Part

01

of one

Part

01

Office Depot Digital Transformation Strategy

Key Takeaways

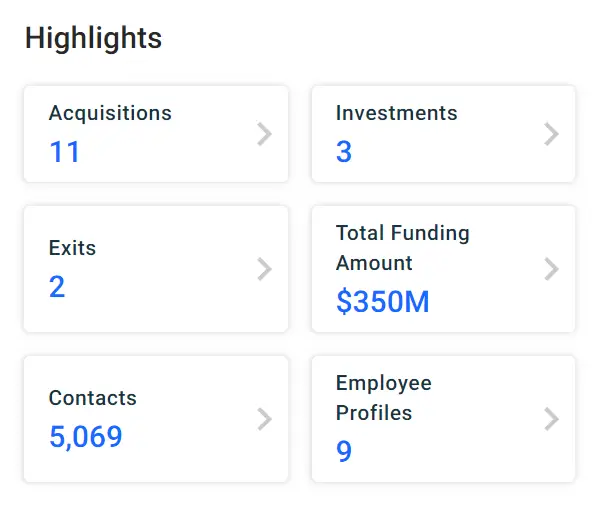

- Office depot deals in a range of products, including office furniture, computers & computer software, and business machines. The company provides the following services: shipping, mailing, document reproduction, printing, and copying. Aside from retailing/supplying office services and products, the company deals in "computer hardware and electronics designed for small business applications." Office Depot went public in 1988, which marked the date (June 1, 1988) of the IPO, and is currently in its post-IPO equity. The company "closed its last funding round on Jun 23, 2009, from a Post-IPO Equity round." With total funding of $350 million, the company's annual revenue was $9.71 billion and $8.87 billion as of 2020 and 2021, respectively.

- The acquisition of CompuCom was a past/recent strategic initiative for Office Depot to become a business service and technology-oriented platform. And according to the CEO, "acquiring CompuCom is the first step in this new strategic direction. The combination of CompuCom’s enterprise IT services with our millions of customers and approximately 1,400 distribution points gives us the credibility and scale to build a sustainable platform and stand apart from the competition. The company will create value for shareholders from a diversified revenue base with a clear opportunity to grow higher value services and business-to-business revenues." Office Depot is taking another strategic initiative to merge technology and humanity as a way to "become more customer-focused." During the 2022 e-Tail West conference, Office Depot's EVP and Chief Retail Officer — Kevin Moffitt, shared how their "e-commerce team is applying user-centered design (UCD) techniques and expertise from store associates to create more connection points with stores, customers, and communities."

- Office Depot uses a range of software & tools for e-commerce, including (among others) Stibo PIM, hybris, PROS Pricing, and Lengow. According to Slintel, Lengow is an e-commerce marketing tool/software that allows for easy export of "product catalog from [one's] store and sell on marketplaces, comparison engines, social networks." On the other hand, Stibo PIM is a Product Information Management (PIM) software that "enables users to identify, link, and source data from a variety of internal and external sources." Office Depot also uses a range of software & tools for marketing. For instance, the company uses Mindmatrix as a "sales enablement and channel marketing automation platform for direct and channel sales." Additionally, the company uses Lead Liaison Marketing Automation as "a cloud-based marketing automation and lead generation, nurturing, & qualification application for SMBs."

- Surprisingly, the latest poll by Forbes indicates that 16% wish to return to their offices after 2022, whereas another 16% prefer not to return to their workplaces. This "delayed return to office plans" continues to diminish Office Depot's customer base. Traffic declines affect the company's ability to meet its sales targets due to traffic declines. Ultimately, this results in reduced sales revenue. Gerry Smith — the company's CEO, indicated they were anticipating "a shortage in printer ink and toner until early 2022." And with "supply chain disruptions expected to impact office supplies," this implies that Office Depot cannot complete the supplies to the few remaining corporate clients, thus, affecting its revenue generation capability.

Introduction

The report provided information surrounding Office Depot's digital transformation strategy. This included providing a company analysis of Office Depot and some corporate challenges faced by the company. We focused on Office Deport's digital transformation strategy, which (for this report) was defined as an enterprise remodeling approach through incorporating digital technology across all its business areas "to create new — or modify existing — business processes, culture, and customer experiences" as a way of meeting changing market and business requirements.

We expanded our scope to a reputable article about Office Depot's past initiatives, which was published in 2017 because the nature of the topic granted this flexibility. Details about our logic can be found in the research strategy section.

Office Depot Digital Transformation Strategy

I-Company Analysis of Office Depot

An Overview of The Company

- Office Depot was founded in 1986 and currently operates more than 300 stores, most of which are situated in the West, the lower Midwest, and the South. Headquartered in Florida, United States, Office Depot is among North America's largest "discount retailer of office supplies and furniture."

- Office depot deals in a range of products, including office furniture, computers & computer software, and business machines. The company provides the following services: shipping, mailing, document reproduction, printing, and copying. Aside from retailing/supplying office services and products, the company deals in "computer hardware and electronics designed for small business applications."

