Part

01

of one

Part

01

Market Size: Last-mile Deliveries

Key Takeaways

- Technavio, a leading market research firm, found that the last-mile delivery market in the US is expected to grow at a CAGR of 16%. The report predicts that the market will grow by almost $60 billion between 2021 and 2025.

- Mordor Intelligence believes that the last-mile delivery market will grow to $65 billion by 2023. It asserts that business-to-customer (B2C) transactions/deliveries will account for the lion's share of the market thanks to the rapid proliferation of omnichannel retailing in the US.

- In December 2021, DC Velocity, a US magazine dedicated to transportation, reports that the heavy-goods delivery market may currently be worth $13 billion. This is set to grow to $16 billion "several years down the road".

Introduction

This research brief details the market size of last-mile deliveries in the United States. It features estimated revenues and compound annual growth rates (CAGR) given by various research firms including Technavio and Statista.

Unfortunately, the research team could not find information on the proportion of last-mile deliveries meant for big-ticket items or the number of last-mile deliveries attributable to big-ticket items per year. We offer a few helpful findings on what industry practitioners predict about the growth of the white-glove segment as well as examples of paywalled research reports that may offer more information. Further details of our approach can be found in the Research Strategy section.

Last-Mile Deliveries: Market Size

- Statista reports that in 2018, the last-mile delivery market in North America was estimated to be worth $31.25 billion. Statista believes that the market will amount to about $51 billion in 2022.

- A report by Technavio found that this market is expected to grow at a CAGR of 16%. The report predicts that the market will grow by almost $60 billion between 2021 and 2025. Unfortunately, further details were sequestered behind a paywall. A white paper by Freight Wave asserts that the industry is expected to grow at a CAGR of 12% through to 2025.`

- Mordor Intelligence, on the other hand, believes that the last-mile delivery market will grow to $65 billion by 2023. It asserts that business-to-customer (B2C) transactions/deliveries will account for the lion's share of the market thanks to the rapid proliferation of omnichannel retailing in the US.

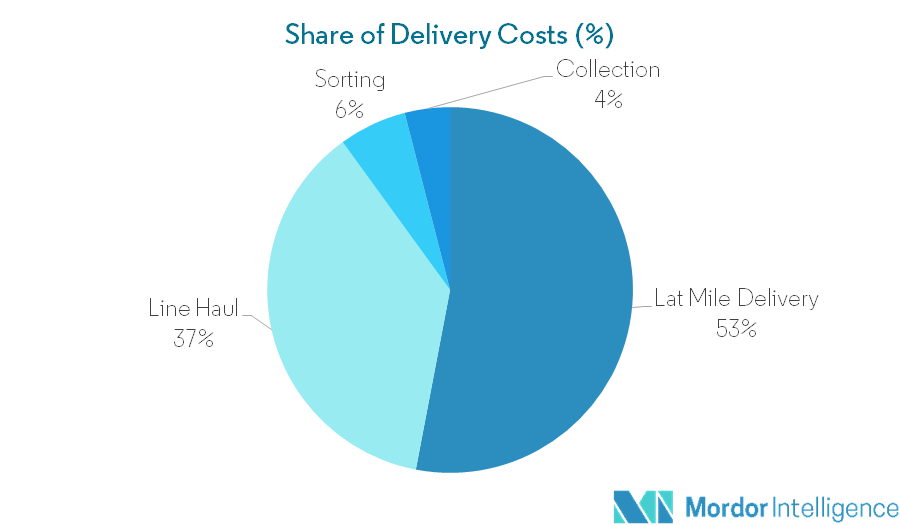

- Mordor's report also estimates that last-mile delivery accounts for 53% of total delivery costs. Capgemini Research Institute puts this figure at 41% while the Bureau of Economic Analysis believes that this segment takes up about 28% of all delivery/logistics costs.

- While most of these reports/findings detail North America as the scope, we safely assumed that they adequately represented the state of the US market as Technavio remarks that a whole 82% of the estimated growth will emanate from the States.

Last-Mile Deliveries: Big Ticket Items

- A 2017 report by Global Tranz, a global transportation company, found that the global e-commerce market that catered to large appliances and furniture "requiring white-glove service" stood at $199 billion, or as the article asserts, about 17% of the existing market.

- In December 2021, DC Velocity, a magazine dedicated to transportation, reports that the heavy-goods delivery market may currently be worth $13 billion. This is set to grow to $16 billion "several years down the road".

- The article further adds that the heavy-goods category promises the "most compelling aspects of growth". Satish Jindel, President of Ship Matrix, a transportation data analytics company, says, "The market will continue to have a need for big and bulky deliveries; it will be a growth area, particularly as consumers are more and more comfortable ordering online and the conversion [to e-commerce from brick-and-mortar retail] continues to take place." Jeff Abeson, the VP at logistics provider Ryder Last Mile, remarks, "The large-format home-delivery market continues to present opportunities and will only continue to grow, given how consumers have embraced online buying and won’t be going back."

Research Strategy

For this research on last-mile deliveries, we leveraged the most reputable sources of information that were available in the public domain, including Statista, Technavio Research, Mordor Intelligence, Global Tranz, Freight Waves, and DC Velocity.

Unfortunately, the research team could not find information on the proportion of last-mile deliveries meant for big-ticket items or the number of last-mile deliveries attributable to big-ticket items per year. We searched through research reports, white papers, industry commentary, and analysis, and while research firms such as Cognitive Market Research, Market Watch, Industry Research, A2Z Market Research, and Transparency Market Research claim to have research reports on the white-glove segment of last-mile delivery market, most of the data and any relevant information was hidden behind paywalls. We also searched for the year-on-year growth of deliveries for big-ticket items (furniture, large electronics, etc) in the United States, in an attempt to gauge the CAGR for the same, to no avail. We include a few helpful findings from DC Velocity and a 2017 report by Global Tranz, which also include commentary from some top players in the industry.