Part

01

of one

Part

01

Homeless Tax

As homelessness increasingly becomes an issue in many areas in the United States, a number of cities (and counties) have enacted various types of taxes to support their homeless programs. Below is a summary of key findings on "homeless tax" in the United States. Details of initiatives to impose such taxes in select cities of five states (plus Denver, CO) may be found in a spreadsheet here. The five states included are California, Florida, Michigan, Oregon, and Washington State. These states are selected based on the widespread of homelessness in their cities. Some of the cities are selected based on their similarities to Austin, TX. For example, San Francisco has seen a number of its companies moving to Austin, making the two cities rivals in hosting tech companies. There does not appear to be any existing homeless tax in any city in Virginia. Thus, this report provides information on additional cities outside of the states mentioned in the initial research that have homeless taxes. Some of the measures covered in this research are implemented by counties and are therefore effective in multiple cities.

Homeless Taxes in Select Cities/Counties

CALIFORNIA

- In November 2018, San Francisco voters approved Proposition C to fund the city's spending on homeless shelters through increases in taxes on businesses operating in the city. Although it went into effect in January 2019, the Proposition faced a legal challenge at the California First Appellate District, which ruled in favor of the Proposition. It is estimated to raise additional $250 million to $300 million beginning 2019. Since its implementation, the city has raised $470 million.

- In March 2017, Los Angeles County voted to approve Measure H to increase sales tax in the county to fund rental subsidies and housing. The Measure aims to combat homelessness. The Measure went into effect in October 2017. Due to their already high sales taxes, the cities of Compton, La Mirada, Long Beach, Lynwood, Pico Rivera, Santa Monica, and South Gate are exempt until each of their existing taxes expires.

- Statewide, there was a proposal for a corporate tax hike in California earlier this year to raise more than $2 billion a year to end homelessness. However, the proposed corporate tax hike was dropped from the bill, which continues to aim at raising the same amount of money address homelessness in the state.

FLORIDA

- Miami-Dade County introduced a homeless and domestic violence tax of 1% on food and beverage in 1993. However, the cities of Miami Beach, Bal Harbour and Surfside are excluded. Of the tax collected, 85% goes to fund the Homeless Trust, which is estimated to receive $11 million annually from the tax.

MICHIGAN

- In November 2015, Kalamazoo County voters approved a 0.1-mill property tax to raise fund to assist homeless families in the county for six years. In 2020, the voters approved another 0.75-mill property tax for another eight years.

- The City of Ann Arbor also approved a 1-mill property tax to fund affordable housing in order to address homelessness. The tax went into effect this year.

OREGON

- In May 2020, voters in three counties that make up the greater Portland region approved "a 1% marginal income tax on the wealthiest residents and a 1% tax on gross profits for the region’s biggest businesses" to raise $2.5 billion over 10 years (that is $250 million annually) to address homelessness. It is set to take effect in 2021.

WASHINGTON STATE

- In October 2020, King County, in which Seattle is located, approved an additional 0.1% to its sales tax to fund "housing for nearly half of the county’s chronically homeless population;" however, several of its smaller cities had already passed their own version of the tax. The county-wide sales tax went into effect in January 2021. It is expected to raise $70 million annually for the county.

- Separately from the county, the Seattle City Council approved a "head tax" on the city's largest employers in May 2018 to combat homelessness. The city planned to impose a tax of $275 per employee on companies with at least $20 million of revenue. However, less than a month after its passage, the measure was repealed by the same city council because of strong opposition from businesses, particularly Amazon.

