Part

01

of one

Part

01

Gap Company Analysis

Key Takeaways

- Don and Doris Fisher founded the Gap in San Francisco in 1969, initially offering just Men's Levi's and record tapes. Its initial focus was to make it easier for consumers to "find a pair of jeans that fit" with an accompanying promise to "do more" for its customers and the community.

- Gap's history includes a number of partnerships and collaborations, including Dodge Motors (1982 Dodge Charger raffle), RED (2006 partnership to support African disease-fighting programs), a Mad Men collection collaboration (2011), Yeezy Gap (a 2021 collaboration between Ye, formerly Kanye West, and Gap), and collaborations with athletes Allyson Felix (2019) and Simone Biles (2021). Gap has also extended its reach into non-apparel collaborations, recently partnering with artist Demit Omphroy on an NFT collection.

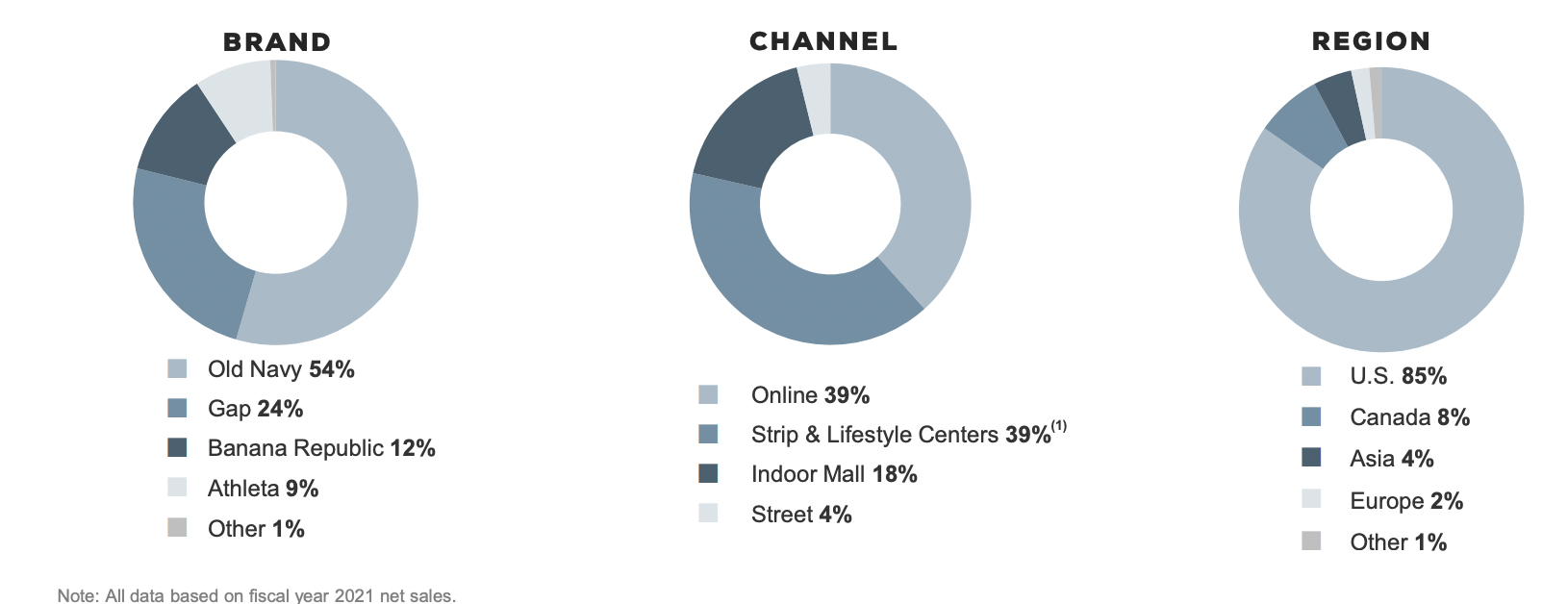

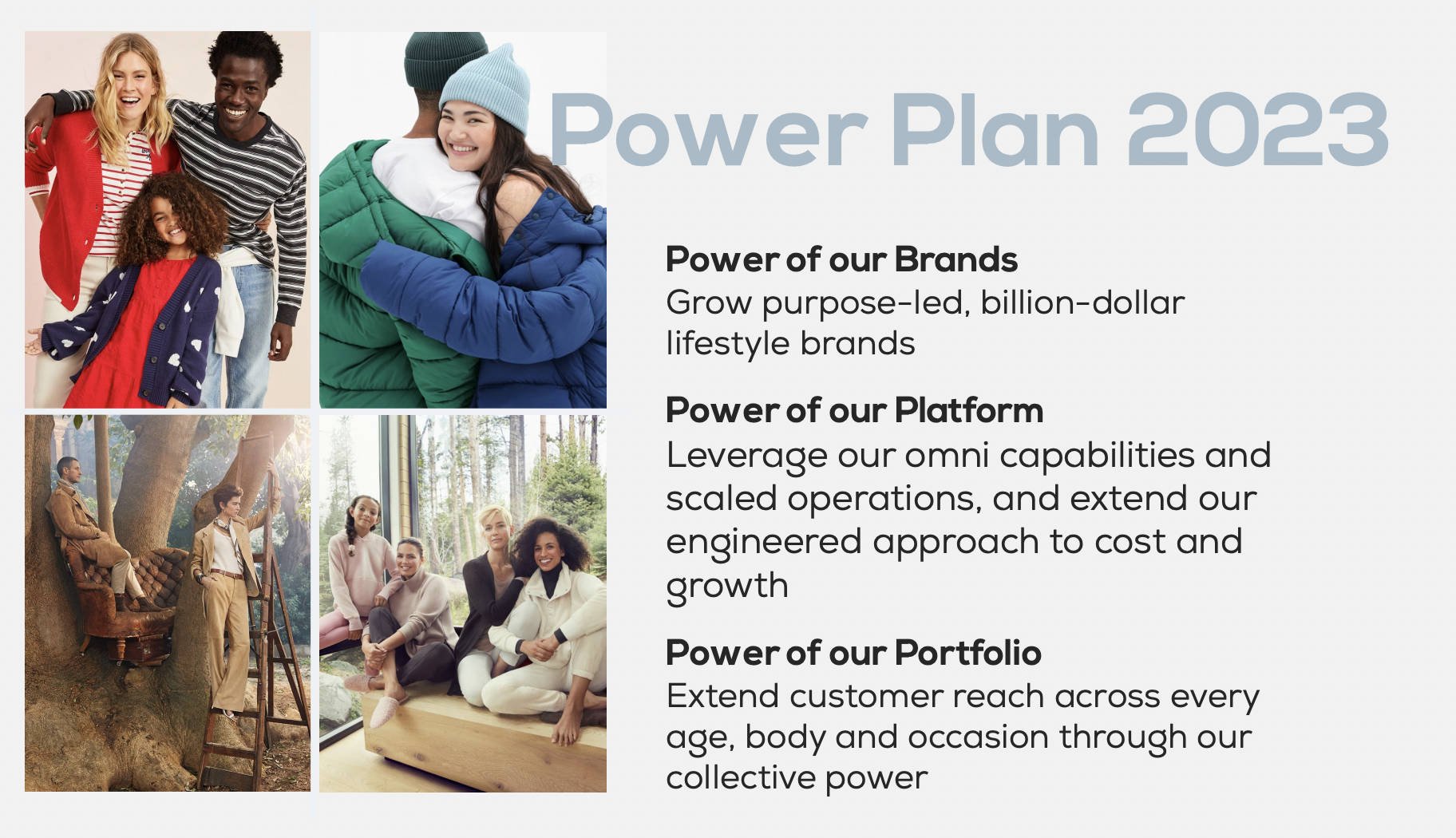

- The company's four brands, Gap, Old Navy, Banana Republic, and Athleta, are designed to "offer relevant and covetable product at every price point." In 2020, Gap launched its Power Plan 2023. Key components of the Power Plan re-emphasized in 2022 include growing Old Navy and Athleta, repositioning Gap and Banana Republic, increasing its online business (continuing a "digital-first" strategy), category expansion, and strategic partnerships.

- Gap acquired CB4, an AI and machine learning technology that helps make personalized recommendations to improve the customer experience, in October 2021. Sally Gilligan, Chief Growth Transformation Officer Chief, and head of the Strategic Growth Office at Gap Inc., said of the acquisition, "We believe artificial intelligence and machine learning will shape the future of our industry. Gap Inc. has experience working with CB4’s world-class data scientists, so we understand the impact and the wide applications their science can have across sales, inventory and consumer insights, as well as its potential to unlock value and enhance the customer experience."

