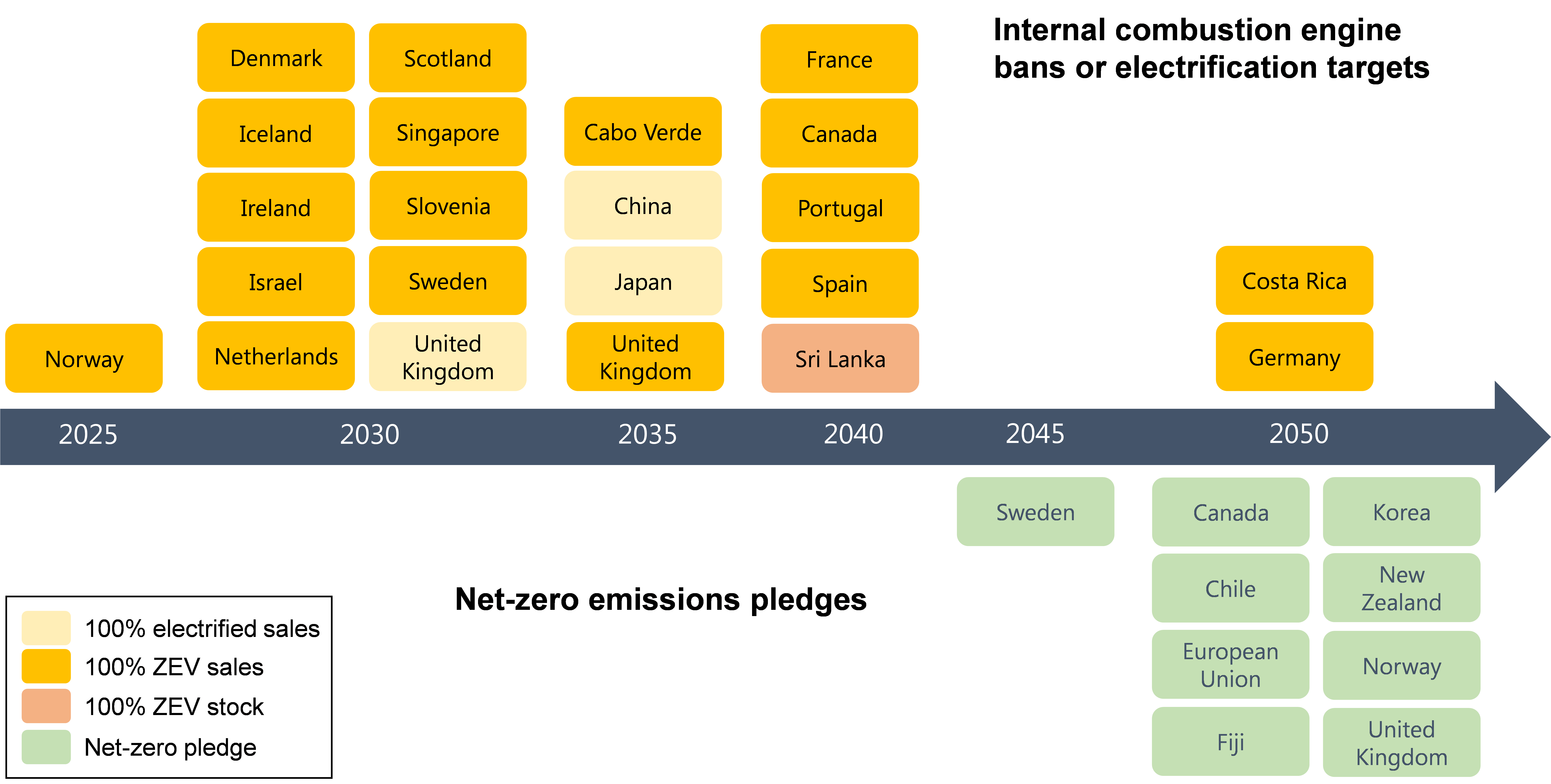

- Just 22 countries have targets specific to electric vehicles and/or non-fossil fuel vehicles. Most of these targets are outlined in government documents or were mentioned in speeches - few have been adopted as laws. For example, Singapore's deputy prime minister noted a target of no internal combustion engine vehicles by 2040, while a Japanese government document outlines a goal of 23%-33% electric vehicles by 2030. While targets are less enforceable than laws, it is worth noting that laws can also be modified and updated.

