Part

01

of one

Part

01

Mortgage Servicing

The detailed research that follows covers several components of the mortgage servicing industry including background, companies in the industry, trends, and recent changes. Additionally, the concept of mortgage servicing rights and where they fit in the overall mortgage servicing industry is described, along with some insights into investing in mortgage servicing rights, including firms in the space and potential challenges. While there was no publicly available data that allowed us to determine the number of 3rd party mortgage servicers in the U.S., we were able to find other relevant data that has been provided as helpful findings.

Definition and Background

- "Mortgage servicers collect homeowners’ mortgage payments and pass on those payments to investors, tax authorities, and insurers, often through escrow accounts."

- Although collecting and distributing payments are the most basic service offered by mortgage servicing companies, there are actually many actions that are required of these companies in addition to those items. Some examples include:

- Working with delinquent homeowners to possibly help the stay in their home

- Providing all options to homeowners when it becomes clear they can't stay in the home

- Communicating with homeowners in the case of natural disasters in the community

- Property preservation, or the act of caring for the property if the homeowner is not

- When loan goes into default, the servicer may be required to cover payments to the MSR investor

- "Generally, when a lender originates a mortgage loan, the lender may retain the loan and the servicing function for the loan in its portfolio, sell the loan along with the mortgage servicing rights to another party, or separate the mortgage servicing rights (MSRs) from its mortgage loan and transfer only the loan or the MSRs to another party." These various options can result in several scenarios which are outlined below:

- The loan originator keeps the loan and servicing

- The loan originator sells both the loan and the mortgage servicing rights to a 3rd party

- The loan originator sells the loan to a third party but retains the servicing rights

- The loan originator retains the loan but sells the servicing rights to a third party

- It is important to note that the loan originator has the power to decide what to do with the loan.

Third Party Mortgage Servicing

- As of the end of 2018, "six of the ten largest [mortgage] servicers were nondepositories." Small mortgage servicers are more likely to be a depository institution such as a community bank or credit union.

- Based on data from 2008 to 2019, the share of loans serviced by nondepositories has increased from 10% of mortgage volume to 42% of mortgage volume.

- Of note, the above data does not distinguish between nondepositories that are servicers-only versus those that originate and service loans.

- According to 2017 data which was published in 2020, the number of firms using NAICS code 522390 was 3,772. This code is titled "Other Activities Related to Credit Intermediation," and includes companies offering loan services. This number does not represent the total number of third party mortgage servicers because there are other businesses included in the code (e.g. check cashing and payday loans), and because there could be other third party servicers that also originate loans that may be included in another code.

- According to Lab49, the mortgage servicing industry is "competitive, low-margin, and highly fragmented."

- The mortgage market is quite complicated with primary lenders also participating in the mortgage servicing market for loans they didn't originate.

- Some key players in the mortgage servicing industry in the US (some of which are also originators) are Colonial Savings, F.A.; Mr. Cooper Group; Mortgage Contracting Services, and VRM Mortgage Services.

- Inside Mortgage Finance publishes lists of the top mortgage servicers by quarter, but the reports are behind a paywall.

- When Freedom Mortgage Corp finalized the acquisition of RoundPoint Mortgaging Servicing Corp in August 2020, the company became a top 10 mortgage servicer. In 2020, the company serviced over 1.5 million loans worth over $300 billion.

Research Strategy

- We began our research on the number of 3rd party mortgage service providers in the U.S. by utilizing government resources including a report from the Consumer Financial Protection Bureau and the Census Bureau, but were only able to access data in aggregate which did not allow for a further breakdown of data.

- Next, we accessed data at the NAICS website to try to determine approximately how many mortgage servicers there are in the U.S. We hoped that if we could first determine the total number of mortgage service providers, we could then estimate how many of them were considered 3rd parties by finding data breaking down the mortgage servicers by type of business. While we were able to find the NAICS code for loan servicers, 522390, which has a total of 28,970 businesses, there was not enough publicly available data to determine how many of those were actually mortgage servicers. Additionally, further research found that figure most likely related to the number of establishments (including multiple locations of a single company) rather than the number of firms. Unfortunately, in addition to loan servicing, this code includes businesses such as check cashing services, payday lending, and money transmission services, and there was no further breakdown by type of business within the code.

- Since we were unable to find or estimate the number of 3rd party mortgage servicer in the US based on publicly available information, we have instead provided related data that can help provide clarity on the size of the industry and the growth of 3rd party providers.

Mortgage Servicing Rights

- The three most prominent models for mortgage servicing are bank servicer, non-bank servicer (including both originator/servicer models and servicer-only models), and subservicers. In the first two models, the servicer also owns the mortgage servicing rights (MSR). Subservicers typically service the loan but do not take on any of the risk associated with the loan (meaning they do not own/hold the MSR). Therefore, while MSRs are a component of the mortgage servicing industry that is created when a mortgage is sold, they are distinct from mortgage servicing companies, as a company can service a mortgage without having the MSR.

