Part

01

of one

Part

01

Luxury Resale Market Research

Key Takeaways

- The TAM of the global luxury resale market is estimated to be in the ballpark of $95,544,871,500 (calculated below).

- 78% of luxury shoppers surveyed said they use their mobile phone as a second screen while watching TV, which means they can quickly search the web after seeing a TV ad.

- It is estimated that between 47,772,435 and 57,326,922 of global orders/transactions are made online, while between 133,762,820 143,317,307 global orders/transactions are made offline (calculated below).

- Ongoing supply chain disruptions have resulted in an increased demand for pre-own products. According to Bain & Company, this is a key driver of growth in the secondhand luxury market specifically.

Introduction

This report provides estimates related to the luxury resale shopping market, specifically the TAM and average spend per second, among other data. This report also provides information about the share of online vs. offline transactions, consumer demographics, geographic market shares, consumer behavior insights, and market drivers. This report emphasizes the luxury resale market, where possible, and also includes information about the broader luxury market as logically applicable, due to the limitations surrounding publicly available data regarding luxury resale specifically.

Luxury Resale Shoppers: TAM, Average Spend Per Second, & Other Estimates

Based on the triangulations shown below, the following estimates have been made with regard to the global luxury resale market. A detailed description of the research strategy, data, and calculations used to obtain these estimates is shown further below:

- The total number of active buyers globally in 2021 is estimated to be in the ballpark of 51,089,743.

- The total number of orders/transactions globally as of 2021 is estimated to be in the ballpark of 191,089,743.

- The average number of orders per customer is estimated to be about 3-4 orders per year.

- The average order value of purchases in these markets is estimated to be in the ballpark of $500.

- The TAM of this market is estimated to be in the ballpark of $95,544,871,500.

- The average spend on luxury resale items per second is around $3,029 per second.

Estimate Triangulation Strategy:

In this section of the report, the TAM of the luxury resale market has been estimated, along with the average spend per second, and the total number of transactions. These figures were estimated, as they were not found to be publicly available across existing market reports, industry reports, surveys, media articles, etc. Furthermore, although there is a wealth of hard data available that pertains to the luxury resale market, the types of data that are ideal when it comes to estimating these figures were also not found to be publicly available with regard to this niche market. Given this, some logical reasoning was applied with a little creativity to arrive at a series of loose, ballpark estimates for these figures. Specifically, data specific to The RealReal TRR, a major player in this market, was used as a market sample/proxy to serve as a foundation upon which the estimate triangulations were built. Because TRR is a publicly-traded company, they published highly detailed data about their transactions. Given that TRR is a major player in this market and has a wealth of transactional data available, it made logical sense to estimate TRRs market share within the global luxury resale market and then calculate the market share figure alongside TRRs transactional data to arrive at a series of ballpark estimates for the global market. Although the logic of this approach is not 100% flawless, this path seems to be the most accurate approach that can be implemented based on the publicly available data. This path also allows for a full series of data to be estimated based on actual, official reported figures that stem from the same source, rather than creating a hodgepodge of estimates based on other estimates posited by multiple unrelated sources. The series of bullet points below lays out the triangulation process step by step.

- The RealReal (TRR), the leading luxury resale platform. The company's revenue as of 2021 was $468 million.

- Globally, the luxury resale market size is around $30 Billion as of 2021.

- This means TRR's market share of the global luxury resale market is around 1.56%. (or, 468 million is 1.56% of 30 billion).

- TRR reported about 797,000 active buyers in 2021. If these buyers represent 1.56% of the global market, it can be estimated that there were around 51,089,743 active buyers globally in 2021 (or, 797,000 x 100 / 1.56).

- In 2021, TRR reported 861,000 orders for Q4, 757,000 orders for Q3, 673,000 orders for Q2, and 690,000 orders for Q1. This equates to a total of 2,981,000 orders for the year. If these orders represent 1.56% of the global market, it can be estimated that there were around 191,089,743 orders globally in 2021 (or, 2,981,000 x 100 / 1.56). This further equates to an average of about 3.7 orders per customer, per year (or, 3-4 per year), if 191,089,743 orders were made by 51,089,743 customers.

- TRR's average order value in 2021 was $474 in Q1, $520 in Q2, $486 in Q3, and $508 in Q4. Based on this, it can be logically implied that the overall average order value is around $500. If this figure is used as a proxy to represent the typical order value in the luxury resale market, it can be estimated that the TAM of the global luxury resale market is in the ballpark of about $95,544,871,500 (or 191,089,743 total global orders x ~$500 per order).

