Part

01

of seven

Part

01

Sports Travel - Overview

Notable insights in the global sports travel market include growth in the number of mega-events, development of new sporting facilities, the rise of health-savvy participatory tourism, growth of solo-travelers, digital transformation, and increasing focus on outdoor activities.

Market Overview

- Sports tourism is defined as leisure-based traveling of individuals and groups to participate in sporting activities, attend live sports events, or visit attractions associated with sports.

- Sports travel is often considered as a social, economic, and cultural phenomenon created from the interaction of people, sports activity, and place.

Growth and Future Perspectives

- The sports tourism industry was growing positively till the beginning of 2020, but the ongoing global pandemic severely impacted the sports travel industry. In March 2020, about 10 million fewer tourists participated or watched a sporting event, resulting in a decline of $2.5 billion in direct revenue. Further, it is reported that about 75 million people did not participate in sporting events from March to December 2020, resulting in a direct loss of $20 billion.

- Many national and international sporting tournaments are planned for the coming years, and the development of new sporting venues is underway to cater to the growing popularity of sporting events. For instance, the recent PTT Thailand Grand Prix generated an income of more than $96 million and attracted over 222,000 visitors in 2018. An increasing number of such mega sporting events is attracting numerous visitors and driving the growth of the sports travel industry.

- A rapid growth in the number of inter-country and intra-country sporting events is seen over the past few decades. These events serve as a source of attraction for international and domestic travelers alike. Further, experts believe this trend will grow drastically from 2021 to 2024.

Growth Drivers and Challenges

- The main constraints in the sports travel industry include money and time for travelers. Another important factor challenging the growth of the industry is the increasing fragmentation of the sports travel industry. Nevertheless, an uptick is seen due to the growth of health-savvy participatory tourism.

- A few years ago, many people planned on watching sporting events from home. Today, sports tourism is one of the fastest-growing segments in the global tourism industry. The rapid growth can be attributed to ease of travel, affordability, and hassle-free booking.

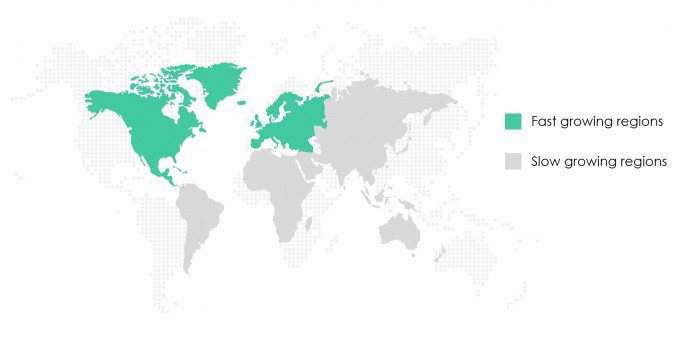

- Since 2016, the Asia-Pacific region has led the growth of international tourist arrivals. Large-scale events like the Beijing Olympics, Pyeongchang Winter Olympics, and Rugby World Cup have majorly contributed to the growth of international tourists.

Traveling for Sports Events and Leisure

- The individual and group travel segment is expected to grow at the fastest rate and will account for the highest market share in the coming years. Further, groups of individuals aged 20-30 years accounted for about 41% of the market share. This can be attributed to a significant growth seen in the number of solo travelers visiting international destinations to explore culture and nature.

- Participatory sports tourism is projected to grow significantly in the near future. However, the growth is expected to be cut-down owing to affordability.

- Alternatively, it is noted that created events built and operated locally would become an essential business development tactic for destinations to attract sports tourists for events.

- Fan safety is another issue that hosting organizations need to consider for hosting events. Even as the pandemic is receding, the organizers need to put additional safety measures to ensure the safety of athletes and fans, alike. Thus, enhanced safety measures will likely become industry benchmarks for the future.

Outdoor vs. Indoor Sports

- Hard sports tourism segment held the largest market share in 2018 and is expected to grow at the fastest rate between 2021-2024. Alternatively, the football and adventure segment accounted for the highest share in sports tourism in 2018.

- Individual sports have witnessed the fastest recovery in the sports market. This can be largely attributed to better safety measures being implemented over team sporting events. Thus, increased participation is seen in sports like golf, racing, tennis, BMX, and pickleball. This trend will further grow as the pandemic fades out in 2021.

- According to the United Nations World Tourism Organization (UNWTO), tourists interested in adventure sports have increased by 5.0% in 2019. Alternatively, the land-based sub-segment is predicted to grow significantly due to the increasing demand for land-based activities such as trekking, wildlife safaris, cycling, among others.

Enhanced Sporting Facilities

- According to a recent report by Technavio, there is an increasing focus on facility expansion and redevelopment of sporting venues. For instance, FC Cincinnati announced an investment of $200 million for constructing a new stadium.

- To lower the operational costs, a large national trend is underway to repurpose publicly managed venues such as golf courses, tennis courts, and pools. Additionally, many sports venues have started to host non-sporting events, such as drive-up concerts.

COVID-19 Impact

- The cancellation of sports events has created huge financial constraints on organizers, it is likely to pose a significant challenge for all stakeholders, including the market vendors, destinations, organizers, hotels, and suppliers.

- It is anticipated that event managers and venue holders would require spending additional time and resources to host sporting events safely. This may lead to the development of newer models to host sporting events in the future.

New Strategies

- Over the years, the sports tourism market has been constantly reshaped due to digital technology advancements. To counter the deleterious impact of the COVID-19, companies are adopting new strategies to reduce fan friction.

- New technologies like mobile ticketing, easy transfers, online concessions, free WiFi, Venue-specific apps are poised to create smoother experiences for fans at sports venues. For instance, StubHub is working to make the fan experience more seamless for live events in 2021.