Part

01

of one

Part

01

Nanovesicle Encapsulation and Emulsion Technology Overview

The nanovesicle encapsulation and emulsion technology markets are expanding rapidly as technology continues to develop and infrastructure grows to match. New research and applications across multiple major industries (from food and beverage to pharmaceuticals and medical treatment) points to the importance of these products in alleviating major world issues (hunger and medical ailments) while the success of competing companies indicates a large profit opportunity.

In Part (A), trends such as the usage of nanomaterials for specific medical applications, the growth in the Asia-Pacific region in the volume of food produced with nanoencapsulating techniques, and the growth of nanoemulsion in the food and beverage industry are discussed, along with insights related to the potential increase in demand due to COVID-19 and the impact of nanovesicle technology on cancer treatment.

Part (B) provides a competitor profile of two key companies in the nanovesicle and encapsulation and emulsion technology fields: Aquanova and Frutarom. Of the two companies, Aquanova is a smaller operation in terms of its employees and revenue, but it has a significant global footprint nonetheless. Frutarom is a massive company poised to become even larger with a recently-announced DuPont merger.

In Part (C), industry-specific insights for the CBD/hemp, whey/plant protein, energy stimulants, nootropics, alcohol, vitamins and minerals, and probiotics industries are examined. The alcohol industry is the largest one but nanoencapsulation is at the beginning stages, while probiotics and vitamins and minerals are well-established on this frontier. The whey and plant-based proteins market has potential due to their ability to act as nanocarriers for bioactive compounds across multiple industries.

—

Part (A): Trends and insights related to the nanovesicle encapsulation and emulsion technology markets.

Nanomaterials Are Increasingly Being Used for Specific Medical Applications

- Since their introduction to the medical field at the turn of the millennium, nanomaterials have been making major strides in their applications due to their growing potential for impact.

- Nanomaterials are now used in "nanodiagnostics, as nanomaterials for tissue engineering, as drug carriers for specific delivery/targeted biodistribution or controlled release, and as agents/drugs for prevention/treatment of diseases".

- Nanomaterials can better preserve antioxidants (thus reducing the deterioration of the cell), probiotics (for intestinal health), cancer-fighting nutraceuticals (such as honey, cinnamon, and vitamin D), and nutraceuticals that support the development of mental and psychomotor systems, giving them the potential to help patients at every stage of their lifespan.

- The global nanomedical market grew from $134.4 billion in 2016 to $151.9 billion in 2017, and is expected to hold a 14.0 percent growth rate through 2022.

Asia-Pacific Region Sees High Growth in Food Products Industry

- The Asia-Pacific region is the fastest growing region for volume within the food products portion of the nanoencapsulation industry.

- The increasing rate of growth is due to the continued spread of the technology across the region.

- China, Japan, Thailand, and Korea are already manufacturers of substantial amounts of food products at the commercial and industrial levels, making the potential volume as high as the food manufacturing markets themselves in these areas.

- China and India are engaged in large-scale distribution of products at the manufacturing level, and this has led to a consistent rise in the volume of nanoencapsulated products.

- China's nanoencapsulated food market will grow by 5.8 percent each year, adding $596.2 million in opportunity by 2025.

Nanoemulsion Continues to Grow in the Food and Beverage Industry

- The nanoemulsion industry is growing vigorously on the food and beverage stage of the global market. Nanoemulsion improves the lifespan and quality of food, including the preservation of vital nutrients.

- The nanoemulsion industry is expected to grow at a rate of 11.5 percent each year, attaining $4.91 billion by 2026.

- Small-molecule surfactants have the highest growth (11.9 percent) within the nanoemulsion industry as a direct result of the food industry.

- The growth in Asia-Pacific millennials will contribute to the growth of nanoemulsion food consumption in that region through 2026.

COVID-19 Will Contribute to Higher Demand for Nanoencapsulation and Nanoparticle Emulsion Technologies

- In late June, a peer reviewed article reported the potential of nanotechnology in providing treatment for COVID-19.

