Part

01

of one

Part

01

Indoor/Outdoor House Plant: Wellness and Expressionists

Key Takeaways

- It was estimated that the US houseplants market had a size of $12.78 billion in 2020.

- It was estimated that the US wellness houseplant market had a size of $2.81 billion in 2020.

- From estimates, the US expressionist houseplant market had a size of $2.68 billion in 2020.

Introduction

This report provides the following details for the wellness and expressionist audience segments of the US houseplant market: a description of the audience, a description of the indoor versus outdoor market sizes, the number of people who belong to the audience, and the indoor versus outdoor sub-audiences. Insights into the purchase decision-making and behavior of each separate audience and sub-audiences were unavailable from public sources. Instead, insights into the purchase decision-making and behavior of the entire US houseplant consumers market were provided.

The size of each audience and sub-audience of the US houseplant consumers market was unavailable from public sources. However, by making logical assumptions and calculations, the research team was able to estimate the size of each audience and sub-audience. The details of all assumptions and calculations made, as well as the research strategy used in providing these estimates, are available in the research strategy section below.

US Houseplant Market — Wellness Audience

Wellness Audience — Who Are They?

- This audience is concerned about well-being and sees keeping houseplants as a way to improve their personal well-being. This is why the major motivation behind the decision of this audience to purchase houseplants is wellness, especially mental health. Across different surveys, mental health improvement, better air quality, and happiness were often identified as benefits of having houseplants. For example, in a 2021 consumer report coordinated by the Floral Marketing Fund and co-sponsored by five other firms, most houseplant owners admitted that houseplants make them happier.

- Young people make up an important part of this audience. In 2020, Articulate, in collaboration with OnePoll surveyed 2,000 US millennials. Almost half (47%) of the respondents said they own houseplants because they help to improve air quality.

- Similarly, Trees.com recently surveyed 1,250 American adults and found that 54% of 18 — 24-year-olds who started keeping houseplants during the pandemic did so because they wanted to improve their mental health.

- It is estimated that the US indoor wellness houseplant market has a size of $1.18 billion.

- It is estimated that the US outdoor wellness houseplant market has a size of $1.63 billion.

- The US general (indoor and outdoor) wellness houseplant market is estimated to have a size of $2.81 billion.

Indoor vs Outdoor Market Sizes

Audience Size (Number of People)

- It is estimated that there are 15.75 million indoor wellness houseplant consumers in the US.

- It is estimated that there are 21.75 million outdoor wellness houseplant consumers in the US.

- The total number of wellness houseplant consumers in the US is estimated to be 37.5 million.

US Houseplant Market — Expressionist Audience

Expressionist Audience — Who Are They?

- This audience is concerned about the appearance and decoration of their spaces and sees keeping houseplants as a way to improve the aesthetics. This is why the major motivations behind the decision of this audience to purchase houseplants are things such as to complement the home decor, to make a space look beautiful, to be able to look at something beautiful. The audience is spread across different age groups, as revealed by different survey findings. For example, half of the respondents from the Tree.com survey said they owned houseplants because it complements the overall aesthetic of their home decor.

- Similarly, Stoneside surveyed 1,000 consumers in 2020 and found that most of the surveyed plant owners identified decoration/ambiance as the reason they had houseplants. This response was consistent across different generations.

