Part

01

of one

Part

01

High End Textiles

The following research covers the following topics as they apply to the high-end bed and table linens market: market sizes, consumer demographics and psychographics, key industry players, and typical sales and distribution channels.

MARKET SIZINGS

As the aspects of the project cover multiple verticals within the textile market, insights for each element have been provided. Of note, no overlapping triangulations are made to combine the data as there are no parameters which allow for an accurate estimation of how the verticals co-exist. Additionally, some estimates are provided in global or regional terms as segmentation and US-specific market shares were not publicly available. A section has been provided with links to paywalled market data that is likely to include these metrics.

Table Linen Market Size

- According to data from Data Bridge Market Research, the global table linen market is expected to reach $14.02 billion by 2027.

- Given that the market is predicted to grow at a rate of 4.3% during that period, it can be calculated that the current estimated value of the market is $10.89 billion.

- Publicly released excerpts of the paywalled report indicate that the “North America region is expected to hold a dominant position amongst all of the regions worldwide, growing at the highest growth rate and holding the largest share in the table linen market for the forecast period 2020 to 2027.”

- Grandview Research states that the North American region represented 34.5% of the total market in 2018.

- Though data indicates that the North American market is growing, as there were no specific details on how fast, the 2018 market share figure is used in the following estimation.

- Based upon the above data points, it can be estimated that the current value of the North American table linens market is $3.81 billion (10.89*.35).

Luxury Bedding Market Size

- Data from Analytical Research Cognizance (ARC) states the size of the global luxury bed linens market was valued at $2.14 billion in 2019 and was anticipated to grow at a CAGR of 2.5% over a five-year period.

- The North American region represents 26.81% of the total market.

- Thus, the current estimated value of the global luxury bed linen market is $2.25 billion and the estimated current value of the North American market is $573.73 million (2.25B*.2681).

Total Bed Linen Market

- According to Grandview Research, “the global home bedding market size was valued at $73.88 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 9.0% from 2021 to 2028.”

- Of note, it is important to clarify that this market segmentation includes mattresses, bed linens, pillows, and blankets. Of the total market, bed linens represented 31.6% in 2020.

- In 2017, the United States market was valued at $12.37 billion.

- Assuming the growth rate and market share percentage remained steady between 2017 and today, the global market was valued at approximately $57.04 billion in 2017, thus the US represented 21.68% of the total market (12.37 / 57.04).

- Thus, the current United States home bedding market is estimated to be valued at $16.2 billion (73.88*.2168) and of that, $5.06 billion (16.2*.316) would be bed linens.