- Mortgage servicing rights (MSR) are basically the contractual right to service an existing mortgage, and the MSRs are often sold by the original lender to a 3rd party. The owner of the MSR is not obligated to service the loan. If they hold the MSR but contract out for servicing, this would be an example of the subservicer model described above.

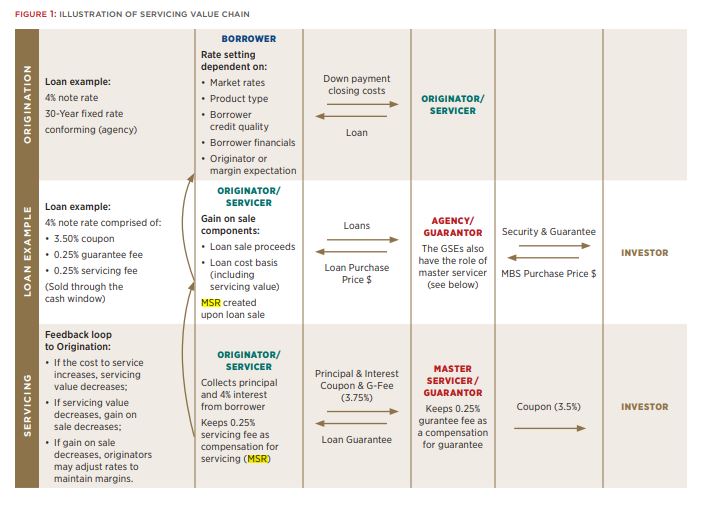

- The following chart illustrates the mortgage servicing value chain, including where MSRs fit.

- The two largest purchasers of mortgages on the secondary market (i.e. existing loans) are Fannie Mae and Freddie Mac. However, these institutions do not service loans, and sellers have the option to retain or release servicing when they sell the mortgage. So in these cases, Fannie Mae and/or Freddie Mac would hold the MSR, but would not be servicers.

- The average servicing fee generated by a MSR is 25 basis points.

Liquidity of Mortgage Servicing Rights

Investing/Liquidity

- MSRs have been a popular investment vehicle in recent years, but the market is not liquid for several reasons.

- For new entrants into the industry, there are licensing requirements that require a large amount of paperwork and can take between 1 month to over a year to process.

- In addition to the licensing requirements, which can vary by state, there are other barriers to entry. These include statutory, regulatory, operational, market familiarity, and identification of an exit strategy.

- Loan originators can decide whether they want to hold or sell MSRs, and there can be uncertainty in the market when they change their typical practice. For example, as a result of COVID, many loan originators who previously sold many MSRs, decided to hold them which meant fewer opportunities for investment.

- Over 90% of US mortgages are invested in by the government, primarily Fannie Mae and Freddie Mac. While the institutions purchase the loans, the servicing rights are either held by the originator or sold to a 3rd party servicer. While they don't own the rights, the contract with Fannie Mae does state "that Fannie Mae retains the right to terminate the servicer or require the transfer of the servicing rights, either for cause or without cause."

- This paper from global law firm Mayer Brown discusses the creative structuring that may be required to invest in MSRs.

- Due to COVID, there was a significant increase in the number of loans in forbearance, which means that loan servicers may need a significant amount of cash in order to meet their obligations. The CARES Act did not provide assistance for mortgage servicers.

- Although the majority of the article is behind a paywall, a writer for Housing Wire suggests that 2021 "might be the year of MSR."

Investors

- Matrix Financial Services, a subsidiary of Two Harbors Investment Corp, is a residential loan servicer that invests in MSRs from Fannie Mae and Freddie Mac loans. In the third quarter of 2020 their MSR portfolio represents $14.5 billion in unpaid principal balance. This amount was $11.1 billion in the 3rd quarter of 2019.

- New Residential Investment Corp invests in MSRs and its MSR portfolio was valued at $571 billion in unpaid principal balance as of September 2020, which was a decrease from $593 billion in the 3rd quarter of 2019.

- Both of these companies appear to actually service the loans they invest in, rather than being a passive investor.

Mortgage Servicing Trends

- The mortgage servicing industry was influenced by COVID due to the surge in customers not being able to make payments, and the increase in loans entering forbearance. The first trend identified below came about as a direct result of the pandemic.

Increased Litigation

- While litigation related to the criteria laid out by the CARES Act is just beginning, there is general agreement from mortgage servicers that it will be increasing. In the same survey that showed 90% of servicers believe litigation is coming also showed that 6.5% of servicers are already dealing with individual lawsuits, while 3% are dealing with class actions.

