Part

01

of one

Part

01

Public B2B SaaS Companies

Key Takeaways

- Duck Creek Technology, nCino, and CrowdStrike went public in 2020, 2020, and 2019 respectively.

- In 2019, nCino's professional services were 29.6% of its total revenue. This percentage decreased in subsequent years to 17.9% in 2022.

- Before its initial public offering, Duck Creek Technology's revenue from professional services was 45.4%. This decreased to 37.9% in the fiscal year 2021.

- CrowdStrike's revenue from professional services was 22.0% before its first public offering. Currently (fiscal year 2022) it earns less than 10% from this income stream.

Introduction

During this research six business-to-business (B2B), software-as-a-service (SaaS) companies were identified that went public between 2018 and 2022. These companies are nCino, Duck Creek Technology, CrowdStrike, Jamf, Snowflake, and Dynatrace. On the attached spreadsheet the requested information for all companies can be found.

Below are the findings for nCino, Duck Creek Technology, and CrowdStrike. These three companies have in common that at some point before and/or after the IPO, their revenue from professional services offered was more than a tenth of their total revenue. The financial information for the other three companies was provided as well to show what data went into calculating the proportions.

B2B SaaS Companies With Professional Services Revenue Higher Than 10%

nCino

- nCino went public on July 13, 2020.

- nCino provides cloud-based software to financial institutions such as banks, credit unions, and independent mortgage banks. The solution is an end-to-end platform that provides "customer relationship management (CRM), customer onboarding, account opening, loan origination, deposit accounts, workflow, credit analysis, enterprise content management and instant reporting capabilities" for commercial, small business, and retail lines of business.

- To help clients become operational, nCino provides professional services that consist of configuration and implementation of its software, training, and advice, among others. It provides services itself for smaller financial institutions and works with system integrators (SI) such as Accenture and Deloitte for larger financial institutions.

- In the future, the company expects large financial institutions to make up the greater part of its clientele and, therefore, will increasingly outsource professional services to SIs (also for smaller banks and credit unions). Consequently, this revenue stream is expected to further decrease.

Financial Data

- In 2019, nCino's professional services were 29.6% of its total revenue. This percentage decreased in subsequent years to 17.9% in 2022. At the same time, the company's costs for professional services in relation to its total costs are decreasing from 56.95% to 42.1%.

- The proportion of professional services revenue to total revenue a year before the company's initial public offering (IPO) was 29.6%. [see example calculation below]

- Professional services revenue 2019: $27,076,000

- Total revenue 2019: $91,534,000

- The proportion of professional services revenue to total revenue one year after IPO was 20.5%. [see example calculation below]

- Professional services revenue 2021: $41,854,000

- Total revenue 2021: $204,293,000

- The proportion of professional services revenue to total revenue in the most recent fiscal year is 17.9%. [see example calculation below]

- Professional services revenue 2022: $49,011,000

- Total revenue 2022: $273,865,000

- The proportion of professional services costs to the total cost a year before IPO is 56.95%. [see example calculation below]

- Professional services cost 2019: $26,456,000

- Total cost 2019: $46,451,000

- The proportion of professional services costs to the total cost in the most recent fiscal year is 42.1%. [see example calculation below]

- Professional services cost 2022: $46,905,000

- Total cost 2022: $111,413,000

Duck Creek Technologies

- Duck Creek Technologies went public on August 13, 2020.

- Duck Creek Technology provides core systems for property and casualty insurance companies. It provides the Duck Creek Suite that consists, among others, of solutions such as Duck Creek Policy (allows customers to develop and launch new products and manage policy administration), Duck Creek Billing (allows for payment and invoicing), and Duck Creek Claims (supports the claim life cycle from beginning to end). It provides the Duck Creek Platform that allows users to make system changes to Duck Creek applications.

- Duck Creek provides professional services to configure and integrate its solution and it provides continuous customer support. Most of its services are provided at the outset of the contract. The company also works with third-party SIs to provide professional services.

- The company expects its revenue from the professional services income stream to increase as the number of its customers grows, however, it will decrease as a percentage of the total revenue. The company will increase its professional services headcount but will also increase the quantity of implementation work to third-party SIs.

Financial Data

- Before its initial public offering, Duck Creek Technology's revenue from professional services was 45.4%. This decreased to 37.9% in the fiscal year 2021. Its professional service costs in proportion to its total costs are also decreasing (from 59.9% in 2019 to 52.3% in 2021).

