Part

01

of one

Part

01

Inflation and Investing in Real Estate (2)

There are several approaches to hedge against inflation - which is the erosion of nominal currency value over time. Real estate investment is one such asset class that can be used to hedge against inflation. The returns in real estate are thought to be fairly consistent and come in the form of property appreciation of value and rental income.

Key Takeaways

- Compared to other forms of hedging, real estate is a reliable shield against inflation.

- Returns from real estate investments are not the highest, but are consistent when compared to other forms of investment. This makes them ideal for counteracting the impact of inflation.

- The value of property moves congruently with inflation, in general.

- However, regional factors may influence property values in certain geographic locations. As such, external and macroeconomic influences ought to be noted when considering real estate investment.

- Further, rentals are sticky in the short run and tend not to react to inflationary pressures. However, in the medium and long runs, rentals reflect inflationary pressures unless hindered by regulation.

Real Estate as a Hedge Against Inflation

- Inflation is one of the prime issues faced by individuals, financial institutions and other organizations as it reduces purchasing power, standards of living, and returns on investments - thus profitability of businesses.

- To counteract the effects of inflation, organizations and individuals have invested in assets such as real estate, gold, and stocks with the expectation that the nominal value of these assets will rise at the same rate as inflation; thus maintaining the same rate of return - the Fischer Theory.

- Unlike the other aforementioned asset classes, real estate is both an investment and a consumption good. A contemporary study (2020) of returns in each of these asset classes versus inflation shows that real estate provided, not only a hedge against inflation but, a higher return over other asset classes in the U.S. (about 2.7%) since the turn of the millennium.

- Real estate as a hedging tool can be split into two categories: direct and indirect ownership of real estate. Direct ownership, as implied, refers to the holding of title deeds of the underlying property whereas indirect ownership of shares in either listed or unlisted trusts.

- Further, investment into real estate can be split into residential, commercial, industrial, retail, and office real estate sub types. Studies ranging from the late 70s to 2018 in different regions of the world have demonstrated that real estate is a reasonable short run and long run hedge against both expected and unexpected inflation - although in some cases and in specific markets, there was inadequate evidence to support real estate as a viable option.

- While returns in other industries are volatile and, in most cases, declining, returns real estate have remained stable and consistent even through turbulent economic downturns. This supports the idea that, although it may not have the highest returns, real estate is a reliable hedge against inflation.

- It ought to be noted, however, that the ability for real estate to hedge against inflation may be location-dependent and the information used to make hedging decisions ought to be updated regularly. For example, China's real estate market has grown rapidly in the most recent decades but there are significant differences in the ability of real estate holdings to hedge against inflation across regions.

Property Rentals versus Inflation

- There seems to be a significant relationship between inflation and property rental levels in different markets. Regardless, it is reasonable to conclude that rentals move congruently with inflation in the absence of other factors.

- In Europe, for example, the Euro area Harmonised Index of Consumer Prices (HICP) has fluctuated in tandem with rentals as shown in the image of year-on-year percentage changes shown below:

- The above image factors out energy and food since the prices of these are highly dependent on external factors in addition to inflation.

- However, this is not to suggest that rentals move with inflation universally. In the US, inflation impacts the value of assets and, in the case of real estate, the value of the property. However, rentals and mortgages are fairly stagnant in the short run and changes in house prices hardly move synchronously with rentals.

- As such, it must be noted that, while inflation significantly impacts changes in rentals, regional rental and house pricing changes may not be used to estimate regional inflation differences.

- Regardless, in the long run, landlords tend to react significantly to inflation. Granted, there are limitations to change in rentals in the short run, leases tend to factor in rental changes annually or biennially. Unless regulations regarding rentals are enforced, as happens in the U.S. and in Europe (for example, Ireland), inflationary pressures result in the rise of rentals - thus augmenting real estate as a hedge against inflation.

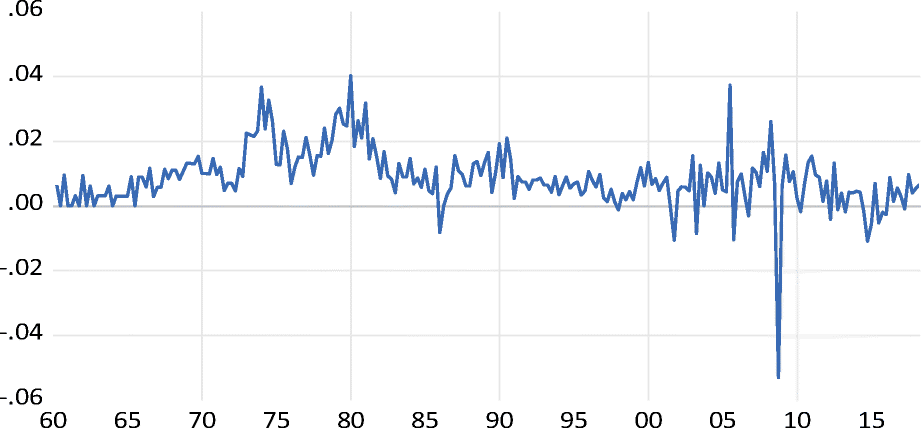

This is demonstrated quite profoundly in the US market. Not only are nominal rentals increasing, but when contrasted with inflation, real rentals are rising and have been since the 60's — with an exception in the wake of housing bubbles. In the same period, inflation rates have been fairly stable.

Research Strategy

While quotes and soundbites from internationally recognized figures or corporations may be convincing to most, the most reliable sources of verifiable information tend to be peer-reviewed journals and other academic sources. As such, to explore the viability of real estate as a hedge against inflation, we focused on multi-generational scientific studies to investigate how real estate has managed against inflation over the most recent decades. Despite global recessions and housing bubbles, evidence suggested that real estate remains a formidable and robust investment strategy.