Part

01

of one

Part

01

Plant-based Meat Market Research

- The global plant-based meat market is estimated to range between $4.2 billion and $6.67 billion for 2020.

- Most analysts identify continued growth for the market segment in light of a deceleration of the actual growth figure.

- 2020 estimates report the market share of plant-based meat products at 0.5% of the much larger overall meat industry, which was valued at $1.4 trillion.

Introduction

While the plant-based meat market growth rate has slowed during the 2 years of the pandemic, most analysts predict continued growth in the long and short term. Growth rates vary based on several factors including the industry's ability to lower price-points and continued innovation addressing taste, texture, and food allergens. Without question, the pandemic affected the industry in consumer-demand changes, stay-at-home requirements that moved demand from the food-service industry, and continued supply-chain issues. However, recent movement trends toward the trajectory the industry enjoyed prior to spring 2020.

Market Details

- Michigan State reported the plant-based meat global market at $6.67 billion for 2020, and is estimated to reach total sales of $16.7 billion in 2026.

- Contrarily, Supermarket News, referencing Bloomberg Intelligence and the OECD, reported the global market to be $4.2 billion in 2020 with expected growth to range from $21.6 billion to $56.8 billion in 2026, depending on future market penetration rates of plant-based meat alternatives to the larger all-inclusive meat market. They reported "Plant-based meat accounted for just 0.3% of total meat sales in 2020."

- For the US market, plant-based meat products were valued at $1.4 billion for 2020, an increased of more than $430 million in sales YoY representing growth of 45% over the previous 12 months and 72% over the past two years

- Global Data reported US plant-based meat sales increased "from $800m in 2015 to $1.5bn last year (CAGR 13.3%) compared to 8.5% globally to $6.1bn. The US retail category is expected to increase a CAGR of 10.8% by 2025 to $2.5bn, while the global market is forecast to grow 14.3% to $11.9bn".

- According to the Good Food Institute, "Over 290 million units of plant-based meat were sold in the past year, a unit increase of 36 percent. While, plant-based meat sales now account for 2.7 percent of all dollar sales for retail packaged meat and approximately 1.4 percent of all dollar sales for total retail meat."

- The institute also reports plant-based seafood remains a whitespace, with approximately $14 million in 2020 sales representing only 1% of total plant-based meat alternatives market.

- Additional whitespaces include bacon and chicken, as reported by Vox. Other reported whitespaces include pork and fish, "Plant-based pork is up 18.2% on menus year over year and plant-based fish is up 12.1%."

- It is estimated that the average adult American eats more than 200 pounds of meat annually. With a market penetration of 1.4%, the total plant-based meat products consumed by Americans (258,300,000 in 2020) is calculated to be over 723 million pounds.

- Of the total meat consumption by Americans, 68 pounds of beef is consumed per year on average, which represents approximately 246 million pounds of beef alternatives.

- In addition, Eating Well referenced a recent Michigan State University Food Literacy poll that found "35% of people, and almost half of those under the age of 40, have eaten plant-based meats in the past year". The number almost certainly increased drastically as COVID's impact on supply chains and meat-packing plants took effect.

- An important driver for growth in the market is the industry's ability to lower plant-alternative costs at retail compared to conventional meat products. In addition, " improved taste, broader availability and the commingling of plant-based alternatives in grocers’ refrigerated meat sections" are also listed as important market drivers.

Market Analysis

- The analysis of current market growth forthe plant-based meat sector is mixed. Most sources definitively show a slow-down or deceleration of growth beginning in the second year of the pandemic. For example, the first few months of the pandemic realized an increase in traditional meat of 45% while the alternative plant-based market saw an increase of 65%. However, "research market firm IRI found that the sector’s growth has begun to decelerate, with refrigerated plant-based meat sales down 6.6 percent in November 2021 from the year before, though sales were nearly 30 percent higher than November 2019."

- Beyond Meat missed its third-quarter guidance in 2021 of between $120 million to $140 million in sales and reported $106 million in revenues during the period. Ethan Brown, president and chief executive officer, ticked off six reasons for the sales decline during a Nov. 10 conference call. “One, consumers reported fewer and less frequent trips to the store; two, consumers reported being less open to trialing new products; three, consumers reported less interest in healthy options,” he said. “Four, the cancellation or reduced scope of our sampling programs as a Delta variant spread, limited new consumer exposure to our brands and category; five, to a much lesser extent than in foodservice, they’re still relevant, labor issues created complexity and possibly impacted demand due to delay in shelf resets and less frequent restocking; (and) six, with increased competition over the past two years, we're seeing, as expected, some impact on our market share.”