DEMOGRAPHICS

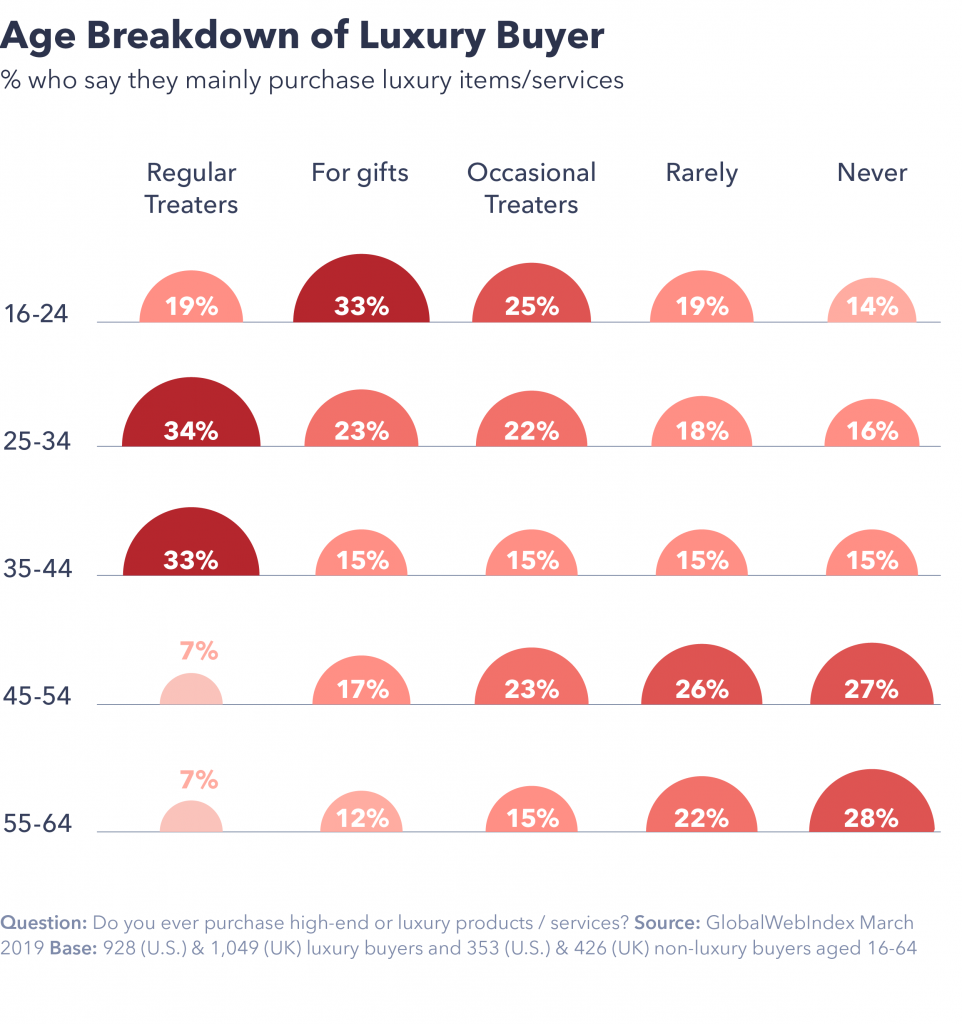

- Data from Media Boom indicates that the target brand audience for luxury goods is a consumer who is between 25 and 44 years of age. This age bracket represents about 64% of the total luxury goods audience.

- The following infographic shows a more in-depth age breakdown of the luxury buyer.

- Of the luxury audience between 25 and 44, 62% of these consumers are men.

- The typical annual income of the luxury goods buyer in this age cohort lies between $100,000 and $249.600.

- A report on the luxury consumer from Agility PR states that “data from Pew shows that Hispanic, African American, and Asian demographics are all growing substantially, while the percentage of white consumers decrease. This has created a shift in which demographics are driving luxury sales, as supported by data from MRI. For example, in 2017, 29% of multicultural consumers owned or purchased luxury brands in fashion, vs. 20% of white consumers”.

- According to government data, among this age cohort, 36.4% hold at least a bachelor’s degree, however given the income data, it is likely that this figure is higher amongst the targeted audience.

- This audience represents a shift over the past decade. “Today luxury brands face a generational shift in the demographics of the target market, from maturing Baby Boomers (born 1946-1964) to Millennials (born 1980-2000). Both generations are about equal size, give or take 75-80 million people, but not of equal spending power. Affluent Boomers have already made their money, accumulated wealth, as well as acquired the luxury lifestyles to which they aspire. Their appetites for luxury has turned primarily to experiences and they simply don’t have much interest in luxury goods anymore.”

- “Among those who primarily purchase luxury items for gifts or special occasions, Generation Z and millennials emerge as the primary demographic; a third fall into the 16-24 age bracket, and just under a quarter into the 25-34 group.”

PSYCHOGRAPHICS

- In the US, bed linen consumers tend to research online before purchasing in-store. 62% state that they perform research online, but 70% purchase in a physical location.

- 65% of consumers purchase home textiles from mass merchants, 40% from chain brands, 29% from department stores, and 28% from specialty stores.

- Report Linker data states that the market is seeing a “penetration of customizable mattresses and bed linens, thereby boosting the market growth. Higher residential growth across regions indicating rising housing construction as well as housing permits is bound to revamp the market demand.”

- Additionally, the Netflix series Bridgerton and its Regency-era decor is credited with inspiring growth and interest in this vertical. “Bridgerton bedrooms alone have gained increased popularity, with an 81% increase in Google search since the show aired, according to a blog by Real Homes as of 17th January 2021. This trend has influenced consumers to adopt layering as adding a mixture of different textures and tones into a bedroom by using cushions, bedsheets, and throws is a simple way to build a luxurious feel. This scenario is likely to offer growth opportunities for the market.”

- According to Lifestyle Monitor, consumers looking for “decorating ideas will find them everywhere from Pinterest to Houzz and even the real estate site, Trulia, which gives young people a step-by-step guide on how to buy bedding like a grown-up.”

- However, 48% of consumers indicate that they get ideas for home textiles as a result of store displays.

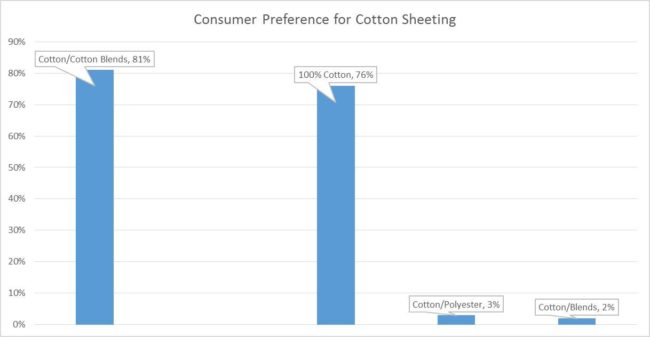

- A Lifestyle Monitor survey indicates that 81% of consumers prefer their bed linens to be made of cotton and cotton blends.

