Part

01

of one

Part

01

Traffic Management Vertical - Top Players

Key Takeaways

- SWARCO AG and Cleverciti were identified as two of the top players in the points of interest field of use.

- For the provision of real-time traffic information field of use two of the top companies were identified as Iteris, Kapsch TrafficCom, and TransCore.

- TomTom and Mapbox are two of the top market players identified for the specific map attributes field of use.

- In the road operators' benefit field of use two of the top market players are NoTraffic and Citilog.

- For the managing seasonal traffic trends field of use, HERE Technologies, and Cubic Corporation were selected as two of the top players.

Introduction

In the brief below information is provided regarding the top players in five fields of use related to traffic management that is done through the use of vehicle data acquired from connected devices. SWARCO AG, Cleverciti Systems, Iteris, Kapsch TrafficCom, TransCore, TomTom, Mapbox, NoTraffic, Citilog, Cubic Corporation, and HERE Technologies are the companies were identified as top players in the five fields of use. A brief explanation of the research strategy adopted is presented in the last section.

1. Field of Use: Points of Interest (Gas Stations, Parking Areas)

SWARCO AG

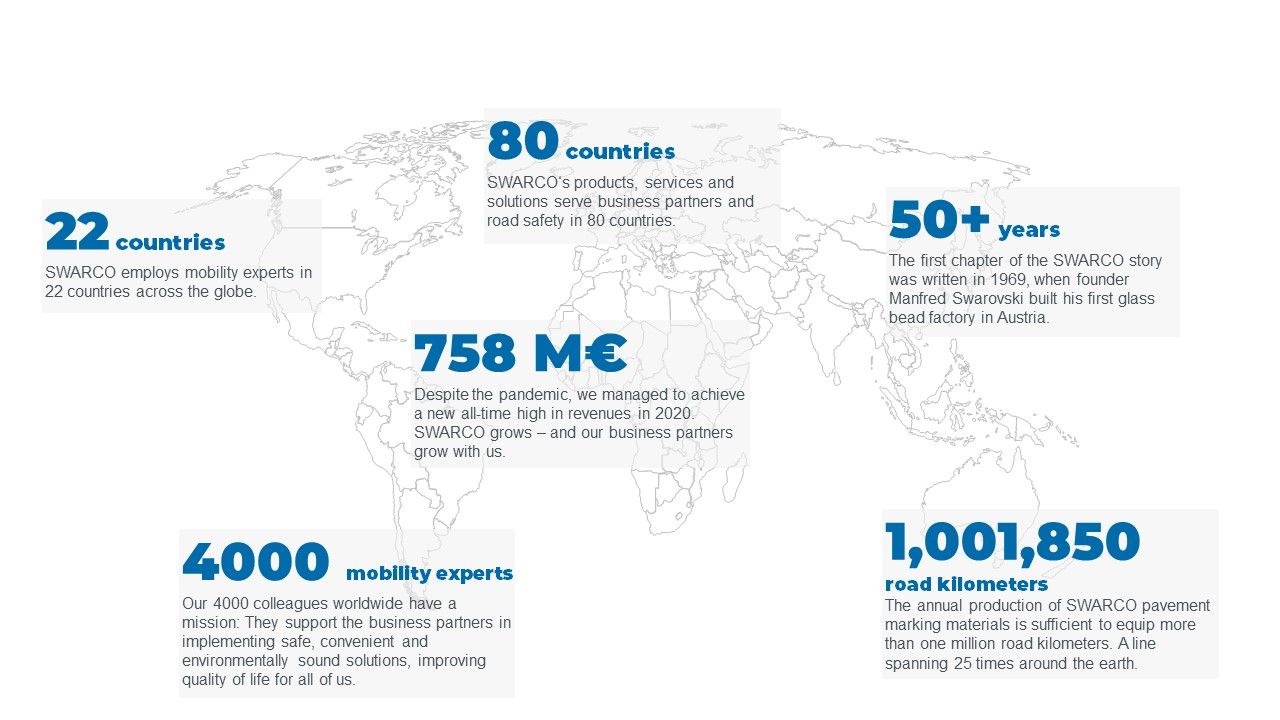

- SWARCO AG is a traffic technology company headquartered in Wattens, Austria. The company is led by Chairman Günther Apfalter and Chief Executive Officer, Michael Schuch. Its business purpose is to "improve quality of life by making the travel experience safer, quicker, more convenient and environmentally sound."