- The report emphasizes that nanoencapsulation in particular "may contribute to the development of safer treatments for COVID-19" due to the level of control in drug delivery the technique offers.

- Nanoencapsulated drugs are said to counter viruses on multiple fronts with their ability to be "more efficient in activating intracellular mechanisms to cause irreversible damage to viruses and inhibition of viral transcription, translation and replication," the report reads.

- Corn-based zein nanocapsules improve the absorption of resveratrol, a compound that has been used to treat COVID-19.

- Nanoparticle emulsion techniques have successfully neutralized COVID-19 in mice.

Nanovesicles Will Transform the Fight Against Cancer

- Plasmonic nanovesicles are particles capable of traveling to specified parts of the body to deliver carefully-metered dosages of specific drugs. They are activated by a beam of light, prompting them to disperse their contents and then leave the body. While still in development, the level of accuracy and control granted by plasmonic nanovesicles is believed to be incredibly significant for fighting pathogens located in specific areas (such as tumors).

- Hybrid nanovesicles have been successfully utilized to activate the body's responses to prevent cancer recurrence and metastasis.

- Lipid nanovesicles have been used for the treatment of solid tumors.

- A nanovesicle called SapC-DOPS has successfully targeted cancer cells, leading scientists to call them a "promising therapeutic option" for cancer treatment.

—

Part (B): Competitor profiles for Aquanova and Frutarom.

Aquanova Competitor Profile

- Website and history: Aquanova is a chemical manufacturing company based in Germany. They produce "liquid colloidal formulations" and have been in operation since 1995.

- Employees: While it could not be confirmed via an official source, Aquanova appears to have between 10 and 20 employees.

- Revenue: Aquanova's revenue in 2019 was €2,120,729 (or $2,513,744.01).

- Value proposition: Aquanova's products are based on two decades of in-house research, leading them to have an established voice and presence in the chemical solutions market. Major private label manufacturers utilize their products.

- Product: All of Aquanova's solutions (including vitamins, astaxanthin, curcumin, omega, and resveratrol) and additives (including colors, flavors, and preservatives), are under the name Novasol.

Frutarom Competitor Profile

- Website and history: Frutarom was founded in 1933 and has been dedicated to producing more than 70,000 products in the realm of flavor and fragrance additives, food and beverage, pharmaceutical, nutraceutical, and cosmetic industries.

- Employees: Frutarom has 5,600 employees based from its headquarters in Israel.

- Revenue: Frutarom's 2019 sales were $375.6 million, a growth of 4 percent over the previous year.

- Value proposition: In December 2019, IFF (Frutarom's parent company) announced it will be merging with DuPont's Nutrition and Biosciences Business. This will make it the "immediate leader" in the industry with a focus on "better for you" products. It will be able to significantly increase speed to market, have a more efficient development process, and involve robust consumer insights for its next-generation products.

- Product: Frutarom produces Neuravena, a health ingredient extracted from green oat that improves cognitive health. It was named the 2018 European Cognitive Health Ingredient of the Year by Frost & Sullivan.

—

Part (C): Overview of individual industries and their usage of nanovesicle and encapsulation and emulsion technologies.

CBD/Hemp

- Nanoencapsulation is used in the cannabis industry to dramatically improve the absorption of chemicals such as THC and CBD.

- Nanoencapsulation enables users to bypass smoking cannabis for THC or CBD effects, making it a healthier choice for the health-conscious consumer.

- There is significant application for topical CBD products (such as creams and makeups) that benefit from the rapid absorption of CBD in improving medical conditions and skin wellness.

- There is also potential for CBD gum and CBD eyedrops using this method.

- Nanoemulsion is viewed as the key to unlocking the potential $1 billion CBD beverage market.

