Part

01

of one

Part

01

Personal Care Contract Manufacturing

The requested information revolving around key players in the United States' personal care contract manufacturing space by revenue, the estimated size, growth, and percentage of organic/natural products sold within personal care segments, as well as insights on the country's personal care products imports has been carefully selected and provided below.

Major Players in United States' Personal Care Contract Manufacturing Market by Revenue

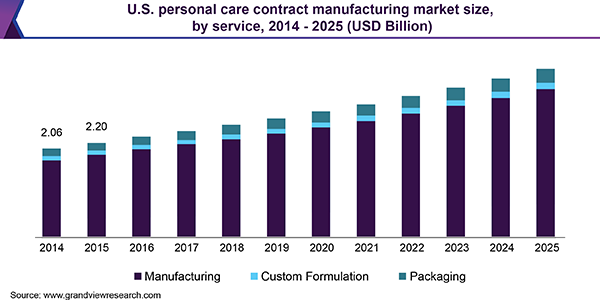

- According to Grand View Research, the US personal care contract manufacturing industry had a market size of $2.62 billion in 2018 and is expected to register a CAGR of 6.0% from 2019 through 2025.

- The increase in demand for skincare and haircare products as well as organic personal care products are some of the major drivers behind the growth of the US personal care contract manufacturing.

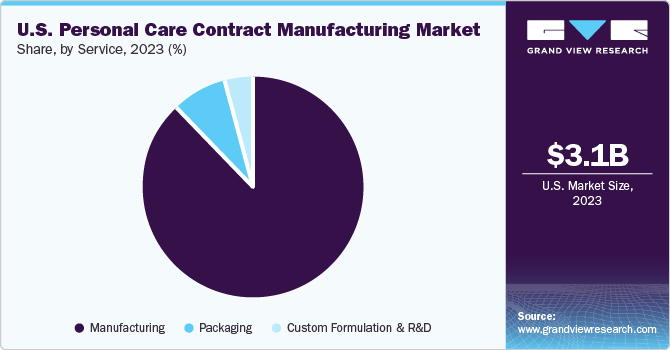

- Over the years, contract manufacturing service has been accounting for the highest market share of the US personal care contract manufacturing, followed by packaging and custom formulation. We however could not get the exact percentages as the figures were hidden behind paywalls.

We could not get a pre-compiled list of the largest players by revenue only in the United States' personal care contract manufacturing market. As a result, we looked into all the companies that were named as major players in the global market by credible reports to find out which ones are from the United States and then looked for their revenues in order to build the top 10 list provided below.

Vi-Jon

- According to its website, Vi-Jon is the United States' oldest private label manufacturer in the health and beauty sector. The website also states that Vi-Jon has around 140 years of collective R&D experience as well as two state-of-the-art R&D facilities and so it is able to handle all the processes from product design to delivery for their customers. However, from its LinkedIn page, it specializes in private brand Health and Beauty Care (HBC) products, Germ-X, and Hand Sanitizer.

- D&B Hoovers estimates that the company has an annual revenue of $494.66 million.

Minerals Technologies Inc.

- Minerals Technologies Inc. had a total revenue of $1.791 billion in 2019 with $377 million coming from the Household, Personal Care, and Specialty segment, which is the part of the company involved with contract manufacturing services.

- The company provides the following contract manufacturing services;

- Formula development with an in-house R&D team.

- Raw material selection.

- Process development – small batch and scale-up.

- OTC drugs, cosmetics, and Rx skin care manufacturing.

- Product filling and packaging.

- Warehousing and inventory management.

- Global sourcing and distribution.

Cosmetic Essence LLC

- Cosmetic Essence was acquired by Vee Pak in 2018 and the two companies together with a third one known as Aware Products merged and became Voyant Beauty Holdings.

- According to D&B Hoovers, Cosmetic Essence has an estimated revenue of $240.51 million.

- The company offers R&D, package design & sourcing, and manufacturing & filling of products such as color cosmetics, creams and lotions, fragrances, bath and hair care products, and household supplies.

HatchBeauty Brands

- HatchBeauty Brands is a privately held company headquartered in Los Angeles, California. A 2019 article by Beauty Matter estimated that the company is making between $100 to $200 million in sales while another by dot.LA that interviewed HatchBeauty's cofounder and CEO, Tracy Holland, stated that the company has grown from $150,000 in debt to over $100 million in sales.

- HatchBeauty specializes in "Brand Architecture, Concept Development, Creative Services, Go-To-Market Planning, Launch Planning, Packaging Design, Imaging, Product Development, Product Roadmap, Revenue Planning, Sourcing, Strategic Planning, Product Planning, and Turnkey Product" according to its LinkedIn page.

