Part

01

of one

Part

01

Hydroelectric Turbines Market Analysis

Key Takeaways

- According to a report by Allied Market Research, the global hydropower turbine motors market size was valued at $194.1 billion in 2020, and is expected to reach $422.2 billion by 2030, growing at a CAGR (compound annual growth rate) of 8.1% from 2021 to 2030.

- Research findings indicate that there is still room for hydro to grow even though many nations such as the U.S. have already developed their suitable hydro resources. Growing economies in Asia and Latam are the ones having planned hydro power projects, indicating that there are still more potential rivers for building hydro plants.

- Non-economic barriers, including lengthy permitting processes, high risk and costs of environmental assessments, and local opposition discourage investors and impede the development of hydropower resources.

Introduction

The research report provides a detailed overview of the hydroelectric power turbines market, calculations of the estimated current hydroelectric power turbine market size, competitive landscape and business model analyses, and insights into the future of hydropower. The competitive landscape covers the following companies ANDRITZ Hydro, Sinohydro Corporation, Toshiba Energy Systems & Solutions Corporation, and Voith GmbH.

HYDROELECTRIC POWER TURBINES OVERVIEW

There are two main types of hydroelectric turbines — impulse and reaction turbines. Reaction turbines further divide into propeller turbines, gravity turbines, Kaplan turbines, and Francis turbines, while impulse turbines divide into Pelton turbines and Cross-flow turbines.

TYPES OF TURBINES AND USE CASES

REACTION TURBINES

- Reaction turbines fall into two distinct categories based on water flow direction, i.e., inward or outward. In inward reaction turbines, water flows through the runner from outwards to inwards, on the contrary, outward reaction turbines generate electricity from the water that flows through the runner from inwards to outwards.

- Reaction turbines are further divided into propeller turbines (Kaplan turbines, Bulb turbine, Straflo turbine, and tube turbine); the Francis turbine; and the Kinetic turbine.

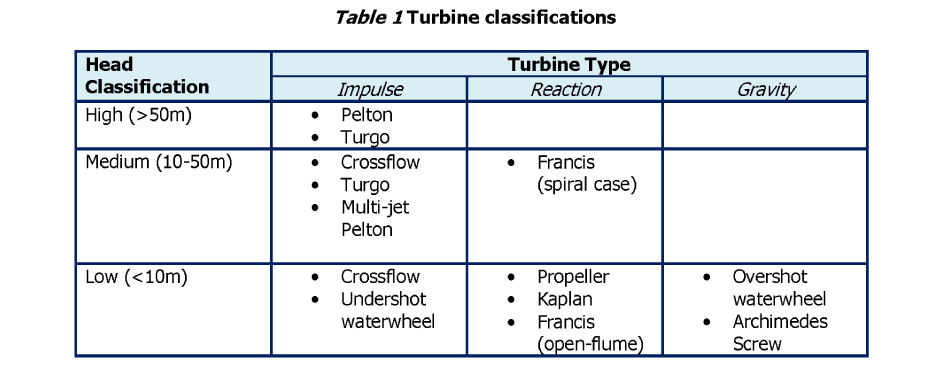

- The image below provides an overview of hydroelectric turbines by type and head classification

- The propeller turbine is a variation of the inward flow reaction turbine and has a propeller-shaped runner similar to the propeller seen on ships and submarines.

- Propeller turbines are commonly used in sites with high flow rates. Below are overviews of the common types of propeller turbines in the market.

- The Kaplan turbine is commonly used in hydropower plants for electricity generation. These turbines feature adjustable blades and automatically adjusted wicket gates for a wider range of operations.

- Kaplan turbines are highly efficient in low head/high flow applications.

- Bulb turbines feature a compact design that combines both the turbine and generator to form a sealed unit. The compact design saves space but makes it hard to access the turbine for service.

- These types of propeller turbines are placed directly in the water stream and require specific air circulation and temperature conditions to operate efficiently.

- Just like the Bulb turbine, the Straflo turbine also features a compact design with the “generator built into the rim of the turbine runner.”

- Its generators are kept outside the water channel. The unique design makes the Bulb turbine ideal for use in low-head sites.

- In the tube turbine design, the penstock bends just before or after the runner to allow a straight-line connection to the generator.

Propeller Turbines

Kaplan turbine

Bulb turbine

Straflo turbine

Tube turbine

- The Francis turbine is a modified version of the propeller turbine and most popular type of turbine deployed across hydroelectric plants and sites with high head applications that range from 130 to 2,000 feet.