- The company website can be accessed at this link.

- Solutions are provided for traffic management, road marking systems, connected driving, smart charging, parking, public transport, and advanced industry systems. According to Michael Schuch, chief operating officer (COO) ITS at SWARCO, the company has adopted a holistic approach to traffic management and considers its impact on "towns and cities, on motorways, in tunnels, in car parks, at the charging station, in port areas or in public transport networks. " The solution covers company competencies in traffic telematics, urban traffic management, highways and tunnels, bicycle solutions, and port solutions.

- Products supplied are software, road markings, traffic signals and accessories, electronic signs, smart charging, parking, detection and sensors, cycle products, industrial glass beads and blasting media, outstations, gantries and cantilevers, static signs, street furniture, and barriers.

- Specific to parking, the SWARCO product covers parking guidance (single space recognition and dynamic parking signs), barriers, payments, and software (OPTIPARK Parking Guidance). The parking solution covers the user journey and allows for the planning, reserving, and paying for parking services before pulling out from the driveway. The technology covers communications and congestion management, and detection. Additional details can be sourced at this link.

- SWARCO is privately-held, however its annual revenue is estimated to be $895.98 million by Dun & Bradstreet for the last financial year. Key customers include Transport of London, the City of Paris, and Motor Fuel Group (UK).

- Strengths of SWARCO include the variety of solutions offered by the company, its market coverage (by vertical and geography), and its internal expertise. According to the Managing Director of SWARCO Traffic, the company's strengths include reliability and high-quality mobility.

- Weaknesses for SWARCO at the 360 Quadrants website are the enhanced image processing, journey time measurements, and Predictive Traffic Modeling System. Additional weaknesses can be found at this link.

- SWARCO AG was selected for inclusion in this report because it was named as a key player in the intelligent traffic systems market and as one of the top 10 companies in the parking management system market.

Cleverciti Systems GMBH

- Cleverciti Systems is a provider of high-tech solutions for on-street and outdoor parking detection, guidance, and monitoring. Founded in 2012, Cleverciti's products have been deployed in over 20 countries. European headquarters are in Munich, Germany and North American headquarters are in Atlanta.

- The company cites the desire to help organizations, and the reduction in traffic and emissions as part of its purpose. Cleverciti is led by CEO Thomas Hohenacker. The company website can be accessed at this link.

- Since 2015, Cleverciti has received $28.3 million in funding, and annual revenue is estimated at $1.77 million by Dun & Bradstreet.

- Cleverciti operates in the following verticals: city tourism destination, train station, shopping, truck stop, airport, automotive, office, university, hospital, stadium, fleet management, convention center, and parking operator.

- Solutions are provided for space management, parking guidance, curb management, permits payments, dynamic reservation, advertising, and smart lamppost.

- Innovations from the company include the Clevercity Cockpit smart parking dashboard, the Cleverciti Sensor, the Cleverciti Circ (a real-time guidance that wraps around lampposts), Cleverciti Sign, Cleverciti Card, the Cleverciti App, and the Cleverciti PowerRing.

- Key global customers include Stadt Koln, Bad Hersfeld, Kerken, Dubai, Koblenz Verbindet, Berlin, RheinEnergie, Geneva Airport, South Western Railway, Vienna International Airport, Sibley Memorial Hospital at Johns Hopkins Medicine, Denison Parking, the District of Columbia Hospital Association, and the University of British Columbia.

- The key differentiator for Cleverciti is the provision of an end-to-end solution that utilizes artificial intelligence based guidance systems "known for delivering robust and highly reliable solutions."

- The Cleverciti smart parking system has been called one of the most technologically sophisticated parking management systems. One customer lauded the "very reliable, unproblematic, and universally applicable" technology underlying the parking sensors. Company weaknesses from credible sources were not publicly available for Cleverciti.

- Cleverciti was selected for inclusion into this report despite being a startup, Iteris based on the comprehensiveness of its smart parking product and solution offering, because it was included in a list of the top 10 parking management companies, and because it was named as one of the top seven parking management systems in the world by Verified Market Research.

