Part

01

of one

Part

01

Number of Technology Companies in the United States

We have curated nine pieces of information, data, and/or statistics surrounding segmentation in the United States tech industry. This has included, but not been limited to, the number of businesses in the segmentation, as well as any facts pertaining to the segmentation. As we mentioned in the initial hour of research, we were unable to find recent publicly available sources for this data. As agreed upon, for this research, we have looked at older sources which will provide some recent historical perspective. We are defining older sources as those from 2017, 2018, and 2019. These older sources leverage McKinsey, Deloitte, as well as other credible and reliable thought leaders. Of course, when we came across more recent data, we used those sources, and we clearly mentioned the year they were from. To provide one cohesive document that could be referred to, we brought over the six early relevant findings from the initial hour of research, which can be found at the end of this document.

As a reminder, we wanted to restate that we are of the opinion that there are no publicly available sources that provide the number of U.S. technology companies that ONLY serve other businesses (B2B Technology companies) and/or are ONLY B2B tech companies. This is simply not available, and this research reflects only what the selected scoping offered.

- According to Pitchbook December 2020 data, these twelve segments of technology are expected to be front and center in 2021. They are agtech, artificial intelligence & machine learning, cloudtech & DevOps, enterprise health & wellness tech, fintech, foodtech, information security, insurtech, internet of things, mobility tech, retail health & wellness tech and supply chain tech. [A free download is required to receive the report, and can be accessed here].

- There are 1,794 AgriTech startups in the United States, according to data from Tracxn. This was last updated on April 16, 2020. To contrast this number to a global number, Tracxn reveals in a May 28, 2020 source that there are over 8,100 startups globally that provide tech enabled services for agriculture based companies. "This includes companies offering services like tech-enabled service for planning, decision support, remote field operations and automated operations." According to Crunchbase data, venture capitalists have invested a combined total of $4 billion in startups in the global agtech space in 2018 and 2019. As of mid August 2020, VC's had already invested $2.6 billion in this segment of technology.

- When referring to Deloitte research published in 2017, it is of note that the United States fintech world was composed of thousands of smaller companies, but in China it appeared to have been the opposite with large diversified companies such as Tencent and Ping An dominating most of the investment interest. In fact, when looking at the payments category there were 264 companies that had received a total of $7.71 billion in investment since 1998. Juxtapose that with China's low number of 7 fintechs but had received $6.92 billion in funding. Similar patterns are seen in deposits and lending, investment management, personal insurance, and real estate leasing/purchase and sale.

- As can be seen in the graphic below, in 2017 the United States greatly surpassed all other countries when looking at the total number of fintechs in operation as well as the total investments surrounding them. This was observed for many sub sectors within fintech. "Not surprisingly, those sub sectors have been in the forefront of fintech activity from the beginning, such as deposits and lending, payments, financial management, and investment management."

- According to data from Statistica, the number of artificial intelligence (AI) companies in the United States as of June 2018 was 2,028.

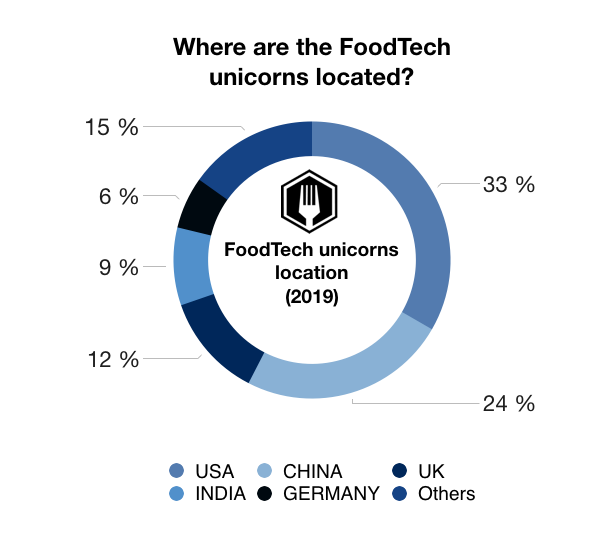

- There are 2,254 food tech startups in the United States, according to Tracxn. This data was last updated on April 15, 2020. "2019 was an exceptional year for food tech, with a record-breaking $16.9 billion in funding recorded. According to Crunchbase, the three biggest deals of the year included $1 billion for Swiggy, India’s leading online restaurant marketplace; $600 million for Instacart, a U.S. grocery delivery service; and $590 million for iFood, a Brazil-based restaurant marketplace."

- Most of the food tech unicorns are domiciled in the United States: eleven unicorns of the 33 are from America. They are represented, in part, by Delivery (DoorDash), Agtech (Indigo), Robotics (Zume Pizza) and FoodScience (Just).

