Part

01

of one

Part

01

NFTs Ecosystem and Tokenomics

Key Takeaways

- An NFT is a "cryptographically secured token with their history of ownership and current owner stored on a blockchain", as defined by Visual Capitalist. It is a good with unique properties, making it have a different value from other similar tokens or goods. What makes NFTs so special is their non-fungibility.

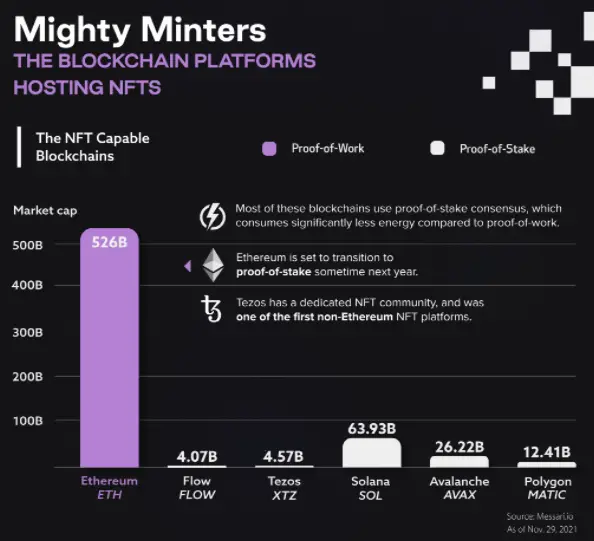

- NFTs and minted and hosted in blockchains. Ethereum is the largest and most used blockchain for NFTs.

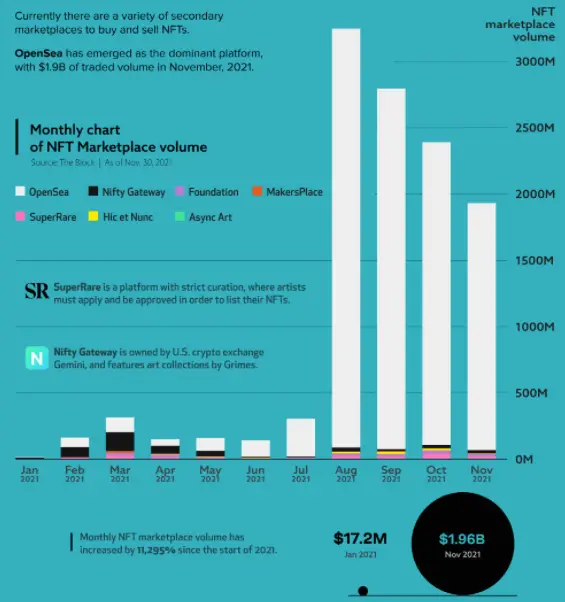

- There are several secondary marketplaces for NFTs where the majority of NFT exchanges take place. OpenSea has emerged as the leading secondary NFT marketplace with $1.9 billion of traded volume or 95% of total NFT trading volumes by November 2021.

- Today, there are many NFTs being traded but not all are equally successful. The following are relevant factors that might determine the success of an NFT project: scarcity, notoriety, community, subjective aesthetic, and blockchain.

- The term basically points to the economics of a crypto token. This means all the qualities of a crypto token that makes it appealing to investors. The project whitepaper of a crypto token contains all the information required to know about functionality, objective, allocation policy, and many other aspects related to the token.

Introduction

This research is divided into two main sections titled Key Elements of the NFTs Ecosystem and Key Elements of Tokenomics. In the first section, there are several descriptions and explanations related to the NFTs ecosystem. In the second section, the main elements of tokenomics are explained. Some comments about Slotie NFTs and CyberKongz were included in the report.

Key Elements of the NFTs Ecosystem

NFT or Non-Fungible Token

- It is a "cryptographically secured token with their history of ownership and current owner stored on a blockchain", as defined by Visual Capitalist. It is a good with unique properties, making it have a different value from other similar tokens or goods. What makes NFTs so special is their non-fungibility.

- Since transactions of the tokens are stored on a blockchain, there is digital proof of ownership.

Fungibility

- It is when a good's individual units are interchangeable and indistinguishable in value. As the opposite, a fungible good has interchangeable units that are indistinguishable in value (e.g. bitcoin, US dollars, and arcade tokens)

Cryptopunks

- This is a successful example of NFTs. Cryptopunks is an NFT collection of 10,000-pixel art punks and all are different. It is one of the most popular NFTs today. The random combinations of attributes with differing scarcity result in each punk having a unique value (see the figure below).

- NFTs and minted and hosted in blockchains. Ethereum is the largest and most used blockchain for NFTs. See the comparison in the chart below.

- The average Ethereum transaction fee varies between $30-80 (depending on the specific transaction) and the current NFT minting fee is ~$130, every other blockchain in the table above has transaction and minting fees that remain below $1.

- There are several secondary marketplaces for NFTs where the majority of NFT exchanges take place. OpenSea has emerged as the leading secondary NFT marketplace with $1.9 billion of traded volume or 95% of total NFT trading volumes by November 2021. See the chart below.

- Not all marketplaces work the same way. OpenSea, for example, allows anyone to easily mint and offer an NFT for sale. Other platforms like SuperRare limit the art and artists on offer, resulting in a more curated marketplace. Marketplaces may host NFTs from multiple blockchains - like the case of OpenSea with Ethereum and Polygon. However, other marketplaces like Hic et Nunc are faithful to one blockchain (Tezos).