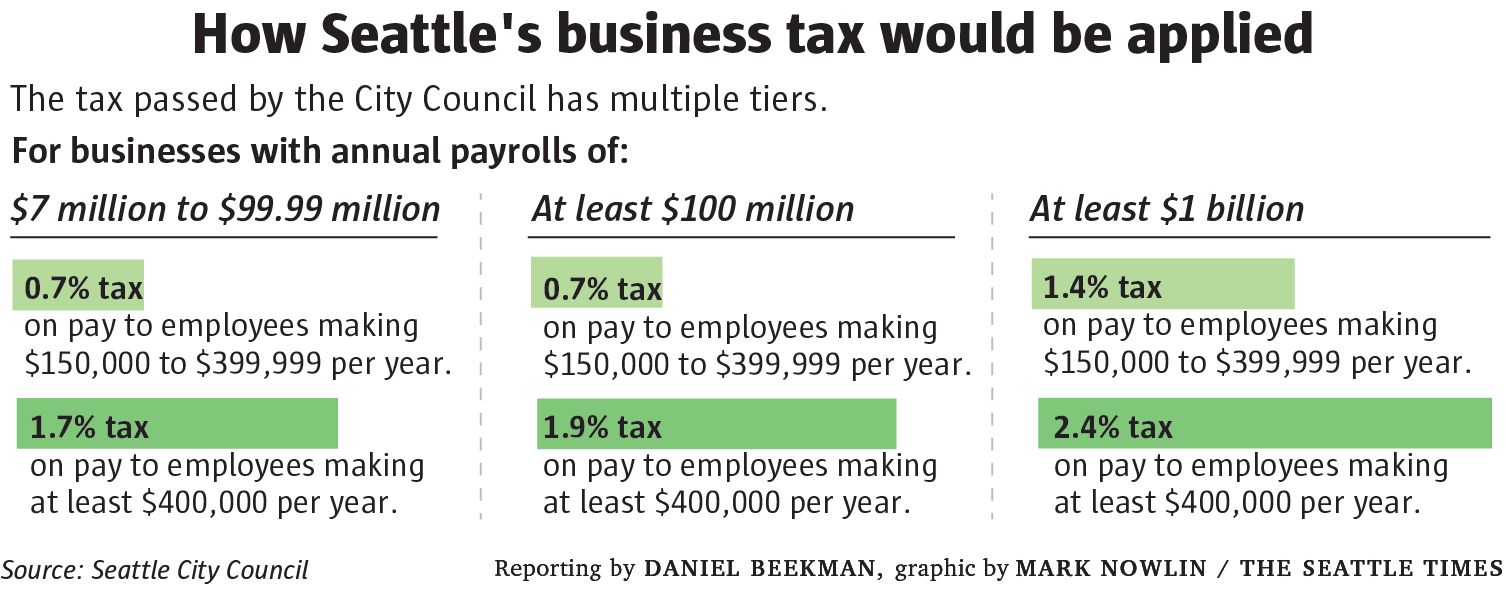

- The city, nonetheless, made another attempt and approved its "JumpStart Seattle" tax, which took effect in January 2021. The tax details may be found in the figure below.

Figure 1

- The cities of Wenatchee and East Wenatchee approved a 1% sales tax "to fund a low-barrier homeless shelter and expanded services for those experiencing homelessness" earlier this year.

Overview of Homelessness in the United States

- Homelessness is a common problem associated with "urban life in the United States." There are many factors contributing to homelessness. According to an academic study of homelessness in Los Angeles, these factors fall into three broad categories: "loss of material resources, loss of family or social connections, and loss of health." Domestic violence, however, is a leading cause of homelessness for women and children.

- An estimate by the National Low Income Housing Coalition suggests that there a shortage of more 7 million affordable homes for those with extremely low income across the country. This group of people live "on the brink of homelessness, and any number of factors could push them over the edge, especially in the most expensive cities."