- The proportion of professional services revenue to total revenue a year before the company's initial public offering (IPO) is 45.4%. [see example calculation below]

- Professional services revenue 2019: $77,692,000

- Total revenue 2019: $171,273,000

- The proportion of professional services revenue to total revenue, one year after IPO is 37.9% [see example calculation below]. The fiscal year 2021 is also the most recent financial year for this company.

- Professional services revenue 2021: $98,627,000

- Total revenue 2021: $260,350,000

- The proportion of professional services costs to the total cost, a year before IPO is 59.9% [see example calculation below]

- Professional services cost 2019: $43,228,000

- Total cost 2019: $72,178,000

- The proportion of professional services costs to the total cost in the most recent fiscal year is 52.3%. [see example calculation below]

- Professional services cost 2021: $57,522,000

- Total cost 2021: $110,086,000

CrowdStrike Holdings

- CrowdStrike went public on June 12, 2019.

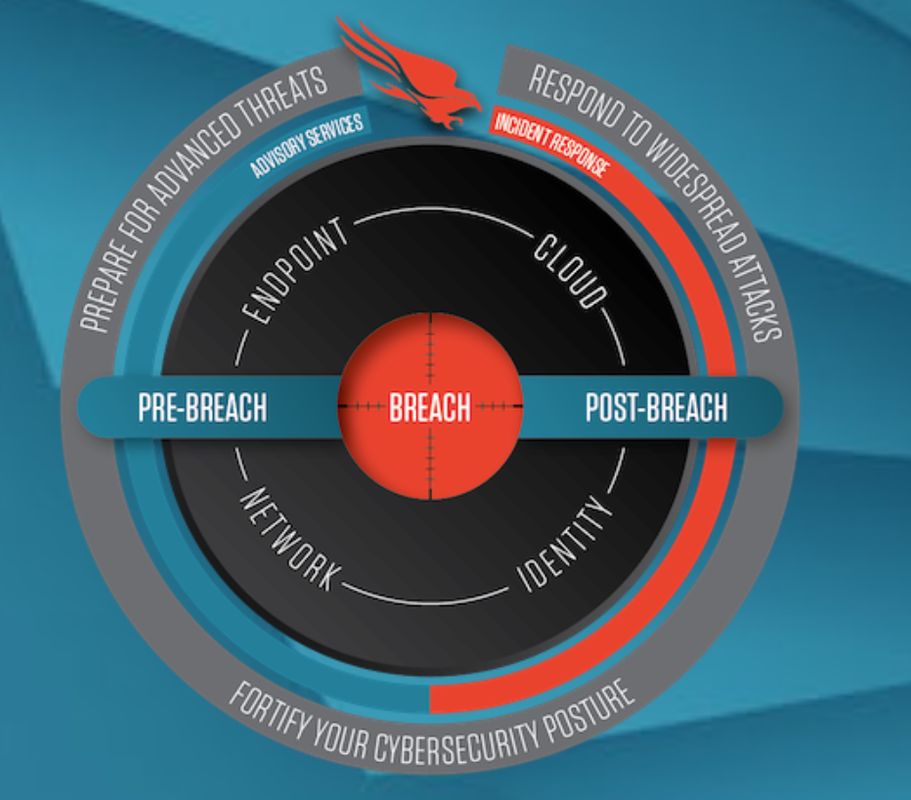

- CrowdStrike provides cybersecurity services. It uses a cloud-native platform (CrowdStrike Falcon platform) to detect and prevent threats. For this purpose, it "correlates trillions of cybersecurity events per week with indicators of attack, threat intelligence and enterprise data (including data from across endpoints, workloads, identities, DevOps, IT assets and configurations) to create actionable data, [and] identify shifts in adversary tactics."

- CrowdStrike’s professional services consist of incident response and forensic investigatory services, technical assessment and strategic advisory services, and training.

- The company provides professional services and subscriptions separately. Clients can opt for "hourly rate and fixed-fee contracts, one-time and ongoing engagements, and retainer-based agreements."

Financial Data

- CrowdStrike's revenue from professional services was 22.0% before its first public offering. Currently (fiscal year 2022) it earns less than 10% from this income stream. Its costs from this income stream in relation to the total costs has also decreased from 26.8% in 2018 to 16.0% in 2022.

