Part

01

of one

Part

01

Oasis Networks - Industry & TAM Research

Key Takeaways

- The types of organizations investing in edge computing include facilities, networks, hardware, cloud infrastructures, and applications/software companies. Others organizations include VCs and private equity (PE) firms.

- The companies in the ecosystem tool have invested a total of $3.1 billion in external funding. Amazon, Microsoft, and Google invest a total of $60 billion per year.

- A recent report by Sherweb shows that it costs about $731.94 per year to maintain an average server.

Introduction

The research brief contains quantitative and qualitative insights about the on-premise server space, the Edge Computing, and Kubernetes spaces. The research team has provided details on the types of organizations investing in the on-premise and the Edge Computing space, reasons for investing in Edge computing, the amount invested in the Edge Computing space, and more. Unfortunately, details about the length of time it takes to add or spin up a physical server, the identity (name and all job titles that apply) of a typical server buyer, and Edge computing buyer was not available in the public domain. We also found that insights about the on-premise server space and Kubernetes space were limited. However, we have provided the available details.

Organizations Investing in Edge Computing

- The types of organizations investing in edge computing include facilities, network, hardware, cloud infrastructure, and applications/software companies. Others organizations include VCs and private equity (PE) firms.

- Some of the main companies investing in edge computing include about 30 companies in the ecosystem tool, Amazon, Microsoft, and Google.

- The average size of organizations investing in edge computing is the fortune 1000 and 500 companies.

Reasons For Investing in Edge computing

- Edge computing brings about data storage, computation, and power nearer to the pinpoint of action or event, lowering the response time and saving bandwidth. "Its revolutionary capabilities coupled with artificial intelligence (AI) enable the interpretation of data patterns, learning, and decisions in real-time. Ready to respond Real-time data processing at the edge allows for more immediate insights from connected devices and systems. "

- A higher percentage of surveyed investors claim that edge computing applications will benefit their organizations by improving operational responsiveness. The main impact is projected to be reduced operating costs.

- According to experts, a combination of edge computing and Industrial Internet of Things (IoT) devices allows for the better equipment of smarter supply chains, allowing them to handle disruptions of all kinds.

- Edge computing is will also improve and expand the "performance of drones used for a myriad of reasons, from disinfection and diagnosis to crowd management and deliveries."

The Amount Invested in Edge Computing

- The companies in the ecosystem tool have invested a total of $3.1billion in external funding. Amazon, Microsoft, and Google invest a total of $60 billion yearly.

- HPE had declared that it would invest about $4billion over four years starting in 2018 into edge computing.

- In 2020, Apple invested a sum of $200million into the acquisition of Xnor.ai. Xnor.ai is a Seattle-based startup focused on providing AI capabilities at the edge.

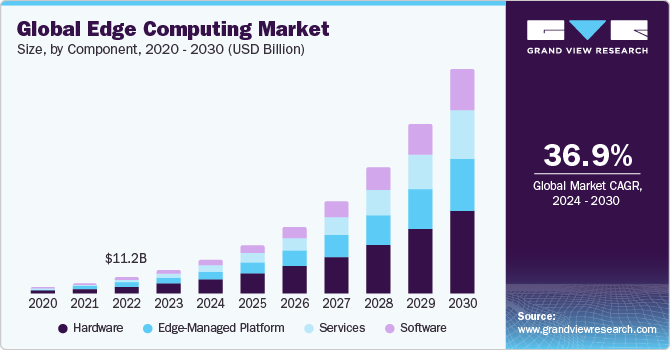

Growth of Edge computing

- The Edge computing market is growing at a steady speed. According to STLPartners, the North American edge computing market is currently worth about 50% of the global revenue share.

- According to Statista, the manufacturing "sector makes up the largest segment of the edge computing market in the United States." The market size is anticipated to be worth about $306 million in 2025.

- According to Allied Market research, the Edge computing market was worth $1.7billion in 2017 and is projected to reach $16.557 billion by 2025. The market is growing at a CARG of 32.8%.

- The US edge computing market size was worth $716.8 million in 2017.

Investing in Kubernetes for edge computing Kubernetes

- Kubernetes enables organizations to effectively run containers at the edge in a way that allows "DevOps teams to move with greater dexterity and speed by maximizing resources."

On-premise Server Space.

Types of Companies Investing in Servers

- According to an article by Ciodive, about 98% of companies run on-premise server hardware based on a survey of about 500 IT decision-makers.

- The types of companies investing in large numbers of servers include real estate investors and e-commerce companies,

Cost for Obtaining and Maintaining Servers

- A recent report by Sherweb shows that it costs about $731.94 per year to maintain an average server.

- Purchasing a server in the US can range between $1000 to $2500.

The identity of server buyers

- Servers are generally purchased by IT decision-makers.

The security and compliance requirements

- According to an article by Folio3, on-premise infrastructure or applications are thought to be more dependable and secure compared to Cloud. They are known to offer complete ownership and control.

- Traditional on-premise servers appear more secure as it is in-house. However, numerous actions need to be taken to fully sustain the security of the data. Hence, security is an essential requirement of any organization when it comes to a financial account, customer and employee details, critical measures need to be taken to maintain the security."

- Most companies are mandated to comply with government and industry regulations. Companies can easily remain compliant and have their data in place if all data is maintained in-house.

Research strategy

To provide quantitative and qualitative insights about the on-premise server space, the Edge Computing, and Kubernetes spaces, the research team thoroughly reviewed various market reports, industrial reports, surveys, articles, and whitepapers, including Allied Market Report, Sherweb, STLpartners, Grandview Research, and more. We have provided details on the types of organizations investing in the on-premise and the Edge Computing space, reasons for investing in Edge computing, the amount invested in the Edge Computing space, and more. Unfortunately, details about the length of time it takes to add or spin up a physical server, the identity (name and all job titles that apply) of a typical server buyer, and Edge computing buyer was not available in the public domain. We also found that insights about the on-premise server space and Kubernetes spaces were limited. However, we have provided the available details.

The research team attempted to expand the scope of the research to a global level to find the missing data point, such as the identity (name and all job titles that apply) of a typical server buyer and Edge computing buyer. Unfortunately, the approach did not yield a positive result.