- If future claims mirror the claims that have been filed so far, it is likely they will relate to "allegations about eligibility for forbearance and length of initial forbearance periods to complaints that fees were improperly charged during the forbearance."

- However, these are not the only areas where litigation could occur. There could be litigation related to consumers being confused about what was available to them and claiming they didn't understand what they were agreeing to; consumers claiming that significant wait times and problems with customer service did not allow them to get through to get the help they needed; and the impact of state laws on the CARES Act provisions.

- An in-depth article from Law 360 describes why mortgage servicers are on the hook for relief provided by the CARES Act. While the article does not specifically mention future legislation, it describes how the process that was put in place provides an incentive for those who don't need help to take advantage of it anyway, which could help reduce reserves the servicers need to help those who truly do need it.

- This was included as a trend because it was reported by Bradley, a "national law firm with a reputation for skilled legal work, exceptional client service, and impeccable integrity," and because the data was based on a survey of those in the mortgage servicing industry who are in a position to know. Additionally, other lawyers with expertise in the field of mortgage law agreed that litigation would be an aftereffect of the CARES Act.

- Examples of litigation that has already been seen by mortgage servicers includes a class action suit claiming that consumers were "automatically" put into forbearance plans they didn't request, and that servicers did not follow the forbearance guidelines in the CARES Act.

Improved Customer Analytics

- With consumers leading the way on many of the changes that are being implemented in the mortgage servicing industry (see section below), customer data is becoming more important in order to provide customers with the services and tools they expect.

- This video from Equifax discusses the importance of data analytics for servicers, and how analytics can provide a competitive edge. At the 1:40 mark, they discuss how the right data can help servicers identify customers who may be selling their property or be suffering from economic hardships. Having this data can help servicers work proactively with customers for the best possible outcome.

- DS News reports that customer service is a differentiator for customers, and that detailed data, along with robust analytics of that data, are key components of being able to provide high-level customer service. Strong customer analytics will help deliver better document management, intuitive search, and process automation.

- This was included as a trend because it was reported by multiple experts in the field, including DS News, Banking CIO Outlook, and Equifax.

- One company that is strong in the area of data analytics is Quicken Loans. The company was able to implement a process that allowed for loans to be implemented electronically. In 2018, James Carson, a Data Science Team Leader at Quicken, presented "Simplicity is Genius: Bridging the Gap Between Data Scientists and Senior Leadership" at the Predictive Analytics World for Business conference in Las Vegas. One measure of the success of the increased use of data analytics is that Quicken Loans was the highest-ranked mortgage servicer for seven years running in the J.S. Power annual survey.

Blockchain

- The benefits of using blockchain in mortgage servicing was highlighted by Mortgage Banker magazine, Infosys, DS News, and other experts in the space, which is why it is being included as a trend.

- Blockchain "provides for technological automation that ensures compliance with time-sensitive requirements," which can help with two pain points in the servicing industry: processing payments and transferring documents between entities. Additionally, blockchain can limit access to documents, which is important when considering privacy laws.

- DS News reports that blockchain can help with both transparency and authenticity, while Infosys states that blockchain can reduce both time and cost in the mortgage servicing process.

- Although the article was behind a paywall, National Mortgage News reported in February 2019 that The Money Source (TMS) was received provisional approval. pursuing patents to use blockchain in mortgage servicing. TMS reported at the same time that they had

Mortgage Servicing Changes

Basel III

- "Basel III is an internationally agreed set of measures developed by the Basel Committee on Banking Supervision in response to the financial crisis of 2007-09. The measures aim to strengthen the regulation, supervision and risk management of banks." These regulations impacted the mortgage servicing industry.

- When the Basel III standards were initially implemented in the U.S., the ratio requirement for mortgage servicing assets (MSAs) changed from a cap of 50% to a cap of 10%. In 2017, the cap was reduced to 25% "for banks with less than $50 billion in assets." These lower caps likely increased the mortgage volume being serviced by third parties, as the banks needed to maintain enough room for originating new loans.