- Some corporate challenges include the recent poor performance of Old Navy due to inventory planning issues and establishing a clear point of difference and identity for each brand.

Introduction

The research below includes 2 parts. Part I focuses on Gap, Inc. and its 4 brands: Gap, Old Navy, Athleta, and Banana Republic. Part 1 includes a company overview (history, mission and values, brands and products, and financial information), strategic initiatives and digital priorities, CEO and senior-level commentary, some insight on marketing technologies, and current corporate challenges. Part 2 highlights 7 competitors to the Gap, providing a brief summary of the brand and a link to its website.

While we attempted to provide as much detail as possible on each individual brand within the Gap's portfolio, particularly as the individual brand strategies relate to the overall corporate strategy, time limitations precluded us from providing a full deep dive into each individual brand.

Part 1: Gap Analysis

Company Overview

1) History

- Don and Doris Fisher founded the Gap in San Francisco in 1969, initially offering just Men's Levi's and record tapes. Its initial focus was to make it easier for consumers to "find a pair of jeans that fit" with an accompanying promise to "do more" for its customers and the community.

- The company went public in 1976 and acquired Banana Republic (a safari-themed retail store) in 1986.

- The company started its global expansion in 1987 in London and now has a presence in 44 countries. Interestingly, Gap announced in 2021 that it was closing all of its UK retail stores and less than a year later re-entered the UK market via a partnership with Next (UK's largest clothing retailer).

