Part

01

of one

Part

01

Global Collectibles Industry

The shifts towards collecting as a form of investing and purchasing collectibles through digital channels are two trends that are currently reshaping how and why consumers engage with the global collectibles industry.

Collecting as Investing

- Collecting as a form of investing was identified as a resurgent trend within the global collectibles industry based on the fact that a preponderance of top-tier media (e.g., CNBC), leading market researchers (e.g., Deloitte) and industry experts (e.g., Antique Sage) are highlighting new, worldwide momentum around purchasing collectibles to diversify investment portfolios and increase overall financial returns.

- The current worldwide climate of economic uncertainly, paired with the fact that stocks and bonds are "priced to perfection" after bottoming during the 2008-2009 financial crisis, is piquing new interest in collectibles as a source for returns and diversification, according to CNBC, Deloitte and Antique Sage.

- Antique Sage and Deloitte attribute this renewed, "widespread investor interest" in collectibles to the fact that this category of goods has historically shown a "low correlation with traditional asset classes," and therefore serves as an "ideal hedge" against inflation and the potential stagnation traditional financial assets.

- Moreover, collectibles are an opportunity for high net worth investors to "save on taxes," and have demonstrated the potential to outperform traditional assets over longer time horizons, based on the fact that The Economist Valuables Index of Art and Other Collectibles has grown 64% faster than the MSCI World index over the past two decades.

- As such, Deloitte and ArtTactic report that investors are increasingly purchasing collectibles to boost investment returns (40%) and hedge their larger portfolios (25%).

- CNBC adds that "many advisors and experts" are recommending that investors allocate between 5% and 10% of their portfolios to collectibles.

- However, the 2018 Wealth Report Attitudes Survey suggests that collecting as a form of investing will remain a trend within the larger collectibles industry, given that the “joy of ownership” continues to serve as the primary motivation for global consumers in purchasing collectibles, even when compared with parallel desires for "capital appreciation, safe financial haven and portfolio diversification. "

Digital Sales of Collectibles

- The sale of collectibles through digital channels was similarly selected as a key shift in the global collectibles industry based on the consistent reporting of this trend by industry leaders (e.g., Certified Collectibles Group, LiveAuctioneers), collectibles media (e.g., Antique Sage, Go Antiques) and market researchers (e.g., TMR Research, TEFAF).

- Specifically, collectibles transactions are transitioning to internet platforms such as eBay, Etsy and Ruby Lane, which provide retailers with larger viewership at significantly lower capital costs than traditional brick-and-mortar stores.

- Historically, industry researchers including TEAFA reported a more conservative shift to these virtual outlets, with online sales of key collectibles products growing at a CAGR of 7%.

- More recently, however, TMR research forecasts that online sales across categories including coins, memorabilia, figures, books and jewelry will "witness soaring popularity" through 2025.

- Similarly, Antique Sage reports that the "major" and "permanent" shift to online channels for collectibles retailing will be "largely complete" within the next 10 years, while Certified Collectibles Group Chairman Mark Salzberg remarked this past May 2020 that the coronavirus pandemic has only accelerated the "permanent and irrevocable" transition to online sales for these products.

- Meanwhile, in response to this trend, the global collectibles industry is seeing the continual entry of new digital-only collectible distributors (e.g., ArtAndCollect) as well as the consolidation of market share and purchasing power through joint ventures in the virtual retailer space (e.g., LiveAuctioneers/eBay partnership).

The emerging category of digital collectibles, alongside the more traditional collecting areas of sports memorabilia and animation products, are some of the largest and highest growth opportunities for collectors and sellers worldwide.

Digital Collectibles

- Digital collectibles were identified as one of the largest and fasting growing opportunities within the global collectibles industry based on the analysis of top-tier business media (e.g., Forbes, Nasdaq), technology trades (e.g., TechCrunch, BlockCrunch) and other credible experts (e.g., Sport Industry Group, Readwrite).

- Digital collectibles are a form of digital asset that can be "identified, purchased, trade and sold" without ownership disputes or infringements on IP rights.

- Notably, digital collectibles have "only recently become possible" with the advent of blockchain technology, as well as the ability to create "unique and identifiable digital assets" (also referred to as non-fungible tokens).

- These digital items, which are written into blockchain, ultimately represent a single object (e.g., work of art) and serve as a "certificate of authenticity" that is verified by a blockchain's distributed ledgers.

- Despite their relatively new appearance within the global collectibles marketplace, TechCrunch asserts that digital collectibles are "gaining popularity" and "spreading relatively quickly" across the worldwide collectibles community, buoyed by the novelty of these new product offerings and their ability to attract a more diverse group of collectibles consumers.

- Nasdaq adds that digital collectibles are not only popular with adults, teenagers and kids, but are also attracting attention from investors, who view these "immensely popular" collectibles as "appreciable assets."

- This is due to the recent success of digital collectibles lines by companies including Topps Trading Cards, who released a digital line of Garbage Pail Kids trading cards in 2018 and sold out of all merchandise just 24 hours after the official release date.

- Ultimately, Forbes reports that the burgeoning digital collectibles industry using blockchain technology will grow into a $200 billion annual revenue opportunity for collectibles sellers globally.