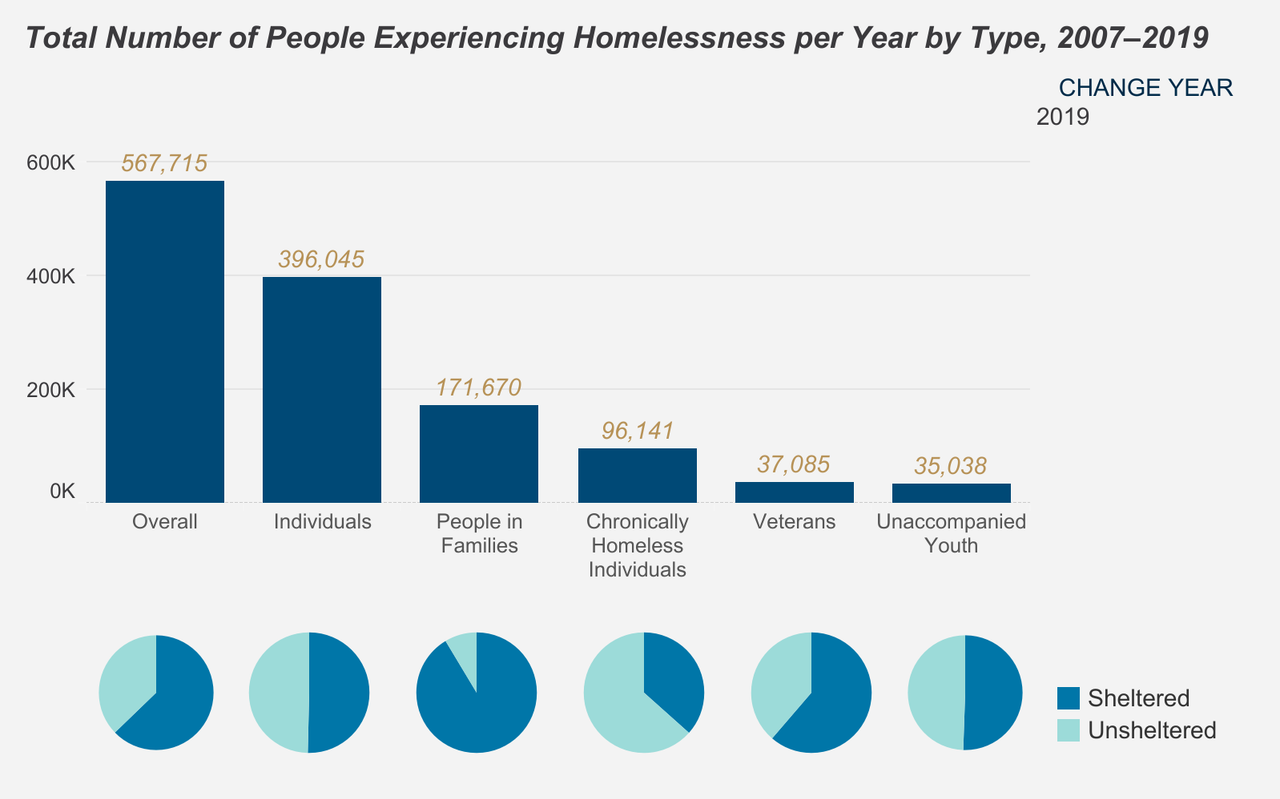

- According to the National Alliance to End Homelessness, there are 567,715 people experiencing homelessness across the United States. Of these, 96,141 individuals are chronically homeless. The figure below breaks down the number of people experiencing homelessness by type (data shown is for 2019 only).