- Vox recently reported, "In recent months, a flurry of headlines cast doubt on the future of the once red-hot sector. The Financial Times asked, “Has the appetite for plant-based meat already peaked?”, DW declared “Demand for plant-based food products declines amid pandemic,” and the Food Institute, a food industry news outlet, said the slowing growth signaled a “niche future” for the category." However, fast-food restaurants continue the trend of launching new plant-based meat offerings. President of KFC in the US Kevin Hochman stated, "Every one of our pieces of research suggests plant-based diets will continue to grow and grow."

- Likewise, "Jennifer Bartashus, a senior analyst with Bloomberg Intelligence, agrees. “Because it’s a young industry and because there’s a lot of volatility, you’re going to have times that go up and down. But when you look at the long-term, I think there’s been a fundamental shift in how people think about their health.” She predicts plant-based meat and dairy alternatives will comprise 5 percent of the global market by 2030."

- Also reported by Vox, "Over one-third of Americans also reported that the pandemic made them more conscientious and open to new experiences, including new ways to eat, a promising change for plant-based meat advocates."

- While the industry segment has seen a recent slowdown in growth, a deceleration, the segment continues to grow albeit at a slower rate. For the long-term, most analysts predict economies-of-scale and improvement in pandemic related supply-chains will accelerate growthin the mid-term future, 10 to 15 years. "Some in the industry are convinced that plant-based food products, like those made of pea protein, will one day be cheaper than animal products."

- "According to the Good Foods Institute, sales of plant-based meats in the US grew by 16% and 18% in 2018 and 2019, for total unit sales of more than 208 million in 2019. Fourteen percent of all US households (about 18 million) purchased plant-based meat in 2019, 8.5% more than in 2018. Of these purchasers, 60.1% made 2 or more purchases. Out of these sales, frozen products account for 65.7%, refrigerated for 33.2%, and shelf-stable for 1%. Notably, the report found that plant-based meat is increasingly being stocked in meat coolers rather than in produce sections. The most sold products were burgers, followed by sausages/hot dogs and chicken/breakfast patties."

- Sentient Media explained, "Alongside this shift in meat consumption is an increase in the number of people trying plant-based alternatives. In another Gallup poll from 2020, 41 percent of adults in the U.S. reported having tried plant-based meats. Women (43 percent) were more likely to have tried a plant-based meat alternative than men (39 percent). Out of all age groups, those 65 and older (26 percent) were least likely to have tried an alternative. Over half of those from households making more than $100,000 a year had tried a plant-based meat product. "

- Significant decreases in recent sales figures from Canadian protein manufacturer Maple Leaf Foods and Beyond Meat accelerated the talk of demise for the plant-based meat industry. But a deeper look at what occurred in 2021 and what continues today shows a somewhat rosier outlook. "Beyond Meat suggested a “pause” in consumer demand was partially behind the third-quarter retail tail-off rather than any structural issue in appetite." And, its main US based competitor Impossible Foods just closed another $500 million in funding.

- Just Food explains, "The US plant-based meat market might just be adjusting to more reasonable expectations – in other words, some analysts got ahead of themselves in making such arguably lofty predictions."

- The founder of Elohi Strategic Advisors in Illinois Stephanie Lind states unequivocally, "Plant-based sales as a category are not in decline. It isn’t that the consumer is buying less plant-based. Rather,the bigger brands tend to go after big customers and launch PR stunts which doesn’t create sustainable revenue. It only creates a shaky foundation."

- Kellogg CEO Steven Cahillane was equally positive about its MorningStar Farms brand on a recent call with analysts, noting the pre-pandemic sales comparisons for the slowing category growth. “When you look to consumer behaviour, when you look to the consumer research we have, there’s still a lot of enthusiasm and excitement around plant-based. And so we think going into next year, you’ll start to see healthier growth rates on a year-over-year basis because of those comps.”

Article Data Points

- The Good Food Institute presentation contains important data points that are outdated from 2019. The section above provides the most current data available from 2020 and 2021. For example, it reports plant-based meat sales in the US of $898 million. The most recent data shows sales for the category had increased substantially to $1.4 billion in the US.