Sports Memorabilia

- In parallel, the more traditional collectibles market for sports memorabilia was chosen as a current opportunity for collectors and sellers, given the scale and forecasted growth trajectory of this product category within the worldwide collectibles market.

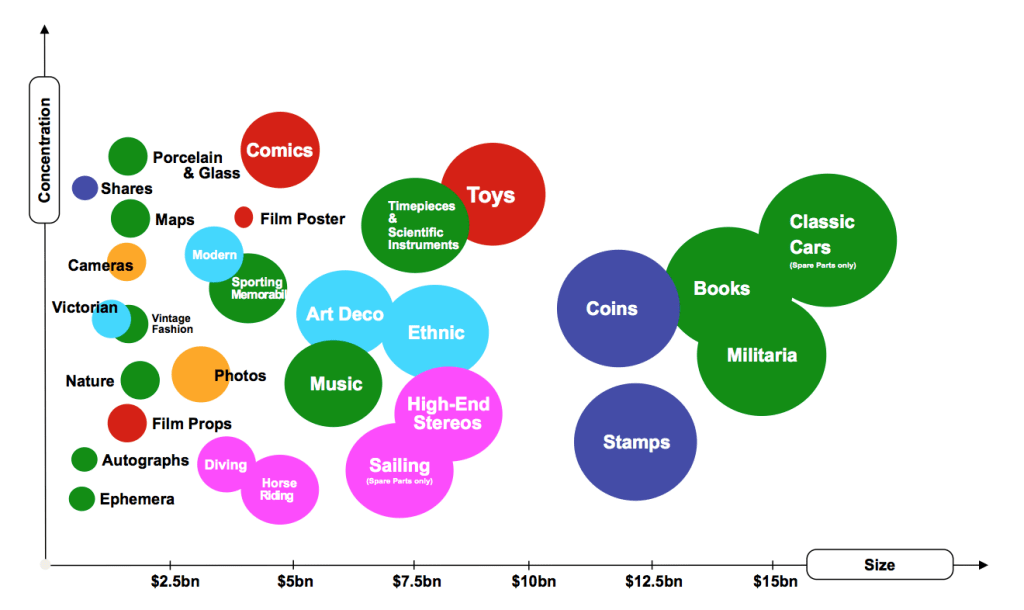

- As highlighted within the following graphic, sports memorabilia has historically represented a significant segment within the overall collectibles industry.

- Among the 200 million active collectors worldwide, approximately one-third have "purchased, owned, or previously owned" a piece of sports memorabilia, according to Forbes.

- Notably, such widespread demand and interest has expanded the sports memorabilia market to approximately $10 billion globally, with approximately half ($5.4 billion) of sales within the United States, and the majority of revenue attributed to jerseys (24%), autographed photographs (23%), autographed helmets (8%), autographed baseballs (8%) and autographed footballs (5%).

- According to The Wall Street Journal, these and other sports memorabilia items have not only "soared in value" since the 2008-2009 financial crisis, but they are expected to see further "price run-ups" for the foreseeable future.

- Industry experts including The Wall Street Journal and Coast to Coast Collectibles attribute the projected growth in demand and value for sports memorabilia collectibles to a variety of factors, such as:

- The increasing wealth of Baby Boomers

- The entrance of Millennials into the larger collectibles market

- Growing interest in sports memorabilia outside of the US

- The prevalence of technology that enables sports fans to "get closer" to favorite athletes and teams (e.g., social media, podcasts, 24/7 coverage).

- Meanwhile, industry leaders such as The Certified Collectibles Group (CCG) are currently leaning into this trend, with CCG announcing this past July 2020 that it is creating a new service "dedicated to expert and impartial certification" of sports memorabilia.

Animation Collectibles

- Meanwhile, animation collectibles are consistently highlighted as a significant and growing opportunity within the global collectibles industry by market researchers including Technavio, 360 Research Reports, ResearchReportsWorld, Advance Market Analytics, Strategyr and FastMR.

- Animation collectibles encompass both the licensed merchandise as well as animation toys that depict characters from "feature films and television shows."

- Not only does this collectibles category encompass newly manufactured and sold items, but it also includes specialty and antique animation collectibles, which generate some of the highest valuations and returns within this collectibles segment.

- Overall, animation collectibles represent a sizable portion of the global collectibles market at $5.6 billion as of 2020.

- Moreover, the preponderance of industry researchers forecast that demand for animation collectibles will "rise at a considerable rate" through 2026, with most experts forecasting a CAGR of between 4.73% and 5% for the period, while more conservative outlets predict a still respectable CAGR of 2.7% through the late 2020s.

- Meanwhile, FastMR asserts that there are two primary drivers behind the growth trajectory for animation collectibles: (1) growing fan followings for animation and gaming characters and (2) increasing disposable income worldwide.

- In particular, the current "craze" for movies, animation and games, paired with "rising affection" for associated characters, is attracting new consumers to this segment of the collectibles industry.

The collectibles market in China is currently valued at approximately $60.7 billion, and is likely to grow significantly for the foreseeable future.