- Some countries have passed laws related to reducing vehicle emissions, but without specifically mentioning EVs, but no doubt impacting future sales. Spain, for example, passed a Law on Climate Change and Energy Transition in May 2021, which states that light vehicles and passenger cars "shall gradually reduce their emissions such that no later than 2040 they become vehicles with emissions of 0 g CO2/km." Chile has an energy efficiency law which applies energy efficiency standards to imported vehicles, and some policies to support EVs, but no laws.

France

- In 2019, France adopted a Mobility Guidance Law which aims to end the sale of new passenger cars and light commercial vehicles using fossil fuels by 2040. Because of translation issues, the law is also known in English as the Mobility Orientation Law (LOM).

- The legislation process included the creation of mobility organizing authorities (AOM) with powers over mobility services (car sharing, carpooling, electric vehicles, self-service vehicles).

- Articles 30 to 39 of the law provide a legal framework for autonomous vehicles, and outline ways to create dedicated lanes for extremely low emission vehicles. Article 51 supports a framework for micromobility, including for electric scooters (e-scooters) and free-floating bikes. Cars and light commercial vehicles running on fossil fuels (petrol, diesel, natural gas, etc) will be outlawed by 2050.

- Article 77 sets a minimum percentage of low-emission vehicles for companies with over 100 vehicles: 10% renewal by 2022, 20% by 2024, and 50% by 2030.

- As part of this law, the government has envisaged various projects, including multiplying the possibilities of electric recharging in public zones by five by 2022. Real estate operators are obliged to pre-install charging stations in parking lots of new or renovated buildings.

- The bill includes plans for a new subsidy for purchasing clean vehicles (hydrogen or electricity powered). To facilitate the deployment of EV charging stations and EV car-sharing, Article 23 defines EV charging operators as service provision rather than just providing electricity.

Canada

- Some provinces in Canada have laws promoting zero emission vehicles, while the country has broader goals. Canada had a target of 100% electric vehicle sales by 2040 (recently updated to 2035). The country is spending $182 million on electric and alternative-fuel infrastructure.

- To achieve its goal, Canada has announced investments and regulations, but has yet to finalize or detail those. Its zero emission vehicle program was last updated last month, and mentions electric vehicle charging infrastructure in parking areas and on-street, as well as supporting charging infrastructure in multi-unit residential buildings.

- Quebec passed legislation in 2016 that obliges any car companies that sell over 4,500 new vehicles per year over a three-year average, to offer customers a minimum number of hybrid and electric models. Some 3.5% of the total number of cars sold by such companies in Quebec have to be zero emissions vehicles from2018, increasing to 15.5% in 2020. Last year, the province announced it would ban the sale of new gasoline-powered cars from 2035.

- British Columbia passed the Zero-Emission Vehicles Act (ZEV Act) in May 2019. It requires car makers to meet an annual percentage of new light-duty ZEV sales and leases: 10% by 2025, 30% by 2030 and 100% by 2040. Under the law, ZEVs include battery electric, plug-in hybrid electric, and hydrogen fuel-cell vehicles.

China

- China has a mandate that automakers' sales of EVs must make up 40% of all sales by 2030.

- MIT analyses suggest that the move will expand the production of EVs and EV batteries sufficiently to reduce the worldwide cost of both.

- China had been subsidizing the cost of EVs since 2009, with the goal of making them more affordable and of increasing sales. However, that worked out to be costly, and as of 2020, was going to end those subsidies and replace them with the mandate on car manufacturers. However, with the pandemic, that end has been postponed to 2022.

- To avoid financial penalties, manufacturers must earn a certain number of points each year. They are awarded based on each EV produced, and a formula which considers range, energy efficiency and performance.

US - California

- California has a Zero-Emission Vehicle program, which is part of its CARB's Advanced Clean Cars package of coordinated standards controlling pollution by passenger vehicles in the state.

- The ZEV regulation requires car manufacturers to offer certain numbers of the cleanest cars available. The ZEV requirement was first implemented in 1990, and has been modified over the past three decades, and joined by two Advanced Clean Car Regulations. Production requirements have been adjusted each year, and are in terms of percent credits, at 4.5% in 2018 to 22% by 2025.

- Vehicles with greater range provide manufacturers with more credit. Credits not needed for compliance one year can be banked and used in the future, sold to other manufacturers, or traded.