- There are 31,536,000 seconds in a year. Given this, about $3,029 are spent on luxury resale each second (or $95,544,871,500 / 31,536,000 seconds).

Additional Marketing Sizing Data:

- According to Credit Suisse, the total addressable market of luxury second-hand supply is about $195 billion in the U.S. As of 2019, only about $7 billion of this amount was actively consigned.

- Edward Yruma, managing director at KeyBank Capital Markets, Internet/E-Commerce, has stated that the primary luxury market is around $300 billion (globally) and that the "accessible luxury market" is potentially 2x more than this, equating to a potential of $600 billion (300 billion x 2).

- According to Luxe Digital, "the secondhand luxury market accounts for around 7 percent of the $365 billion personal luxury goods market."

- 26% of consumers that spend an average of $44,000 in annual luxury spending buy pre-owned goods.

Brick-and-Mortar vs. Online Transactions:

- Most of the luxury resale trade still takes place offline as of 2021, according to McKinsey & Company.

- As was calculated above, the total number of luxury resale orders/transactions globally as in 2021 is estimated to be in the ballpark of 191,089,743. According to McKinsey & Company, digital platforms make up about a 25-30% share of this market. Given this, it is estimated that between 47,772,435 and 57,326,922 of global orders/transactions are made online, while between 133,762,820 143,317,307 global orders/transactions are made offline.

- Within the overall luxury market, online was the key channel in 2021. The share of the online segment has doubled in the past two years.

- Digital platforms of trading used luxury goods account for 25-30% market share, and are expected to grow at a rate of 20-30% per year.

- Online sellers are driving growth in the pre-owned luxury market more than brick-and-mortar channels.

Consumer Demographics: Luxury & Luxury Resale Market

According to Rati Sahi Levesque, President of The RealReal, "every demographic actively participates in luxury resale. From Gen Z to the Silent Generation, every demo increased its adoption of secondhand luxury in 2021." Below are some key data points surrounding consumer demographics in the luxury resale and luxury goods markets. (Note: Because publicly available data on the demographics of luxury resale consumers is limited, data about luxury consumers overall has also been included in these findings.)

Age: Gen X and Millennials Are Primary Buyers, Gen Z is the Fastest Growing

- While luxury fashion consumers have traditionally skewed towards an older demographic, the luxury resale market is increasing consumption among the younger generations. According to insights published by ThreadUp in 2020, younger consumers are the fastest-growing generation of second-hand fashion consumers.

- According to a report published by luxury reseller, The RealReal, Gen Z and Millennial consumers are the fastest-growing consumer base when it comes to luxury products.

- The number of Gen Z second-hand consignors has increased 86% since 2020 and the number of Gen Z second-hand buyers has increased 33%.

- Gen Z represents 5% of sellers in the luxury resale base, according to a report by The RealReal in 2022. Millennials represent 36%, Gen X represents 33%, Baby Boomers represent 22%, and the Silent Generation represents 4%. All generations, aside from Millennials, are primarily selling to Gen X, suggesting that Gen X is one of the primary bases of buyers. Millennials are mostly selling to other Millennials, suggesting they are also a primary buyer base.

- According to McKinsey & Company, "younger buyers (Generation Z and Millennials) are significantly more willing than Generation X and older to purchase pre-owned products."

- The typical consumer of used luxury watches are young collectors.

- According to Luxe Digital, "Millennials and Gen Z are adopting secondhand fashion 2.5 times faster than other age groups."

- According to data published by Microsoft Advertising, out of 52 million luxury shoppers in the U.S., 71% are under age 45.

Gender

- Internet users searching the keyword 'luxury consignment' are mostly female (77.42%).

- Internet users searching the keyword 'used luxury cars' are mostly male (66%).

- Internet users searching the keyword 'luxury' are mostly female (53.39%).

- Among luxury eCommerce consumers, 53.4% are female and 46.6% are male.

- About 75% of the luxury resale market consists of apparel and accessory items, most of which is focused on women's fashion.

- 12% of men surveyed were first-time luxury consignors in 2021, vs. 5% in 2019.

Education Level

- Among U.S. luxury consumers, 64% have graduated from college, according to Microsoft Advertising.

- Most shoppers to visit a luxury brand's website have a high level of education.