Figure 2

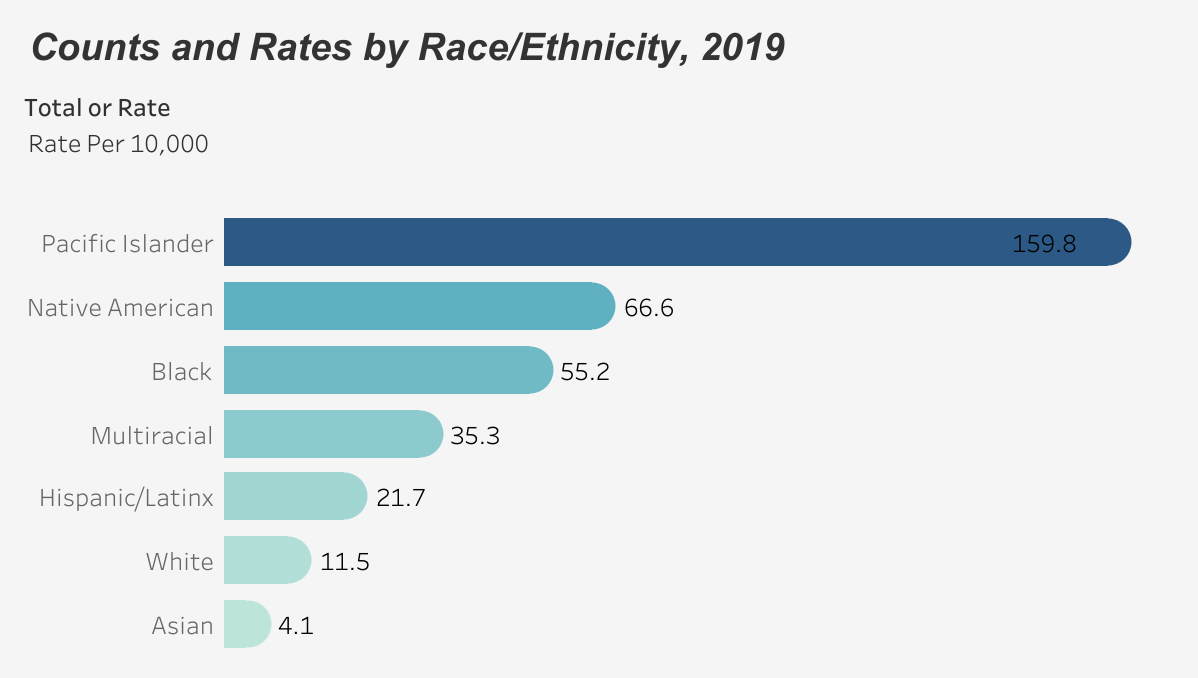

- Data also shows that males are more like than females to be homeless with 60% of those experiencing homelessness are male. "Pacific Islanders and Native Americans are most likely to be homeless in America when compared to all other racial/ethnic groups." The figure below breaks down the rate of homeliness per 10,000 population by race/ethnicity.

Figure 3

- Homelessness is geographically concentrated with 56% of people experiencing homelessness are in the five states that have the largest homeless counts. "The District of Columbia (93 people experiencing homelessness out of every 10,000) and New York (47 out of 10,000) have the highest rates" while "Louisiana (6 out of 10,000 ) and Mississippi (4 out of 10,000) have the lowest rates." The figure below shows U.S. cities with the highest homeless population.

Figure 4

- In 2019, homelessness increased by 3% from 2018--the third consecutive year of national-level increases. However, the national increase is largely attributed to the rise of homelessness in California, which experienced a 16.4% increase for the same period while most other states recorded reductions. On the other hand, long-term data shows that overall homelessness has decreased by 12% between 2007 and 2019. The National Alliance to End Homelessness, however, suggests that the impact of COVID-19 might have wiped out this improvement.

- It is noted that states and cities with the highest homeless rates are associated with housing issues with many of them "having the highest housing costs and highest rent burdens (housing costs as a percentage of income) in the nation."

