Part

01

of one

Part

01

Gifting for Special Occasions

Key Takeaways

- The COVID global pandemic increased online shopping. In 2020, shoppers in the US spent $201.32 billion, which was a 45.2% increase from the previous year.

- The gift purchasing process is shifting toward consumer convenience, which has played a key role in promoting omnichannel shopping trends.

- Based on the lists presented in publications such as Woman Getting Married, Refinery 29, and Brides, the competitors of HoneyFund include Honeymoon Wishes, Traveler's Joy, Zola, Wanderable, and Prezola.

Introduction

This research presents insights into the general shift in the global gifting behavior, the true competitors of HoneyFund, and the top players in the UK and the US gifting industry. This research has presented findings for the global gifting behavior by prioritizing insights from US and UK sources. Additionally, any global insights have been included in our findings. This research has focused on the purchase of these gifts. The findings of this research have been categorized to address all the different areas.

GLOBAL GIFTING BEHAVIOR: INSIGHTS

Social Media Gaining Traction

- According to a National Retail Federation (NRF) survey conducted in 2019, 46% of Gen Zers turned to social media platforms for gift inspiration. Their top sources, in this specific order, included Instagram, YouTube, Pinterest, Snapchat, and Facebook.

- A Deloitte survey conducted in 2020 discovered that about 31% of consumers say that their gift purchase was triggered by social media. Additionally, Kantar and Catalyst’s State of Ecommerce 2021 revealed that shoppers use these platforms for discovery and inspiration.

- According to a Hootsuite and We Are Social report, the global total users of social media reached 4.33 billion. When asked why they are on these platforms, 27.8% wanted inspiration for the things they would want to buy and 26.5% said that they were looking for specific products.

COVID-19 Increased Online Gift Shopping

- The COVID-19 pandemic increased online shopping. Over the 2020 holiday season, online gift purchases were higher than ever. In the US, shoppers spent $201.32 billion, which was a 45.2% increase from the previous year. This meant that e-commerce was 25.7% of the total sales.

- According to the head of EU marketing at Square, Stephen Smythe, the pandemic not only accelerated eCommerce but also omnichannel shopping. Additionally, a Google survey revealed that gifts were used to bridge the distance that was caused by the quarantine.

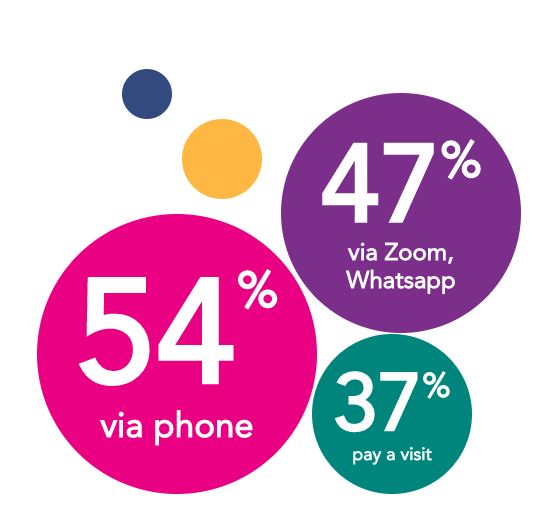

- In 2020, the use of online platforms had increased significantly. The use of online platforms had witnessed a significant increase. The charts below demonstrate this increase.

- 50% of the respondents say that they would shop online while 40% say that nothing is better than brick and mortar.

Convenience is a Priority

- The consumer's need for convenience played a key role in promoting omnichannel shopping. Consumers today demand a quicker, cost-effective, and efficient purchase journey: click and collect, free delivery, and returns. They also wanted to have access to a wide range of products and payment options. The Kantar and Catalyst report also revealed that 66% of shoppers would select a store primarily based on the convenience, while just 47% prioritized price or value.

- The consumer's desire for convenience is not just limited to eCommerce; consumers would also want to have an optimized brick-and-mortar experience.

- Some clever ways of increasing the consumer experience are presented below:

- Optimizing search within a website using a search bar, voice search, category pages, visuals, recommendations, bundles, among others.

- Assessing customer data to improve the findability of products and services within the website.

- Offering a variety of options for the different services that would facilitate the purchase process: free shipping, same-day delivery, curbside, free return, among others.

- Promoting holiday gifts across various channels and platforms to increase visibility, meeting consumers where they are: at the right place and time.

- Providing a seamless omnichannel experience: in-store, mobile, desktop, click and collect, among others. A synced and consistent brand look enhances this experience.

- The chart below demonstrates the priorities in the online gift shop experience.

Personalized Gifts

- A 2020 survey conducted by Inviqa reveals that the primary factor when purchasing the perfect gift is gift suitability (85%) between the gift and the receiver.