- GapKids was launched in 1986 and babyGap in 1990. Old Navy and Gap Outlet stores were launched in 1994. Within 4 years, Old Navy was the first retailer to reach $1 billion in annual sales.

- Athleta, a catalog company focusing on women's activewear, was acquired in 2008. More recently, in 2019, Gap acquired Janie and Jack, a high-end children's retailer, only to divest the brand in 2021 as part of its Power Plan 2023 (which pivoted the company's focus to Old Navy and Athleta, while divesting smaller businesses).

- In 2021, Gap Home launched on Walmart.com.

- Gap's history includes a number of partnerships and collaborations, including Dodge Motors (1982 Dodge Charger raffle), RED (2006 partnership to support African disease-fighting programs), a Mad Men collection collaboration (2011), Yeezy Gap (a 2021 collaboration between Ye, formerly Kanye West, and Gap), and collaborations with athletes Allyson Felix (2019) and Simone Biles (2021). Gap has also extended its reach into non-apparel collaborations, recently partnering with artist Demit Omphroy on an NFT collection.

- The Yeezy collaboration has already experienced significant success, with the Yeezy hoodie achieving the highest single-day sales of any Gap item, with 70% of the buyers being first-time Gap brand buyers.

2) Mission and Values

- Gap, Inc.'s stated purpose is "Inclusive, by Design."

- The company emphasizes that the business is guided by this purpose: "We Grow Purpose-Led, Billion-Dollar Brands That Shape Peoples' Way Of Life."

- Highlighted values include "equality & belonging," "gender equality & empowerment," and sustainability.