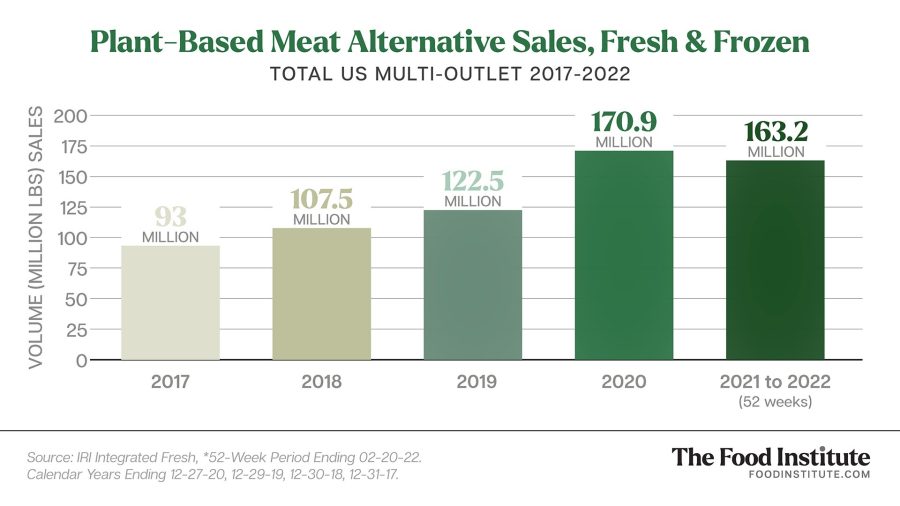

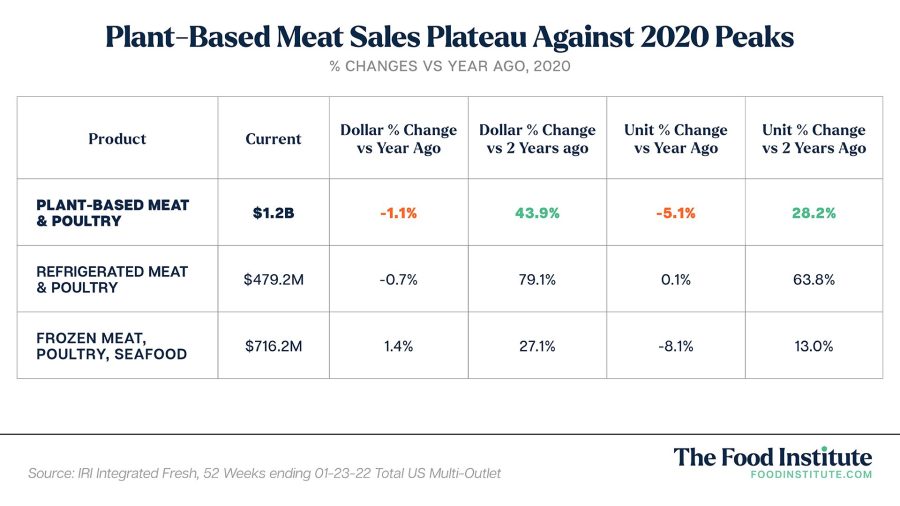

- Important data points from the more recent Food Institute article include: "Sales for refrigerated and frozen meat alternatives totaled $1.2 billion for the 52-week period ending February 20, down 2.6% year over year, with volume sales indicating a steeper 6.6% decline."

- "Overall, category performance stalled in 2021 following a two-year growth period which was energized by expanded distribution, consumer trials, and restaurant shutdowns."

- "According to FoodThink research, two-thirds of U.S. consumers who identify as flexitarians consider themselves foodies, and 64% enjoy experimenting with new foods, recipes, and products. Furthermore, flexitarians frequently purchase plant-based alternatives alongside traditional meats, positioning the categories as more complementary than competitive — and their preferences on both sides continue to evolve."

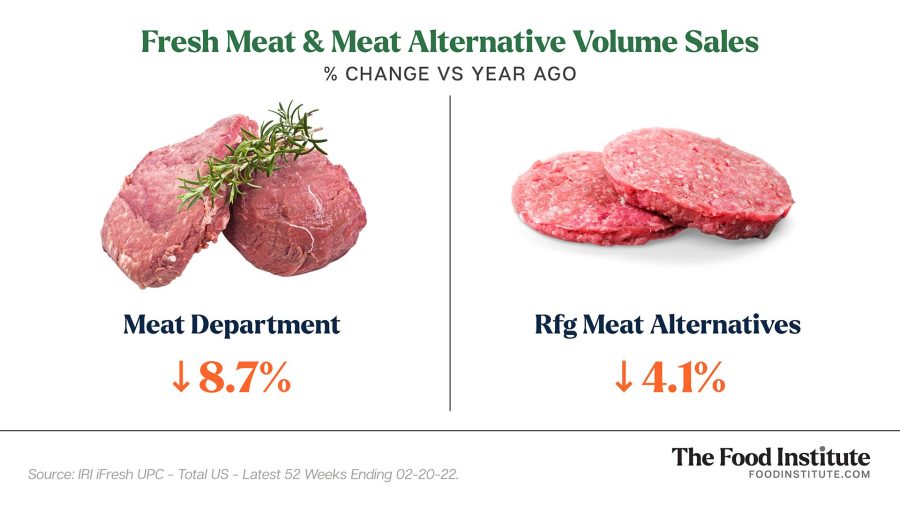

- While plant-based meat alternative sales are slowing, the traditional meat category is worse.