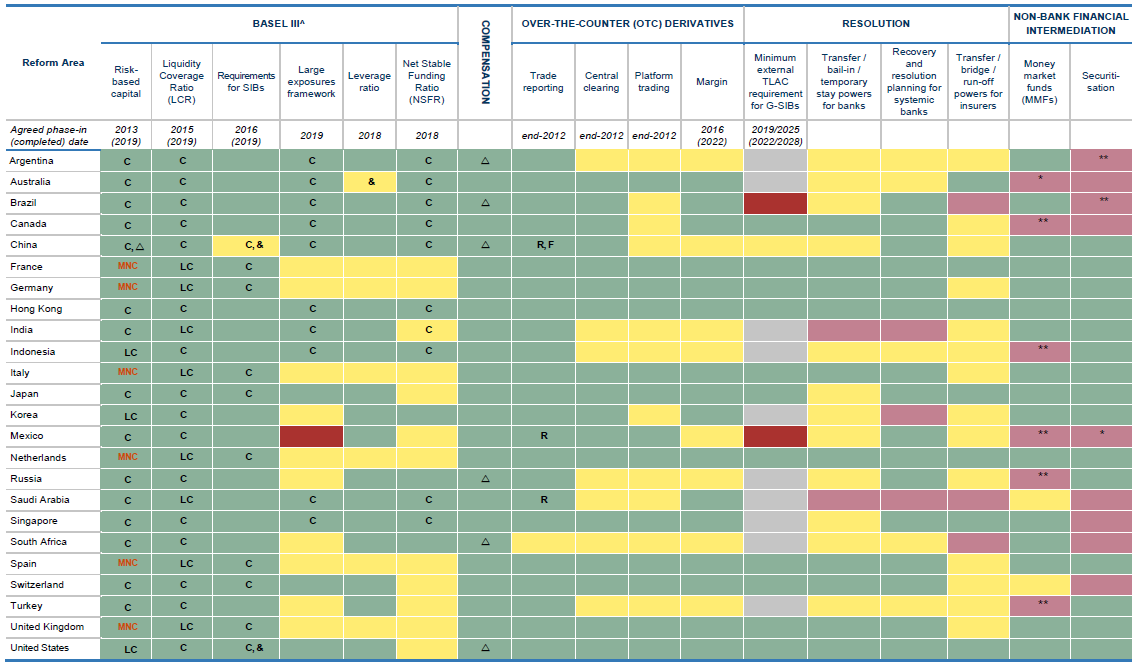

- The entirety of the Basel III reforms will be implemented starting January 1, 2023. The following chart shows where the US, and other G20 countries, currently are in the implementation process.

- Another change in the Basel III regulation was that "the risk weight on MSAs was increased from 100 to 250 percent." This provided an incentive for banks to hold loans on their balance sheets rather than creating MSAs.

- Basel III also increased the capital requirements for banks, while not doing the same for non-bank servicers. This made it easier for non-banks to do more servicing.

Registration of Passive Investors

- Effective March 2019, entities that passively invest in residential mortgage loans, in other words, companies that do not handle any of the servicing activities, were required to register in Ohio. The advisory can be seen in its entirety here.

- Washington put similar regulations in place in September 2018, and New Jersey in 2020. Pennsylvania has a similar requirement.

- While other states make clear that passive investors do not have to register, the uncertainty from state to state can make investing in MSRs complicated. For example, in New York, passive investors can apply for an exemption to the registration requirement.

Consumers Pushing Change

- According to National Mortgage News, consumers are at the forefront on changes that are being seen in mortgage servicing. As with most areas, consumers have high expectations for customer service, and that includes from their loan servicer. While technically consumers can't choose their servicer, many banks and non-banks offer both origination and servicing, so consumers have some say by choosing a lender that is more likely to keep and service their loan. The chart below shows Retention rates for loan servicers from 2008 till early 2018.

- Data shows that customer interaction with mortgage servicers is up, and this means companies need to have a variety of ways for that to happen. Payments are the perfect example of this, as consumers have more than 10 preferred ways to pay.

- Freddie Mac recognized the importance of customer service when it kicked off "Reimagine Servicing." The program's goal is to allow servicers to make "a series of improvements to its technology and processes to help servicers lower costs and improve transparency to the secondary market."

- According to a white paper published by InfoSys in mid-2020, five things consumers are expecting from mortgage servicers are speed, seamlessness, convenience, personalization, and transparency.

Proposed Regulation

- Under current regulations, federal credit unions (FCUs) are not allowed to purchase MSRs as an investment. FCUs are only allowed to service mortgages that are owned by a member.

- Under a rule change proposed by the National Credit Union Administration, FCUs would be allowed to invest in MSRs as long as certain conditions are met. This proposal is open for public comment until February 1, 2021.

Additional Resources

- Although the majority of data on this site is behind a paywall, there appears to be a great deal of information relative to the mortgage servicing industry. One report in particular appears to rank mortgage servicers by categories, including servicers for agencies, Fannie Mae, Freddie Mac, Ginnie Mae, and top banks and thrifts. Additional details on what is included as well as the cost can be found here.

- Although we provided information on publicly available trends in the mortgage servicing industry above, Inside Mortgage Finance published a report titled "Trends Among Top 50 Mortgage Servicers: 3Q20 (PDF)" they may have additional useful data. Unfortunately, the report is paywalled.