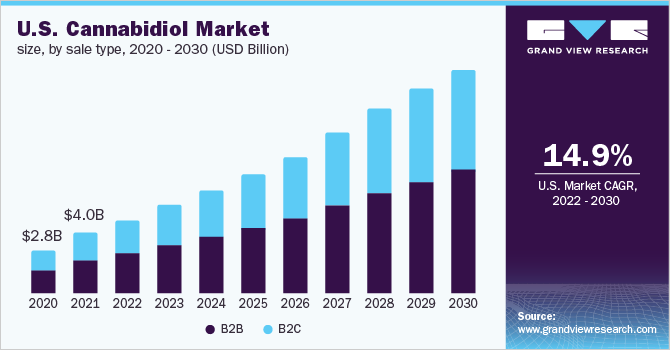

- The CBD market is projected to be $9.3 billion in 2020, with the following projection:

Whey/Plant Protein

- Within the whey industry, nanoencapsulation enables whey to function as a carrier for bioactive compounds (improving the nutrient value of food).

- Whey is capable of carrying vitamin D3, a popular additive to non-clear beverages, lycopene (helpful in cancer treatment), curcumin (useful for enriching acidic beverages), and rhodamine B.

- Whey proteins have "excellent techno-functional properties and high nutritional value", making them ideal carriers for bioactive compounds.

- Plant-based nanocarriers for bioactive agents include soy proteins, corn proteins, and a host of others.

- Importantly, nanocapsules made from zein (a protein derived from corn) improve the absorption of resveratrol, a compound that shows promise in treating COVID-19.

- Globally, the whey market is valued at $93.43 billion in 2020.

Energy Stimulants

- Nanoencapsulation has been increasingly used for drug delivery purposes over the past two decades.

- Nanoencapsulation enables the proper loading of chemicals inside carriers to prevent overdoses or toxicity.

- One study found that nanoencapsulating caffeine in whey "led to smaller and highly monodisperse particles, with a higher degree of sphericity in comparison to nontreated samples", signifying the potential for an even delivery.

- The encapsulation of caffeine has unrealized potential in the food and cosmetic industries in particular. The global caffeinated beverage market was $202.63 billion in 2018.

Nootropics

- Nanoencapsulation and nanoemulsion techniques are being utilized in the nootropics industry as a result of the improved bioavailability and absorption rate of key bioactive nutrients.

- Nanoencapsulation enables nootropics such as racetams (piracetam, aniracetam, oxiracetam, pramiracetam and phenylpiracetam) to enter the body in a water-soluble form. This is a dramatic improvement over its normal fat soluble form in terms of nutrient absorption rates.

- Nootropics are increasingly being linked with positive health effects, including preventing cognitive decline.

- The nootropics market is anticipated to grow to $4.94 billion by 2025.

Alcohol

- In the alcoholic beverages industry, research is ongoing with regard to metallic nanoparticles in particular.

- The uses in the industry include nanobiosensors, nanocapsules for delivery of bioactive agents, and nanocomposite packaging materials.

- The use of nanoparticles and the associated industries in alcoholic beverages is in its early stages leaving many open opportunities for exploration.

- The global alcohol industry was $1.439 trillion in 2017 with a projected rise to $1.684 trillion by 2025.

Vitamins and Minerals

- The Institute of Food Science and Technology made a statement in 2019 that nanotechnology (specifically nanoencapsulation) represented the future of vitamin delivery.

- Nanoencapsulation enables important nutraceuticals such as "vitamins, calcium, iron" to be made into nanosized particles that are much more readily absorbed by the body without negative effects of taste or visual appeal.

- Existing variants include nano-calcium, nano-magneisum, and nano-iron.

- Globally, the vitamins and supplements market was valued at $123.28 billion in 2019.

Probiotics

- Probiotic nanoencapsulation techniques were developed rapidly over the past ten years in the interest of developing probiotic delivery mechanisms that could more readily impact gut health.

- Probiotics suppress pathogens, thus limiting how often people get stomach illnesses. They also help activate and modulate the immune system of the consumer. Lastly, they help regulate fat storage. Based on these benefits, health and weight-conscious consumers would be the primary market.

- Nanoencapsulating technology has significantly improved the bioavailability of probiotics.

- The global probiotics industry was $48.38 billion in 2018.