- In the next future, it is expected to have fiercer competition among marketplaces. For example, Coinbase is expected to have its own NFT marketplace.

NFT key branches

- Art and digital collectibles. These can be art, music, fashion, or sports collectibles. The most expensive NFT art ever sold is “Everydays—The First 5000 Days” by Beeple. It was auctioned off for a whopping US$69 million in March 2021.

- Gaming. With this modality, players get to collect exclusive rewards that they can later trade as NFTs. A notable example of this branch is the Slotie NFTs. Slotie slot machines, allow Slotie holders to become shareholders of the in-house casino and earn rewards. The Slotie community can invest assets and earn rewards every time they spin a slot machine in any of the Slotie casinos.

- The Metaverse. NFTs are redefining identities and spaces, tokenizing digital land in virtual reality.

Further applications

- Almost any physical asset or good can be tokenized for easier proof and exchange of ownership, without the costs and delays associated with paperwork and bureaucracy. Applications of NFTs are endless and innovation in this field is just starting.

- Blockchain technology provides content creators with a broad range of opportunities to monetize their work. The best advantage is a direct relationship with consumers without the need for a middleman.

Success factors

- Today, there are many NFTs being traded but not all are equally successful. The following are relevant factors that might determine the success of an NFT project: scarcity, notoriety, community, subjective aesthetic, and blockchain.

- Scarcity and exclusivity drive price. CyberKongz started in early March 2021 as a collection of 1,000 unique and randomly generated NFTs.

- Notoriety. It is not easy to know how to get notoriety and be unique. Being the first or the most original collection about something could catch the interest of celebrities and other famous people that relate their image to the project and make it more valuable. In the case of Slotie NFTs, the rarer the Slotie, the higher the passive income received by a user from casino partners.

- Community. Being part of a community attracts buyers and the exchange becomes more fluid. More people know about the project. For example, Slotie's website remarks that membership access is provided to the Slotie Club.

- Subjective aesthetic. This is a subjective factor but the buyer has to feel attracted and motivated to own the asset.

- Blockchain. The blockchain used to host the NFTs may affect the value, depending on the perception of buyers about how reliable it is.

Currency and wallet

- Purchases of NFTs require a specific cryptocurrency as a payment method, depending on the blockchain that is being used. For example, purchases of NFTs made on Ethereum require being paid with ETH.

- Wallets store cryptocurrencies and NFTs.

NFTs Ecosystem

- An NFTs ecosystem is where blockchain, NFTs, currency, wallet, and marketplaces coexist and work to allow the creation, trade, and ownership of NFTs. For example, all Cyberkongz are already minted by they may be purchased at OpenSea and Rarible with ETH.

Key Elements of Tokenomics

Tokenomics

- The term basically points to the economics of a crypto token. This means all the qualities of a crypto token that makes it appealing to investors. The project whitepaper of a crypto token contains all the information required to know about functionality, objective, allocation policy, and many other aspects related to the token.

- A relevant example of innovative tokenomics is Cyberkongz. For those privileged owners of one Genesis Kongz, the model now grants 10 $BANANA tokens – which are currently worth approximately $90 each – daily for the next 10 years. Those $BANANA tokens may be used to rename their Kongz, alter their biography, unlock exclusive channels in the CyberKongz Discord server, or buy customized equipment and wearable items for CyberKongz VX avatars. Current earnings from owning a Genesis CyberKongz NFT equate to around $270k a year.

- Some of the most important concepts related to tokenomics are described in the following paragraphs.

Allocation and distribution of tokens

- Crypto tokens can be generated either pre-mined or released through a fair launch. A fair launch means that the currency is mined, earned, owned, and governed by the entire community. This also means that there is no early access to the token before making them public.

- With pre-mining, a number of the crypto tokens are generated and distributed among some exclusive addresses before going public. If the project is distributing its tokens to as many participants as possible, it is likely to think that the project is a legitimate one, and genuinely cares about further development.

Supply

- The circulating supply represents the number of tokens that have been issued so far. It is the amount currently in circulation. The total token supply is the number of tokens that exist at present, excluding any that might have gotten burned (eliminated). The maximum supply is the maximum number of tokens that can ever be generated. For some tokens, there is no maximum supply.

- An example of a total supply that equals circulating supply is the case of Slotie NFTs. There are 10,000 NFTs that serve as tickets into a growing online casino network operating on the Ethereum blockchain.

Market capitalization

- The entire amount of funds invested in the crypto project at a given date.

The token model

- Tokens may be inflationary or deflationary. If it is inflationary, there is no max supply and the toke will be produced again and again as time goes on. A deflationary token model means that the token is capped when the maximum is reached. Most proof-of-stake tokens like ETH are inflationary to reward the validators and delegators in the network.

Research Strategy

For this research on NFTs ecosystem and tokenomics, we leveraged the most reputable sources that were available in the public domain such as Visual Capitalist, Nomics.com, Coinpedia, and Coinspeaker, among others, as well as websites of the NFTs projects Slotie NFTs and CyberKongz, and news about them. We reviewed all concepts described in the sources and extracted the most relevant aspects that represent the bases to understand NFTs ecosystem and tokenomics. Examples taken from the cases of Slotie NFTs and CyberKongz were included.