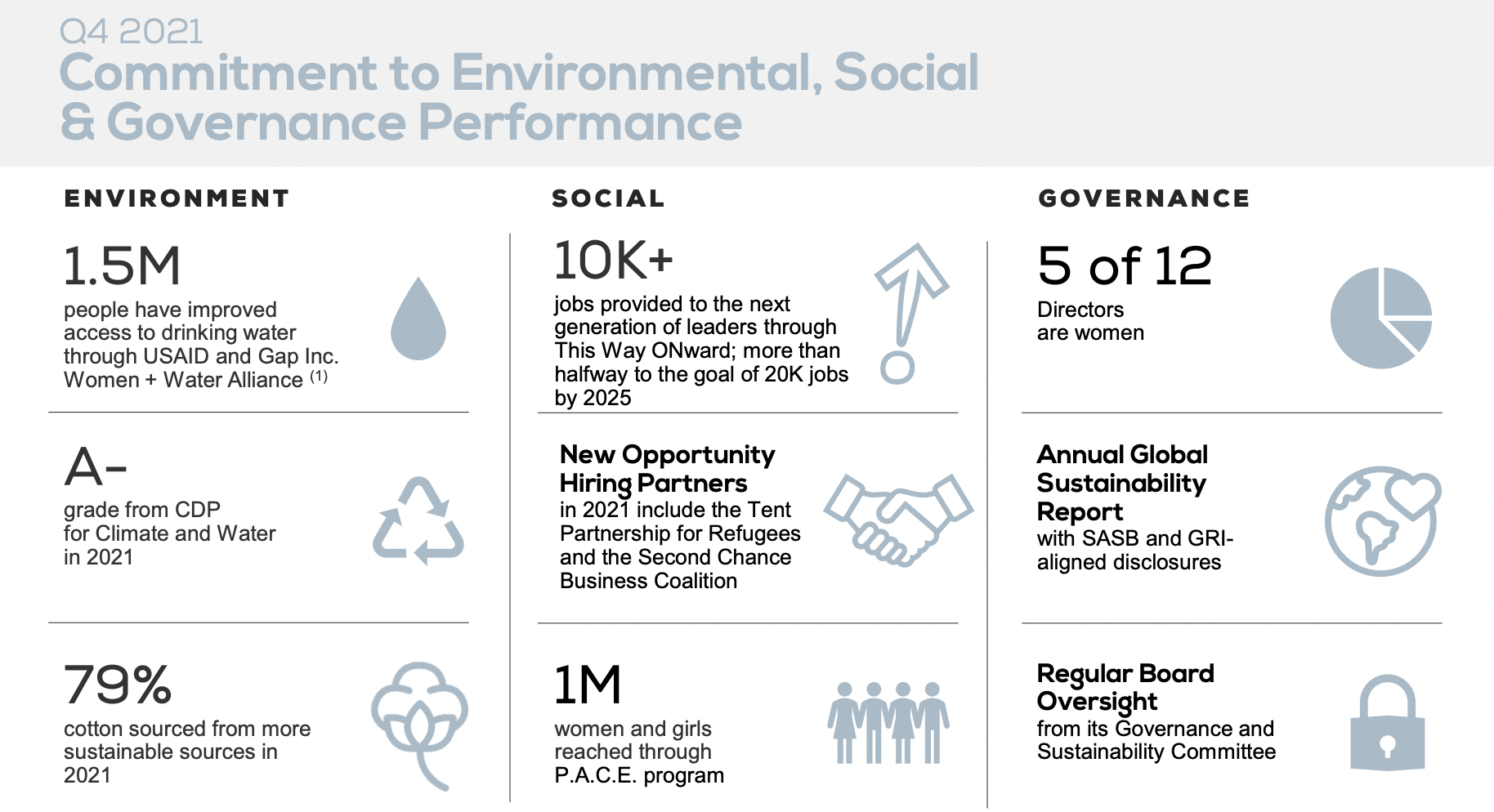

- Gap has a long history of social good and sustainability initiatives, from offering skills training to female garment workers via the P.A.C.E. program (Personal Advancement & Career Enhancement) in 2007 to a $1.5 million clothing donation to Ukrainian refugees in June 2022. Gap's 2021-2022 "Equity and Belonging Report," which highlights its diversity, equity, and inclusion efforts, can be found here.

3) Brands and Products

- The company's four brands, Gap, Old Navy, Banana Republic, and Athleta, are designed to "offer relevant and covetable product at every price point."

GAP

- The Gap brand offers clothing for women, men, children, teens, and babies. The Gap Home partnership with Walmart (launched in May 2021) offers furniture, home decor, bedding, and bath products.

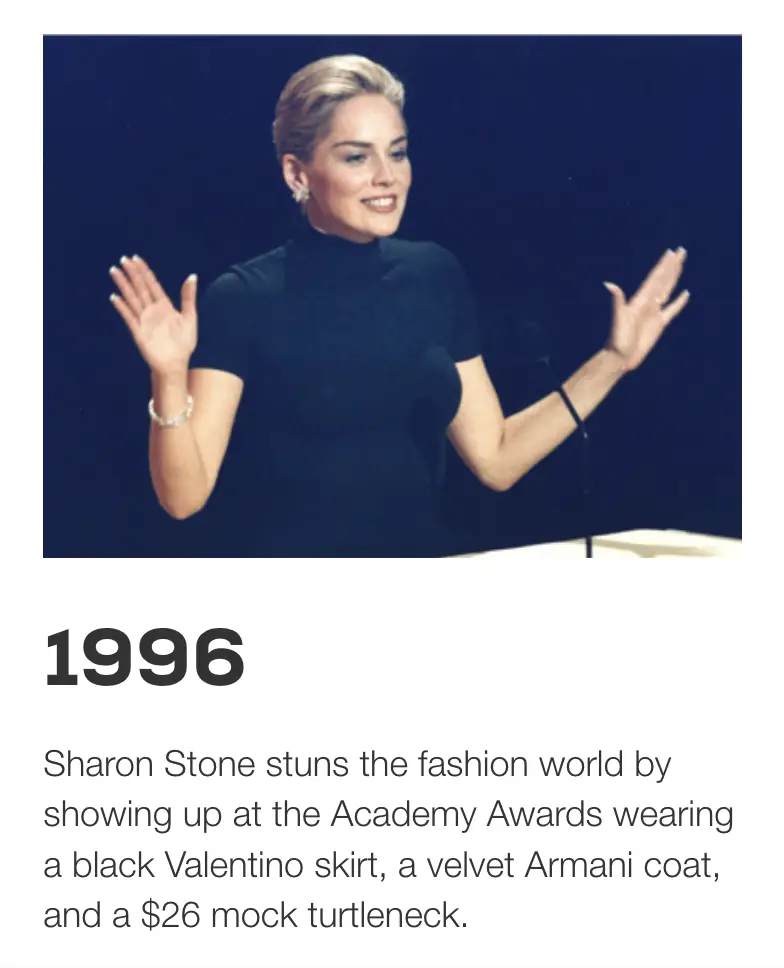

- Gap is known for launching several iconic products throughout its history, including the pocket-T (worn by Michael J Fox in 1984's "Back to the Future), white denim jeans (worn by supermodels on a 1992 Vogue Magazine's 100th-anniversary cover), and a mock turtleneck worn by Sharon Stone at the Academy Awards in 1996.

- The current brand positioning focuses on quality, individuality, and inclusion ("Modern American Optimism"). The brand is seeking to be a "force for good," creating "sustainable change." Gap recently launched a kids-focused home collection in line with this messaging ("Delivering Youthful Optimism for the Next Generation").

- As the Gap brand works to evolve its identity, it is showing some resurgence among a younger, Gen Z, audience, who have been drawn to its Gap Hoodie (#gaphoodie has millions of views and videos with Gen Z demonstrating the hoodie in their own looks). Gap has also recently looked to Tik Tok to crowdsource ideas for future innovation.

Banana Republic

- Banana Republic offers clothing for men, women, and babies as well as a limited selection of home products (e.g., blankets, candles).

- In 2021, Gap repositioned the Banana Republic brand to represent "democratic, approachable, and inclusive luxury," with the repositioning communicated across digital channels and other consumer touchpoints, an elevated in-store experience, and updated product quality and fabrics.