- Further, “the majority of consumers are bothered by fiber substitution away from cotton in their sheets (58%) and are willing to pay a premium to keep their sheets cotton-rich (56%).

- Survey findings indicate that consumers purchase new sheeting about once every two years and 59% state that “softness is very important to their decision-making”.

- Other considerations in purchase decisions are price (54%) and durability to laundering (53%).

- Comfort and technology factors in to the buying process as well. 40% of consumers are interested in wicking or moisture management and 39% look for bacteria resistance and/or temperature control.

- Data from Home and Textiles Today intimates that consumers have little brand loyalty and there is no true brand leader in the home linens market.

- Social Media, chat functions, and artificial intelligence are key customer service drivers among the target audience.

- “29% of those who regularly buy luxury goods (in this audience) prefer the company to have a narrative or story”.

KEY PLAYERS

Analysis of the data above did not reveal any specific leaders in the marketplace. As such, the following key players have been identified based upon their being mentioned as key in multiple market research reports as well as multiple media mentions.

WestPoint Home

- Established in 1813, Westpoint Home manufacturers home fashions in two international facilities. According to their website data, they either own or sell the following brands: Vellus, Martex, Utica, Luxor, Patrician, Grand Patrician, Modern Living, and Gryphon. Additionally, they have licensing agreements for manufacturing with Southern Tide, NostalgiaHome, and Izod.

- WestPoint Home boasts Target, Bed Bath & Beyond, Macy’s, and Home Goods amongst their largest retail customers.

- Further, they have partnerships with hotel groups and airlines to produce and supply linens.

- WestPoint manufactures bed linens (including sheets, comforters, coverlets, and duvet) as well as bath linens (like towels, robes, and rugs), decorative pillows, throws, table linens, and face masks.

- They remain a privately-held company and have between 1000 and 5000 employees.

- WestPoint Home’s annual revenue is estimated to be approximately $754.8 million.

Pacific Coast

- Pacific Coast is a privately-held bedding manufacturer headquartered in Seattle, Washington.

- According to their website, they are the “#1 brand of down and feather bedding in the United States.”

- They have been “creating premium down and feather bedding for more than 125 years. With our most recent addition of European down alternative fiber, we aim to be the most sought-after brand for premium down alternative sleeping products. Pacific Coast is the premier resource for high quality, luxury bedding: down and down alternative comforters, bed protectors, feather pillows, goose down and down alternative pillows, duvet covers, body pillows, feather beds, shams and more.

- “Pacific Coast is the leading supplier of premium down pillows to leading hotels in the United States”.

- The company produces pillows, comforters, mattress toppers, and bed linens like sheets and pillowcases.

- Zippia estimates their annual revenue to be $410.7 million.

Hollander

- Hollander, a privately-held company, has developed and produced high-quality bedding products for over one hundred years with sustainability in mind.

- Their featured brands include Beautyrest, Pacific Coast, Dreamscape, Dreamy Nights, Great Sleep, I Am, Live Comfortably, Chaps, Lauren (by Ralph Lauren), Calvin Klein, and Restful Nights (by Pacific Coast.

- They manufacture comforters, mattress pads, pillows, and foam toppers.

- The company’s 2018 net revenue measured $526.9 million, however with only $523,000 cash on hand, filed for bankruptcy protection in May 2019.

Sferra

- Originally founded in 1891 and based in Edison, New Jersey, Sferra sources the “very finest raw materials to make the finest linens. Sferra is renowned for sourcing the world’s choicest natural fibers and spinning the most gossamer of yarns to weave luxury linens of impeccable quality and comfort. The company was the first to introduce bed linens woven from Giza 45, coveted as the highest grade of Egyptian cotton.”

- Their linens and fabrics have been favorites of the Queen of England, Pope John Paul II, and the White House for state dinners.

- Their products include sheets, pillowcases, shams, blankets, coverlets, quilts, pillows, mattress pads, bath towels, bath rugs, robes, and table linens.

- Dun & Bradstreet estimate the annual revenue of this private company to be $9.4 million.