- Office Depot went public in 1988, which marked the date (June 1, 1988) of the IPO, and is currently in its post-IPO equity. The company "closed its last funding round on Jun 23, 2009, from a Post-IPO Equity round." The company's total funding amounted to $350 million.

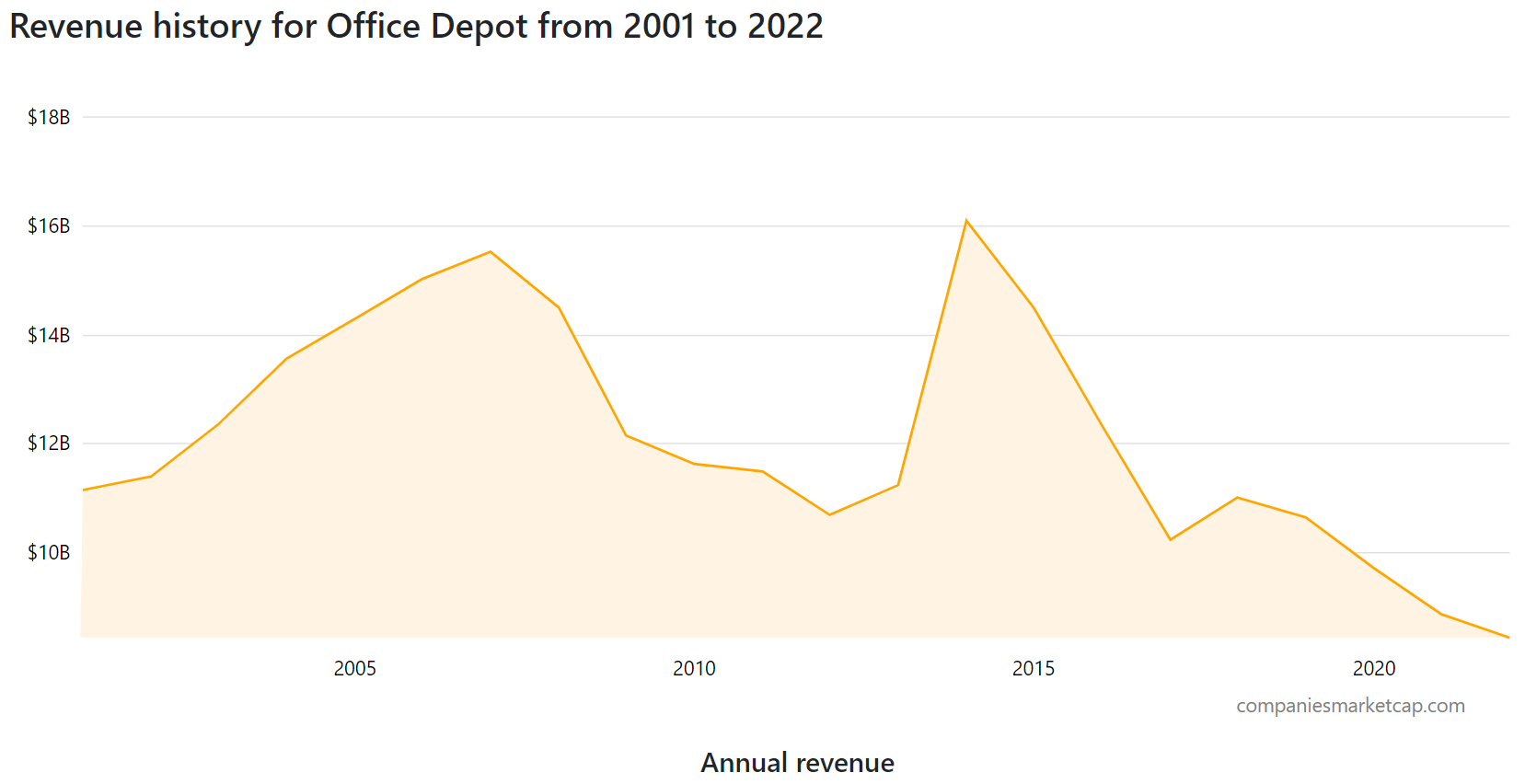

- With a market capitalization of 1.71 billion, the company's annual revenue was $9.71 billion and $8.87 billion as of 2020 and 2021, respectively. Aside from revenues, Office Depot Inc. recorded its lowest profit margin of -3.24% in 2021.

Corporate Value and Missions

- Office Depot's mission "is to be the preferred supplier of workspace solutions to our customers, based on our expertise and a great customer journey."

- The company's mission is to offer solutions for every car, school, home, or office workplace. Office Depot, Inc. aspires to be "a single source for everything customers need to be more productive, including the latest technology."

- The company's corporate values include (among others) integrity, respect, teamwork, innovation, and accountability.