- A Francis turbine consists of a runner with about nine or more fixed blades that spin when water is introduced above, around, and through the runner. For medium-head schemes, the runner is installed in a spiral casing with internal adjustable wicket gates.

- The turbine is ideal for sites with over 100 kW output. It also works well in both horizontal and vertical orientations

- Before the arrival of the propeller turbines, the Francis turbine provided greater efficiency and became the industry leader in the hydropower market.

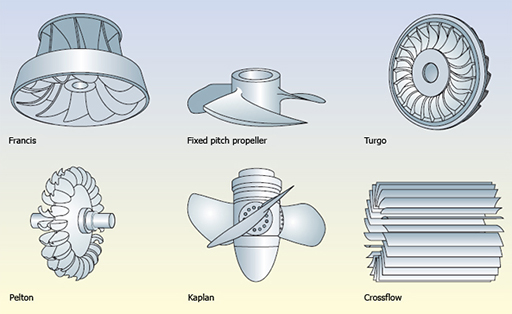

- The image below illustrates the different types of hydroelectric turbines

Francis Turbine

- Kinetic energy turbines are a type of reaction turbines also called free-flow turbines. These types of turbines “generate electricity from the kinetic energy present in flowing water rather than the potential energy from the head.”

- Since these turbines rely on kinetic energy, they use the water stream's natural pathway; hence, do not require diversion of water through man-made channels, riverbeds, or pipes.

- Because these turbines depend on the kinetic energy of the flowing water, they can operate in man-made channels, ocean currents, rivers, and tidal waters.

- Gravity turbines use gravity and water channeling to rotate a runner.

- These systems are ideal for low head applications because they require low rotational speeds which minimizes the potential of fish passing through.

- They are also relatively cost effective because they do not need water jets or precision rotor blades to be efficient.

- Examples include the Gravitational Vortex and the Archimedes Screw turbines that use gravity to generate rotational motion.

Kinetic Turbines

Gravity Turbines

IMPULSE TURBINES

- Impulse turbines use the velocity of the flowing water to spin the runner and discharges at atmospheric pressure. Once high velocity water hits the runner, it flows out the bottom of the turbine casing.

- These turbines are suitable for high-head, low-flow applications and fall into two main categories, Pelton and Cross-flow turbines.

- In Pelton turbines, “pressurized streams of water via nozzles are directed towards a series of spoon-shaped impulse blades, also called buckets, at splitters which divide the water jet into two streams.”

- These types of systems do not require draft tubes because the runners are positioned above the maximum tail water to allow operation at atmospheric pressure.

- Pelton turbines are commonly used at sites with a reservoir of water above and heads above 985 feet.

- Also known as an Ossberger turbine, the Cross-flow turbine design mimics the shape of a drum and has a structure that resembles a water wheel.

- Water enters the turbine from the edge and is moved inward before flowing through the runner and exiting from the inside back out.

- In a Cross-flow turbine, water passes through the turbine blades twice to provide more efficiency in generating power and self-cleaning small particles and debris.

- Due to the drum shape, the Cross-flow turbine is a low-speed turbine system that is suitable for low head and high flow sites.

Pelton Turbines

Cross-Flow Turbine

Major Components of a Turbine

Despite there being different types of turbines, they contain more or the same features. In this section, the summary describes the major components of the Francis turbine, which include a spiral casing, stay vanes, guide vanes, runner blades, and a draft tube.

- The spiral casing acts like the inlet medium of water to the turbine.

- High-pressure water flowing from the reservoir or dam passes through this pipe.

- Stay vanes help to guide the water to the runner blades.

- These vanes stay fixed in their position to reduce the swirling of water because of radial flow; hence, they help maximize the turbine's efficiency.

- The image below shows a stay and guide vane

- Guide vanes are not fixed and vary their angle to control the angle of water striking the turbine blades to increase the efficiency. The image above shows a guide vane.

- These vanes also control the flow rate of water into the runner blades to regulate the power generated depending on the load on the turbine.

- Runner blades affect the performance and efficiency of a turbine depending on their design. In a Francis turbine, the blades fall into the upper and lower parts.

- The lower blades use the impulse action of water to rotate the turbine, while the blades in the upper half use the reaction force of water flowing through to rotate the turbine.

- The impulsive and reaction make the runner to spin.

- The draft tube is a tube of increasing area that is used to discharge the water from the exit of the turbine.

- One end of the draft tube is connected to the outlet of the runner, while the other end is sunk below the level of water in the tail-race.

