Part

01

of one

Part

01

North American Rigid PVC & PVC Compound Companies

Since many manufacturers of PVC materials make both rigid PVC products and PVC compounds, one list each for manufacturers of these products is included, divided into companies that produce both rigid PVC and PVC compounds versus those that only manufacture one or the other. In regard to buyers, the application of both extruded rigid PVC products and PVC compounds is immense. In fact, manufacturers of rigid PVC products are often times buyers of PVC compounds. As such, identifying specific companies as the largest buyers is virtually impossible within the scope of this research. However, detailed lists of applications and industry segments are discussed, as well as the largest importers of rigid PVC and PVC compound products and materials. In addition, wholesalers, retailers, and online marketplaces are introduced.

Of note, some sources state DuPont manufacturers PVC compounds. Until 2018, DuPont was part of DowDuPont. While research clearly shows Dow produces these products, no sources prove Dupont does. Each of the companies listed by Thomas Net as a plastic extrusion company was researched. Only those companies that list rigid PVC or PVC compounds as one of their plastics offerings are listed. Research found about a dozen additional companies in the plastics manufacturing segment located in North America, but could not identify their direct involvement with polyvinyl chloride materials, neither rigid PVC nor PVC compounds. These companies were omitted from the research report.

Rigid PVC and PVC Compound Manufacturers

- Large companies that manufacture rigid plastics as part of their product portfolio include Dow Inc., Indiana based Berry Global, and Westlake Chemical.

- Dow Inc. reported net sales of $20.25 billion for specialty and packaging plastics in 2019.

- Indiana based Berry Global manufactures many plastic materials and products, including rigid PVC and PVC compound products. The net sales for the year ending September 2019 was reported by the company at $8.88 billion.

- Westlake Chemicals, based in Houston and operating 36 North American locations, reported annual revenue of $8.1 billion for all divisions and $5.07 billion for its vinyls segment, which includes PVC and caustic soda products and materials. Plastics Insights shows Westlake Chemicals as the largest U.S. based manufacturer of PVC by volume.

- Privately owned and Rhode Island based Teknor Apex has been supplying both PVC products to its clients for almost 100 years. "Teknor Apex supplies custom rigid PVC compounds specially developed for injection molding, blow molding, and a wide range of extrusion applications such as profile and sheet." The company's estimated 2020 revenues are $1.01 billion.

- Newly named Avient, formally PolyOne, reported net sales of $745 million in 2019 for its specialty engineered materials segment, out of $2.86 billion in total revenues. D&B states approximately 55% of those sales are from the U.S.

- Occidental Chemicals' subsidiary OxyVinyls is North America's third largest producer of PVC products. With an estimated annual revenue of $705.5 million, the company produces many different PVC variants.

- With estimated annual revenue of $233.21 million for its PVC products, Shintech is reported as the largest producer of PVC in the world and provides approximately 35% of the U.S. market. Its products include both extruded PVC and PVC compounds.

- Another privately owned specialty compounder and Minnesota based RTP Company is estimated by D&B to have 2019 annual revenues of just over $128 million. The company produces both rigid PVC products and PVC compounds.

- Achilles USA had estimated 2018 annual revenues of $36.2 million. The Washington based company manufactures extruded semi-rigid PVC films among its larger product portfolio.

- D&B estimates Ohio based Aurora Plastics annual revenues at $30.71 million. The company produces both rigid PVC and PVC compound products.

- Michigan based Preferred Plastics is ranked as one of the top plastic extrusion companies by Thomas Net with annual revenues estimated at between $5 million and $9.9 million. They make both extruded PVC products and PVC custom compounds.

- Producing over 7 million pounds of plastic material per year, Ohio based Plastic Extrusion Technologies produces both extruded rigid PVC products and PVC compounds. Their estimated annual revenues are $1.51 million.

Limited or Specific Plastics Suppliers

The following companies manufacture either (but not both) extruded rigid PVC products or PVC compounds and are ranked by revenue as available.

- Dallas, Texas based Celanese engineers custom plastics compounds to spec for their clients. They reported $2.39 billion in annual sales for their Engineered Materials division in 2019, where PVC compounds reside.

- Ohio based Advanced Drainage Systems manufactures rigid PVC drainage products and reported 2019 net sales of $1.67 billion.

- JM Eagle, headquartered in Los Angeles, manufactures and distributes rigid PVC pipes used for water delivery. D&B estimates 2020 revenue at $998.24 million.