Old Navy

- Old Navy is a $9 billion brand that offers family-focused fashion at affordable prices. The brand offers clothing for men, women, and children, and also has maternity and plus-sized lines.

- The brand focuses on "democracy of style," offering something for everyone via "on-trend, playfully optimistic, affordable, high-quality products, and inclusive size ranges."

- To demonstrate its commitment to bringing affordable and accessible to the masses, the company has pledged not to raise prices during the back-to-school season.

- The brand has struggled of late (-19% in the most recent quarter compared to the previous year), which has been attributed to an unsuccessful launch of its size inclusivity program. The launch included leveraging new technology to optimize garment fit, supply chain optimization, a redesigned pricing strategy, store redesign, and a large ad campaign, but appeared to fail due to inaccurate inventory planning. Despite the large ad campaign, the brand may also have been challenged to build awareness among their key target audience for the collection, plus-size shoppers.

- In April, Nancy Green, Old Navy's CEO and President stepped down, though Gap still appears committed to the size inclusivity strategy.

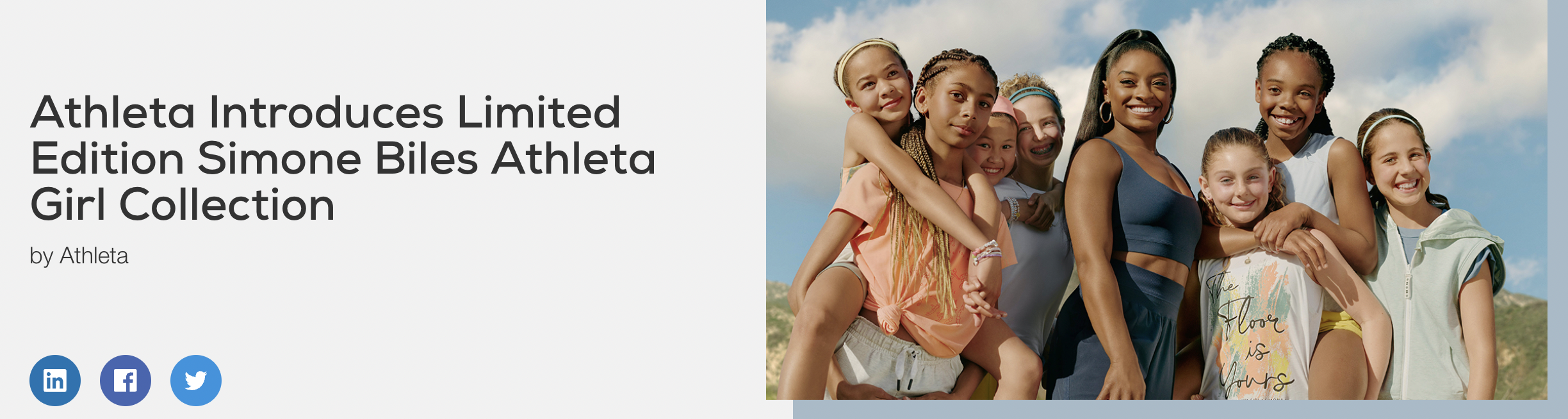

Athleta

- The Athleta brand offers clothing and accessories for women and girls, with a focus on athletics (though the products are not exclusively designed for athletics, including sleepwear, accessories, and dresses, in addition to more traditional athletic gear (e.g., leggings, jackets)).

- The brand's mission is to "ignite a community of active, healthy, confident women and girls who empower each other to reach their limitless potential.

- Focused on female empowerment, the brand has partnered with women to develop new clothing lines including Simone Biles, Allyson Felix, and Alecia Keys. The Simone Biles line below is targeted to girls 6-12.

4) Financial Performance

- Fiscal 2021 sales were $16.7 billion, +21% versus the prior year. Banana Republic (+22%), Athleta (+18%), and Gap (+7%) achieved growth in 2021, while Old Navy was down slightly (-3%).