- In 2020, the personalized gift market was valued at $31.63 billion. According to a CNBC report, searches for personalized gifts have increased by 156% when comparing the holiday season in 2019 and 2020.

- Personalized gifts would typically allow people to add their names, add a message, a gift video, or select wrap sheets they would prefer. Helping customers design the perfect gift for their loved ones adds great value to the consumer experience. This increases consumer retention.

- According to Etsy, an online gift shop, the best-seller items in different categories were personalized. These include home decor, kitchen and dining, clothing, and jewelry.

Increased Demand for Meaningful Gifts

- The Google survey revealed that gifts went beyond special occasions to an expression of empathy during quarantine. More people felt compelled to show their love to others that were struggling in the community or suffering through the tough times across the globe. According to a 2020 Christmas trend report by Etsy, shoppers were increasingly searching for ways to send thoughtful gifts.

- When asked about the attributes a gift should have, a study conducted by De Beers reveals that "meaningful" takes the lead at 56% followed by "practical", "functional", and "fun".

- GAFO stores were the primary place where people would go gift shopping. However, online platforms are slowly siphoning the overall spending from these stores. When addressing the gifting of cards, large retailers' aisles that have these products are generally ignored. These brands need to rethink how they can make these gifts meaningful. Gifting goes beyond the two parties: the gift itself communicates the person's worth.

- The COVID pandemic has radically influenced the gifting process, with a desire for deeper meaning. A survey conducted by DeBeers determined that 45% of the respondents would buy fewer, but better gifts. People will search for more meaningful gifts, which could mean that they will spend more. Additionally, 56% of recipients would prefer a meaningful gift to a practical, functional, or fun one.

HONEYFUND COMPETITORS

Overview

- Honeyfund's competitors have been selected from across various publications that list out the top honeymoon registry sites. The companies listed below are listed across all three sources or at least in two. These sources include Woman Getting Married, Refinery 29, and Brides. This research will focus on those that have been listed in these articles and their headquarters will also be presented as part of the company brief. Additionally, the research team identified a publication that listed the top wedding registry sites in the UK to build on our list and provide the information presented below.

- These companies offer the services that HoneyFund does. These companies have been leaders in this space and have been recognized by various publications and are offered as an alternative. As a result, the research team considers them true competitors.

1. Honeymoon Wishes

- Website: Honeymoon Wishes

- Overview: Honeymoon Wishes, headquartered in San Diego, California, has served 848,376 couples since it was started in 2003. The founders, Kris and Lee, saw an opportunity for spouses to have the option of focusing the wedding registry on experiences instead of store-bought gifts. On its website, visitors can start or find a registry, explore destinations, explore the features and benefits, read through testimonials from other couples, and peruse through the blog.

2. Traveler's Joy

- Website: Traveler's Joy

- Overview: Headquartered in Delaware, offers couples an opportunity to create lifelong memories with the help of their family and friends. This company has been published on notable news media sites such as CBS, NBC, and ABC.

3. Zola

- Website: Zola

- Overview: Headquartered in New York, Zola offers couples a registry and wedding planning platform that addresses all the different areas of a wedding as well as a registry. The other areas that this company assists in include selecting vendors, building the guest list, advice, among others.

4. Wanderable

- Website: Wanderable

- Overview: Headquartered in North Carolina, the Wanderable registry helps engaged couples in setting up a beautiful honeymoon registry. The company's mission is to make gift-giving memorable. The primary promise is to sell a great honeymoon experience.

5. Prezola

- Website: Prezola

- Overview: Prezola, headquartered in the UK, is considered one of the top wedding gift lists in the market. This platform allows couples to add hundreds of gifts and a cash option to cover the honeymoon. This platform also includes an option for guests to do something instead of getting a gift for the couple. Examples here could be participating in acts of kindness, volunteering for a charity, among others.

6. The Wedding Shop

- Website: The Wedding Shop

- The Wedding Shop, headquartered in the UK, has helped couples in their registry process for the past 30 years. It has helped individuals through the traditional gifts journey, cash contributions, giving to charities, travel and experiences, a honeymoon fund, among others.

TOP PLAYERS: THE GIFTING INDUSTRY

- To identify the top players in the gifting industry in the US and the UK, the research team set out to identify industry reports and publications that present the list of these companies. Although the revenue and market share may be behind paywalls, it would be safe to assume that these companies were included in these lists because they have a dominant share of the overall industry.

Geographic Scope: US

Overview

- According to this IBIS World report, the top players in the gifting industry in the US include Party City Holdings Inc., American Greetings Corporation LLC, The Walt Disney Company, Amscan, and Party America.