- Contech Engineered Solutions, a subsidiary of concrete giant Quickcrete, manufactures rigid PVC products for the agriculture, irrigation, and construction industries, among others. Their estimated 2020 annual revenue is $447.47 million, which includes all product types.

- Pexco, based in Georgia, is a plastics extruder company employing more than 500 people and present in most regions of the U.S. and Mexico. The company produces end-line products using extruded rigid PVC material. Their 2018 annual revenues were estimated at $295.68 million.

- Silver-Line Plastics manufactures many rigid PVC products and had an estimated 2018 annual revenue of $155.72 million.

- Cresline Plastic Pipe Company has estimated revenues of $146.97 million. Its primary products are all related to rigid PVC piping and fittings.

- Diamond Plastics Corporation had estimated annual revenues of $124.17 million in 2018, as reported by D&B. The water PVC pipe and fittings company is based in Nebraska.

- D&B estimates annual revenues of $59.44 million for plastics compounding and Louisiana based Adell Plastics. While PVC compounding is not a specific focus of the company, they do state they are able to "produce specialized formulations".

- Minnesota based Intek Plastics manufactures extruded rigid PVC components and products for various industries. The company's estimated annual revenues are $42 million.

- Polytec Plastics is another extrusion company listed by Thomas Net. The Illinois based extruder includes extruded rigid PVC products among its portfolio. Thomas Net estimates the company's annual revenues between $5 million and $9.9 million.

- A sister company to Cresline Plastic Pipe, California based Crescent Plastics Inc. focuses solely on custom plastic extrusions and fabrication and has estimated annual revenues of $2.29 million.

- McKinney, Texas, based Manner Polymers is a privately held company and makes PVC compounds used in flexible PVC products. Its website states it is "one of the five largest flexible PVC compounders in North America" and was founded in California over 60 years ago. Annual revenues or net sales are not published in the public domain.

Rigid PVC and PVC Compound Buyers

- Extruded rigid PVC and PVC compounds are used in a very wide array of industries, from agriculture to construction, medical to retail.

- For example, Aurora Plastics lists 38 industry segments their products have applications for, including toys, automotive, footwear and furniture.

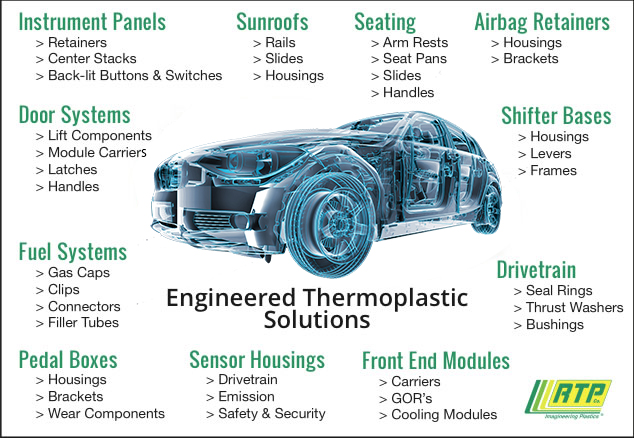

- RTP lists automotive, healthcare, electronics, industrial, and energy as the markets they primarily supply. Within the automotive market, they supply buyers of the following:

- Similarly, Teknor Apex lists 7 principal industries for their products and dozens of applications for their PVC compounds within the building and construction segment alone. These include corrugated roofing, deck and rail ing, doors, windows, fence coating, gabions, hot tub and spa, exterior cladding, and exterior trim.

- The top 4 consumers of PVC products by industry segment are pipes and fittings, profile products, films and sheets, and wires and cables.

- Mexico, followed by China, is the largest buyer of American made PVC products, covering a wide range of industries including automotive and aerospace, buying almost $18 billion worth of various PVC materials and products.

- The Creon Group defines six specific consumption segments within the PVC market: PVC window, pipes and fittings, profile extrusion like siding, packaging, soft flooring, and cable plastics.

- The PVC films segment is primarily composed of packaging, building materials, medical, and printing.

- There are online digital marketplaces where buyers list requests for PVC products, such as PVC Fittings Online, eWorld Trade and go4world Business.

- Other large buyers of rigid PVC end products are large distribution wholesalers and retailers including Grainger and United States Plastic Corp, wholesalers such as RJB, as well as big-box retailers Home Depot, Lowe's, and Menard's.

- Bio-based PVC applications include agriculture films, bags , blisters , bottles and canisters , caps and closures , containers and bins , cosmetics , and fibers in a variety of industries, such as building, construction, packaging, transportation, electronics, and textiles.