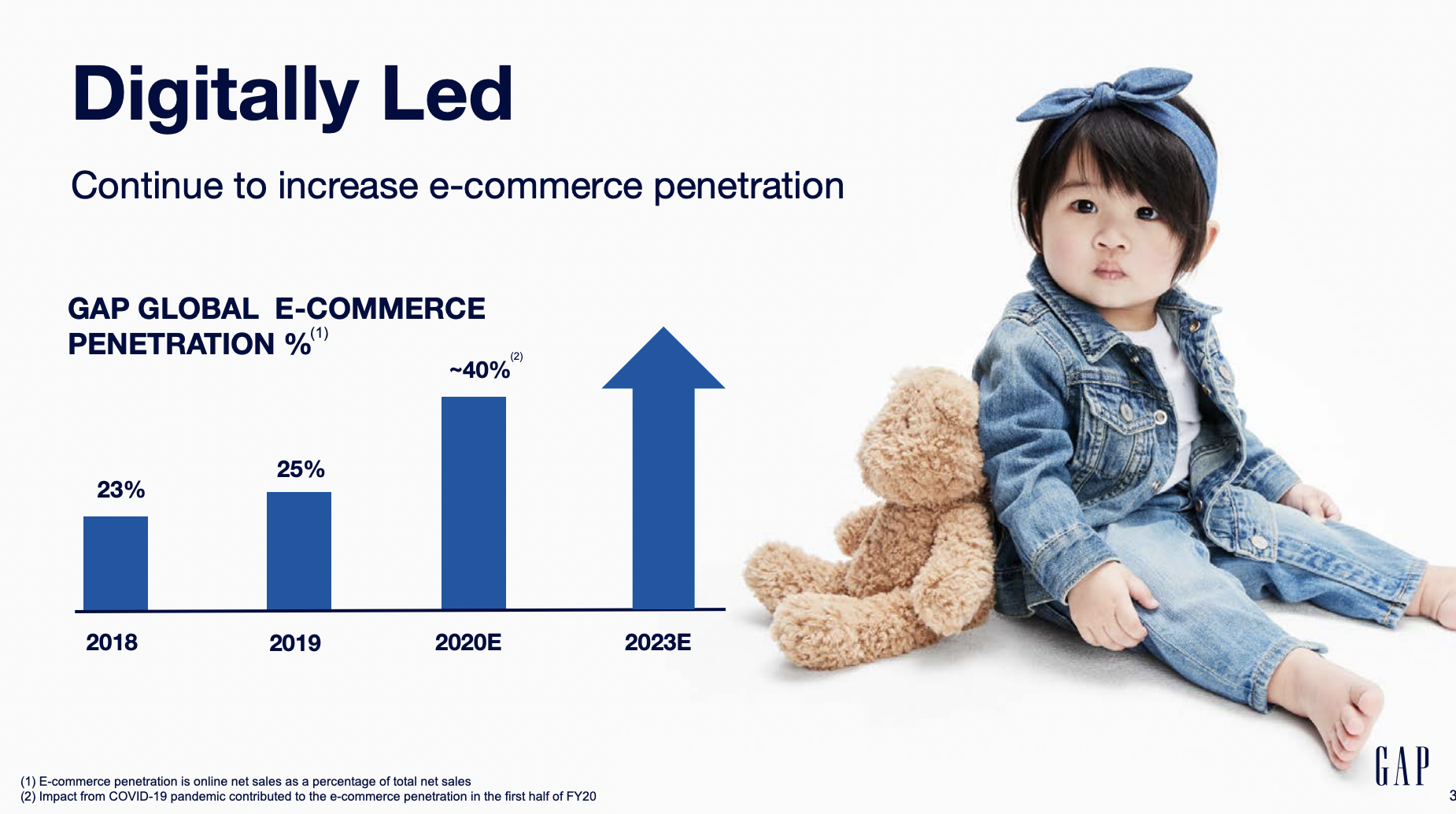

- 39% of sales come from online channels.

- Financial performance turned negative in 2022. Gap reported net sales of $3.5 billion in Q1 2022, a 13% decline vs. the prior year. Some factors highlighted as drivers of the quarterly decline include divestitures, brick-and-mortar store closings, the shift of Gap retail to a partnership model in the UK, higher-than-expected discounting at Old Navy, and increased commodity prices.

- Old Navy (-19%) and Gap (-13%) drove the decline, while Banana Republic (+24%) and Athleta (+4%) experienced solid growth.

- Sonia Syngal, CEO of Gap Inc commented on the disappointing results by expressing optimism about the brand going forward: "We remain anchored by our belief in our iconic purpose-led brands-Old Navy, Gap, Banana Republic and Athleta-and are focused on making continued progress against our Power Plan strategy and getting back on track delivering growth, margin expansion, and value for our shareholders over the long term."

Strategic Initiatives and Digital Priorities

- In 2020, Gap launched its Power Plan 2023 to drive sales growth and margin expansion. The plan involves leveraging its brands to deliver distinct experiences, maximizing the use of customer segmentation to reach the majority of the addressable market (representing a wide range of demographic and psychographic audiences), and delivering "omni-capabilities," which involves using technology and automation to improve efficiency and speed and delivering a better customer experience.

- Key components of the Power Plan re-emphasized in 2022 include growing Old Navy and Athleta, repositioning Gap and Banana Republic, increasing the online business (continuing a "digital-first" strategy), category expansion, and strategic partnerships.

- Power Plan 2023 includes specific plans for each brand, such as enhanced digital customer experience via an optimized mobile app, optimized shopping experience via services such as BOPIS (buy online pick up in-store), and personalization across digital and physical touchpoints for the Old Navy brand. Athleta's objectives (shown below) include growing omni-shoppers and building its digital presence.

- The Gap brand emphasizes its shift to a digital-first model with a focus on growing online sales.

- Retail personalization is another key strategic objective for Gap. The company leverages data science and technology to elevate onsite experiences and marketing communications, with the ultimate goal to drive loyalty across its brands. In 2021, Chief Digital and Technology Officer, John Strain, commented on the importance of personalization: "Retail personalization at scale is a major focus for Gap Inc. and the new currency for customer relevance in 2021."