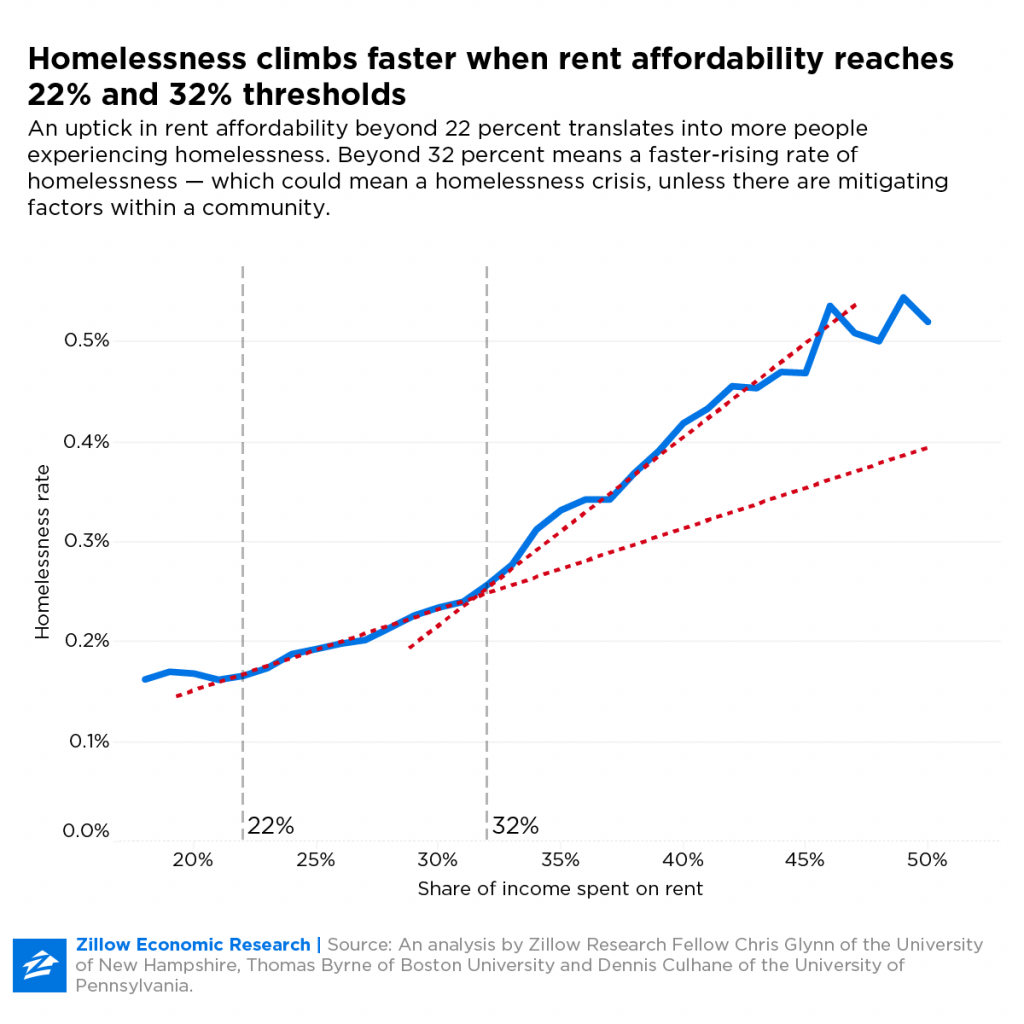

- Similarly, a study by Zillow shows that there is an association between homelessness and rising rent, with areas where people spend more than 32% of their income on rent are likely to experience a more rapid increase in homelessness.

Figure 5

- According to a recent study by a Columbia University professor, it is estimated that the impact of COVID-19 could lead to a 45% increase in homelessness within one year. This may a result of "economic disruption, housing instability, and mass unemployment."

- On the federal level, funding for homeless services is mandated by McKinney-Vento Act of 1987, "which removed permanent address requirements for certain government benefits and created grant programs for emergency shelters and transitional housing." It is the only major federal legislation that addresses homelessness.

- Federal funds go to a number of "public sector programs, nonprofits, and faith-based organizations (FBOs)" to provide homeless services and housing, with FBOs accounting for 30% of emergency shelter beds across the country.