Spiral casing

Stay vanes

Guide Vane

Runner blades

Draft Tube

Pricing and Lifespan for Turbines

- Based on power output, the installed cost ($/kW) for conventional hydropower turbine that generates about 50 MW is estimated to cost from $1,000-$5,000 ($/kW).

- Microhydro systems that generate less than 0.1 MW cost from $4,000 — $6,000 ($/kW).

- Run of river hydro systems that generate about 10 MW cost approximately $1,500- $6,000 ($/kW).

- The installed cost ($/kW) for pumped storage systems that generate over 500 MW cost about $1,010-$4,500 ($/kW).

- The U.S. National Hydropower Association estimates the lifespan of hydro systems to be over 50 years.

HYDROELECTRIC POWER TURBINE MARKET SIZE

- According to a report by Allied Market Research, the global hydropower turbine motors market size was valued at $194.1 billion in 2020, and is expected to reach $422.2 billion by 2030, growing at a CAGR (compound annual growth rate) of 8.1% from 2021 to 2030.

- Another Globe News Wire report indicates that in 2019, the global hydropower generation market was valued at $202.4 billion and is expected to reach $317.8 billion by 2027, growing at a CAGR of 5.9% from 2020 to 2027. [9]

- Equally, according to the most recent hydropower turbine market report by Market Watch, the global hydropower turbine market is anticipated to grow at a CAGR of about ~5% over the forecast period, i.e., 2022 – 2030.

- While numerous reports provide conflicting figures, it is evident that from most reports, the anticipated CAGR for the global hydropower turbine market ranges from about 5% to 8.1%.

- Therefore, to estimate the current hydropower turbine market size in 2022, the average of the varying CAGR figures will be used with the 2019 market size value as the base year.

- Using the future value formula [FV=PV(1+i)^n], the current (2022) market size of the global turbines market can be estimated as follows

- Therefore, the global hydropower turbine motors market size in 2022 is valued at about $243.3 billion.

- The image below provides an overview of the global hydropower turbine market

Turbines Market Segmentation

- The global turbines market is segmented based on technology, i.e., reaction and impulse turbines, whereby the reaction turbines segment is anticipated to garner the largest market share over the forecast period. Reaction turbines have the ability to generate maximum power at low water supply and currently, it is estimated that more than 60% of the global hydro power stations use reaction turbine systems.

- The market is also segmented based on capacity, i.e., less than 10MW, 10–100MW, and above 100MW. According to research, the above 100MW segment is expected to garner the biggest market share over the forecast period. This is due to increasing construction of large hydro power stations in major economies of Asia and LATAM, including Brazil, China, and India, which have favorable landscapes to build large power plants.

- The market is also segmented based on region, which include North America, Europe, Asia-Pacific (APAC), Latin America, and Middle East & Africa. Likewise, the hydropower turbine market is also segmented based on application, i.e., commercial and industrial applications, of which, the industrial segment is the most lucrative one.

COMPETITIVE LANDSCAPE AND BUSINESS MODEL ANALYSIS

ANDRITZ Hydro, Sinohydro Corporation, Toshiba Energy Systems & Solutions Corporation, and Voith GmbH & Co. KGaA, are four examples of the leading players in the hydropower turbine market. These four companies are mentioned as key players in most of the market research reports on the global hydropower turbine market. Below are in-depth reviews of each company, including its annual revenue and estimated market share in the global hydropower turbines market.

ANDRITZ Hydro

- ANDRITZ Hydro is a global provider of electro-mechanical systems and services for hydropower plants and is also among the key players in hydraulic power generation. Its website can be accessed here. The company was identified as a key player in the space based on its product and service mix and numerous mentions across market research reports published by reputable vendors like Allied Market Research and Market Watch, among others.

- ANDRITZ Hydro provides a broad range of hydro power turbines. To date, the company has installed over 31,900 turbines — more than 471,000 MW globally. Its proprietary turbine — HYDROMATRIX is designed for low head operations up to 19m. It also supplies Bulb turbines, Francis turbines, Kaplan turbines, Pelton turbines, and Pump turbines.

- ANDRITZ Hydro has not provided a segmentation showing how much it earns from the individual products it sells. Instead, it reports revenue for the entire hydro segment, which includes penstocks, valves, generators, etc. According to the company’s most recent annual report, the hydropower division generated a total of €1.335 billion. Using this figure, we can estimate ANDRITZ’s market share in the global hydropower turbine market as

- The estimated 2022 market size = $243.3 billion

- ANDRITZ’s revenue in the market = €1.335 billion (Equivalent to about $1.52 billion using the xe.com currency converter platform)

- Using the market share formula: Market Share = (Total Sales of the Company / Total Sales of the Market) X 100

- ANDRITZ market share = ($1.52 billion ÷ $243.3 billion) x 100% = 0.625%

- An example of ANDRITZ project includes Inkia Energy’s Cerro Del Águila project in Peru with three 171 MW Francis Turbines generating a total of 513 MW. Unfortunately, ANDRITZ has not published the pricing of its turbines. Interested clients are encouraged to contact the company or visit the nearest local ANDRITZ partner.