Northern Labs Inc.

- Northern Labs Inc. was acquired by Knowlton Development Corporation, a contract manufacturer and custom formulator for the consumer goods industry in Canada, in December 2017 but still operates on its own.

- D&B Hoovers estimates that the Wisconsin-based company has an annual revenue of $119.99 million.

- Contract manufacturing services offered by Northern Labs include manufacturing, filling, unique packaging, and distribution of auto care, bath & body, hair care, home, industrial, and skincare products.

Bradford Soap Works

- Bradford Soap Works is one of the top manufacturers of private-label bath soaps and personal care products with an estimated annual revenue of $70 million.

- With an experience of around 140 years, Bradford offers formulation, manufacturing, packaging, and assembly services.

Nutrix

- Nutrix is a contract manufacturing, private label, and design company located in Salt Lake City, Utah, and according to RocketReach, it has an estimated annual revenue of $36.60 million.

- Some of the personal care contract manufacturing services offered by Nutrix include manufacturing, R&D formulation of liquids, creams, lotions, oils, toothpaste, and Gel, filling, and formula development.

Diamond Wipes International Inc.

- According to its LinkedIn page, Diamond Wipes specializes in contract manufacturing of beauty wipes. In addition to manufacturing, it also provides R&D, formula design, filling, packaging, and distribution services.

- D&B Hoovers estimates the company's annual revenue to be $32.72 million.

Mansfield-King

- Mansfield-King is an Indianapolis-based personal care contract manufacturer with an estimated annual revenue of $31.42 million.

- Mansfield helps personal care companies in R&D, formula design, manufacturing, filling, packaging, and shipping of products.

Gar Laboratories

- Gar Labs has an estimated annual revenue of between $25 to $49.9 million according to ThomasNet. Zoom Info also estimated the company's revenue to be $26 million.

- Gar Labs offers formulation, manufacturing, filling, packaging, and palletizing services to skin and hair care companies that need from 5,000 units.

Other personal care contract manufacturing major players in the US that we analyzed that had approximately $10 million in sales and above but did not make our top 10 list include;

- Amr Laboratories - $25.00 million.

- Devcare Solution - $22.2 million.

- Cosmetic Solutions - $19.81 million.

- HCP Packaging - $15.95 million.

- Ariel Labs - $11 million.

- Tropical Products - $10.64 million.

- Formulacorp.Com - $9.92 million.

Research Strategy

To determine the 10 largest players by revenue only in the United States personal care contract manufacturing market, we used a variety of trusted and reputable sources including industry reports, market reports, and articles in association with the market among others. However, we were not able to find a pre-compiled list of key players in the US industry. As a result, we looked into all the companies that were named as major players in the global market to find out which ones are from the United States. After identifying which companies are from the US, we looked for their revenues in order to build the top 10 list provided above. Moreover, most of the companies identified are privately held, so we relied on third-parties for revenue estimates.

The Size, Growth, & Percentage of Organic/Natural Products Sold Within the United States' Personal Care Segments

Hair

- According to Statista, the US hair care segment had a market size of $12.86 billion in 2019, a figure that is expected to drop to $11.93 billion in 2020. Additionally, the segment is expected to register a CAGR of 2.9% from 2020 through 2025.

- Technavio also predicted that 31% of the expected growth in the segment will come from hair color products.

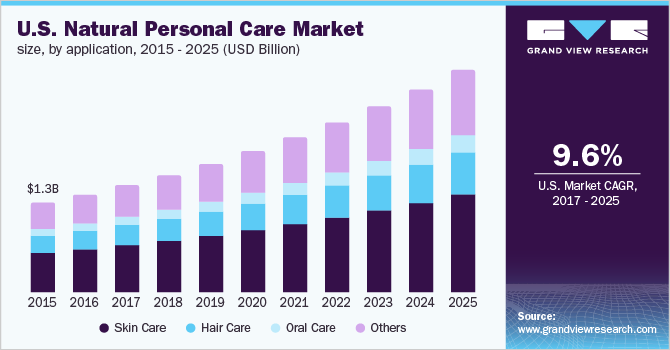

- Although we could not find the exact percentage of organic/natural products sold in the US hair care segment, we discovered that out of the $12.71 billion in revenue registered by the country's hair segment in 2018, approximately $900 million came from organic/natural hair products. Moreover, the organic hair care revenue is expected to reach $2.55 billion by 2025.

- We also found out that the hair care segment had the second-largest market size in the US natural personal care market after the skin care segment. We however could not establish the exact percentage as figures were hidden behind a paywall.