- In 2018 the Milken Institute undertook research digging into the InsurTech ecosystem globally. There were some significant findings surrounding the United States. They found that there are approximately 1,500 InsurTech startups around the world. However, this research focused specifically on a cohort of 104 InsurTech companies worldwide. "The research shows that the U.S., U.K., India, Singapore, and Germany rounded out the top five countries with the most InsurTech startups. Of the 104 InsurTech platforms profiled in the report, just under 90% are headquartered in those five countries. The U.S., in particular, accounts for 64 of the 104 InsurTech platforms profiled (62%)." When further parsing out the United States number, the top three states with the most InsurTech startups are: California with 24, New York with 16, and Massachusetts with a total of 6.

- According to 2019 McKinsey research, investments in new mobility start-ups have been trending upwards. "Since 2010, investors have poured $220 billion into more than 1,100 companies across ten technology clusters." However, when McKinsey reflected in an August 2020 report on how COVID-19 has affected mobility tech companies, they stated that "[a]gainst a backdrop of mass layoffs, disrupted travel, and public-transit ridership down 70 to 90% in the world’s major cities, shared mobility—and mobility in general—is struggling. In particular, rumors of the demise of shared mobility are everywhere. Suddenly, private cars are in, shared rides are out, and the best-laid plans of mobility players appear to be in tatters." However, McKinsey also asserts that "[o]ne realistic scenario has tech players seizing the moment to secure their stakes in the mobility industry. They possess tremendous cash reserves, and COVID-19 did not hurt them as hard as the traditional economy. A potential secondary effect: cross-industry cooperation on new technologies could intensify as players pool scarce resources."

From the Initial Hour of Research

- According to Tracxn Technologies, as of 2019, there were 19,128 HealthTech startups in the United States. [Last Updated: September 3, 2019]