- A review of ANDRITZ's distribution model shows that it has operations in more than 280 sites worldwide. In this regard, the company leverages its expansive network to sell and distribute its products.

Sinohydro Corporation

- Sinohydro Corporation website can be accessed here.

- The company was identified as a key player in this space based on its annual revenue from hydrocarbon engineering projects and inclusion in global hydropower turbines market reports published by vendors such as Globe News Wire. Moreover, a review of the company’s offerings aligns with the expected offerings from players in the hydropower turbines market.

- Sinohydro Corporation claims to have qualified contractors for the construction of hydropower engineering projects. They are leaders in RCC dam construction, arch dam construction, concrete gravity dam, installation of large turbine generation units.

- The company’s main products and services include power generating equipment, equipment for power transmission & substation, electric machine, and engineering machinery, among others.

- Sinohydro Corporation has published limited information online regarding its operations and financial performance. Thus, third party vendors like Rocket Reach estimate Sinohydro Corporation’s revenue at $41 billion. Since there is no revenue breakdown showing the amount earned from hydropower turbines, then the whole company revenue cannot be used in estimating its market share because it earns its revenue from various other streams.

- Sinohydro Corporation’s project portfolio includes Tekese Hydroelectric station in Ethiopia, Teleghan Hydroelectric project in Iran, Tianhuangping pumped storage power, and Lubuge hydropower project, among others. The company has not provided any pricing information regarding its turbines. Interested buyers can fill out a form to contact the company suppliers.

- Unfortunately, Sinohydro Corporation has not shared any information regarding its business model, especially how it distributes its products. However, since they encourage potential buyers to fill out a form to reach out a supplier, it is highly possible that this business has a network of global suppliers to fulfill orders.

Toshiba Energy Systems & Solutions Corporation

- Toshiba Energy Systems & Solutions Corporation website can be accessed here.

- The company was identified as a key player in the hydropower turbine market based on its turbine products portfolio and numerous mentions across market research reports, including Market Watch, Allied Market Research, and Research Nester, among others.

- Toshiba Energy Systems & Solutions Corporation claims to offer “high-reliability, high-performance hydro power generation systems that best suit the topographical conditions and customer needs.” The company also provides products and services for other types of renewable energy including geothermal power, virtual power plant (VPP), wind power, and IoT solutions.

- Toshiba’s hydro-turbine systems include both reaction and impulse turbines, including Pelton & Cross-flow turbines, Kaplan turbines, Francis turbines, etc. It also manufactures the various components of turbines, including splitters, runners, blades, transformers, and monitoring systems, among others.

- According to Toshiba Energy Systems & Solutions Corporation most recent annual report, the thermal & hydropower systems divisions are consolidated when reporting revenue. In this regard, the thermal and hydropower systems division at Toshiba Energy Systems & Solutions Corporation generated an estimated $1.54 billion in 2021. Since the revenue is for both the thermal and hydropower systems divisions, it cannot be used to estimate Toshiba’s market share in the global hydropower turbine market.

- Toshiba has delivered over 2,300 hydro-turbines generating more than 62,000 MW and over 1,800 hydro-generators (over 75,000 MVA), to more than 40 countries globally. Examples include Myanmar where it has installed 6 turbines generating 316 MW and Kenya where it has installed two turbines generating 62 MW. The company has not shared any pricing information in the public domain.

- Overall, Toshiba leverages its global presence to power its distribution model. The company has a presence across all continents, with group companies in Japan and overseas. The company has more than 20 branches globally and in Japan.

Voith GmbH

- Voith GmbH website can be accessed here.

- The company was identified a key player in the space following numerous mentions as a key player by global hydropower turbine market reports published by reputable vendors like Allied Market Research and Market Watch, among others.

- Voith claims to have developed, built, and installed hydraulic systems for the development of hydropower systems for more than 100 years. Since its inception, the company has helped accelerate the development of hydropower turbines globally.

- The company’s product portfolio in the turbine segment include Francis turbines, Kaplan turbines, Pelton turbines, Bulb turbines, and pump turbines. Other products include shut-off valves.