- Technology transformation will be prioritized to improve inventory management and maximize the efficiency of the supply chain, including digital product creation and predictive analytics to optimize assortment.

- Digital-first priorities have also emerged in marketing efforts, including an Old Navy commercial "Written by the Internet" which uses social media commentary to shape the ad campaign. Jamie Gersch, CMO of Old Navy, says of the campaign: "To be the most democratic and accessible brand we must listen to our customers and give them what they want. Even when it comes to how we are marketing to them."

- Athleta leverages its online community and mobile app, Athleta Well, to build brand awareness, create stronger relationships with its customers, and generate customer insights. Kim Waldmann, the chief digital officer at Athleta, says of the digital engagements efforts, "It’s this idea of building a direct relationship with the customer. The app is a clear way we can do that through driving frequency through fresh daily content and personalized push notifications. I would also add it being the integrator between digital experience and the physical world. We know our phones are with us wherever we go. The app is with her on her home screen. It can be a really important bridge as we think about transitioning from shopping online to being in a physical store and helping her be in that environment in terms of what products are available in that particular store, creating wishlists, etc."

- Unrelated to digital priorities, partnerships and collaborations have remained a key priority for Gap. In 2021, CEO Syngal noted that "Purpose-led marketing and creative partnerships have improved the health and relevance" of its brands.

CEO and Senior-Level Commentary

- In her 2021 remarks, Syngal said of the company's digital-first approach to optimizing the supply chain: "In an era characterized by disruption, we are creating an increasingly agile, digitally-led, and resilient business. We are investing in technology and integrating newly acquired artificial intelligence capabilities to drive efficiencies across our organization."

- In early 2021 Syngal said about the brand's digital focus: "As stores’ traffic came back, we sustained our digital dominance with 82 percent online growth versus 2019...customers are emerging from the crisis wanting to express their style without sacrificing the comfort and digital convenience they’ve become accustomed to. Through the power of our brands, platform and portfolio, we deliver it all."

- In discussing the November 2021 appointment of digital marketing and data leader, Lisa Donahue, to the Gap Board of Directors, Syngal said, "Lisa is a brand-building visionary and proven authority in driving business transformation through customer-centric leadership. Her unique perspective along with her passion for driving social impact will benefit our future growth strategies."

- In discussing the importance of mobile shopping to improve the customer experience, John Strain, Head of Customer, Digital, and Technology says, "We believe that removing barriers to shop and focusing on a mobile-first experience will enable us to create enduring customer relationships with both our new and existing customers."

- Strain comments more generally on the company's digital-first strategy: "Digital transformation is the way we leverage our integrated technical capabilities to deliver a better customer experience [which is] both omni-channel in nature and digitally-enhanced."