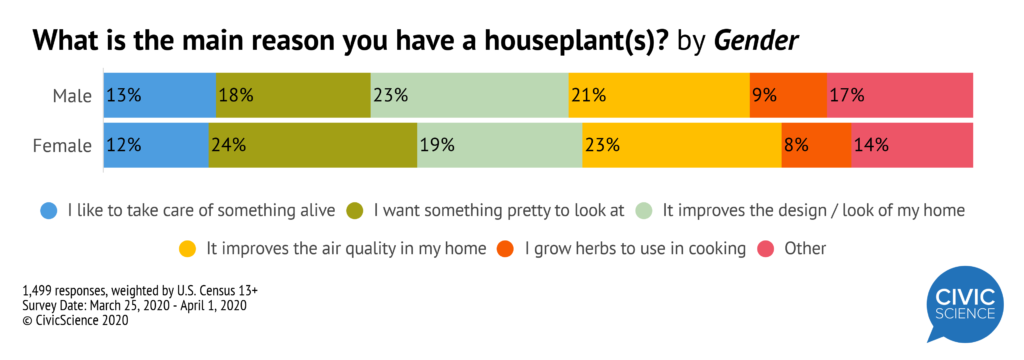

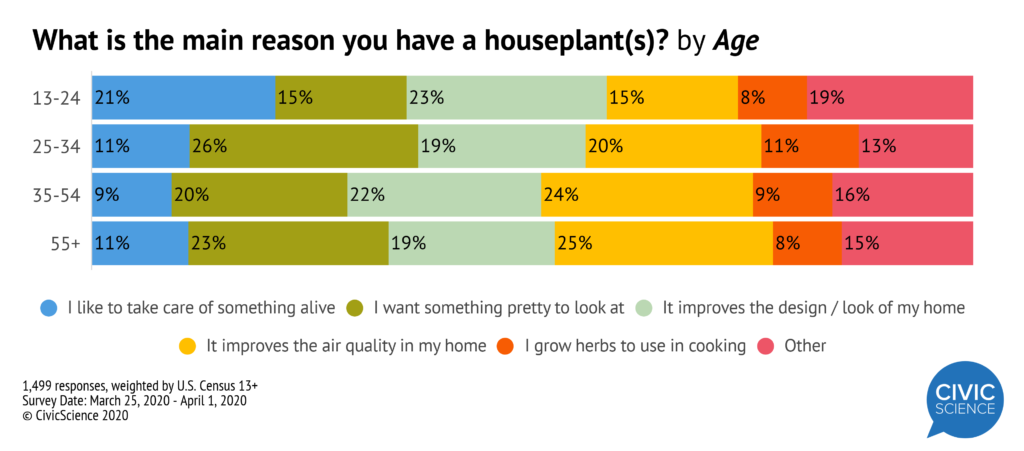

- Similarly, CivicScience conducted a study of American consumers in 2020 and found aesthetic reasons for owning a houseplant, such as improving the design of their homes, were not restricted to any one generation. However, more women than men cited the need to have something beautiful to look at, as one of the reasons for owning a houseplant.

Indoor vs Outdoor Market Sizes

- It is estimated that the US indoor expressionist houseplant market has a size of $1.13 billion

- It is estimated that the US outdoor expressionist houseplant market has a size of $1.55 billion

- The US general (indoor and outdoor) expressionist houseplant market is estimated to have a size of $2.68 billion.

- Audience Size (Number of People)

- It is estimated that there are 15.04 million indoor expressionist houseplant consumers in the US.

- It is estimated that there are 20.76 million outdoor expressionist houseplant consumers in the US.

- The total number of expressionist houseplant consumers in the US is estimated to be 35.8 million.

Behavior and Purchase Decision Insights

- According to Floral Marketing Fund’s 2021 survey of over 1,700 US houseplant consumers, about 85% of houseplant consumers have at least one social media account, but most of them (67%) do not follow any houseplant retailer on social media, neither do they follow any organization associated with houseplants.

- Only 18% of consumers who view the social media of a houseplant business make frequent purchases from the business they viewed, while 19% make infrequent purchases.

- Garden Centers and Home Improvement stores are the most preferred houseplant shopping locations for US houseplant consumers and the most common factors they consider in choosing a purchase location for houseplants are convenience, price, and available selection of products.

Houseplant Owners Population

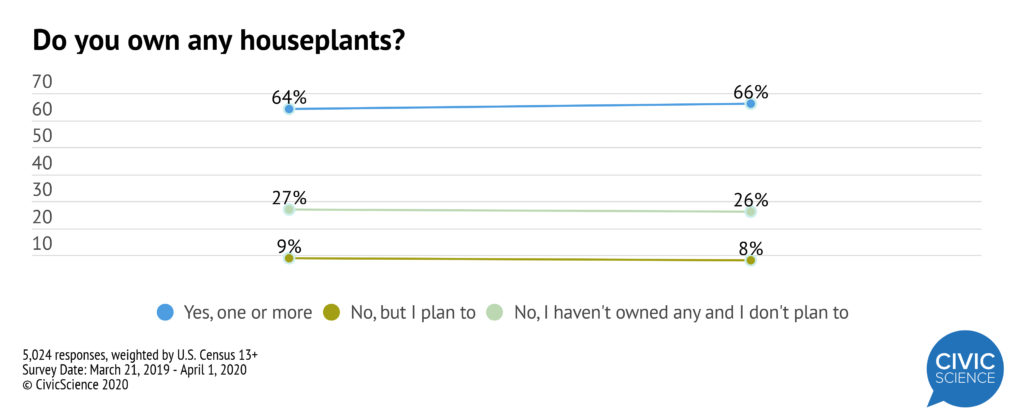

- CivicScience found from its consumers’ study that 66% of US consumers own houseplants.

