Part

01

of one

Part

01

Modern Business Leadership Shift

Key Takeaways

- The professional services' industry is becoming more specialized, and there is a trend toward corporate clients moving away from contracts for professional services and choosing new models instead. These models include flexible consumption, as-a-service models, value-driven or outcome-based models,

- In 2021, banking, discrete manufacturing, and professional services were the industries making the biggest investment in data and business analytics (DBA) globally. Those three industries were predicted to account for one-third of all DBA spending for 2021.

- The move to remote work that was accelerated as a result of the pandemic has led to firms extending their recruitment globally. It is no longer considered essential for employees to be able to come to the office regularly. Along the same lines, clients often don't feel the need to work with a local company so when they need services, they may look globally, and the level of talent in a firm can be a major factor in determining who they will work with.

- Relationships are a critical component of what clients want from a partner firm. Companies can highlight their commitment to establishing a strong relationship by using an effective client management system, following up regularly with clients, and being generous with deals.

- Some areas that employees expect their employers to address and accommodate include providing work-life balance, flexible work arrangements, and jobs with purpose. Additionally, employees are looking for more autonomy, and they want their mental and emotional health to be prioritized.

Introduction

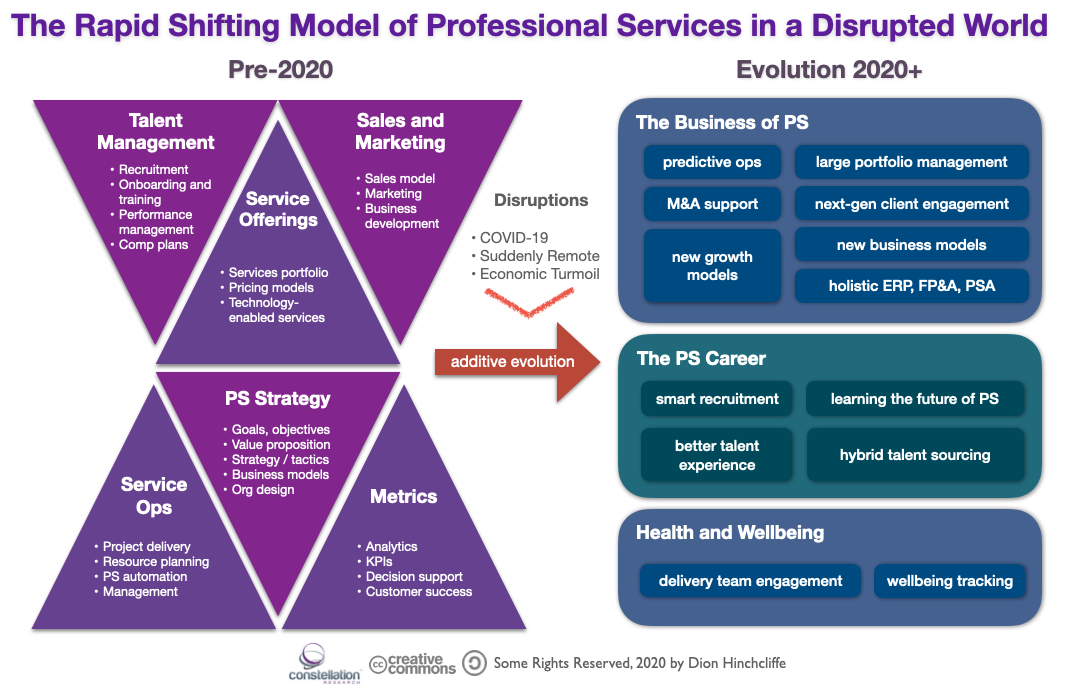

Provided in this report are five insights into shifts in the professional services' industry globally. The insights cover the topics of changing service models, data analytics, talent, client experience, and employee demands. According to Constellation Research, professional services' firms are moving toward a client/talent model. Many of the areas highlighted in this model are covered below.