China Market Size

- Although the majority of available data about the collectibles industry in China is dated and/or behind paywalls, Deloitte published a relatively recent, credible estimate for the size of the collectibles market in this country.

- Specifically, China represented $102 billion or 16.4% of the $621 billion worldwide arts and collectibles industry as of 2017, according to the latest available reporting by Deloitte.

- In parallel, credible media outlets including Forbes, TechCrunch and CoinTelegraph consistently size the more narrowly defined global collectibles industry at $370 billion as of 2020.

- Historically, China has held a relatively smaller share of the art market and a relatively larger share of traditional collectibles industry sales, according to Greatest Collectibles.

- As such, it is reasonable to assume that China represented at least 16.14% or $60.7 billion of the $370 billion global collectibles industry as of 2020.

- Meanwhile, Deloitte and HobbyDB expect "particularly strong growth" in collectibles for the foreseeable future across emerging markets, "primarily in China."

- This would be consistent with the growth of collectibles across all Asian markets between 2012 and 2017, which registered a CAGR of between 14% and 23% during the period.

Toys, famous liquors and national heritage art represent three booming collectibles categories in China. Notably, local consumer preferences for these and other collectibles categories range significantly from collecting as a form of investing to collecting as an expression of identity. Meanwhile, Poly International, China Guardian, Sotheby's and Christie's remain market leaders in selling collectibles across China, although eBay and other online sellers are adding new competition to an already fragmented dealers marketplace in the country.

China Market Opportunities

- Three leading growth opportunities within the collectibles industry in China are toys, liquors and national heritage art, all of which are forecast to experience a substantial growth in the coming years.

- Top-tier Chinese media (e.g., South China Morning Post, CGTN) as well as industry researchers (Euromonitor, Statista) highlight toys in particular as one of the fastest-growing segments of collectibles within the country.

- Perhaps most notably, revenue from toy collectibles in China expected to more than triple from 20.7 billion yuan in 2019 to 76.3 billion yuan by 2024.

- Statista and the South China Morning Post add that China has eclipsed the US as the world's largest toy market, fueled by Chinese collectors who are acquiring figurines to "express their identity, boost their street cred, and indulge their inner kid."

- In parallel, the growing middle and upper classes of China are expanding the local collectibles industry for wine, spirits and other liquor, according to Outsider Club, China Daily and Statista.

- As evidence of this opportunity, exports of scotch and whiskey to China increased 71% over the past decade, while overall sales of such collectible liquors grew by 35% during 2018, per China Daily.

- Similarly, Statista reports that liquor currently represents the leading collector's item among the wealthy Chinese, as highlighted by the following chart.

- Meanwhile, Deloitte and Basilinna are among the industry experts that highlight national heritage art as yet another "booming" area of collectibles demand in the country.

- Not only is China's art and antiques market is currently valued at approximately $12 billion, but industry experts report that it has been growing at a staggering rate of 20% annually in recent years.

- Deloitte and Basilina add that this "strong trend" among Chinese collectors to acquire heritage art is driven both by the expanding upper class in the country as well as government promotion of China's cultural heritage.

Chinese Consumer Preferences

- Chinese consumer preferences for collectibles appear to vary significantly based on the type of collector as well as the product category of interest, according to the latest available data from Deloitte, the South China Morning Post, Outsider Club and Basilina.

- Notably, Deloitte's most recent reporting on the collectibles industry in China suggests that the "main motivation" behind collecting for a substantial 25% of the region's buyers is investment returns, or "capital growth."

- In contrast, the South China Morning Post suggests that collectors within the country's skyrocketing toy market are unconcerned with potential returns, adding that "price is of little concern" for these buyers when making a purchase.

- This cohort of Chinese toy collectors, which primarily consists of adult men between the ages of 20 and 40, indicate that they are most interested in "tangible" goods that can highlight their "personality" and enhance their social credibility.

- Meanwhile, Outsider Club and Basilinna report that the high net worth Chinese buyers of liquor, heritage art and other pricey collectibles are fueled by a variety of alternative desires, including the growing appreciation for fine "quality" and an interest in "repatriating" historic artifacts.

Leading Chinese Sellers

- Although publicly available information regarding the competitive landscape among collectibles sellers in China is limited, a comprehensive review of related reporting over the past decade suggests that the leading traditional dealers in the country have remained fairly constant, but are experiencing increasing competition from digital retailers.

- In terms of traditional collectibles sellers such as action firms, the top retailers in China by annual revenue in 2011 were Poly International, China Guardian, Sotheby's and Christie's, according to TEFAF.

- Notably, as of 2019, all four of these auction houses remained within the "top 5 auction houses in the world" and more specifically within the region.

- However, these top collectibles sellers have historically been accompanied by over 350 smaller auction houses in China (e.g., Beijing Hanhai, Beijing Council, Xinlingyinshe, Sungari) in addition to other collectibles retailers across the country.

- More recently, virtual collectibles sellers through online platforms such as eBay have added to competition among collectibles distributors in the country, given that 85% of the world's top eBay sellers were based in China or Hong Kong as of 2020.

- Details related to these top eBay outlets in the region are included below for further reference as desired.