Income Level

- According to data published by Microsoft Advertising, out of 52 million luxury shoppers in the U.S., over 50% earn more than $85K annually.

- Consumers in this market are likely to have higher levels of discretionary income. For example, Ben Hemminger, CEO of Fashionphile, has suggested that the pandemic has led to an increase in discretionary income, given the closure of entertainment venues and travel options. This availability of extra discretionary income among consumers has created a significant opportunity with regard to the secondhand luxury market.

- Luxury consumers in 2021 are frequently millennial HENRYs (high earners, not yet rich). "In the U.S, HENRYs are said to earn between $100K-$250K." HENRYs tend to have high levels of debt, little savings, and work full-time. HENRYs make up about 35% of the luxury market and are expected to make up 50% by 2025.

- Most shoppers who visit a luxury brand's website have high-income levels.

- According to Luxe Digital, younger affluent generations are driving luxury resale growth.

Marital Status

- A 2015 academic study conducted by Dr. R. Srinivasan, et. al. notes that there are no correlations between marriage status and luxury products purchasing frequency. Although this paper is already 7 years old, the study came to some interesting conclusions that may be valuable to consider. Namely, the study reported the following conclusions: "It is found that there is no relation between marital status and frequency of buying luxury products. Also, there is a relation between marital status and kind of luxury product that consumers intend to buy. Apparel, mobile phones, and watches are preferred by all luxury consumers. Married people also like to buy luxury bags, shoes, and pens more in comparison to single people. There is no relation between marital status and the place from which they buy luxury brands. There is a relation between marital status and influence to buy luxury products. All the consumers depend on themselves, friends and family for deciding to buy luxury products, but married people give a higher importance to family as compared to single people who give higher emphasis to friends. Also, there is no relation between marital status and intention to repurchase the brand. It is also found that there is no significant difference in the perception of the different dimensions of luxury value with respect to marital status."

- More recently published data relevant to the marital status of luxury and/or luxury resale consumers was not found to be publicly available. However, it may be valuable to consider the overall marital status of the generations driving this market, namely Millennials, and Gen X. According to Pew Research in 2020, 44% of Millennials were married in 2019 and 53% of Gen X were married (at the same age). Additionally, 61% of Baby Boomers and 81% of the Silent Generation were married (at the same age). Another survey found that both Gen Z and Millennials show high levels of interest in getting married in the future.

- Likewise, given that luxury consumers are likely to have a higher level of education, it may also be valuable to consider that the likelihood of marriage increases: 38% for high school grads, 40% for those with some college, and 50% for those with a Bachelor's or higher.

Geographic Locations: Luxury & Luxury Resale

This section of the report explores the largest geographic markets for luxury and luxury resale in terms of dollars, growth rates, and market shares.

- Europe accounts for the largest share of the luxury resale market.

- The U.S. accounts for the second-largest share of the luxury resale market.

- China accounts for the third-largest share of the luxury resale market, equating to about 10%. The luxury resale market in China is valued at around $2.7 billion as of 2020.

- The United States leads in the luxury market in terms of spending.

- In 2021, about 21% of global consumer spending on luxury items was generated by China.

- According to Bain & Company, "the Americas account for €89 billion in annual sales (31% of the global market), while sales in mainland China amount to €60 billion (21% of the global market)." NOTE: These figures are for the overall luxury market; not specific to luxury resale.

- The Middle East is also a key player in the luxury markets, especially in Dubai and Saudi Arabia leading growth in this region.

- China is expected to be the biggest spender in the luxury market by 2025, according to Bain & Company.

- In 2021, it was reported that China was the "only region globally to end [2020] on a positive note". The country's luxury market grew 45% to €44 billion that year. In 2021 China's luxury market great by 36% from 2020 to reach $73.6 billion. China's luxury market is expected to grow at 6.03% CAGR through 2025.

- Meanwhile, Europe's luxury consumption declined 36% to €57 billion in 2020. In 2021, Europe's secondhand luxury goods market grew 6% CAGR. From 2022-2025, Europe's luxury market is expected to grow at a rate of 4.27% CAGR. The market size was totaled at $113 billion in 2022.

- In the Americas, the luxury market declined by 27% to €62 billion in 2020. In the United States, the luxury goods market was valued at $75 billion in 2022 and is expected to grow at a rate of 2.65% CAGR through 2025.

- In Japan, the luxury market declined by 24% to €18 billion in 2020. In 2022, the luxury goods market in Japan was valued at $35 billion and is projected to grow at a rate of 6.43% CAGR through 2025.