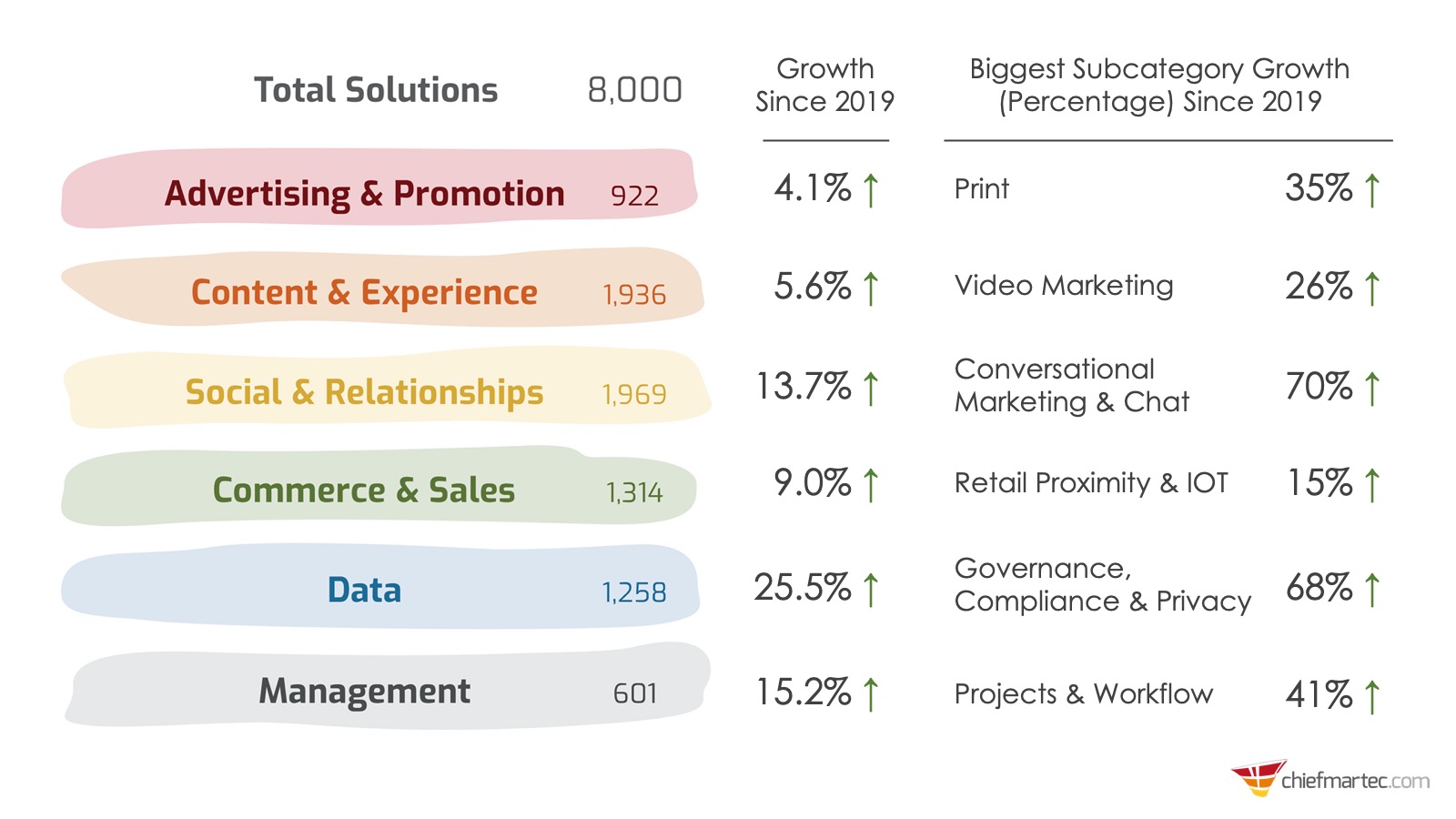

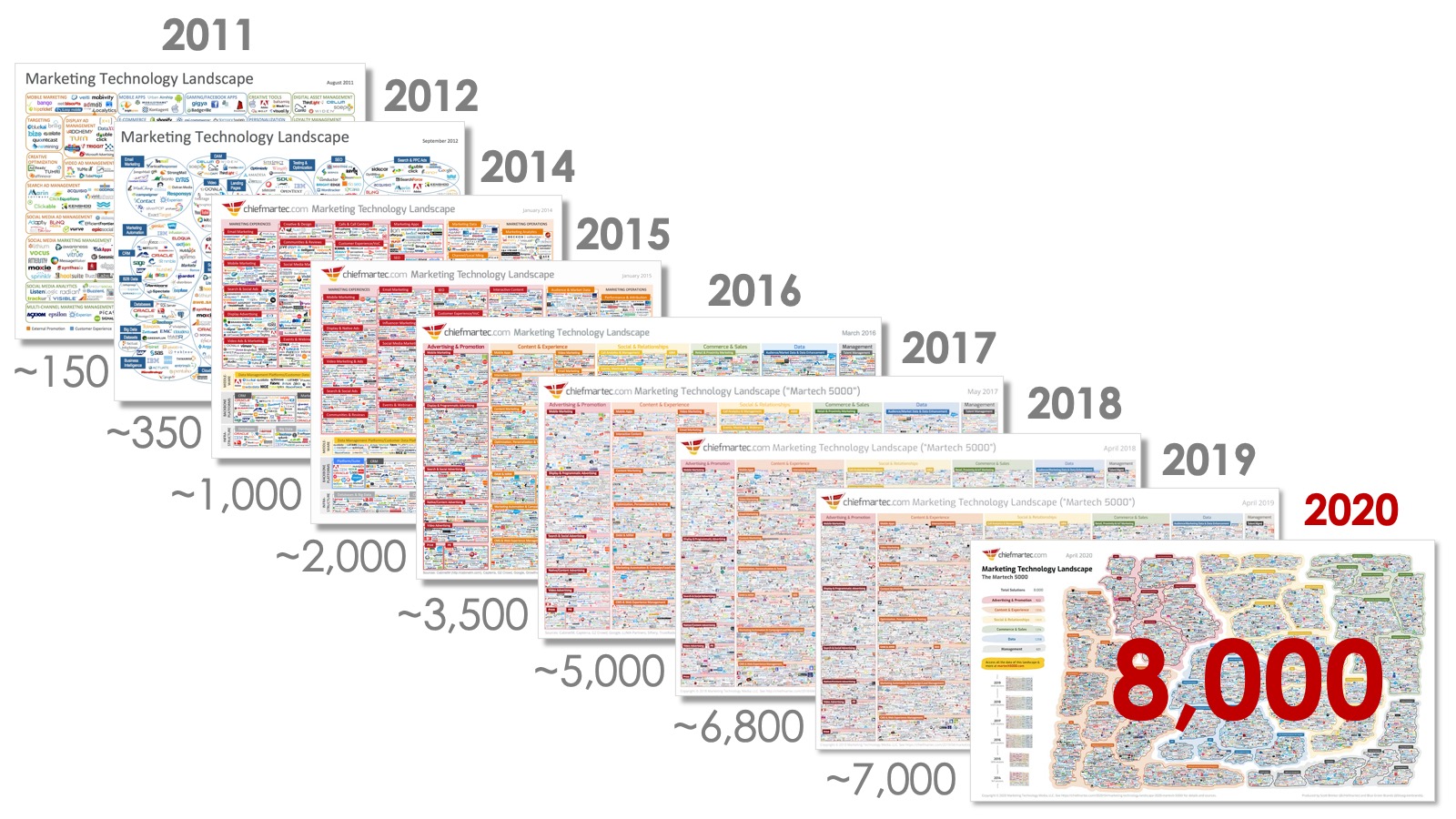

- There were 8,000 martech companies in the United States in 2020. This figure is 13.6% higher than the 2019 count, according to Cheifmartec.com. Within the martech segment, the data subcategory is by far the fastest growing, up by 25.5%.

- The complete progression of the overall martech landscape since 2011 can be visualized in the graphic below.

- "There were 8,775 financial technology (Fintech) startups in North America in February 2020, making it the region with the most Fintech startups globally. In comparison, there were 7,385 such startups in Europe, the Middle East, and Africa, followed by 4,765 in the Asia Pacific region." Specific up-to-date United States data was not publicly available.

- There are more than "6,500 medical device companies in the United States" with the majority of them being small and medium-sized enterprises (SMEs).

- "There are 6,829 SaaS companies in the marketing space alone."