Part

01

of one

Part

01

Make-up Brand for Male Audience

In general, there is a bright future for a makeup brand targeted at a male audience since stigma for using makeup is falling while the pressure to look perfect is increasing, creating a beneficial environment for men to turn to makeup. However, attitudes towards the type of makeup and shopping behavior remain conservative. Men prefer makeup that aims to "cover up" rather than to highlight, traditional channels like supermarkets and hypermarkets dominate, and products that are clearly marketed towards men receive more attention (although gender-neutral brands are growing). They also respond well to men that are popular and successful, as their success gives them permission to talk about beauty and grooming. Influencer-driven content on social media is the go-to tactic for many successful brands in this space.

Reasons for Use/Objectives

- When it comes to why men might be open to using makeup, experts point to the fact that societal norms around its use are loosening but just as importantly, that the pressures of social media mean that men (not just women) must be picture-perfect at all times. In short, the stigma around makeup is decreasing at the same time that the advantages to makeup are increasing.

- According to Devir Kahan, the founder of the men's makeup brand Stryx, “The rise of social media, and just the ubiquity of it, should not be underplayed... You’re taking selfies and sharing videos and on FaceTime — meaning you never know when you’re going to need to be ‘camera ready'."

Barriers to Purchase/Problems

- One big barrier is simply a lack of familiarity. Both Kahan and Grella said that it will be key to focus on product education that gets men to rethink products they never considered "for them".

- As a completely new category for men, there is both opportunity and challenge in the fact that no norms have been established yet. According to Grella, “Women grew up with makeup — it’s a multi-billion-dollar industry. Whereas men, they haven’t grown up with it. They haven’t had it on the counter. Their fathers never used it. They don’t have it in the bathroom.”

Social Media and Men's Makeup

- Men use social media differently than women when it comes to makeup and grooming. According to Oscar Yuan from IPSOS, “Women are focused on the process of how products are applied versus just the outcome of a look or product. For men, it’s a different story; they aren’t into the process yet. Men use social media as [social] permission to know that grooming is now acceptable.”

- Because of this, strategies for social media have to be more about driving the category and allowing men to even talk about beauty or grooming. These strategies are less sophisticated than those of beauty brands targeting women. “Before we even try to drive brand or product preference, we’re still trying to get men to slap lotion on their face,” said Yuan. “We need to take a step back and just drive permission and awareness."

- Brands like Manscaped rely on influencers to spread the word. According to Tyler Wentworth, Manscaped director of social media, their content strategy focuses on what it's like to be a "modern groomed man", equating being a man today with taking care of yourself via grooming. They have over 1,800 influencers in their network with 50% of them having less than 100,000 followers, 30% with more than 100,000, and 20% with more than 1 million. Around 50% of them are paid.

Product Behavior

- Makeup attitudes vary by age. Men aged 18-29 are the most open to using it, with openness dropping steadily the older the cohort. 33% of men aged 18-29 said they would wear makeup, with only 20% of men aged 45-54 saying they would.