- According to the most recent Voith GmbH annual report, during fiscal year 2022-21, the company's hydropower division made an estimated €945 million.

- The estimated 2022 global hydropower turbine market size = $243.3 billion

- Voith GmbH annual revenue = €945 million

- Formula: Market Share = (Total Sales of the Company / Total Sales of the Market) X 100

- Voith GmbH market share = (€945 million ÷ $243.3 billion) x 100% = 0.388%

- Notable projects by Voith GmbH include Hong Ping (China), Wu Dong De (China), Lam Ta Khong (Thailand), and Frades (Portugal), among others. Unfortunately, the company has not shared any pricing information about its turbines.

- Voith GmbH leverages an expansive globally oriented sales and service network to fulfill orders. At the bottom of the hydropower turbines website page, the company claims to be the contact for hydropower turbines and encourages customer to find their regional contact using a filter provided. In this regard, it is highly likely that Voith GmbH has sales agents and distribution centers spread across different regions of the globe.

INSIGHTS INTO THE FUTURE OF HYDROPOWER

Research findings indicate that there is still room for more hydropower projects because existing water development resources have not been exploited fully. Equally, the future of hydropower projects will continue facing numerous challenges and barriers, including lengthy approval processes, local opposition, and changing climatic conditions, among others.

- Research findings indicate that there is still room for hydro to grow even though many nations such as the U.S. have already developed their suitable hydro resources. Growing economies in Asia and Latam are the ones having planned hydro power projects, indicating that there are still more potential rivers for building hydro plants.

- Thus, various reports in the public domain disprove the idea that ‘most rivers that are suitable for dams have been exploited already.’ The growing demand for renewable sources of energy is necessitating the construction of additional generating capacity across regions globally.

- For example, in Canada, there are several planned projects being developed, including the "1,100 MW Site C Dam on the Peace River in northeastern British Columbia (BC), the 824 MW Muskrat Falls development on the lower Churchill River in Labrador, and the 695 MW Keeyask Generating Station on the Nelson River in northern Manitoba."

- Emerging economies, especially Brazil China, India, and Russia still have untapped water resource development that can facilitate the development of future hydro plants. For instance, in China and India, reservoir and pumped-storage hydropower development facilitates integration with variable renewables.

- According to a report by Sustainability Times, more than 500 new hydropower dams are being constructed in protected areas. Moreover, an estimated 260,000 kilometers of major rivers including the Amazon, Congo, Irrawaddy, and Salween rivers are threatened by proposed hydro dams. Overall, existing research in the public domain disproves the idea that ‘most rivers that are suitable for dams have been exploited already.’

- According to a report by the International Energy Agency (IEA), non-economic barriers, including lengthy permitting processes, high risk and costs of environmental assessments, and local opposition discourage investors and impede the development of hydropower resources.

- Delays in construction persist even after the issuance of permits due to unexpected complications like unforeseen civil works issues and lengthy litigation, which can result in increased costs, as well.

- The long economic lifetime of hydropower projects hinders forecasting to determine profitability because of unforeseen market volatility, variations in water availability, and the impact of climate change.

- For the case of brownfield projects, market and regulatory barriers often discourage plant operators from investing despite the potential of improved performance and increased competitiveness.

- Some common market and regulatory barriers affecting brownfield projects include "complex license and concession renewal processes, uncertainty over water regulations, changes to environmental restrictions, and lack of visibility over future market conditions and revenues."

There is Still More Room for More Hydropower Dams

Non-economic Barriers Hinder Development

Research Strategy

To determine the current global hydroelectric turbine market size, the research team leveraged market research reports published by Market Watch, Allied Market Research, Globe News Wire, and Research Nester to estimate the market size and the expected CAGR. These market reports also provided insights into the future of the hydropower market. Further the research team reviewed the U.S. Energy Department website and hydropower technology websites to uncover more information about hydroelectric turbines.

To identify the competitors reviewed above, the research team searched through the market research reports identifying the global key players mentioned in the report. Next, each global key player selected was further reviewed to ensure its offerings fall in the hydropower turbine market. Unfortunately, none of the key players reported earnings from the sale of turbines only, instead, most of their annual reports contained consolidated earnings for the entire hydropower systems division or a combination of the thermal and hydropower divisions. These bundled reporting hindered the team’s ability to estimate the market share of some companies within the global hydropower turbines market. These players also did not mention the price of the turbines they manufacture, and instead require interested clients to fill out a form or contact their nearest sales/distribution agent.