Part

01

of one

Part

01

Next Generation of Landlords

Key Takeaways

- About 50% of millennials planned to invest in rental properties within suburban areas, 25% in urban core areas, and 25% in rural areas and smaller towns.

- The most recent data shared by Zippia shows that 53.1% of landlords in the U.S. are men, 43.5% women, and 3.40% unknown.

- Virtual tours can also help an individual to make a real estate decision. Data shared by Real estate 360 virtual tour statistics showed that "75% of customer decision-making is affected by a virtual tour."

Introduction

Below is an overview of landlord demographic changes in the past 3-5 years, including trends in the U.S. rental market. The demographic factors profiled include the age of landlords, gender, race/ethnicity, and an overview of how millennials have been investing in real estate.

LANDLORD DEMOGRAPHIC CHANGES

Age

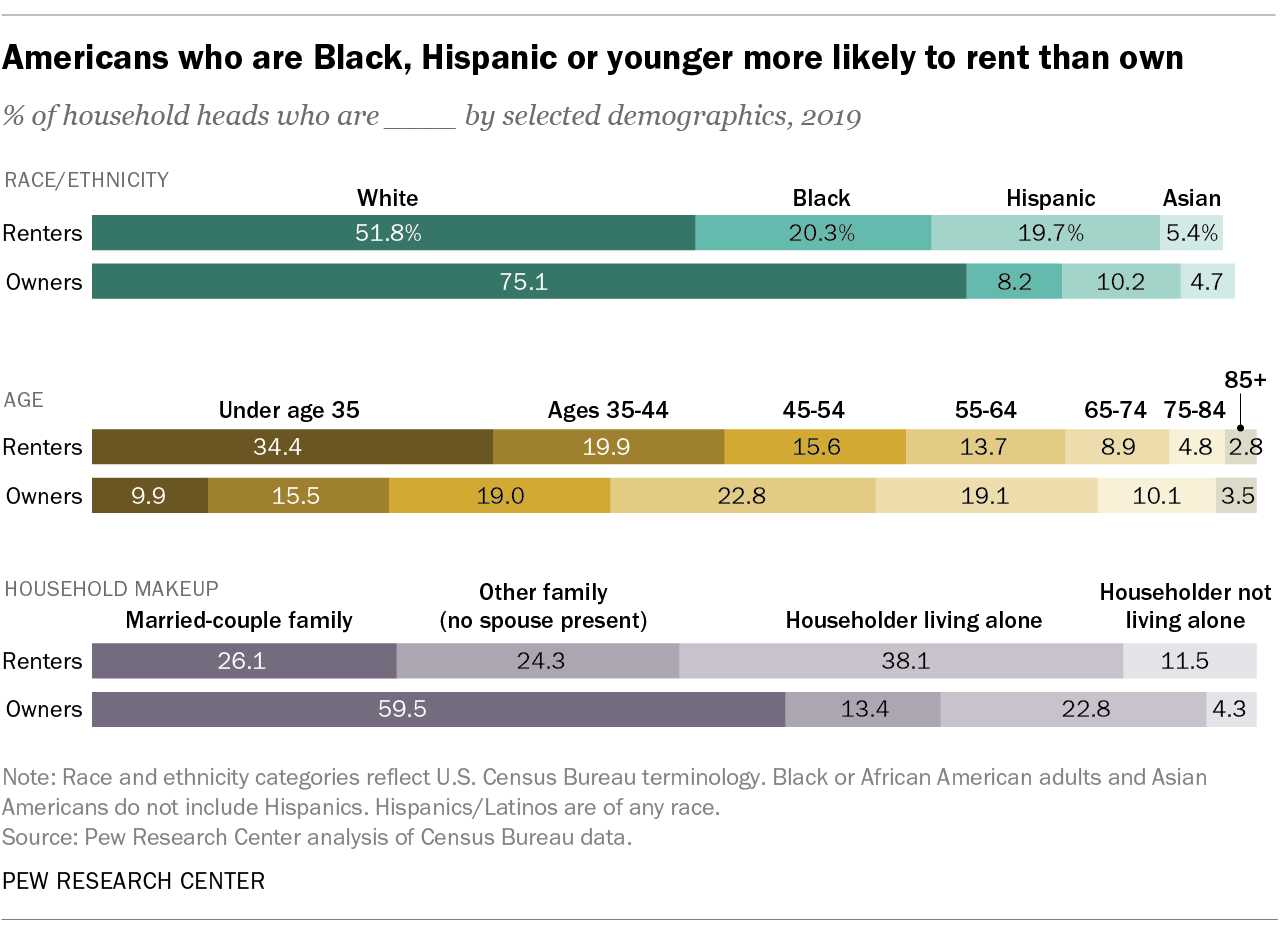

- Data by Pew Research shows that 9.9% of U.S. landlords are aged below 35; 15.5% are aged 34–44; 19% are aged 45 -54; 22.8% are aged 55 -64; 19.1% are aged 65–74; 10.1% are aged 75–84; and 3.5% are aged 85+.

