Part

01

of one

Part

01

HBC Digital Transformation Strategy

Key Takeaways:

- Hudson's Bay Company (HBC) describes itself as a holding company of businesses and investments at the convergence of technology, real estate, and retail operations.

- In 2018, HBC turned to digital transformation to counter and mitigate the effects of the slow retail market at the time that forced it to lay off 2,000 workers in an effort to reduce about $350 million in operating costs.

- In March 2021, HBC launched its e-commerce marketplace, Hudson's Bay Marketplace, which was expected to add over "500 new sellers to thebay.com by the end of 2021."

Introduction:

- This report provides a company analysis for Hudson's Bay Company (HBC) focusing on their digital transformation strategy. Notably, the company does not publish annual reports, probably because it was privatized. Below is an overview of the findings.

Summary of Findings

Overview and Corporate Values

- Hudson's Bay Company (HBC) describes itself as a holding company of businesses and investments at the convergence of technology, real estate, and retail operations. Established in 1670, it claims to be the longest-operating North American company. It has headquarters in Toronto and New York.

- HBC is the majority owner of e-commerce companies Saks (luxury fashion), Saks OFF 5TH (off-price fashion), and Canadian e-commerce marketplace The Bay. It also fully owns operating companies for Saks Fifth Avenue, Hudson’s Bay, and Saks OFF 5TH physical stores.

- Additionally, HBC owns over 40 million square of leasable area in prime locations and top markets across North America, which is managed by HBC Properties and Investments. It offers additional real estate products, including property development company Streetworks Development.

- HBC, states that it strives to enhance and foster sustainable business practices and it is taking strategic action to improve the world. The company also aims to uphold fundamental labor and human rights and reduce its environmental impact through ethical sourcing.

Financials

- According to Forbes, HBC's 2021 revenue was about $11 billion. In 2019, HBC's last official financial announcement placed the annual revenue for the fiscal year at $7 billion. The company's only funding came from a 2017 Post-IPO round that raised $500 million.

Digital Strategy and Executive Quotes

- In 2018, HBC turned to digital transformation to counter and mitigate the effects of the slow retail market at the time that forced it to lay off 2,000 workers in an effort to reduce about $350 million in operating costs.

- HBC's digital transformation efforts focused on structural reorganization to better support its e-commerce strategy. It merged the newly-formed HBC Technology Group with IT to integrate e-commerce platforms with retail technology to "create an omnichannel center of excellence."

- The company also merged its retail and digital marketing departments and formed a new HBC "logistics and supply chain center of excellence" to oversee digital operations functions. Then CEO of HBC, Gerald Storch, said;

- "The company is fully integrating HBC digital throughout the business, so that strategic decisions are made holistically around a seamless in-store and online shopping experience, further supporting HBC's all-channel retail model in the future. As a result of this change, the digital strategy for each banner will be even more tightly integrated into the banners' overall strategy and direction."

- In March 2021, HBC launched its e-commerce marketplace, Hudson's Bay Marketplace, which was expected to add over "500 new sellers to thebay.com by the end of 2021." Iain Nairn, CEO and President of The Bay, said;

- "As part of our digital-first strategy, the launch of Marketplace catapults Hudson’s Bay to the forefront of eCommerce in Canada. We now have the ability to add millions of products to our offering, quickly adapting to customer demand. The response from the seller community has been extraordinarily positive as more and more brands seek to join this modern and convenient shopping experience."

- In August 2021, HBC announced the separation of its e-commerce and 86-store fleet businesses to accelerate its "digital-first transformation." The e-commerce and physical store business began operating as 'The Bay' and 'Hudson's Bay,' respectively. The Bay, under Iain Nairn, was put in charge of marketing, buying, brand direction, technology, and planning for both businesses.

- Indicating that HBC will work towards expansion of its e-commerce business to make it Canada's largest online store, Richard Baker, HBC’s Governor, CEO, and Executive Chairman, said;

- "Establishing e-commerce and stores as distinct businesses is a pivotal next step in the future of Hudson’s Bay. With the launch of Marketplace on thebay.com earlier this year, Hudson's Bay set in motion a rapid expansion of its e-commerce business to gain significant market share and become the country’s largest premium hybrid online shopping experience. To date, digital performance and onboarding of new sellers have dramatically exceeded expectations. Furthermore, this move enables each team to make unencumbered strategic investments into their respective businesses to deliver an incomparable customer experience for Canadians."

Marketing Stack

- All the sources that can provide information on HBC's technology stack, including Techleap, ZoomInfo, and Slintel, either require a subscription or registration. However, a snippet from ZoomInfo showed that the company uses Google Analytics and Google Universal Analytics.

- Third-party publications revealed that HBC's The Bay is powered by Miraki and uses IBM Sterling for order management. and a job advertisement showed that it also uses Salesforce communities.