2. Field of Use: The Provision of Real-Time Traffic Information (Traffic conditions, Estimated Time of Arrival (ETA))

Iteris

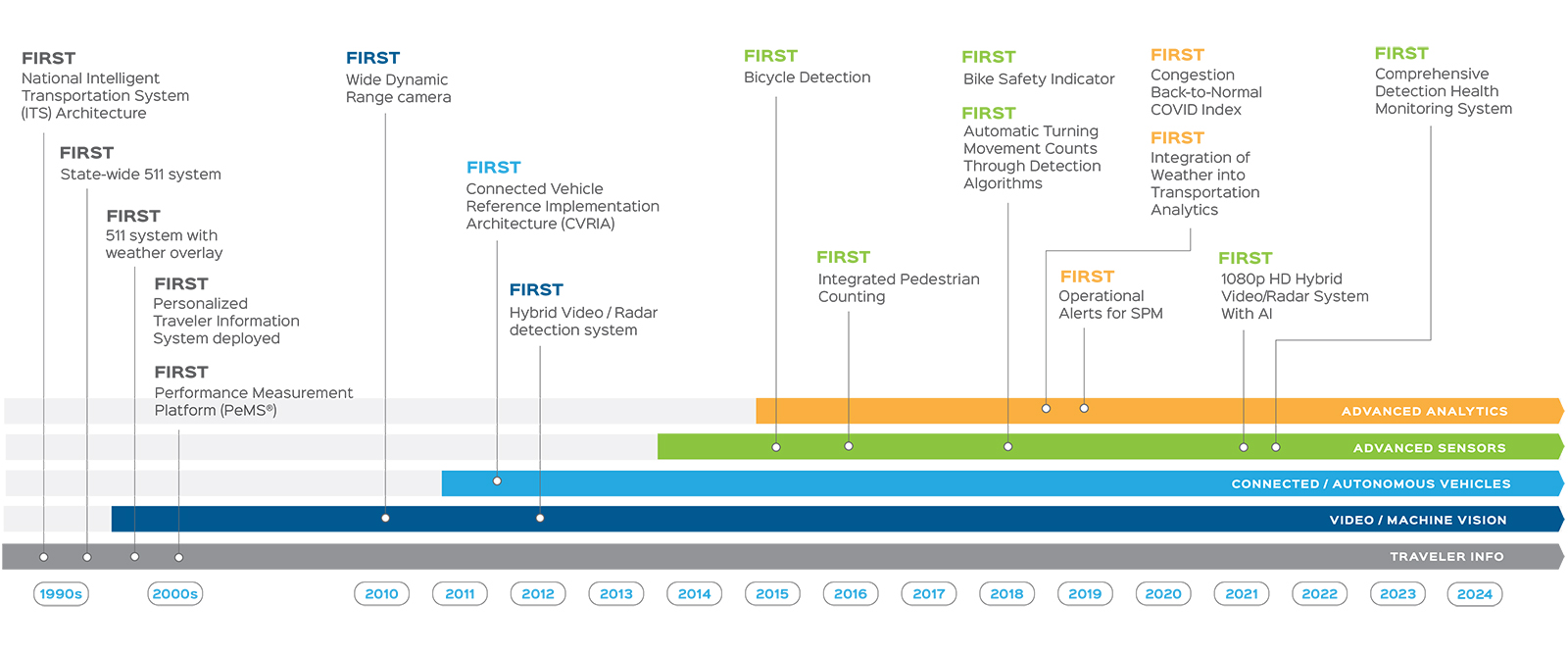

- Iteris was founded in 2004 and is headquartered in Austin, Texas. Company services have been deployed in over 40 countries. In the North American market, safety at over 100,000 intersections and along 900,000 road miles is secured from SaaS mobility deployments from Iteris.

- Led by Joe Bergera, president and CEO, Iteris's website can be accessed at this link.

- Annual Revenue for Fiscal Year (FY) 2021 was $117.1 million, an increase of 9% year-on-year (YoY).

- Key public sector and commercial enterprises customers of Iteris are presented in the image below.