- The Financial Times article cannot be reviewed as a subscription is required.

For Comparison

- As stated above, the current market share of plant-based meats as part of the global overall meat food segment is approximately .5%, since the larger meat market is estimated at $1.4 trillion.

- Several of the larger food conglomerates and food product companies have launched or acquired plant-based meat brands. Many have weathered the ups and down of the larger meat market including Tyson, ConAgra Foods, Hormel, and Kellogg. Further still, plant-based meats are only an estimated 3% of packaged meat sales in the U.S.

- Other important data points for comparison: "6 out of 10 of the largest US meat producers have plant-based CPGs."

- "5 out of 10 of the largest European meat producers have plant-based CPGs."

- "2020 saw $3.1B investment into alternative proteins. Three times more than in 2019."

- "And, plenty of the rounds were led by Big Food players: Tyson, Cargill, Nestlé, Kellogg’s, General Mills, Louis Dreyfus Company and more."

- "Europe’s largest meat producer, Vion Food Group, is investing in plant-based meat, with €15M in production line investments for meat-free products in 2020."

- "Nestle invested heavily in plant-based in 2017 with the acquisition of Sweet Earth in the US, now running the Garden Gourmet brand in Europe and Harvest Gourmet in Asia. With a localized offering and marketing (kung pao chicken and pork belly in China, burger patties in the West), Nestle is quietly the most global plant-based player."

Allergens and Plant-Based Alternatives

- Estimates range between 20% to 30% of today's consumers avoid gluten food products, even though a small fraction suffer from actual gluten related allergies. Most analysts do not agree if gluten-free is a passing fad, like the Atkins diet, or a movement towards less allergen food products.

- Surveysshow 14% of the US population reports having a food allergy. In addition, "Some consumers also avoid certain allergens such as gluten, milk, or soy because they do not like these ingredients, think these ingredients are unhealthy, or simply have a negative perception of the ingredients. As such, the allergy friendly food market appeals to a much broader audience than the name implies."

- Some alternative plant-based meat products are made from other plants besides soy or peas. The Factory Farming Awareness Council reports, "The only legume in the Impossible burger is soy, while MorningStar Farms’ veggie burger only has black beans. Other brands with plant-based meat alternatives include Field Roast, Amy’s Kitchen, Dr. Praeger’s, and many others with varying amounts and types of legumes."

- Other protein options being tested and/or brought to market include rice protein isolate, which is hypoallergenic while being used in plant-based meats either on its own or in combination with other plant-based proteins, as well as algae, peanut protein concentrate, rapeseed meal, quinoa and protein from surplus potatoes.

- Startup and Israel based More Foods is bringingfurther options to market currently under consideration and testing, which include pumpkin and sunflower seeds.

- Vox confirmed the pea protein supply chain issues Beyond Meat experienced recently citing, "In summer 2021, the price of yellow peas rose when a drought in Canada cut pea production in the country by 45 percent. Sixteen percent of US plant-based meat products are pea-based." The analysts stated smaller companies "don’t have the scale that the big CPG [consumer packaged goods] companies have. They get hit harder when raw material prices rise. And because many players in the space use third-party manufacturers, supply chain issues had a big impact on them."

- In addition, "Some startups have seen success through bypassing retail and food service altogether. Deborah Torres, CEO of Atlas Monroe, a vegan chicken company based in San Diego, told me they were already selling directly to consumers before the pandemic, which put them in a good position in early 2020 when people wanted groceries and food delivered."

- Senior Analyst Jennifer Bartashus of Bloomberg Intelligence told The Food Institute, "At retail, we are seeing the biggest [plant-based] players continue to grow volume, and smaller players cede share, underscoring how important scale has been to deal with pandemic-related production and supply chain issues."

Research Strategy

The report addresses information gaps and potential data discrepanciesfrom the first report. Accurateinformation and leading company analysis is not repeated. Targeted sources include industry analysis provided by experts and insiders. Where possible, commercial market reports were avoided. It is important to note the timeline of sources and plant-based meat segment predictions, as well as analysis. Many articles written after Beyond Meat's 3rd-quarter results were published concentrated on and predicted a demise in the market segment. Most trends and future outlooks written in early 2022 portray a rebound for these alternative food offerings.