Strategic Initiatives & CEO's Quotes

- Strategic Initiatives Related to Digital Technology: The acquisition of CompuCom was a past/recent strategic initiative for Office Depot to become a business service and technology-oriented platform. According to Business Wire, "adding a market-leading provider of world-class IT services with approximately $1.1 billion in sales" was a way for the company to "create a powerful omnichannel tech services platform."

- Moreover, combining "CompuCom’s broad set of managed technology services with access to Office Depot’s extensive customer base and last-mile advantage" was geared at generating substantial growth opportunities.

- Regarding the future, Office Depot is taking a strategic initiative to merge technology and humanity as a way to "become more customer-focused." During the 2022 e-Tail West conference, Office Depot's EVP and Chief Retail Officer — Kevin Moffitt, shared how their "e-commerce team is applying user-centered design (UCD) techniques and expertise from store associates to create more connection points with stores, customers, and communities."

- As among the most animated and engaging presenters, Mr. Moffitt maintained that prioritizing "[...] opportunities for digital and physical connections" is critical in creating a virtuous customer cycle.

- Quotes: According to Office Depot's chief executive officer — Gerry Smith, "technology is the office supply of the future."

- The CEO continues to note that "Today marks a significant milestone as we move to provide a unique business services platform for our current and future customers. Acquiring CompuCom is the first step in this new strategic direction. The combination of CompuCom’s enterprise IT services with our millions of customers and approximately 1,400 distribution points gives us the credibility and scale to build a sustainable platform and stand apart from the competition. The company will create value for shareholders from a diversified revenue base with a clear opportunity to grow higher value services and business-to-business revenues."

Existing Marketing Tech Stack

- Office Depot uses at least "74 technology products and services," including jQuery, Google Analytics, and HTML5. Additional research indicates that the company uses 103 technologies, including Google Tag Manager, LetsEncrypt, and Google Font API, for its website.

- Office Depot uses a range of software & tools for e-commerce, including (among others) Stibo PIM, hybris, PROS Pricing, and Lengow. According to Slintel:

- Lengow is an e-commerce marketing tool/software that allows for easy export of "product catalog from [one's] store and sell on marketplaces, comparison engines, social networks." On the other hand, Stibo PIM is a Product Information Management (PIM) software that "enables users to identify, link, and source data from a variety of internal and external sources."

- hybris is an order management software that "produces enterprise multichannel e-commerce and product content management (PCM) software." Finally, PROS Pricing is a price optimization software that delivers "insight into pricing practices, enhances execution, and provides prescriptive recommendations."

- Office Depot also uses a range of software & tools for marketing. For instance, the company uses Mindmatrix as a "sales enablement and channel marketing automation platform for direct and channel sales." Additionally, the company uses Lead Liaison Marketing Automation as "a cloud-based marketing automation and lead generation, nurturing, & qualification application for SMBs."

II-Corporate Challenges faced by Office Depot

[I] Tepid Return to Office

- Covid-19 revolutionized workplace habits, and with a majority of corporations' workers working from home, such corporations no longer needed to buy furniture from commercial dealers, such as Office Depot. Additionally, Retail Dive notes that home-based consumers have been (for years) "buying less from the retail specialist (such as Office Depot)." This has steadily shrunk sales and store numbers.

- Surprisingly, the latest poll result by Forbes indicates that 16% wish to return to their offices after 2022, whereas another 16% prefer not to return to their workplaces. This "delayed return to office plans" continues to diminish Office Depot's customer base. Traffic declines affect the company's ability to meet its sales targets due to traffic declines. Ultimately, this results in reduced sales revenue.

- Delayed return to office is considered a challenge because it is repeatedly mentioned across reputable industry sources, such as Retail Dive and South Florida Business Journal.

[II] Supply Chain Disruptions

- Gerry Smith — the company's CEO, indicated they were anticipating "a shortage in printer ink and toner until early 2022." This is sufficient evidence that "the disruptions to the global supply chain caused by factory shutdowns in Asia, congestion at US ports, and a nationwide labor shortage have led to widely publicized microchip and building materials shortages." Research further indicates that "Office Depot saw increased demand for essential products, resulting in supply chain disruptions."

- Supply chain disruption is considered a challenge because it is specifically mentioned by the company CEO, Gerry Smith.

- Supply disruptions are "making it increasingly difficult to meet strict delivery schedules" to an already shrinking client base. And with "supply chain disruptions expected to impact office supplies," this implies that Office Depot cannot complete the supplies to the few remaining corporate clients, thus, affecting its revenue generation capability.

Research Strategy

To provide the requested information surrounding Office Depot's digital transformation strategy, we leveraged the most reputable sources of information available in the public domain. These include (among others) Business Wire, Digital Marketing Institute, Forbes, Companies Market Cap, CB Insights, Crunchbase, Funding Universe, Reference for Business, Netcials, Retail Wire, Poppulo, Retail Dive, and South Florida Business Journal. We expanded our scope to a reputable article about Office Depot's past initiatives, which was published in 2017 because the nature of the topic granted this flexibility.