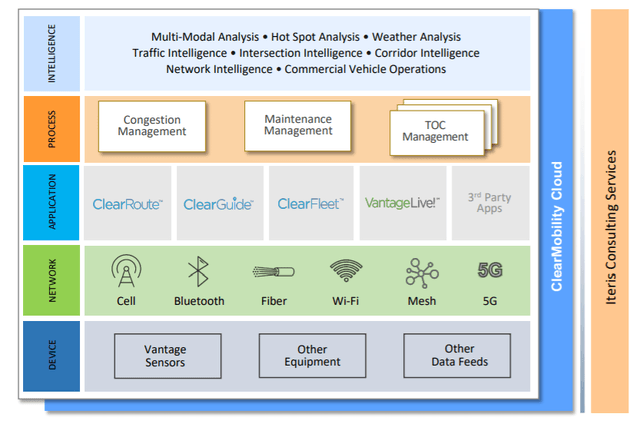

- Solutions provided by Iteris are smart sensors (traffic detection, connected vehicles/V2X, pedestrian and cyclist safety, and travel time measurement), mobility intelligence (traffic analytics, asset management, signal performance, traveler information, and commercial vehicle operations systems), managed services (asset management, congestion management, and detection support), and mobility consulting services (connected and automated vehicles, transportation planning, workforce development, TMC design and operations, traffic signal timing, and ITS architecture, design, and engineering).

- These solutions are offered to local municipalities, regional agencies, state DOTs, federal and national governments, construction and consulting companies, automotive OEMs, map tech, media, and insurance industries.

- A key differentiator for Iteris is it's ClearMobility Platform which was developed utilizing expertise gained from the development and management of the reference architecture for connected vehicles at the US Department of Transportation, an industry gold standard. The ClearMobility Platform was built with standard requirements incorporated into the product roadmap.

- Strengths of Iteris include the relationships developed from advisory services provided to municipal agencies and commercial entities for the sale of its platforms. This gives Iteris a uniquely advantageous market position given the proposed infrastructure upgrades required for road infrastructure in the USA.

- Bridging pain points (communication, cybersecurity, cloud enabling, 5G and DSRC support standards, and infrastructure for V2X) resident in the gap between hardware and software for its municipal customers is a primary weakness for Iteris, since instead of purchasing the platform, these customers may opt for point offerings from vendors instead of Cisco, an Iteris partner.

- Weaknesses for Iteris at the 360 Quadrants website are on-site support, autonomic alerts and triggers, and Red-Light Enforcement System. Additional product weaknesses can be found at this link.

- Iteris was selected for inclusion into this report on the basis of its product, customers, and the fact that it was named a key market player in the Global Real-time Traffic Information Systems market by Cognitive Market Research.

Kapsch TrafficCom

- Kapsch was founded in 1892 and is headquartered in Vienna, Austria. Kapsch TrafficCom is a provider of solutions for traffic and transport for connected vehicles, road safety, smart urban mobility, sustainable mobility, tolling, and traffic management.

- Led by CEO Georg Kapsch, Kapsch TrafficCom has engaged in projects in over 50 countries, and has offices in over 25 companies with approximately 4,660 employees. The website for Kapsch TrafficCom can be accessed at this link.

- For FY 2020-21, annual turnover was €500 million (approximately US $537 million). Segment revenue for traffic management was €147 million (US$158 million).

- Solutions provided are traffic management, traffic demand management, tolling, and tolling services. Specific to traffic management, solutions are delivered based on three thematic areas: traffic optimization, decision intelligence, and mobility operations.

- These solutions are applied by cities (traffic demand management and traffic management), highways, and for tunnels and bridges.

- In the traffic management market, the key differentiator for Kapsch TrafficCom is its trademarked software Dynac® and EcoTrafiXTM, and the offering of solutions for the entire value chain from hardware to installation, to operation.

- Key customer groups for Kapsch TrafficCom are public-private partnerships, fleet card companies, private concessionaires, and automotive groups (M2B), cities, municipalities, governments, and public authorities.

- Strengths of Kapsch TrafficCom are its addressable market which had a volume of EUR 4.6 billion in 2020,

- Risks facing Kapsch TrafficCom as stated by company management in the Annual Report for FY 20/21 are continued measures emanating from management of the COVID-19 pandemic, new order volatility, project execution risks, loner-term public sector contracts, strategic risks (inability to innovate, country risks, expansion risks), financial risks (foreign exchange, interest rate, credit risk, and liquidity risk), personnel risk, and legal risk.

- Weaknesses of the traffic management product at Kapsch according to 360Quadrants are subscription licensing, functionalities gaps in the solution, and the facial recognition system. Additional weaknesses can be found at this link

- Kapsch TrafficCom was selected for inclusion in this report on the basis of its product and solution portfolio, addressable market, geographic spread, and its inclusion in a list of the top market players in the global real-time traffic information systems report from Cognitive Research.