- Hong Kong and Macau's luxury markets performed the worse, globally, in 2020. The rest of the Asian region declined by 35% to reach €27 billion in 2020. In 2022, the luxury goods market in Hong Kong is valued at $6.7 billion and is projected to grow at a rate of 4.29% through 2025. As a whole, the luxury market in Asia is valued at $121.5 billion in 2022 and is projected to grow at 6.24% CAGR through 2025.

- Overall, the luxury market in the rest of the world declined by 21% to €9 billion.

Consumer Behaviors: Luxury & Luxury Resale Online Shopping

Luxury Consumer Journey

- Compared to 2020, 65% of luxury shoppers surveyed said they would do more research, browsing, and shopping for luxury goods in 2021.

- Almost 90% of luxury shoppers surveyed said they some amount of browsing, shopping, or researching online before making a purchase.

- Luxury shoppers are 70% more likely than consumers in general to spend a lot of time browsing and consider themselves to be 'shopaholics'.

- Across all categories of luxury goods, web search is the first shopping action consumers take after viewing an ad for a luxury good, regardless of the channel the ad was viewed on.

- 78% of luxury shoppers surveyed said they use their mobile phone as a second screen while watching TV, which means they can quickly search the web after seeing a TV ad.

- Luxury shoppers who use multiple search engines spend 32%-105% more than those who only use one. They also make purchases 30% more frequently. Among those using two search engines, Google is used 58% of the time, while Bing/Yahoo is used 42%.

- 52% of luxury shoppers surveyed said they own 5+ devices that can connect to the internet.

- 80% of luxury shoppers surveyed say online shopping offers a better variety and selection of luxury items.

- Over 50% of luxury shoppers surveyed said they feel comfortable buying luxury products online.

Increasing Awareness of Online Players in the Secondary Luxury Space

- In terms of awareness, the following online players in the secondary luxury space gained an increased level of awareness from 2019 to 2021: Poshmark, ThredUp, The RealReal, Tradesy, Farfetch, StockX, Rebagg, Depop, Fashionphile, Vestiaire Collective, and Watchfinder.

Increasing Purchase Intent in Pre-Owned Luxury

- The intent to purchase in the pre-owned luxury market increased 6 points from 2019 to 2021, with 21% saying they are extremely likely and 27% saying they are very likely, for a total of 48%.

- The items that respondents are most intent on buying in the pre-owned space are women's handbags (60% up 6 points from 2019), women's apparel (56% up 9 points from 2019), jewelry (53% up 13 points from 2019), women's shoes (44% up 10 points from 2019), watches (43% up 12 points from 2019), and men's apparel and shoes (38% up 11 points from 2019).

Sustainability is Increasing as a Deciding Factor to Purchase Resale Items

- Overall, the top drivers to purchase luxury resale are value (86%), and brand/merchandise selection (62%).

- Since 2019, sustainability/environmental impact has increased 13 points as a purchase driver, ending at 43%. Meanwhile, the desire to extend the cycle of luxury items increased 9 points since 2019, ending at 40%.

- 32% of luxury shoppers surveyed said quick and easy online checkout is a purchase driver.

