Part

01

of one

Part

01

Intergenerational Wealth in the UK

Key Takeaways

- Although more than 60% of individuals plan on passing on their wealth after their death, there are several benefits associated with dividing wealth before death.

- Today, baby boomers in the UK are living longer because of medical advancements, assisted living, and healthy living practices. This generation is also the wealthiest: £332,000 on average.

- When addressing investments, millennials are keener to select impact investing; these are investments that have an impact on the environment or on society: 64% millennials, 50% generation X, and 34% baby boomers.

Introduction

This research presents an overview of Intergenerational wealth in the UK, addressing insights such as the history, the planning process, the current state of the different generations, among others.

Baby Boomers: Increased Life Expectancy

- Over the years, Baby Boomers that had invested in property in the 1980s have benefited from the increase in property prices and stock markets. Property is an integral part of the intergenerational wealth transfer in the UK, expected to reach 70% in the coming years.

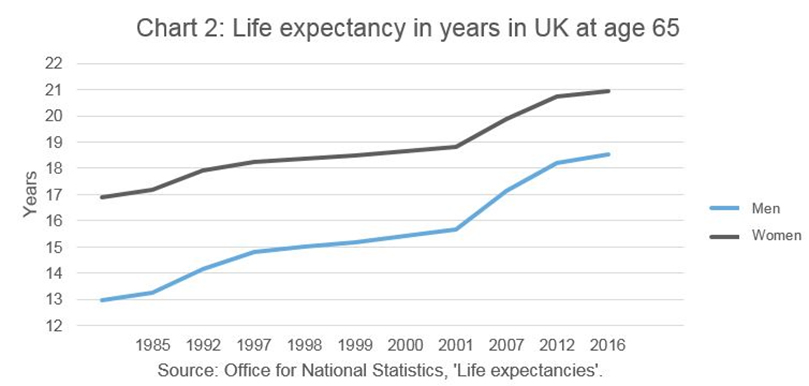

- As medical advancements, assisted living, and healthy living practices intensify, the life expectancy of baby boomers has increased. In comparison to 1984, life expectancy for males increased from 13.0 to 18.0 years and for females from 16.9 to 20.7 years. The chart below demonstrates how this has changed over the years.

- As many of them live longer, it means that they would hold on to their wealth longer. As a result, the intergenerational wealth transfer process would take longer.

Baby Boomers are Wealthy

- Many grandparents would be better placed to help their families if they would think through and distribute wealth before their death. Currently, the wealthiest age group in the UK is the 60-somethings. The average wealth here is £332,000. They have amassed wealth from savings, pensions, and property.

- In sharp contrast, millennials are the first generation to have less than their parents. For those that do not own property, their house rent would reach or exceed half of their income, which means that they can barely save. For this reason, the wealth divide here is influencing conversations around passing wealth while they are still alive. Furthermore, millennials would probably be in their 60s when their parents pass on.

- Baby boomers are thinking of passing on some wealth now and writing out wills that would allocate cash, assets, and property to their family members. This is critical in addressing large-ticket items such as education and home-ownership plans.

When to Pass Wealth

- More than 60% of individuals plan on passing on their wealth after their death. Typically, most people would want to hold on to their wealth to maintain a certain lifestyle. Additionally, most people would consider it taboo to discuss money and death while the individual is still alive.

- The “Giving while living” concept addresses instances where those that live to be really old would pass their wealth to those in their 60s. At this age, these inheritors would most-likely be contemplating retirement as well. Additionally, inherited wealth would be most beneficial at a time/age when it can be used to build a home or pay for school fees.

- Individuals benefit greatly when they get a cash inheritance when they are still early in their career path or starting a family. However, human beings would typically hold on to their wealth for longer. Some reasons here include wanting to look after a surviving spouse and any other related needs.

- One way that individuals can ensure that there is no bias or inequality is to give inheritance while they are still alive. Leaders within the community also seem to agree that giving while alive would be good practice for both parties: the gift giver and the inheritor.

Investment Knowledge Across Generations

- The UK's baby boomer generation is currently the most wealthy. Their wealth is in pensions and invested in property. However, research has proven that various generations do not have adequate investment knowledge. About 40% of millennials state that they lack investment knowledge, which is their major barrier when deciding to invest. One factor that may have contributed here is that they may have been affected by the 2008 financial crisis.

- Millennials are keen to select impact investing; these are investments that have an impact on the environment or on society: 64% millennials, 50% generation X, and 34% baby boomers.

- Younger generations are also looking for immediate, accessible, and digital investment advice that addresses their personal situations, goals, strategies, and offers a tailored solution.

Intergenerational Planning

- Planning this process is critical in ensuring a smooth transfer and conserving family relationships. Simply handing them money has its dangers and getting them to appreciate inheritance is also not an easy venture. Planning well in advance ensures that the beneficiaries are prepared to handle the wealth responsibly.

- Wealth adviser discussions are critical in demystifying wealth and investments from as early as possible. Focusing the discussions about the various needs and interests of the different parties is critical in ensuring that they remain engaged and optimize their inheritance.

- This also allows individuals to address the amount of inheritance tax (IHT) that would need to be paid. Failing to address this could affect the total inheritance amount. Additionally, it reduces the large tax bill that the next generation would inevitably face.

- Intergenerational planning addresses "tax-efficiency, control, timing, access, sustaining your standard of living, and protection." Any individual that would leave wealth for their children or grandchildren should ensure that this process serves their families adequately.

Research Strategy

For this research on 'Intergenerational Wealth in the UK,' we leveraged the most reputable sources of information that were available in the public domain, including Russel Investments, Headway Wealth, Law Society, Barclays, among others.