Clients Preference for New Service Models

- The professional services' industry is becoming more specialized, and there is a trend toward corporate clients moving away from contracts for professional services and choosing new models instead. These models include flexible consumption, as-a-service models, value-driven or outcome-based models, and subscription models.

- With technology advancements, many companies now have the digital tools to manipulate and analyze their own data, and do not want to pay professional services companies to do it for them. For those that do still want those services handled by an outside firm, much of the work will be automated by the firm doing the work, which impacts staffing needs.

- The move toward new service models is being driven by several factors including an increase in digital first specialized firms entering the market, the gig economy, and a desire for more transparency in pricing. There are new specialized firms entering the market that are digital first, have small operations that can make adjustments quickly, and are hyper focused on one area so they can provide additional value.

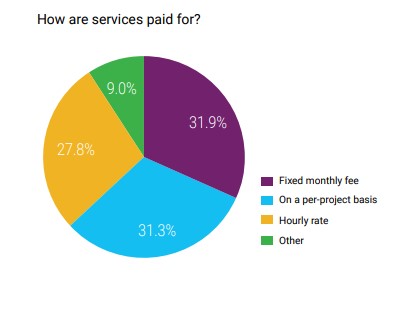

- A report released in June 2020 by Bill.com, CPA.com, and Hinge Research Institute provided insights into business model trends in the accounting advisory services industry. One finding was that hourly rate billing was less common than both a fixed monthly fee model and a per-project payment model.

- If firms want to move clients to new payment models, the data from this survey found that it was more likely to be successful when the switch is made within 5 years of the start of the relationship.

- Although slightly older data, in 2018 value and ROI based pricing represented about 12% of models for consultants, while hourly was about 26% and project-based was most popular at 31%. The following chart shows the data on most popular fee structures for consultants from 2018.

- Professional services firms that are moving to value-driven models are finding that clients "will now pay for the overall gains such as tax savings, ROIs, insurance claims, and so on. This shift from time-driven to the value-driven model allows PS firms to get more clients and increase their profitability.

Focus on Data & Technology

- According to a 2021 report by PwC that examined the professional services' industry, data is one of the three areas that successful professional services' firms will focus on. According to Dan Priest, a principal at PwC, "Technology, data, collaboration methods—it’s more than just enablement. It’s central to your competitiveness in the market."

- Based on data from 2020, 65% of enterprise companies were making an investment of at least $50 million in artificial intelligence (AI), machine learning (ML), and advanced analytics. This was an increase from 40% of companies in 2018.

- In 2021, banking, discrete manufacturing, and professional services were the industries making the biggest investment in data and business analytics (DBA) globally. Those three industries were predicted to account for one-third of all DBA spending for 2021.

- Data needs to be a focus "both internally and as part of the client relationship."

- Internally, data is needed to drive decision-making such as pricing and marketing decisions. Brand research also produces data which allows firms to truly differentiate themselves from competitors, based on what clients actually want.

- Externally, firms that take a holistic view of their clients, combining data from various functions, and adding metadata to further improve the usability of the data, will benefit from more in-depth insights and gain a competitive edge. Additionally, data allows firms to justify the recommendations being made, and become a valued partner for their clients.

- Detailed, high-quality data allows firms to categorize clients and use approaches that are most effective. For example, Harvard Business Review suggests professional services firms first determine what type of practice they are, using a scale of commodity, procedure, gray hair, and rocket science.

- HBR further suggests that clients be categorized based on their willingness to pay and cost to serve, and then use different relationship management strategies depending on where they fall on the spectrum.

- With the increased focus on data, cybersecurity will also have to be a priority to ensure the data is secure.

Talent Will Drive Success

- Talent is a second area that PwC believes will drive success in the professional services' industry. Matching clients to the best employees for what they need is critical to achieving the outcomes the client is looking for. However, 38% of leaders in the HR space said that workforce planning was a major challenge.