Frette

- According to their US website, “Frette uses the finest fibers and collaborates with the most skilled Italian artisans to craft products that embody luxury, comfort and creativity. Known for chic, original designs and inimitable finish and feel, Frette linens can be found in the world's most illustrious hotels as well as in the most discerning private homes, yachts and aircrafts. Historically, Frette linens have been featured everywhere from the altar of St. Peter's Basilica to the dining car of the Orient Express, and more than 500 European royal families have slept beneath its sheets. Today, Frette can be discovered at celebrated retailers and more than 1,000 luxury hotels around the world. With a heritage defined by craftsmanship and an outlook rooted in innovation, Frette will continue to outfit the world's most exceptional spaces for generations to come.”

- Some of their hospitality partners include the St Regis Aspen Resort, Ritz-Carlton, Balboa Bay Resort, Loews, The Liberty, and The Ballantyne.

- They produce sheets, pillowcases, shams, fillers, decorative pillows, throws, blankets, bath towels, bath mats, bath robes, and both men’s and women’s loungewear.

- 40% of the company’s revenue is generated in the hospitality sector.

- Estimates on the annual revenue of this privately-held company vary from $35.1 million, $51.71 million, and $55.7 million.

- Additionally, there is mention that at least a portion of the company was acquired by Change Capital Partners in 2014.

Brooklinen

- After being inspired by the comfort of a Las Vegas hotel’s sheets, but not by the sticker price, Brooklinen was “built to deliver simple, beautiful home essentials at a fair price”.

- The company built a direct-to-consumer model in order to offer a sheet with the quality of a $800 price tag for under $200.

- Brooklinen products include sheets, luxe sheets, comforters, pillows, quilts, shams, blankets, bath towels, robes and loungewear.

- Their 2020 annual revenue is estimated at $100 million.

SALES / DISTRIBUTION CHANNELS

- Unfortunately, retail sales channel statistics are not available specific to luxury consumer linens. As such, data for the bed linen category as a whole has been provided as a proxy.

- Both Grandview and Report Linker states that “the offline distribution channel segment dominated the market by accounting for (a) 68.9% share in 2020.”

- Grandview Research indicates the “online distribution channel is expected to register the fastest CAGR of 10.2% from 2021 to 2028. With the advent of online retailers and the increased efficiency of e-commerce sites, consumers are making fewer trips to brick-and-mortar stores.”

As is evidenced both in the research presented above and below, most companies implement a combination of sales channels for distribution of their products. Of note, no data was uncovered which would provide a percentage of sales that occur within the hospitality industry or as a result of them partnering as a brand's exclusive manufacturer, which are both significant sources of revenue for linen brands.

Mass Merchant Examples

- Amazon has listings for multiple high-end offerings from the likes of Sferra and Brooklinen. They also feature table linens from brands like Amenz and Calyvina.

- Bed Bath & Beyond offers high-end sheet sets from Marimekko and Grand Hotel Estate and table linens from brands like Saro and Riegel.

Chain Store Examples

- Pottery Barn has their own branded line of high-end bed and table linens.

- Frette, though a manufacturer, has flagship retail stores in the following US locations: New York, NY; Boston, MA; Sunrise, FL; Aspen, CO; Cabaon, CA; Costa Mesa, CA; Beverely Hills, CA; and Palo Alto, CA.

Department Store Examples

- In addition to their own branded line, Macy’s offers other high-end sheet sets from brands like Fisher West and Sheex.

- Neiman Marcus offers high-end bedding products from brands like Sferra, Frette at Home, and TL at Home and table linens from brands like Matouk, Dian Austin Couture, and Sweet Dreams.

Specialty Stores

- Bedside Manor is a specialty home decor boutique located in Charlotte, NC. They offer a variety of linens from Sferra, Bovi, and Peacock Alley.

- Available in both their on-site resort properties and online, the St Regis Boutique offers the bedding linens, for Frette, featured in their guest rooms.

Online Only Examples

- Brooklinen, as outlined above, is a direct-to-consumer brand offering luxury linens at an affordable cost.

- Linoto is an online only manufacturer and seller of American-made bed, bath, and kitchen linens.

Additional Paywalled Resources

Several paywalled market research reports were located and have been included here as reference in case external purchase of the data is desired.

- Global Table Linen Market to 2019 - Market Size, Development, and Forecasts

- Global Organic Bedding Market, Drivers, Restraints, Opportunities, Threats, Trends, Applications, And Growth Forecast To 2029

- Global Home Bedding Market: Information By Product Type (Mattresses, Pillows, Bed Linen, Blankets and others), By Distribution Channel (Store-Based {Supermarkets & Hypermarkets, Specialty Stores} and Non-Store-Based) - Forecast till 2025