- According to a Market Watch report, the top players in the gifting industry in the US include "The Walt Disney Co., Spencer Gifts LLC, Hallmark Licensing LLC, Card Factory Plc, Costco Wholesale Corp., American Greetings Corp., Enesco LLC, Bed Bath & Beyond Inc., Williams-Sonoma Inc., among others."

- The research team will first provide an overview of the companies that have appeared on both lists, and follow with the rest, maintaining our threshold of the research brief.

1. American Greetings Corporation LLC

- American Greetings Corporation is a private company headquartered in Ohio.

- This company's estimated employee count, according to Crunchbase, is between 5,000 and 10,000. It also has a variety of products: cards, access to the brand's apps, a shop with gifts, party supplies, among others.

2. The Walt Disney Company

- This company is publicly-traded and is headquartered in California. Walt Disney Company is a cartoon entertainment platform that has several subsidiaries. The subsidiary company that competes in this industry is called Shop Disney.

- Shop Disney offers several gifting options: Black Friday, Holiday, Gift Guide, Clothing, Accessories, Toys, among others.

3. Spencer Gifts LLC

- Spencer Gifts is a privately owned company that is headquartered in New Jersey. According to Crunchbase, the company has over 10,000 employees.

- By incorporating humor, this company brings a different twist to gifting. It has categories such as Naughty and Gags, which hopes to bring some humor. The company also has various items under each category. This company offers gifts in various categories: holidays, t-shirts, jewelry, fashion, lingerie, among others.

4. Costco Wholesale Corp

- Costco is a publicly-traded company that is headquartered in Washington. According to Crunchbase, this company employs over 10,000 people.

- On its website, Costco has a quick link to its gift guide, where one can explore the current seasonal gifts and many more. People have the option to display the items by price. One can choose to select $100 and under, %50 and under, or $25 and under. Additionally, these items are placed in various categories for individuals to select and shop. These categories include Gamers & Tech, Chefs & Bakers, Kids & The Young at Heart, Beauty Gurus & Fashionistas, Athletes & Sports Enthusiasts, among others.

5. Bed Bath and Beyond Inc.

- Bed Bath and Beyond Inc is a publicly-traded company that is headquartered in New Jersey. This company has over 10,000 employees.

- This company does not seem to have a direct link to a gift shop page on its site. Instead, the brand has a gifts section where the visitor can select the category they would like, or browse based on their desired spend.

Geographic Scope: UK

Overview

- To identify the top companies in this space, the research team searched through various industry reports. The research team quickly discovered that there were extensive reports that addressed segments within this industry. Examples here include the corporate gifting and the personalized items segments. After extensive research, the companies presented in this report have been listed in the gifts and gadgets market report by Salience.

1. Prezzybox

- Prezzybox is a private company that is headquartered in the UK.

- The products on the company's site are categorized as follows: Christmas Gifts, Stocking Fillers, Secret Santa, For Him, For Her, Kids Gifts, Birthday Gifts, Flowers, Personalised Gifts, Fun Gifts, Occasions, and Experiences.

2. Getting Personal

- Getting Personal is a private company that is headquartered in the UK and has raised £4M in funding.

- The website's menu categorizes the company's products as follows: Christmas, Personalised Gifts, Birthday, Anniversary, Wedding, Occasions, Kids & Baby, and Cards.

3. MenKind

- This brand was established in 2001 as a gift shop.

- This company's products are categorized as follows: Christmas Gifts, Popular, Food & Drink, Home & Outdoor, Gadgets, Gaming, Fun Stuff, R/C (Remote Control Zone), Massage & Health, Merch, and Experiences.

4. Buy a Gift

- This is a private company that is headquartered in the UK.

- This brand has products in various categories. These include Christmas, Driving, Days Out, Food & Drink, Spa & Beauty, Short Breaks, Adventure, Flying, Gifts, and Smartbox. Another item on the menu that is strategically placed to increase engagement is the "OFFERS" tab.

5. Not On The High Street

- Not On The High Street is a private company that has raised £81.8 million and is headquartered in the UK.

- The products on this site are categorized by type and further on by gender. These categories include Christmas, Gifts, Birthdays, Cards, Home & Garden, Jewelry, Kids, Weddings, Food & Drink, and Inspiration. Other menu items that increase engagement is the "SALE" and "SEE MORE" tabs.

Research Strategy

Our research team has conducted extensive research to present a comprehensive report that addresses all aspects of this research. We have conducted a thorough analysis of articles, publications, and industry reports. The research team has presented our research strategies at the beginning of each section and labeled them as an overview, where applicable.

For this research on "Gifting for Special Occasions", we leveraged the most reputable sources of information that were available in the public domain, including Market Watch, Deloitte, Etsy, Digital Commerce 360, CNBC, Entrepreneur, among others.