- According to Statista, 33.1 million US households were involved in indoor houseplant gardening in 2019. In 2018 and 2017, the figures were 34.4 million and 37 million, respectively.

Amount Spent on Houseplants

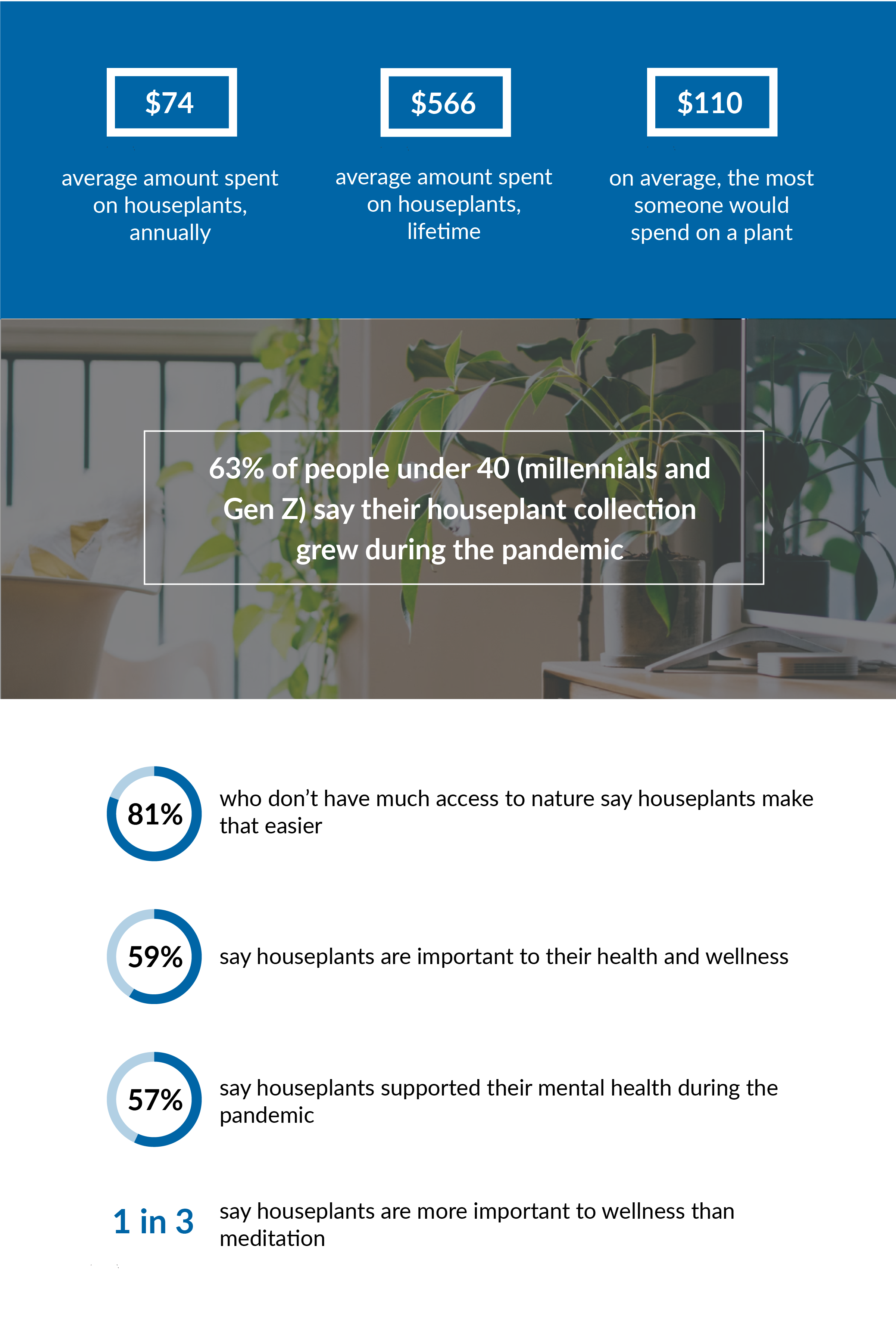

- In October 2021, CraftJack surveyed 1,111 Americans and found that the average amount an American consumer spends on houseplants every year is about $75. Moreover, another survey showed that $111 and $112 were the average annual spend on the two houseplants with the highest average spend per year.

Reasons for Buying Houseplants

- In CraftJack’s survey, 59% of respondents said houseplants are important to their health and wellness, and 57% said houseplants supported their mental health during the pandemic.