Skin

- A report by Statista estimates that revenue in the US skincare segment will amount to $17.545 billion in 2020 and is expected to grow at a CAGR of 5.3% between 2020 to 2025.

- Statista also reported that facial cleansers and acne treatments are the best-selling skin care products in the country, having sold 316 million and 13.85 million units respectively in 2019.

- The most recent estimated revenue of the organic skincare segment in the US that we could obtain was from 2015 and for organic face creams at $670 million. However, we established that the segment is expected to register a CAGR of 3.22% from 2020 through 2025.

- As mentioned and indicated in the image above, the skincare segment dominated the US personal care market with a market share of over 45% in 2017.

Cosmetics

- The US cosmetics segment is expected to have a market size of $16.15 billion by the end of 2020 and grow at a CAGR of 5.4% between 2020 and 2025.

- In 2018, foundation was the best-selling cosmetic product in the country with a sales revenue of $985 million followed by mascara at $914.26 million and lipstick at $667.2 million.

- On the other hand, Statista predicts that the revenue of the country's organic/natural cosmetics segment will amount to $1.287 billion by the end of 2020 and will register a CAGR of 9.1% from 2020 through 2025.

Hygiene

- In 2018, the market size for tissue and hygiene products was approximately $34 billion. Statista also predicts that $3.43 billion of the segment's revenue in 2020 will come from female hygiene products, while $7.98 billion will come from shower and bath products.

Fragrance

- The US fragrance market is expected to have a market size of $7.61 billion by the end of 2020 and grow at a CAGR of 3.4% between 2020 and 2025.

- While we could not get the percentage of organic/natural fragrance products in the US, we found a 2017 survey that revealed that around 52% of Americans believed that it is important to purchase natural fragrances while 17% reported buying only organic fragrances.

Oral Care

- The revenue of the US oral care segment is predicted to amount to $8.39 billion by the end of 2020 and register a CAGR of 4.4% from 2020 through 2025.

- We could not get the percentage of organic/natural oral care products sold in the US. However, a 2017 Statista survey showed that 38% of American consumers prefer to purchase organic/natural toothpaste while 20% reported buying only organic oral care products.

Research Strategy

To estimate the size, growth, and percentage of organic/natural products sold within the US personal care segments, we used a variety of trusted and reputable sources including industry reports, market reports, and articles in association with the market among others. Through this, we were able to find the market sizes and predicted growth rates for all six segments. However, we were not successful in obtaining insights on the percentage of organic/natural products sold within the segments, as the information was either hidden behind paywalls or not available in the public domain. We, however, were able to get the market sizes and expected growth rates of organic products in three of the six segments and included them in the report. For the other three, we included the percentage of American consumers that prefer and purchase organic/natural products as available.

Insights on the United States' Personal Care Products Imports

- In 2019, the United States imported beauty cosmetics and skincare products worth approximately $5.12 billion, a decrease of 4.8% when compared to 2018.

- The top 5 suppliers from which the US imported the products include;

- France: $807.6 million (up 4.6% from 2015)

- Canada: $755.3 million (up 16.4%)

- China: $740.8 million (up 5.9%)

- Italy: $571.4 million (up 76.3%)

- South Korea: $516.9 million (up 132.8%)

- According to Statista, the US was the leading consumer of beauty products worldwide with the consumption value of beauty products amounting to about $89.71 billion.

- A 2017 report by iContainers Solutions also reported that the US was the largest importer of beauty products in the world in 2016 and that of the "total beauty products that the US imports, 20% come from China, followed by 17% from France, and 15% from Canada." The report further revealed that the US imports higher-end beauty products from France, Canada, and Italy while the low valued products are bought from China and Mexico.

- A 2018 article by CNBC reported that while African-American men and women spend a lot of money on their hair, US companies are missing out as most of their hair products are imported from countries such as India and China.

- Another report by Statista showed that the "United States was Colombia's most important trading partner for personal care imports in 2018 with 27.6% of the total import value of those products."

- The only import data we could obtain from the Census Bureau related to the personal care market revolved around toiletries and cosmetics. The data revealed that around $1,153,000 worth of toiletries and cosmetics were imported into the country in the month of September 2020.

Research Strategy

To determine the percentage of personal care products in the US that is imported from other countries, by market segment and by country of import, we used a variety of trusted and reputable sources including industry reports, market reports, articles in association with the market, and relevant government sites among others. Unfortunately, we were not able to obtain any of this information from the public domain even after a thorough and extensive search. However, we were able to find several insights revolving around the importation of personal care products in the US and included them in our report.