- The proportion of professional services revenue to total revenue before the company's initial public offering (IPO) is 22.0%. [see example calculation below]

- Professional services revenue 2018: $26,184,000

- Total revenue 2018: $118,752,000

- The proportion of professional services revenue to total revenue one year after IPO is 8.0% [see example calculation below]

- Professional services revenue 2021: $69,768,000

- Total revenue 2021: $874,438,000

- The proportion of professional services revenue to total revenue in the most recent fiscal year is 6.3%. [see example calculation below]

- Professional services revenue 2022: $92,057,000

- Total revenue 2022: $1,451,594,000

- The proportion of professional services costs to the total cost before IPO is 26.8%. [see example calculation below]

- Professional services cost 2018: $14,629,000

- Total cost 2018: $54,486,000

- The proportion of professional services costs to the total cost in the most recent fiscal year is 16.0%. [see example calculation below]

- Professional services cost 2022: $61,317,000

- Total cost 2022: $383,221,000

Financial Information of the Remaining Three Companies

Jamf

- The proportion of professional services revenue to total revenue a year before the company's initial public offering (IPO) is 9.3%. [see calculation below]

- Professional services revenue 2019: $19,008,000

- Total revenue 2019: $204,027,000

- The proportion of professional services revenue to total revenue one year after IPO is 4.4%. [see example calculation below]. This is also the proportion of its most recent fiscal year.

- Professional services revenue 2021: $16,122,000

- Total revenue 2021: $366,388,000

- The proportion of professional services costs to the total cost a year before IPO was 25.4%. [see calculation below]

- Professional services cost 2019: $14,224,000

- Total cost 2019: $56,029,000

- The proportion of professional services costs to the total cost in the most recent fiscal year is 12.1%. [see example calculation below]

- Professional services cost 2021: $10,898,000

- Total cost 2021: $90,357,000

Snowflake

- The proportion of professional services revenue to total revenue a year before the company's initial public offering (IPO) is 4.7%. [see example calculation below]

- Professional services revenue 2019-January 2020: $12,519,000

- Total revenue 2019-January 2020: $264,748,000

- The proportion of professional services revenue to total revenue one year after IPO is 6.5%. [see example calculation below]. This is also the proportion of the most recent fiscal year.

- Professional services revenue 2021-January 2022: $78,858,000

- Total revenue 2021-January 2022: $1,219,327,000

- The proportion of professional services costs to the total cost a year before IPO is 17.1%. [see example calculation below]

- Professional services cost 2019-January 2020: $19,935,000

- Total cost 2019-January 2020: $116,557,000

- The proportion of professional services costs to the total cost in the most recent fiscal year is 24.1%. [see example calculation below]

- Professional services cost 2021-January 2022: $110,616,000

- Total cost 2021-January 2022: $458,433,000

Dynatrace

- The proportion of professional services revenue to total revenue a year before the company's initial public offering (IPO) is 9.5%. [see example calculation below]

- Professional services revenue 2018-March 2019: $40,782,000

- Total revenue 2018-March 2019: $430,966,000

- The proportion of professional services revenue to total revenue one year after IPO is 6.7% [see example calculation below]. This is also the most recent fiscal year.

- Professional services revenue 2021: $46,883,000

- Total revenue 2021: $703,509,000

- The proportion of professional services costs to the total cost a year before IPO is 29.5%. [see example calculation below]

- Professional services cost 2018-March 2019: $31,529,000

- Total cost 2018-March 2019: $106,801,000

- The proportion of professional services costs to the total cost, in the most recent fiscal year is 27.3%. [see example calculation below]

- Professional services cost 2021: $34,903,000

- Total cost 2021: $127,708,000

Research Strategy

For this research on public business-to-business, software-as-a-service companies, we leveraged the most reputable sources of information that were available in the public domain, including lists of (SaaS) companies gone public (such as those provided by Blastmedia and Crunchbase), (industry) news articles (such as those provided by Barrons, MarketWatch, Forbes), the company websites and company documents.

The financial information of the companies where income from a service is under 10% was also provided above to show what data was inputted into the formulas below. As the formula is quite simple and the same for each proportion calculation only an example calculation was provided.

Calculations

- Proportion revenue

To calculate the proportions requested, we divided the revenue for professional services revenue by the total revenue and multiplied it by 100%.

Proportion professional services = (Revenue professional services/Total revenue) x 100%

Example Calculation

For Jamf, its professional services revenue in 2019 was $19,008,000. Its total revenue in 2019 was $204,027,000.

- Proportion costs

To calculate the proportions requested, we divided the revenue for professional services costs by the total revenue costs and multiplied it by 100%.

Proportion professional services = (Costs professional services/Total revenue cost) x 100%

Example Calculation

For Jamf, the cost of its professional services in 2019 was $14,224,000. Its total cost of revenue in 2019 was $56,029,000.