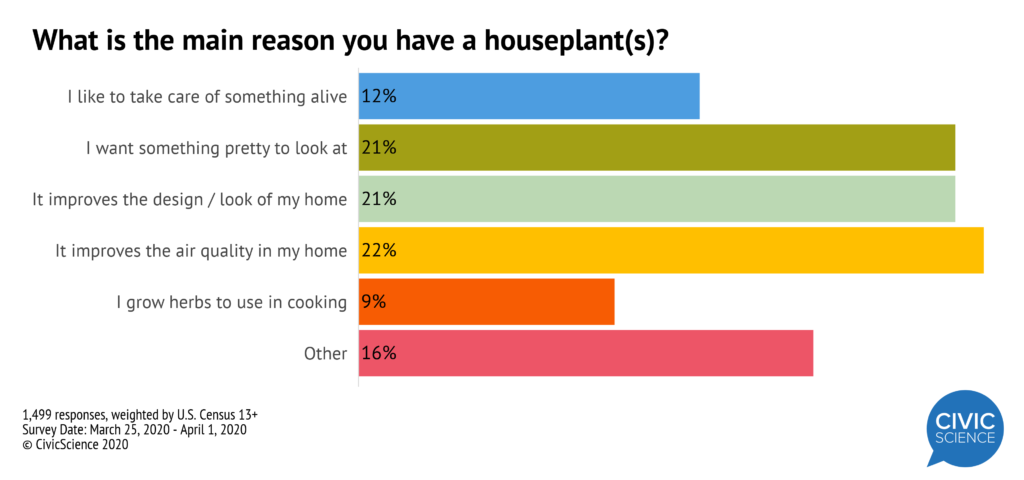

- In CivicScience’s survey, consumers were asked the main reasons why they had houseplants. The following answers were obtained.

- The National Gardening Survey showed that in 2020, there were 18 million new gardeners in the US. These new gardeners started gardening because, among other reasons, it was good for their mental health (49%), and they wanted to beautify their home or landscape with plants (43%).

Research Strategy and Calculations

The research team began by performing a direct search for the size of the US houseplants market, broken down into its various audience segments. Such data or any generalized information on the US market was unavailable from public sources, except reports on the size of the global indoor plants market, such as this one.

Next, the research team began to search for surveys, third-party studies, and findings that provided any statistics on the US houseplant market. This approach yielded results such as the National Gardening Association survey, CivicScience’s houseplant owners’ survey, the Consumer Houseplant Purchasing Report 2021 by the Floral Marketing Fund, and others. However, these reports did not provide any figures for the size of the US market, the wellness and expressionist segment, or the indoor and outdoor sub-segments.

Nevertheless, by following a stepwise approach and making some logical assumptions, the research team was able to estimate the sizes of the US houseplant market, the wellness and expressionist segments, as well as the indoor and outdoor subsegments. The steps taken, the assumptions made, and the calculations performed are outlined below. Unfortunately, throughout the research, insights into the purchase decision-making and behavior of each segment were unavailable from public sources. Instead, insights on the general US houseplants market were provided.

Note: In the following calculations, 2020 was taken as the base year and all figures were rounded to 2 decimal places.

Step 1: Estimate the US houseplant market size:

- The size of the US houseplant market is the result of multiplying the number of houseplant buyers/owners by the average amount a consumer spends on houseplants in a year.

Number of houseplant buyers/owners:

- From CivicScience’s findings reported above, 66% of US consumers own houseplants.

- According to the US Census Bureau, in 2020, there were 258.3 million adults in the US.

Note: For the purpose of this research, a consumer is assumed to be anyone in the US who is at least 18 years old.

- The number of houseplants consumers in the US, then, is 66% of 258.3 million = 0.66 * 258.3 million = 170.45 million.

- As already stated above, the average annual spend of a US consumer on houseplants is $75. Therefore, the size of the US houseplant market = $75 * 170.45 million = $12,783.75 million, that is, $12.78 billion.

- To put the above figure in perspective, Statista reported that the size of the US plant and flower growing market was $15.23 billion in 2020.

Step 2: Estimate the US houseplant market segmentation (Indoor vs Outdoor):

- As already stated above, 33.1 million US households were involved in indoor houseplant gardening in 2019. From the image provided, it is evident that the figure changed only slightly from 2018 to 2018. Moreover, from 2010 to 2019, the figure varied between 31 million and 38 million.

- To estimate the 2020 value, the average of the last 5 years in the image was taken.