TransCore

- TransCore is a provider of transportation solutions for public sector agencies and private enterprise. Founded in 1939 and headquartered in Nashville, Tennessee, TransCore is a subsidiary of ST Engineering from Singapore. Led by President Tracy Marks, TransCore's website can be accessed at this link.

- According to Dun & Bradstreet, annual revenue at TransCore is estimated at $635.90 million.

- TransCore was selected for inclusion in this report on the basis of its product and services portfolio and the fact that it was named as a major market player in market research reports on the intelligent traffic management system market.

- In the traffic management vertical the key differentiator for TransCore is its SCATS system. SCATS achieves system payback within 12 months and reduces emissions. Features of SCATS include adaptability, real-time information, and real-time alarm monitoring.

- The product at TransCore has been deployed at over 30,000 intersections globally. ITS products at TransCore include TransSuite, a platform designed to cover a wide range of traffic management needs within a single platform. Modules are available for event management, traveler information systems, traffic control systems, traffic management systems, and video control systems.

- TransCore also offers products for congestion pricing, tolling, and RFID applications.

- According to 360 Quadrants, TransCore's strengths are its traffic signal timing, the support and services provided, and that it is a dynamic traffic management system. Additional strengths can be accessed at this link.

- Weaknesses of TransCore are its remote support, its consulting services and the incident detection system. Additional weaknesses can be accessed at this link.

- Cobb County in Georgia is a customer of the SCATS system, the New York City Department of Transportation (NVCDOT) is a connected vehicle customer, and TranSuite customers are the Washington D.C. Department of Transportation, and the Arriyadh Development Authority.

3. Field of Use: Generate Specific Map Attributes (Pedestrian Navigation, Roadmaps)

TomTom

- TomTom is a mapmaker provider of geolocation technology for carmakers, developers, drivers, and enterprises. The company, headquartered in Amsterdam, was founded in 1991 and has a team of over 4,500. The TomTom website can be accessed at this link.

- TomTom is led by Harold Goddijn, CEO, and reported annual revenue of €394 million (US$423 million) in 2021.

- TomTom was selected for inclusion in this report on the strengths of its product, its customers, its naming as one of the top four providers of location data by Strategic Analytics, and its inclusion as the third largest player in the CORE rankings of top market players in location and mapping platforms.

- Key differentiators for TomTom according to the Annual report for 2021 are its "unique founder-led culture" and its success in bringing its "values to life."

- Consumer products include apps to provide navigation on mobiles, personal and professional satellite navigation, traffic and map updates, and support services. Business products include traffic and travel information, maps, a digital cockpit, navigation for automotive, and automated driving.

- In the traffic and travel information product category, products are provided for real-time traffic monitoring, for EV Services, for hazard warnings, for speed profiles, speed camera services, parking services, road analytics, fuel services, weather services, and routing.

- Company strengths are that it is well resourced, it has a strong automotive and map content licensing program, its is the market leader in the navigation software vertical with 15 OEMs, it leads in traffic data in Western Europe and North America, company focus is on enterprise and automotive business, developers find it flexible, pricing for location services is aggressive, and it has over 600 million active GPS probe points.

- Weaknesses of TomTom are that it has less resources than HERE and Google, it relies on Apple for probe data, coverage indoors and at venues is weak, and consumer business is declining which presents a risk to stability.

- Key customers include Uber, Microsoft, BMW MotorRad, Daimler, Michelin, Alteryn, Mitsubishi Motors, Volkswagen, Ford, Verizon, Nissan, and Precisely.

Mapbox

- Founded in 2011 and headquartered in Washington, District of Columbia, Mapbox is a real-time location platform with over 600 million monthly active users that powers more than 45,000 mobile applications using a product where registered developers number 2.7 million. The product is 100% carbon neutral and thus far the startup has raised $226 million in Series A, B, and C funding rounds. The company website can be accessed at this link.

- Annual revenue at Mapbox is estimated at $144 million by ZoomInfo.

- Mapbox was selected for inclusion in this report on account of the strength of its product, its customers, and because it was identified as one of the top market players in location based data by Strategy Analytics and in the global digital map market by Research and Markets.

- Products provided by Mapbox are for maps, MapboxGL JS, Statis Maps, Mapbox Tiling Service, mobile maps SDK, vision, atlas, fleets, address autofill, navigation SDK, studio, search, movement data, boundaries, and dash.

- Company solutions are provided for the logistics, automotive, outdoors, retail, travel, business intelligence, and real estate verticals. The automotive solution addresses traffic management from the basis of navigation for planning, accessing other services, and for parking, as well as lane safety and speed limit warnings.