Market Drivers: Luxury Resale Market

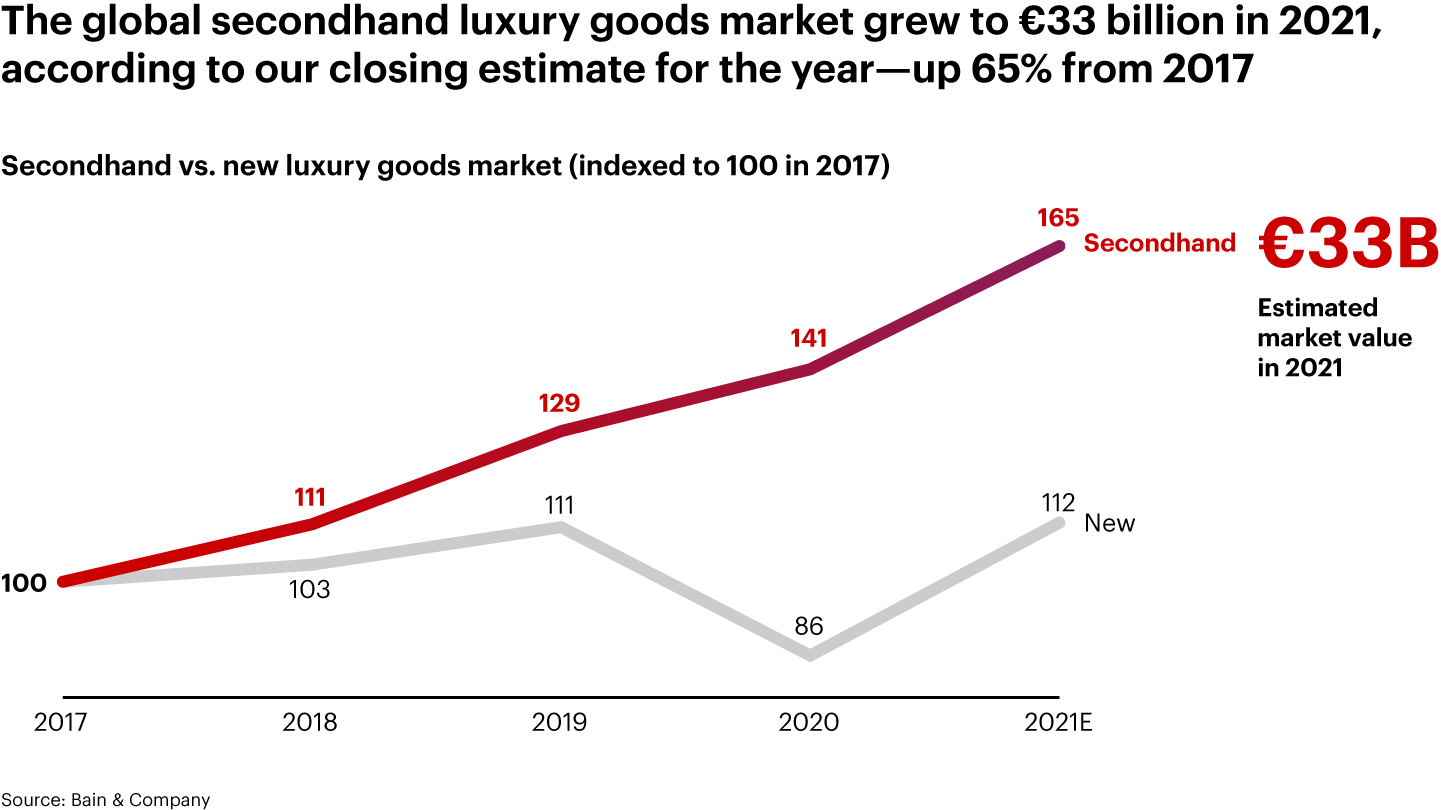

As by the chart below, the luxury resale market has been experiencing surging growth in recent years. The secondhand luxury market grew 65% between 2017 and 2021 (significantly faster than the growth of firsthand luxury products which grew at only 12%). This last section of the report explains the key drivers of growth in the second-hand luxury market:

Supply Chain Disruptions Result in Increased Demand of Pre-Owned Goods

- Ongoing supply chain disruptions have resulted in an increased demand for pre-own products. According to Bain & Company, this is a key driver of growth in the secondhand luxury market specifically.

- Overall, global supply chain shortages and bottlenecks have led to increased demand for pre-owned products globally. Among U.S. consumers, 75% said they planned to buy used items during the 2021 holiday season.

- According to ThredUp, this trend is particularly evident in the used apparel segment. By 2030, the segment is projected to grow to twice the size of the fast fashion market.

- In a 2021 article for Forbes, retail business expert, Catherine Erdly, "many factors have converged this year to make resale one of retail's fastest-growing areas. An increase in sustainable consumers, supply chain issues, and tight purse strings due to the pandemic are all contributing. Shoppers are seeking out coveted items on second-hand selling platforms — especially when businesses are struggling to stock them."

Increasing Adoption of Pre-Owned Initiatives by Luxury Brands

- An increasing number of luxury brands have been adopting initiatives in the pre-owned market. Additionally, luxury brands are witnessing the thriving consignment shopping market and are looking for ways to tap into this trend.

- These initiatives are likely being inspired by the key challenges of luxury brands. According to Bain analysts, these challenges include “creating a compelling value proposition, cracking operational complexity (e.g., authentication, start-up stock, and margins), defining a winning branding (or rebranding) strategy, maximizing customer outreach, and ensuring that the resold items are valued and priced properly.”