- Big manufacturers like Ford and GM must comply with the regulation, while smaller ones such as Volvo must also comply, but can substitute in plug-in hybrids.

- At a federal level, the US is relatively weak when it comes to legislating on vehicle energy efficiency. It's Safer, Affordable Fuel-Efficient (SAFE) vehicle standard has more modest goals than the policy it recently replaced. The main measure the US is taking is to provide tax credits on EV purchases. Most purchasing incentives are on a state-by-state basis.

United Kingdom

- In 2019, the UK passed laws to end its contribution to global warming by 2050. These laws were supported by an Industrial Strategy, which has since been replaced by the Build Back Better Plan.

- In terms of EVs, the plan includes unlocking private sector investment in electrification of vehicles and £1.3 billion towards the roll out of EV charging infrastructure. It also includes funding for mass-scale production of EV batteries and other elements of the EV supply chain. Batteries would be produced in "Gigafactories" that, according to the government, would employ 2,000 people.

- Britain has also announced a ban on the sale of new gasoline and diesel vehicles by 2030. Hybrids will be allowed until 2035. The goal is elaborated on in the Ten Point Plan for a Green Industrial Revolution.

- The plan talks about having "electric vehicle technicians in the Midlands ... specialists in advanced fuels in the North West," but doesn't yet oblige or enforce these changes. Point 4 of the plan is focused on EVs.

- At this point, the UK government is only consulting on a date for phasing out new diesel heavy goods vehicles.

European Union

- The EU has a commitment to decarbonisation in its EU Green Deal and the Next Generation EU and Recovery Plan. These were also bolstered by the EU Sustainable and Smart Mobility Strategy and Action Plan at the end of last year.

- Currently, various EU directives and regulations are being reviewed so that the goals in the above plans can be achieved. Some regulations being reviewed include CO2 emissions performance standards for cars and vans; Alternative Fuels Infrastructure Directive; the European Energy Performance of Buildings Directive (with support for charging infrastructure), and battery directives and regulations.

- The European Commission hopes to have at least 30 million EVs in action by 2030. Through the Clean Energy Package, building owners are required to prepare conditions for charging or plugging in of EVs.

- The Energy Performance of the Buildings Directive (EPBD) also requires that new buildings and buildings being renovated include charging stations or ducting infrastructure. Charging stations have to be smart - ie able to react to signals from the grid. In addition, a Market Design Directive and Regulation encourages EU member states to use smart metering systems for electricity. These sorts of systems mean that users can generate, store, and sell energy.

EV FINANCIAL INCENTIVES

- Incentives are helping to increase sales of EVs globally, however, most of them take the form of cash rebates or tax discounts for individual purchases. Below are some of the main countries which offer financial incentives to manufacturers, or other types of businesses. Countries like Australia, for example, offer rebates and stamp duty exemptions, but no specific incentives to manufacture or distribute EVs.

India

- India provided a subsidy to manufacturers from the end of 2010, but ended it at the start of 2012. The subsidy was up to 20% of the factory price, and at least 30% of parts had to come from India.

- In 2014 a new subsidy was announced, of Rs 8,000 up to R12 lakh (the later for hybrid buses) for automakers, per vehicle. The aim was to cover 30-40% of the cost difference between EVs and diesel cars. There are no subsidies for imports.

- In September this year, the national government approved an incentive scheme worth 260 billion rupees. It aims to attract new investments in the auto sector. Incentives will range form 8% to 18% of the sales value of the car or its components, and companies will have to meet a minimum investment over five years, have 10% growth in sales year, and other requirements.

- Separately, various states, including Andhra Pradesh, Assam, Goa, Haryana, Gujarat, Karnataka, Madhya Pradesh, Orissa, Telangana, and Tamil Nadu offer capital subsidies across the production chain.

United Kingdom

- In 2010, the UK announced a scheme where cars would be discounted when purchased, but the manufacturer could then claim the subsidy. It was worth 25% of the recommended retail price up to a value of £5,000. This scheme continued at that amount until 2016.

- This system is still in place but the grant amount has steadily reduced, and is now at £3,000 with an eligibility cap of £50,000.