- A key differentiator for Mapbox is its presence in the Chinese and Japanese markets gained from a joint venture with Softbank, also an investor in Mapbox.

- Strengths for Mapbox as noted by Strategy Analytics are the high number of monthly active location GPS probes, its status as the leader for map data visualization and business intelligence, the independent and open nature of the product, its large developer community, the large number of app the products is used in, the Softbank investment, and its presence in the Chinese and Japanese markets via JV.

- Company weaknesses are the low number of employees, the lack of control over the company map, OSM dependence, susceptibility to malicious map edits, weak presence in the automotive sector, and weak indoor or venue coverage.

- Key customers include Subaroad, Porsche, Land Rover, Roadtrippers, Tier, Voi, Va de Taxi (Brazil), Transfix, Getaround, Flowmap.blue, GAIA GPS, Atlas.co, Strava, The Weather Company, Yahoo! Japan, Lonely Planet, CNN, Skyscanner, Instacart, The New York Times, Adobe, and AllTrails among many notable others. The full list can be accessed at this link.

4. Field of Use: Benefit the Road Operators (Plan the Traffic Flow, Reduce Incidents)

NoTraffic

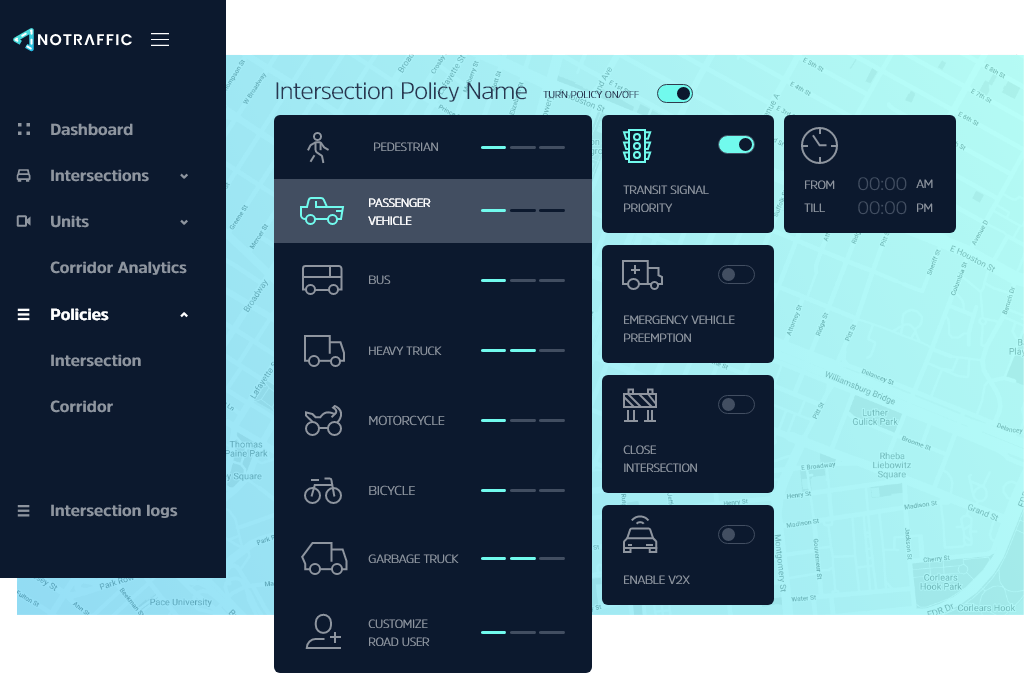

- Led by co-founders Tal Kreisler (CEO), Uriel Katz (CTO), and Or Sela (CSO), NoTraffic is a provider of traffic management services that is headquartered in Tel Aviv, Israel. The company was founded in 2017 and the website can be accessed at this link.

- Although startup still, NoTraffic is included in this report based on the strength of its product, its investors (Lool Ventures, North First Ventures, NextGear Ventures, Alchimia, Grove Ventures, Meitav Dash, Menora Mivtachim, and Vektor Partners) and the fact that it was included on Time Magazine's 100 Most Influential Companies for 2022.

- ZoomInfo estimates annual revenue at the company to be $12 million. Thus, far the company has raised $17.5 million in Series A funding.