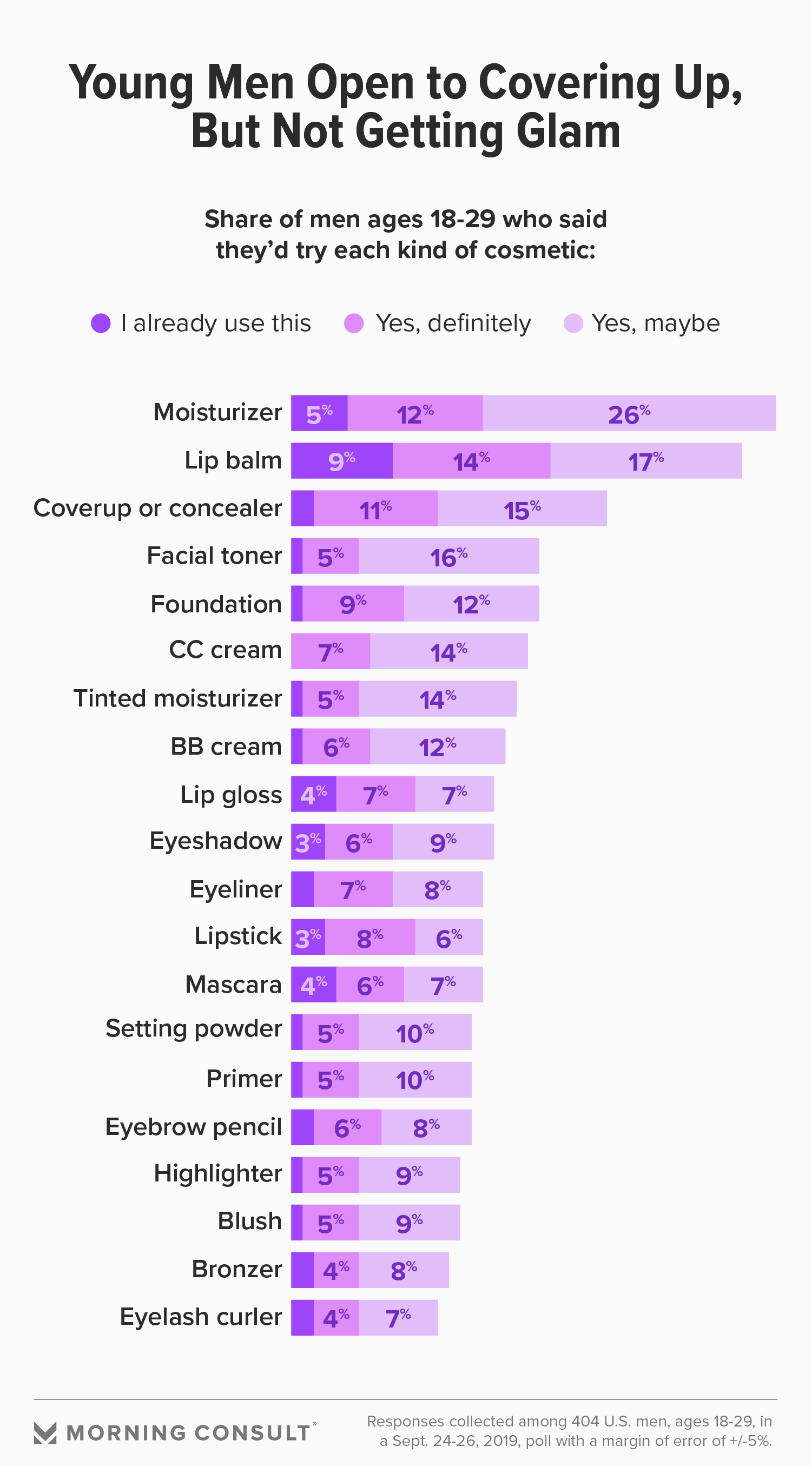

- According to research by Morning Consult, 9% of men aged 18-29 in the US already use lip balm which is the most used product among those surveyed. 5% use moisturizer, which has the second-highest penetration. An additional 14% would be definitely open to trying lip balm, with 12% definitely open to trying moisturizer. Note that because this age group is most likely to be open to makeup or cosmetic use, other age groups are likely to have a lower percentage of consumers open to these cosmetics.

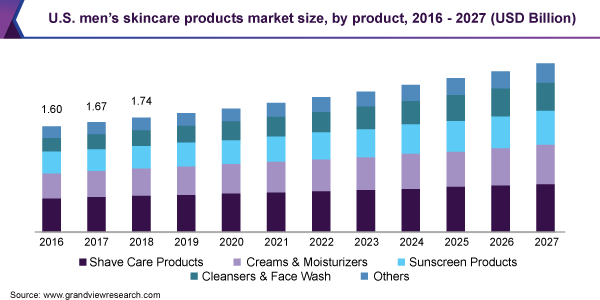

- The popularity of moisturizer-type products is backed up by market research finding by Grand View Research. "Creams and moisturizers" make up the second-largest category for men's skincare and is growing faster than the top category "shave care", meaning any BB cream-like product is likely to have a favorable chance of success in the market.

- Regardless of age, men prioritize makeup that is mostly for covering up or "fixing issues on the face" rather than highlighting. This is in line with a report from Mintel, which predicted that brands and products promoting a "healthy appearance" would see growth.

- According to SIS Beauty Innovation Consulting, specific product attributes that men look for when it comes to skincare include convenient, easy-to-use products, no visible residue on the skin, signs that the product is clearly "for them" (not used by women), and weak scents or no scents at all.

Purchase Behavior

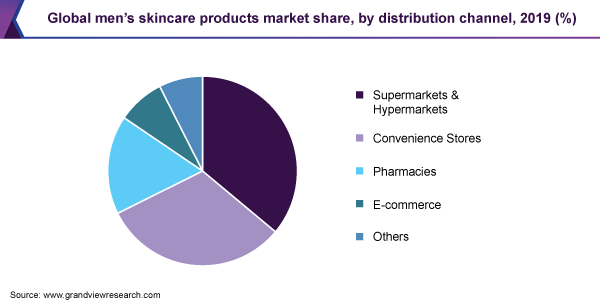

- Most men's skincare is bought in supermarkets and hypermarkets, followed by convenience stores, then pharmacies. E-commerce is a far fourth place; however, it's experiencing exponential growth and will have the fastest CAGR for the foreseeable future. Amazon.com is the largest online retailer.

Trends

- According to Euromonitor, a key trend is that of unisex brands which also reflects the blurring of gender boundaries. This is seen in the rise of cosmetic lines like ASOS Face+Body that are deliberately gender-neutral and advertised with models of different genders. However, because men are conventionally seen to be creatures of habit and resistant to change, most brands continue to focus on firmly signaling their separation from women and femininity.

- Another key trend driving the category is that of sustainability, whether in terms of packaging or formulation. Because brands can charge more for these products, it is also driving the premiumization of the category. Demand globally will be driven by brands that offer organic or natural products with natural extracts.

Research Strategy

While there is no research study focusing specifically on 20-50-year-old men that are already interested in caring for themselves and are users of men's products like Brickell and Manscaped, more research exists focusing on the male grooming and makeup market in general. The team, therefore, turned to market studies, news articles, and various consumer-facing platforms to obtain a holistic picture and highlighted findings that represented male consumers that were either already buying male makeup/beauty products or were interested in doing so. In this way, we were able to answer the listed questions on audience behavior, channel choice, consumer goals, and consumer barriers. The team also identified both global and US findings that are likely to be of most use.