Note: This is based on the assumption that since the figure shows no clear trend of growth — negatively or positively, the 2020 value will be close to the average value of the last 5 years.

- The 2020 value, then, is (36 + 38 + 37 + 34.4 + 33.1) million/5 = 178.5 million/5 = 35.7 million. Therefore, 35.7 million US households were involved in indoor houseplant gardening in 2020.

- According to the Pew Research Center, in 2020, there were 126.8 million US households.

- Now, the market segmentation (indoor vs outdoor houseplants) is the share of US houseplant consumers that purchase indoor houseplants versus the share that purchase outdoor houseplants. Unfortunately, these breakdown figures are unavailable and there is no sufficient data to estimate them directly. However, the research team made another creative assumption to find an alternative solution:

Assumption: Since households comprise individual consumers, it is assumed that the share of households that purchase indoor houseplants versus the share that purchase outdoor houseplants can be a fair approximation of the market segmentation, to a reasonable extent.

- Following the above assumption, it can be said that 66% of US households own houseplants (since 66% of US consumers own houseplants). That is, 0.66 * 126.8 million = 83.69 million.

- That means in 2020, 83.69 million US households owned outdoor houseplants or indoor houseplants, or both.

- As calculated above, in 2020, 35.7 million US households were involved in indoor gardening/owned indoor houseplants. In terms of percentage share, this represents (35.7/83.69) * 100% = 42.66%.

- Therefore, the share of US households that owned outdoor houseplants in 2020 = 100 – 42.66% = 57.34%

- Following the last assumption, it can then be said that 42.66% of US houseplant consumers own indoor houseplants, and the remaining 57.34% own outdoor houseplants.

Step 3: Estimate the share of US houseplant consumers by audience/category (that is, wellness vs expressionist)

- The results from CivicScience’s survey was used in estimating the share of houseplant consumers by category. The others are not used because the results are either highly focused on new houseplant buyers (in the case of the National Gardening survey results) or focused on the effects of the pandemic (in the case of CraftJack’s survey results). CivicScience’s survey results are more generic and cover a wide age range.

- The results from CivicScience’s survey are shown again below, for convenience and easy reference.

Assumption: Since the reasons identified above are stated to be the main reasons for having houseplants, it is assumed that the share of the respondents who identified reasons associated with expressionists can be a fair approximation for the expressionist houseplant consumers’ market share. Also, the share of respondents who identified reasons associated with wellness can be a fair approximation for the wellness houseplant consumers' market share.

- Reasons associated with expressionists:

- Something pretty to look at = 21%

- Improves the design/look of my home = 21%

- Average = (21 + 21)/2 = 21%

- Reasons associated with wellness:

- Improves air quality in my home = 22%

- Following the last assumption, it can then be stated that expressionist houseplant consumers have a share of 21% of the US houseplant market and wellness houseplant consumers have a share of 22% of the US houseplant market.

- As calculated earlier, there are 170.45 million houseplant consumers in the US, and the US houseplant market size is $12.78 billion.

- Using the market share figures above, then,

- There are 0.21 * 170.45 million = 35.8 million expressionist houseplant consumers in the US. From the conclusion of step 2 above, 42.66% of this population represents the indoor segment. That is 0.42 * 35.8 million consumers = 15.04 million consumers. The remainder represents the outdoor segment. That is 35.8 million — 15.04 million = 20.76 million consumers.

- There are 0.22 * 170.45 million = 37.5 million wellness houseplant consumers in the US. From the conclusion of step 2 above, 42.66% of this population represents the indoor segment. That is 0.42 * 37.5 million consumers = 15.75 million consumers. The remainder represents the outdoor segment. That is 37.5 million — 15.75 million = 21.75 million consumers.

- The US expressionist houseplant market has a size of 0.21 * $12.78 billion = $2.68 billion. From the conclusion of step 2 above, 42.66% of this market represents the indoor segment. That is 0.42 * $2.68 billion = $1.13 billion. The remainder represents the outdoor segment. That is $2.68 billion — $1.13 billion = $1.55 billion.

- The US wellness houseplant market has a size of 0.22 * $12.78 billion = $2.81 billion. From the conclusion of step 2 above, 42.66% of this market represents the indoor segment. That is 0.42 * $2.81 billion = $1.18 billion. The remainder represents the outdoor segment. That is $2.81 billion — $1.18 billion = $1.63 billion.

,quality(85)/f/54992/800x1684/ff87d22ae1/stoneside-plant-love-article-infographic-1-202008.png)