- When compared to Zippia's 2018 data, 10% of landlords were aged 20-30 years; 21% aged between 30-40 years; and 69% were aged 40+ years.

- An analysis of the findings from both reports suggest that from 2018 to 2019, there was a slight increase in the number of landlords.

- The image below provides recent data on landlord demographics.

Gender

- The most recent data shared by Zippia shows that 53.1% of landlords in the U.S. are men, 43.5% women, and 3.40% unknown.

- However, data from the past 3–5 years, i.e., (2016 through 2018) shows that women have been the majority landlords

- Though the difference is negligible, the data clearly shows that there are slightly more landladies in the U.S. than landlords.

Race/Ethnicity

- Data published by Pew Research reveals that in 2019, Whites owned the most rental properties (75.1%) in the U.S., followed by Hispanics (10.2%), African-Americans (8.2%), and Asians (4.7%).

- Another research by Zippia shows that from 2013 to 2018, the number of White landlords has been decreasing, while the number of Hispanic landlords has been climbing. In 2013, White landlords owned 69% of rental properties with Hispanic landlords owning 14%; however, in 2018, White landlords owned 67% of rental properties with Hispanics owning 15%.

- The number of African-American landlords also shrunk during the same period from 10% to 9% while the number of Asian landlords increased from 4% to 5%.

Millennials Are Increasing Investments in Rental properties

- While research showing how home ownership rates among Millennials over the past 3-5 years is limited in the public domain, more recent information on the same indicates that in 2018, millennials had become the leading home buyers in the U.S., according to the National Association of Realtors data and make 37% of the overall share in 2021,

- The report further points out that millennials often purchase additional units to operate as rentals. They prefer units like single-family and multifamily communities.

- About 50% of millennials planned to invest in rental properties within suburban areas, 25% in urban core areas, and 25% in rural areas and smaller towns. Research shows that about 85% of millennials concur that real estate is a better investment method when compared to stock markets, with 55% interested in investing in real estate.

US RENTAL MARKET TRENDS

Increasing Rent Prices

- Nationally, rent prices have been rising with some regions and cities reporting over 50% increases in rent, when compared year-over-year. Prices for one-bedroom units jumped 20% and for two-bedroom units (17%).

- In November 2021, the average national rent price for a one-bedroom unit was about $1,670 (+0.6% from the prior month (October) / +19.8% year-over-year).

- The average national rent price for a two-bedroom unit was renting at $1,951 (-0.7% decrease from prior month / +17.3% year-over-year)

- The image above shows the national average rent over a 12-month period

- Popular cities in Florida witnessed some of the fastest rent increases nationally. Rent in Tampa and St. Petersburg has grown significantly since the pandemic hit, making the cities to feature among Zumper’s 100 most expensive markets in the United States.

- Rents plummeted during the pandemic; however, as both new and old people began returning to cities, rents quickly began climbing, a phenomenon experts attribute to rising inflation rates, which are likely to persist and reach about 7% by the end of 2023. Thus, rent prices in the U.S. are expected to continue climbing or remain high.

Rise of Virtual Tours

- The COVID-19 pandemic restrictions intensified the use of virtual tours as renters were not permitted to provide house tours to interested tenants. These restrictions saw the rise of virtual tours, which according to Statista was used by over 31.5% of respondents in a Statista survey.

- Experts predict that soon, many tenants would want virtual tours attached to every rental ad they see. Landlords are therefore encouraged to incorporate this technology into the marketing of their rental units. About 72% of agents claim they will continue to offer virtual tours after the pandemic ends.

- Virtual tours can also help an individual to make a real estate decision. Data shared by Real estate 360 virtual tour statistics showed that "75% of customer decision-making is affected by a virtual tour."

- Many consumers are demanding more virtual tours. For instance, an estimated 67% of consumers would want more virtual tours, 26% are undecided, and 7% say virtual tours are unnecessary.

Research Strategy

Pre-compiled data on the demographic changes of landlords in the past 3-5 years is unavailable in the public domain; hence, the research team did compare the present demographic data of landlords and date from the past 3-5 years to identify changes and differences. One report published by Zippia provided data sets covering over five years for most of the demographic factors. Another report by PEW Research provided more recent (2019) data on Landlord demographics. The research team used these reports to highlight the changes in landlord demographics in the past 3-5 years. The team also focused on data specific to millennials to draw the conclusion that their investments in the real estate sector are expanding. The data on trends and landlord demographic changes was retrieved from reports published by PEW Research, Zippia.com, Digital In The Round, Multi Housing News, Real Wealth Network, Exploding Topics, US News, Apartment Guide, Forbes, etc.