- The NoTraffic platform includes customizable services such as micro payments, micro mobility, and proactive accident prevention. Key features of the NoTraffic platform are that it is cyber-secured, pedestrians and cyclists are prioritized, there is a V2X enabler, emergency vehicle, EVP preemption, transit signal priority, and red light extension. According to an article in MotorTrend, the NoTraffic system is targeting use in 80% of US traffic signals.

- The key differentiator for NoTraffic is its platform which is billed as the first traffic signal platform that is powered by AI.

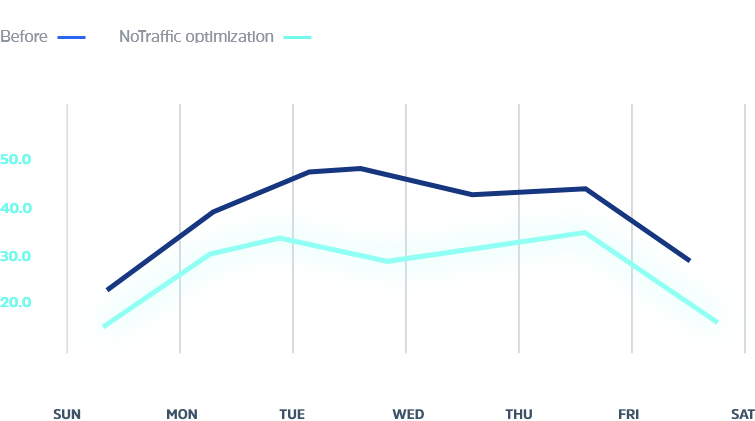

- The average total vehicle delay improvements created from application of the NoTraffic solution is presented in the graphic below.

- Strengths of the company include a product that cuts wait times in half, assists with reducing carbon emissions, and the total number of cars running red lights. Installation costs are low and do not require communications between vehicles and map integration apps, although the product will be enhanced by this. Finally, the control box is firewalled and electronically isolated, adding to the overall security of the item. Weaknesses identified by credible industry resources were not publicly available for NoTraffic.

- Key customers of NoTraffic are Nvidia, Denso, Drive, City of Dublin, City of Phoenix, and Arizona State University. A full partner list can be accessed at this link.

Citilog

- Citilog is a provider of video analytics services in surveillance and monitoring systems for transportation markets. The company was founded in 1997, operates in the North American, Latin American, Europe, Middle East and Africa, and Asia-Pacific markets, and is headquartered in Bagneux, Île-de-France. Led by Eric Toffin, CEO, the Citilog website can be accessed at this link.

- According to Dun & Bradstreet, Citilog has an estimated annual revenue of $7.83 million.

- The technology focus of Citilog is the application of deep learning to the management of multi modal traffic solutions, specifically, but not exclusively, in smart cities. This technology is utilized in solutions for smart cities, highways and expressways, tunnels, and bridges and elevated roads.

- Solutions developed by Citilog address incident management, traffic statistics, and traffic efficiency. For incident management, the solution is built on an analytics module, configuration and maintenance module, and an operator interface. The traffic statistic solution is built on an analytics module, a configuration and maintenance module, and an on-premises operator interface or a web based client Citilog Cloud. An analysis module and a physical or digital interface underlie the traffic efficiency solution,

- Products supplied by Citilog cover analytics, software, and hardware.

- Citilog was selected for inclusion in this report because it was named as a key manufacturer in a smart traffic management market report and as a prominent player in the global video vehicle detection market report from MarketWatch.

- The key differentiator for Citilog is the use of deep learning in its automated incident detection system. Trained on data sets comprising real-world traffic video, the system separates vehicles from reflections and shadows, resulting in improved performance accuracy and reduced false positives.

- The top three strengths for Citilog, based on reviews at 360 Quadrants, are incident detection and management, vehicle detection sensor, and the Dynamic Traffic Management System. Additional strengths can be found at this link.

- Primary weaknesses are system integration and deployment, subscription licensing, and onsite support. Additional weaknesses can be accessed at this link.

- Key customers include the New York Bridges, the City of Atlanta for its Smart Corridor, the City of Melbourne, and the City of Aulnay-sous-boi in the Greater Paris area.

5. Field of Use: Manage Seasonal Traffic Trends (Model Travel Times, Plan Efficient Routing)

Cubic Corporation

- Cubic corporation was founded in 1951 and is headquartered in San Diego, California. The company has over 75 locations in more than 20 countries. Led by Stevan Slijepcevic, president and CEO, Cubic's website can be accessed at this link.

