Part

01

of one

Part

01

Print Magazine Production and Distribution Post COVID -19

Thirteen pieces of information, data, and/or statistics surrounding the predicted and already being seen effects of print magazine production and distribution post COVID-19 in the United States, have been curated and presented below. Additionally, we have provided ten pieces of information, data, and/or statistics surrounding why the time is now to take a print edition to digital format, which we have dubbed “the rise of digital magazines”. Where appropriate, we used the perspective of COVID-19 to guide our research. Finally, we curated nine pieces of information, data, and/or statistics surrounding how advertising (sponsorships) is seen as attractive and an advantage to advertisers for digital magazines.

While it was requested that we focus on the Midwest of the United States, with Kansas City, Missouri being home base, this was too niche for this project. After extensive searching, there was nothing publicly available directly tied to this area. However, gathering United States focused data was easily achieved.

Predicted and Current Effects — Print Magazine Production and Distribution: Post COVID-19

- Publisher events, a financial lifeline for magazine and newspaper brands and what has been seen as a smart diversification strategy for publishers reeling from recession-era print advertising losses have come to a screeching halt. For the foreseeable future, at least, events are likely not going to happen until the third quarter of 2020, at best. "Even when they do return, there is reasonable uncertainty how sponsorship and attendee revenue numbers will shake out."

- According to this source, both digital and print publishing are business models that rely on a number of service providers and vendors in order to operate efficiently. The ability to survive relies directly upon distribution channels. The postal service, telecom companies, internet providers and retailers can easily cause issues for digital and print magazines if they do not function properly as they provide the means for readers, subscribers, and members to access content.

- According to the Interactive Advertising Bureau (IAB) in a study they conducted that was published on April 15th, both buyers and sellers of advertising are predicting that advertising revenues will be down significantly for the period covering March through June of this year. This study asked the opinions of publishers, digital media platforms and advertising companies.

- "However, the IAB expects digital advertising will do better than traditional linear TV, print, and other traditional, non-digital advertising channels." IAB is projecting that digital ad revenue will be down nineteen to twenty-five percent versus traditional TV channels and print ad revenues where they are predicting a downturn of twenty-seven and thirty-two percent, respectively.

- Throughout the United States many print publications have been forced to stop producing their print editions, are asking for donations, and/or have laid off staff. Some of those include the Eugene Weekly in Oregon where they are asking for donations, the Portland Mercury which is also in Oregon, where they have suspended printing and moved to online only, laid off 10 staffers, and are asking for donations, and the Palo Alto Weekly in California where they are seeking subscriptions (the site normally has a paywall, which it’s taken down for COVID-19).

- Also in California the Monterey County Weekly has implemented layoffs and salary cuts, the Sacramento News & Review and Chico News & Review have suspended print publishing and laid off nearly all staff across all three sister papers, and the Coachella Valley Independent is asking for donations.

- In Arizona: Phoenix New Times; Colorado: Westword; Texas: Dallas Observer, Houston Press; Florida: Miami New Times (all part of Voice Media Group). All staff salaries have been cut at least 25 percent (35 percent for executives), layoffs "will very likely be necessary", and they are all seeking donations.

- In Utah the Salt Lake City Weekly is seeking donations. In New Mexico the Weekly Alibi in Albuquerque is also asking for donations, and in Oklahoma the Oklahoma Gazette has suspended print publication.

- There are many more instances of the impact of COVID-19 on print production and distribution which can be viewed here, and are all similar to the ones we highlighted in the previous three bullet points.

- "About 1,800 newspapers closed between 2004 and 2018, as the number of people buying print editions dropped. As the journalism industry attempted to adapt to a world where people get their news online, Google and Facebook gobbled up the digital advertising that was barely keeping news organizations afloat."

- Ken Doctor, a media analyst at Newsonomics, which advises organizations on transitioning to digital media, asserts that "This is not a strong industry or a strong set of businesses going into the virus crisis. It was a weak set of businesses that were already badly flagging — that had lost revenue in a 5-10% range in 2019, in a great economy."

- In the decade since the Great Recession, "many regional and local newspapers have been hanging on by a thread, and some magazines have only survived thanks to the investment of wealthy benefactors. But at the same time, digital media has exploded, and scores of new web-native publications have risen (and fallen)."

- There are publications that have already canceled production because of COVID-19, as well as pulling back on advertising, from digital startup The Outline to various local newspapers around the country, most recently three titles that are owned by the parent company of the Los Angeles Times.

Print Magazine to Digital Magazine — The Time is Now

- The publishing industry, like so many other industries, is going digital. Realizing that digital is no longer a fad, an increasing number of publications are exclusively switching to digital or adding digital content to their business strategy.