- Data analytics can be utilized to map employee skills and expertise which can help ensure the best possible match between employees and clients.

- Multiple sources report that there is a talent shortage in the professional services' industry. Phoenix reports there is a frenzy to hire talent in the accounting, consulting, and legal fields in the UK and Ireland; Bloomberg reported on a survey which found that "nearly 2-in-3 consulting firms say they’re short-staffed, and 1-in-5 are turning down work as a result;" and Robert Half reports that the business and professional services industry is number three on the list of industries facing a talent shortage.

- With the demand for talent outpacing supply, firms are looking at ways technology can handle some time-intensive administrative tasks, which could result in less demand for lower level employees.

- The move to remote work that was accelerated as a result of the pandemic has led to firms extending their recruitment globally. It is no longer considered essential for employees to be able to come to the office regularly. Along the same lines, clients often don't feel the need to work with a local company so when they need services, they may look globally, and the level of talent in a firm can be a major factor in determining who they will work with.

- Having strategies in place to engage and retain talent is critical. The following chart provides some recommendations for how to do that effectively, especially for remote staff.

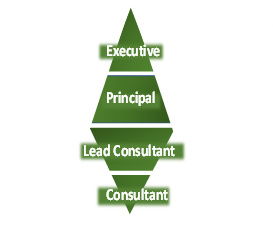

- McMann & Ransford suggests that the talent pyramid promotes success in a professional services' firm by ensuring that there is the right mix of talent resources. However, many firms actually have more of a diamond structure which leads to poor talent development; ineffective use of resources, with higher level employees working on lower level tasks; and certain employees becoming too important to the firm working effectively.

- Successful firms will also look at the mix of talent, ensuring that full-time employees, freelancers, and consultants are utilized at the appropriate time.

Client Experience

- The pandemic led to all sorts of companies changing the way they work. As a direct result, these companies will need different things from their professional services' partners. The firms that can meet those needs and seamlessly pivot into this new reality will be the ones that are most successful.

- The professional services industry has always been competitive, but with companies looking to reduce costs, firms will have to find ways to show clients that they provide value that makes utilizing their services worthwhile. Additionally, many firms were forced to handle tasks in-house that they may have previously out-sourced, so the types of services they need have changed.

- One of the ways that firms can improve the client experience is through the use of specialists. Rather than assuming that a single contact point can handle all of a client's needs, firms need to be able to either hire the talent needed, engage freelancers that can handle the limited work, or even establish partnerships with other firms that have the necessary expertise.

- Relationships are a critical component of what clients want from a partner firm. Companies can highlight their commitment to establishing a strong relationship by using an effective client management system, following up regularly with clients, and being generous with deals.

- In one survey, digital transformation was seen as a primary tool for transforming and managing client relationships. However, only 12.3% of firms surveyed had completed their digital transformation, so there is much room for improvement.

- According to Angela Nalwa, managing director at Grant Thornton, “Clients buy services based on relationships, and that is typically built on the frequent interaction of relationship leaders and consultants with their clients. If you move to a hybrid model, how does that change the relationships and buying decisions for clients?” Conferencing platforms such as Zoom can bridge the gap to ensure those relationships stay strong.

Employee Expectations

- As things have changed for companies, they have also changed for employees. There is a new normal in what employees are looking for from their employers, and this holds true in the professional services' industry.

- Some areas that employees expect their employers to address and accommodate include providing work-life balance, flexible work arrangements, and jobs with purpose. Additionally, employees are looking for more autonomy, and they want their mental and emotional health to be prioritized. The following graphic shows some priorities for employees.

- With a shortage of talent, employees have more leverage than ever and aren't afraid to ask for what they want. The great resignation is giving more power to employees, and employers that want access to high-level talent will have to accommodate their wants and needs, at least partially.

Research Strategy

For this research on insights in the professional services' industry, we leveraged the most reputable sources of information that were available in the public domain, including Salesforce, BusinessWire, PwC, American Express, and Consultancy.