- Alexander McQueen partnered with Vestiarie Collective (a secondhand luxury marketplace) to launch its 'Brand Approved' program. Gucci launched an in-house program called their 'Vault' initiative, which curates a selection of their pre-owned goods. Gucci also announced a major partnership with The RealReal to feature a Gucci e-shop of consigned products. Burberry and Stella McCartney have also launched partnerships with The RealReal.

- Gucci's entrance into the secondhand market appears to be driven by a drop in its sales, as these initiates were launched after Gucci's third-quarter sales reported a decline of 12%. Meanwhile, The RealReal reported a 19% growth YoY.

- Ben Hemminger, CEO of Fashionphile says that, eventually, every brand will participate in the secondary market someday.

- Despite this emerging market driver, Luxe Digital notes that "most luxury brands have yet to capitalize on the booming resale market. Luxury brands have been hesitant to encourage resale by fear of cannibalizing sales of new products and diluting the exclusivity of their brands."

Consumer Demand for Sustainability

- As noted above, many luxury brands are launching initiatives in the pre-owned space, which is a key driver of market growth in this space, according to Bain. The launching of pre-owned initiatives by luxury brands is being driven, in part, by consumer demands for sustainability.

- Data has found that 2.5x more consumers are planning to shift their dollars towards sustainable brands. Increasingly, luxury brands are focusing on developing products made with eco-friendly materials.

- A survey of The RealReal customers (a luxury resale platform), 43% of customers said sustainability is a driver for them to shop on the platform, while 40% have said shopping on the platform is a replacement for the consumption of fast fashion.

- Ben Hemminger, CEO of Fashionphile has suggested that brands are increasingly feeling pressure to meet the demands of younger consumers, as they are the primary future customer base as they get older. Hemminger states: "What this means for the luxury tier and how it will evolve is that brands will not try to distance themselves from the secondary market, which was the case in the past. Brands will not only start to embrace it and increase their access to it but also have a more sustainable business.”

- According to analysts, Claudia D’Arpizio and Federica Levato, the resale market is a "powerful way for brands, fashion platforms, and investors to extend the lifetime of luxury products and show their commitment to sustainability."

Increased Market Accessibility

- As secondhand sales gain an increasing share of the luxury market, the secondhand segment is serving as an additional distribution channel for luxury brands, which is enabling them to reach new target markets.

- The inclusion of this additional distribution channel has created a point of access for brands to tap into the market of entry-level luxury shoppers, who may have been excluded or priced out of the new luxury products market.

- For example, in relation to Gucci's partnership with The RealReal, Allison Sommer, senior director of Strategic Initiatives at The RealReal stated: "By encouraging their community to shop resale, Gucci is helping us bring more people into the circular economy and show that resale is complementary to brands. Gucci is also able to introduce new buyers to their brand with our 17M+ members around the world. By making luxury more accessible, we’re serving as a gateway and building earlier affinity for luxury brands, like Gucci, that ultimately expands their audience."

Increasing Investments in Resale Entities

- Luxury brands have been making investments in pre-owned luxury players. For example, Groupe Artemis has invested in Vestiaire, Grailed, and GOAT; Chanel has invested in Farfetch, which has a resale arm.

- It isn't just luxury brands that are investing heavily in the luxury resale market. Business investors are also investing heavily in this area. For example, the luxury resale market leader, The RealReal has amassed $356.9 million in total funding since 2012, generated by a total of 23 investors. Of this, $185 million was generated in the past 3 to 4 years, with GreyLion Capital noted as the lead investor.

- Between April and August 2020 alone, over $134 million in investor funding was added into the luxury resale market.

- The increasing number of investments in the space are helping to drive growth in the luxury resale market, according to Bain.

- In a 2021 article, Rachel Muzyczka, Investment Director of DMG Ventures said the firm decided to invest in a luxury resale platform due to the following reasons: 1) it's a high growth market, 2) luxury brands have been adopting resale, 3) there is a huge amount of market opportunity, 4) it fits in with sustainability trends, 5) long-term growth rates are desirable, and 5) there is a strong appetite among venture firms to invest in resale.

Research Strategy

To conduct this research, our team relied on market reports, industry reports, surveys, company websites, company annual reports, and articles published by industry experts and trusted media sites. Because the availability of data pertaining to luxury resale specifically is fragmented and was not found to be publicly available for every aspect of this report, insights regarding the overall luxury market have also been included in this report. Within the report, the individual pieces of data clarify which of these two markets the data is referencing.