United States

- The current government is providing four kinds of support for manufacturers in the EV supply chain, through the American Jobs Plan. These include providing new funds to the 48C Advanced Manufacturing Tax Credit, cost-sharing grants for new high-capacity battery facilities, and Brownfield grants for upgrading and reopening facilities that shut down.

- It also includes low cost credit to produce EVs. This means injecting more funds into the Advanced Vehicle Technology Manufacturing Program for companies which produce clean energy vehicles within the US.

Indonesia

- Indonesia is providing financial incentives for local and foreign companies to produce EVs. EV businesses with capital investment worth at least IDR 500 billion are eligible for a 100% deduction in corporate income tax. For those companies with investments worth at least IDR 100 billion there is a 50% deduction in corporate income tax.

- The government also argues that the battery is one of the most important components of EVs, and that Indonesia can provide manufacturers with an advantage because the country has the world’s biggest nickel reserves. Further, EV sales are exempt from luxury tax and import duties, and consumers can access low-interest installments.

China

- China provides a large amount of support to EV makers, and that is giving it an advantage in the global market. However, because of the cost of the subsidies, the country is slowly shifting away from financial support and towards legal mandates.

- In 2019, for example, China gave the biggest EV manufacturer US$1 billion in support in one year.

- Subsidies for long range vehicles are now at 18,000 yuan. There are also subsidies for cobalt and lithium (which impacts battery production).

Canada

- Canada provides provincial and federal rebates for EV sales. The rebates are an indirect benefit to companies, as they promote sales. At a federal level, there is a $5,000 rebate for battery-electric vehicles, fuel-cell electric vehicles, and longer range hybrid vehicles. Provincial rebates can be added on to that for huge rebates, with Quebec providing $4-8,000 in rebates for the same vehicles, as well as a $600 rebate for home chargers.

- Ford announced last year that it will be producing EVs in Ontario, Canada. The federal and provincial governments said they would each contribute $295 million to the project. Fiat Chrysler will also build electric or hybrid vehicles, with government incentives, but hasn't specified what they are.

- Businesses can also deduct the capital costs of zero-emission vehicles they buy as part of their fleets, for a maximum of $55,000.

Germany

- Fully-electric vehicles registered between 2011 and 2030 in Germany are exempted from the motor vehicle tax for 10 years.

- Germany is a key producer of EVs, but its main support to the industry is through purchase subsidies. The government and car manufacturers have an agreement (made in November 2019) to evenly split the cost of subsidies, which at the time of the agreement were raised to €6,000 for electric cars costing less than €40,000, with a 25% increase in the subsidy for cars up to €60,000. In 2020, those subsidies increased to €9,000 and €7,500 respectively. Government and industry also discussed expanding infrastructure for EVs, and the government committed €3.5 billion to charging stations. The German government also provides leasing and second-hand car grants.

Italy

- Italy has among the highest purchase subsidies in Europe, after France. It has an Eco Bonus program which assigned €70 million in subsidies for 2020, and a new bill was set to increase incentives by 50% for the end of 2020.

- Subsidies are worth up to €6,000 towards the purchase or lease of a new EV, but that can increase to €10,000 if the consumer scraps an old vehicle that meets the Euro 1, 2, 3 or 4 emission standards. Rather than rebates, the amounts are deducted from the sales price.

France

- Buyers in France can receive over €10,000 off the price of a new full-electric car. They are also fully exempted from registration tax in most of the country.

- In addition, the country will spend €6 billion in supporting production and innovation of EVs. A plan, called France 2030, will also invest money in renewable energy sources and robotics.

South Korea

- In September this year, the Korean government ear-marked US$10.3 billion for e-mobility for 2022. That money includes spending on charging stations and on EV incentives.

- The government is funding EV battery innovation and hopes to bring down the cost of electric cars by working with the industry on such innovation. Battery manufacturers can receive up to a 50% tax discount for research and development spending, and a 20% tax cut on facility investment.

- South Korea also offers a battery pack lease option, which brings down the cost to buyers of EVs, and car subsidies are worth up to US$17,000.

Research Strategy

We consulted reliable and recent government reports, federal and state documents including laws and regulations, ministry and government press releases, news articles, market reports, and other sources to compile the above two lists and their details. For the financial incentives list, we included the few countries that provide direct incentives to manufacturers and other EV companies, and then also looked at the countries providing consumers with the best rebates, which encourages sales and then benefits companies indirectly. We considered those countries with the highest production of EVs as well.