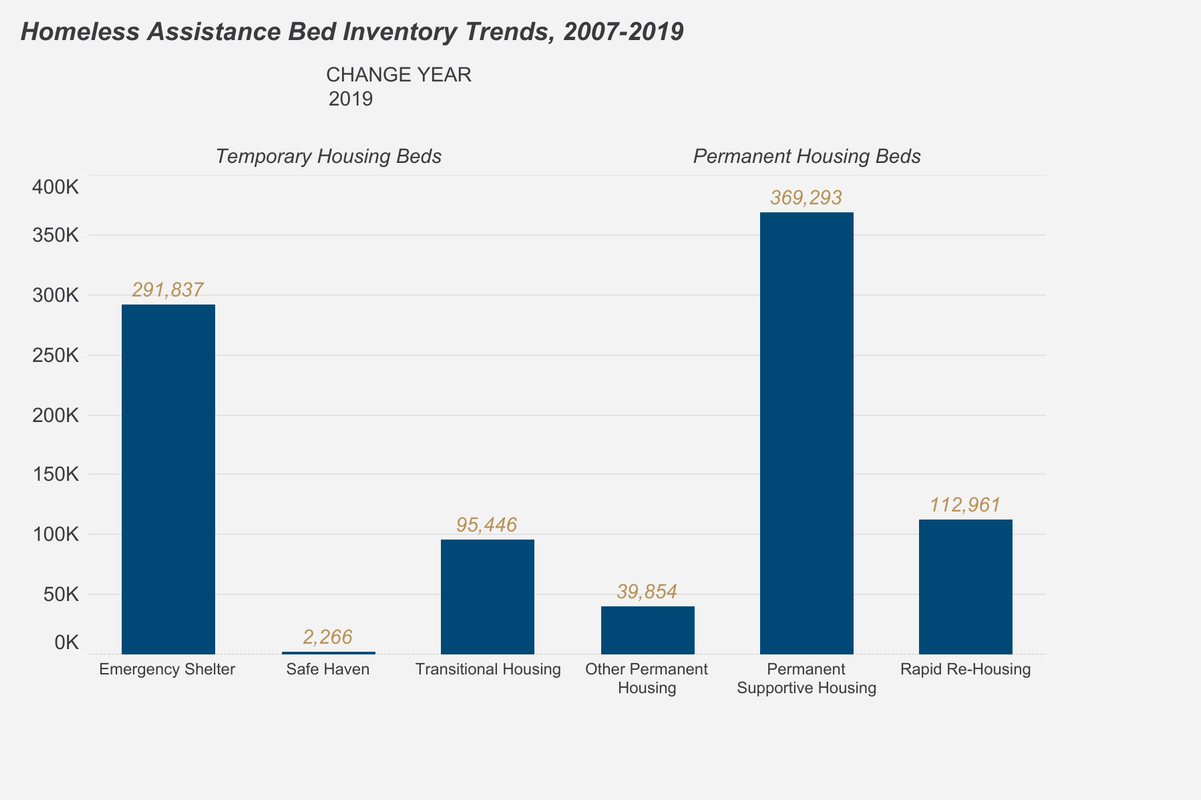

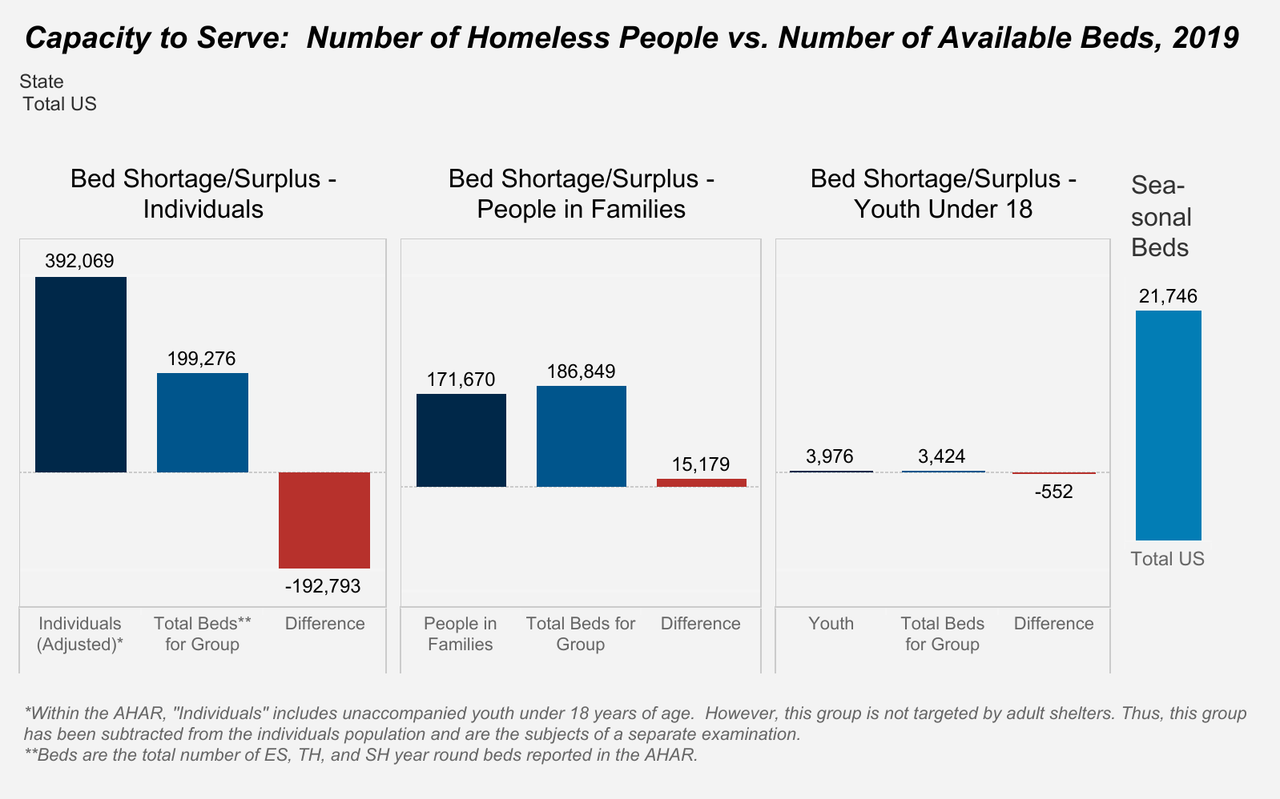

- The most common type of homeless assistance is permanent supportive housing (PSH), which makes up 41% of system beds and has grown by 96% since 2007. The second most common assistance is emergency shelter beds, which have increased by 38% since 2007. The two figures below break down the types of assistance and capacity to serve (data for 2019 only).

Figure 6 (Data Shown for Year 2019 Only)

Figure 7