- According to PaperLit, a tech company dedicated to the development of software products, based on Artificial Intelligence, for content distribution and data monetization, there are eight valid reasons for taking a print magazine to a digital platform. They are: lower costs, global distribution, ability to go viral, interaction, ads hosting, interactive content, convenience for the reader, and sustainability. By going digital a magazine can deliver more earnings, more readers and environmental sustainability.

- A Global Digital 2019 report states that globally, there are 5.11 billion unique mobile users, an increase of 100 million since 2018. That's a lot of people likely accessing digital magazine content from their devices. Even though this was a global source, there are some interesting insights inside about penetration in the United States that we felt might be useful, which is why this source was included.

- As a percentage of all magazine readership, digital magazine readership, increased from thirty-two percent in 2016 to thirty-seven percent in 2018. If this kind of increase continues, digital magazine readership will represent over forty percent of all magazine readership in 2020.

- In this same report, and out of 3,358 people surveyed, Over 42% said they read an average of 2.66 digital magazine issues in the last thirty days. When this is compared to 2016 data, this represents over an eleven percent increase in issues read, just over a two percent increase in penetration, a six percent increase in adults with Internet access, and over an eight percent increase in adults reading digital magazines.

- In 2018, 25.13% of US adults reported spending $2.3 billion per year on digital magazine subscriptions and magazine copies. This is a 16% increase in digital spending since over 2016.

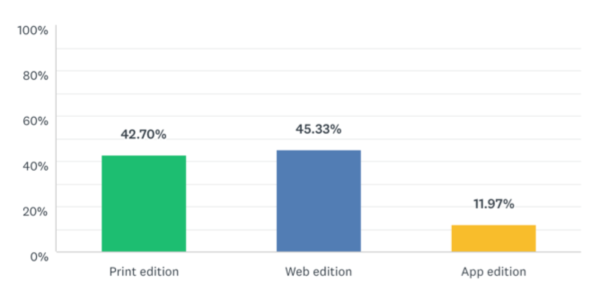

- 57.3% of magazine readers report that their digital edition is the most important to them. This means when coupled with the magazine app, the digital editions reign supreme.

- Among those who choose to subscribe and pay for a publication, Hispanics are extremely likely to use primarily a digital version (45 percent) compared with 34 percent of African Americans and 23 percent of whites.

- When it comes to age differences between the willingness to pay for a print or digital subscription, those differences are what you might expect. Older cohorts like Baby Boomers (age 65+) are much more likely to pay for print before they would consider digital. (Seventy-two percent versus fourteen percent). When you look at GenZ and Millennials (18 to 34) they are actually evenly likely to pay for print or digital (forty-two percent in both areas). "In other words, any forward-looking subscription strategy has to lean more digital, even if the current subscriber base is in print."

- Digitally oriented subscribers are more likely than print subscribers to say the subscription price they pay is not very much (sixty-seven percent versus fifty-six percent). "Roughly 1 in 3 digital and print subscribers say it is a moderate cost."

Advertising in Digital Magazines — Attractiveness and Advantages

- A projected 2.8% decline is projected for the United States ad market according to Interpublic research firm Magna Global. Forty-four billion in ad revenue could be lost just by Facebook and Google because of the COVID-19 crisis, if analysts at investment bank Cowen & Co. are correct.

- Ninety-five percent of people between the ages of 18-29 read a magazine in 2018, according to Magazine Media Factbook. This is higher than the number of Facebook users which sits at eighty-one percent. In the same report, the data asserts that advertising in magazine media increases sales on both print and digital platforms.

- According to this source, there are four main advantages to digital magazine advertising. They are being able to reach readers globally, instant publishing of ads, high levels of interactivity, and higher engagement with readers.

- According to Sara Fischer of Axios, digital publishing, “is doing something it hasn't done en masse since the dawn of the Internet: make money.”

- A UBS survey cited by Yahoo Finance shows "digital ad spending is down nearly 50%, national TV nearly 40%, and print nearly 20%" because of COVID-19.

- US digital advertising revenues are continuing to rise, totaling $124.6 billion for full year 2019 which represents a sixteen percent growth year over year.

- Given the convenience and ubiquity of mobile devices, the percent of time people are spending on phones has been rapidly increasing over the last several years. Publishers and social media platforms understand this and have created attention grabbing applications that advertisers are keen to be part of so they can meet a potential consumer. As such, ad dollars are continuing to shift to mobile devices.

- Video ad revenues on mobile devices now comprise 67.8% of all digital video ad revenues, up from 62.9% in the prior year.

- Media subscriptions are increasing across generations, platforms and genres driving an increase across a wide range of content and topics. From news searches, to music, movies, shows and games, consumers across generations are substantially increasing online activity, which means this is attractive to advertisers.