- In May 2021 Cubic reported second quarter FY 2021 revenue at $343.4 million. Revenue for Cubic Transportation Systems stood at $217.4 million for the same period.

- Transportation solutions offered by Cubic include a mobile suite, fare collection and revenue management, a full service mobility platform, road user charging, rider loyalty and rewards program, and surface transport management. The company also offers training and other computing solutions.

- The Surface Transport Management solution is directed at urban and intra-urban road networks and covers decision support, bus tracking, passenger information, incident management, and integrated traffic. Data analytics and visualizations combined from several travel modes supports the solution and is accessible through one common operating picture.

- Transport management at Cubic offers network efficiency that is improved, demand management, efficient resource utilization, improved customer asset availability, and improved situational awareness.

- According to the 360 Quadrants website, Cubic's strengths are mobile speed enforcement, red light enforcement, and spending for R&D. Additional strengths can be accessed at this link.

- Weaknesses for the company are functionality gaps in the solution, facial recognition systems, and automatic number plate recognition systems. Additional weaknesses can be sourced at this link.

- The key differentiator for Cubic is its GRIDSMART product, which was named as a finalist in the AI & Data category of Fast Company's 2022 World Changing Ideas Awards.

- Key customers for Cubic are in the transportation authorities and transit agencies verticals.

- Cubic was selected for inclusion into this report on the basis of its GRIDSMART Protect platform being named as a world-changing idea, and due to its naming as a major market player in a traffic management market report from Allied Market Research.

HERE

- HERE Technologies is a provider of location data. Operating in the Americas, the Asia-Pacific, and Europe, Middle East and Africa regions, Here has approximately 7,000 employees at work in 56 countries. Led by Edzard Overbeek, CEO, the company website can be accessed at this link.

- To date the company has 200 countries mapped for 48 use cases and over 150 million vehicles with HERE maps onboard. Annual revenue for HERE is EUR €610 million (US$655 million).

- HERE was selected for inclusion in this report on the basis of its product suite, investors, strategic partnerships, and the fact that it was named as the industry leader for most of the seven categories of location data.

- The HERE platform provides on demand data, analyzes and processes at scale, and is customizable. Platform capability includes data visualization, insights generation, application building, service development, and map making.

- For route planning, HERE Routing claims to create a stress-free journey for multiple transportation modes. Multiple transportation options are supported, routes are optimized using over 100 parameters, and journey ETAs are up-to-date and accurate. HERE Routing services include the Routing API, traffic-enabled Routing, and EV routing.

- HERE provides solutions for the automated driving, connected driving, fleet management, supply chain, urban mobility, infrastructure planning, and public safety markets. Applications from the company include last mile deliveries, asset tracking, navigation, and WeGo.

- A key differentiator for HERE technologies is a product that was developed from investments made by Audi, Bosch, BMW Group, Continental, Intel Capital, Mitsubishi Corporation, Mercedes-Benz, NTT, and Pioneer, and strategic partnerships with Altos, Mitsubishi, Oracle, SAP, ESR, Microsoft, and AWS.

- According to Strategy Analytics HERE's strengths include a product that is independent and open, strong ADAS and HD Map momentum, influential investors and partnerships in key LBS growth vectors, significant resources, its status as the leading map provider in North America and Western Europe, global coverage, strong growth vision and product lines, large enterprise customers, hybrid navigation, strong indoor venue marketplace, and the full range of map making tools.

- Weaknesses identified by Strategy Analytics include weak long-tail developers, limited consumer brand, and a danger associated with becoming all things to all people and a diluted brand message.

- Key customers include Accenture, Amazon, Audi, BMW, Bosch, Esri, Baidu, Jaguar, Land Rover, Mitsubishi Corporation, Pioneer, and Ford.

Research Strategy

For this research on Traffic Management Vertical — Top Players, we leveraged the most reputable sources of information that were available in the public domain, including company profiles, market reports, and publications such as LinkedIn, Strategy Analytics, and Reuters.

To determine the strengths and weaknesses of the companies, the research team began with a review of investor documentation on the company website which would typically provide insights on this topic. Where investor documentation was not available, the next step was to search for market reviews or company reviews which would have been completed by industry practitioners or financial market information services such as Seeking Alpha. If this did not yield any information, the next step was to search business publications or customer review websites, such as 360 Quadrants to glean information regarding strengths and weaknesses.