- Other software used by the company include JavaScript, Microsoft Azure, Backbone.js, Oracle Database, and VB.NET. Additionally, the company uses Ubuntu and Cloudflare CDN.

Challenges/Problems

- Even before COVID-19, HBC was experiencing difficulties due to the decline of the department store industry and a "lack of investment in its online infrastructure." After COVID-19 hit, the company tried to add value to its stock by splitting its physical and online businesses. However, while the company is justified to attempt to boost its stock price, it is doing nothing to improve its main business, the retail segment.

- Also, HBC has faced several legal issues in the recent past, which has affected public perception. In November 2020, a Quebeg judge forced the retailer to pay millions of CAD in rent arrears that had accumulated since March 2020 when it stopped paying rent. In 2021, a similar order was given by an Ontario judge.

- Furthermore, the company was faced with multiple evictions as well as stiff competition from other retailers. In fact, experts attribute the announced closure of its Bloor-Yonge retail location and the expected closures in Winnipeg and Edmonton to the shrinking department store sector and customers' growing preference for trendier and higher-end stores like Holt Renfrew and Nordstrom.

Major Competitors

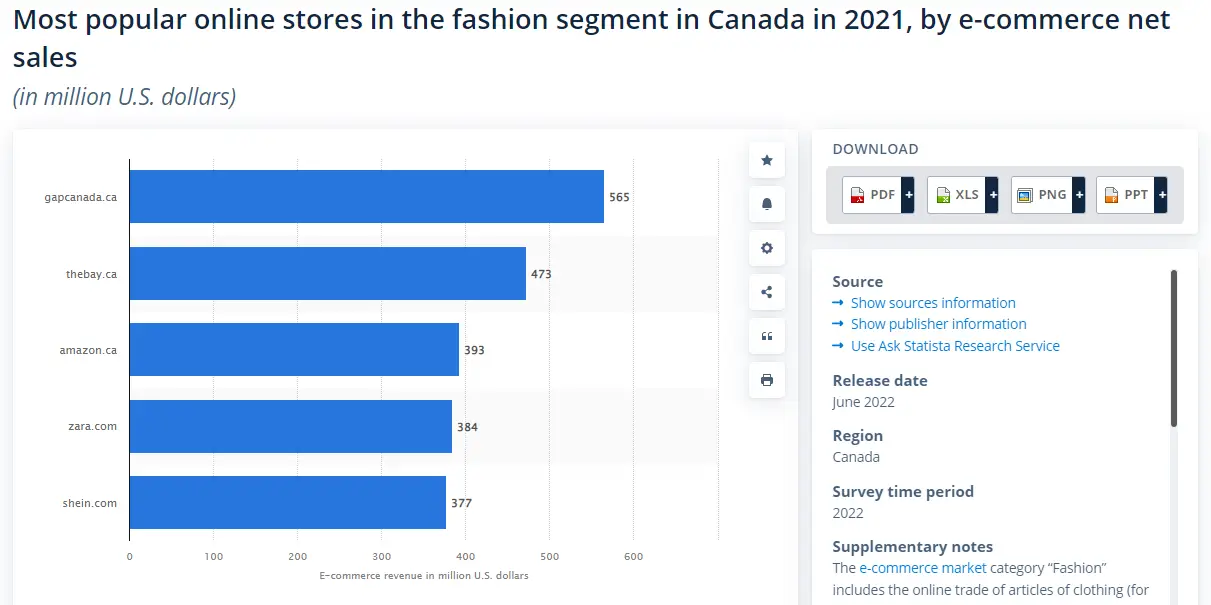

- Gap Canada: This is the largest fashion e-commerce store in Canada, a category in which HBC's The Bay belongs. Gap Canada recorded $565 million in sales in 2021. The Bay was second with $473 million in sales.

- Amazon Canada: This is the third-largest online store in the fashion segment in Canada with $393 million in sales in 2021.

- Zara Canada: This is the fourth-largest fashion e-commerce store in the country with $384 million in revenue in 2021.

- Shein Canada: This wraps up the top-five fashion online retailers in Canada. It recorded $377 million in revenue in 2021.

Relevant Facts

- Hudson’s Bay is among companies that are considering bidding on Kohl's. However, it is facing competition from Sycamore Partners.

- In a move to increase the footprint of its British beauty brand offering, HBC announced that it will increase its "Space NK shop-in-shop locations" in Canada.

Research Strategy

To provide the required information, the research team leveraged HBC's website and press releases as well as credible third-party resources such as CNBC, Fashion United, and Forbes, among others. As aforementioned, all the third-party sources that could provide information on HBC's technology stack, including Techleap, ZoomInfo, and Slintel, either require a subscription or registration. Searching through the website did not produce any useful results. We also expanded to third-party resources such as news articles and tech-focused sites, including G2, but we were unscuccessful in finding all the tools used. Notably, the company does not publish annual reports, probably because it was privatized.