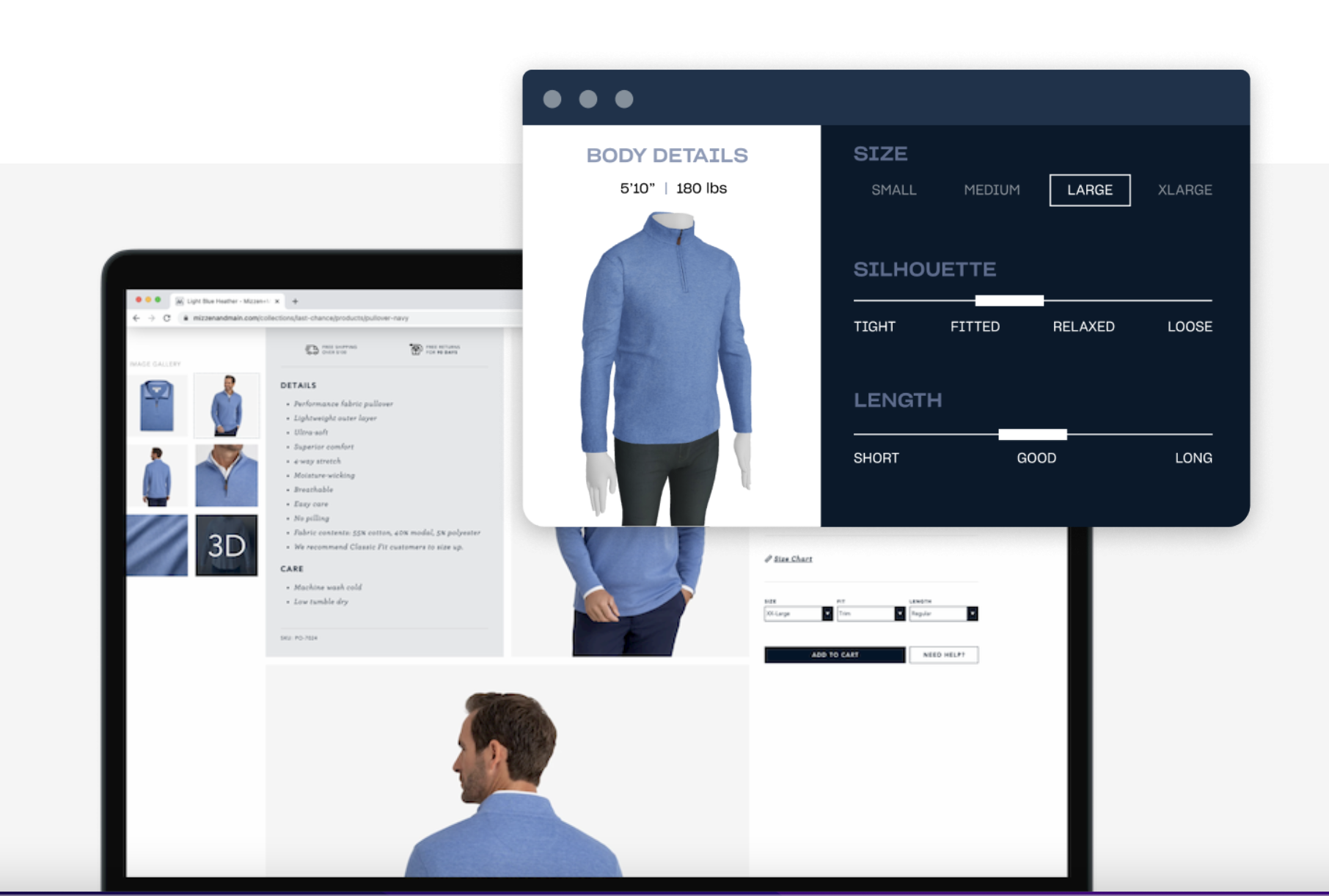

- Commenting further on virtual try-on capabilities piloted by Athleta, Strain says, "Experimenting with one-on-one virtual styling sessions gives our associates the power to deliver next-level retail personalization, services, and convenience to shoppers. While the technology enables virtual clienteling, removing some constraints, the technology provides an opportunity for our store associates to demonstrate their product, brand, and customer knowledge in a new way."

Marketing Technology

- Gap notes that it is leveraging technology to expand its "digital reach, using tech as a catalyst for industry change — both online and in stores."

- In July 2021, Gap launched a feature to allow shoppers to buy Old Navy and Athleta products directly on the Instagram app.

- Gap acquired CB4, an AI and machine learning technology that helps make personalized recommendations to improve the customer experience, in October 2021. Sally Gilligan, Chief Growth Transformation Officer Chief, and head of the Strategic Growth Office at Gap Inc. said of the acquisition, "We believe artificial intelligence and machine learning will shape the future of our industry. Gap Inc. has experience working with CB4’s world-class data scientists, so we understand the impact and the wide applications their science can have across sales, inventory and consumer insights, as well as its potential to unlock value and enhance the customer experience."

- In 2021, Gap acquired Drapr, a virtual try-on technology that allows potential customers to try on clothes virtually using 3D avatars.

- To support its online growth, Gap has invested in fulfillment centers using AI and robotic technologies to maximize supply chain efficiencies.

- Gap leverages Fullstory's digital intelligence platform to develop a data-driven view of a customer's shopping experience.

Corporate Challenges

- Old Navy performed poorly in Q1, 2022 due to inventory planning issues, assortment issues (missing popular styles), and industry headwinds (inflation impact on budget-conscious shoppers, a key target audience for the brand). The CEO of the brand recently stepped down, leaving a need for leadership. BMO Capital Markets Managing Director Simeon Siegel expressed concerns about the brand's revenue upside and strategy: "All in all, this seems like another bit of drama in the strange world of Gap. Their strategies and plans never seem very coherent and they sometimes appear to live moment to moment, grasping at different things they hope will make an impact. It does not inspire confidence in the company.”

- Establishing a clear point of difference and identity for each brand may be a challenge for the company, with some retail analysts noting the relaunched positioning for the Gap brand (Modern American Optimism) as not especially distinctive. Allen Adamson, a co-founder of the retail consultancy Metaforce says that "..for years, the challenge has been that there has been no clear point of difference for Gap. Gap’s squishy new tagline, Modern American Optimism, doesn’t offer much help."

- The Yeezy and Gap 10-year collaboration has been successful, but challenges remain with the speed of innovation rollout (largely driven by Ye) and potentially negative association with publicly-concerning Kanye West (Ye) behaviors.

- The company has experienced limited traffic to its Gap Home retail site. Seema Shah, a senior director of research and analytics at Similarweb, commented, "Gap.com has 66 million visits per month on average. [Gap Home] is not really moving the needle for them.

- High freight costs and overseas factory closures created supply chain challenges earlier this year, with Gap looking to "adjust the geographic spread of its manufacturing base" as a result.

- Competition from companies such as Primark and Uniqlo, along with a declining brand image, was thought to have influenced the closure of its UK stores in 2021. YouGov research director Richard Moller says of the brand, "Gap scores highly among shoppers for quality, brand impression and customer satisfaction, meaning the brand is well known for a good customer experience and well-made products, but struggles with its reputation, recommendation from customers and value for money perception."

Part 2: Competitive Landscape

Zara

- Zara is a Spanish fashion retailer offering clothes for men, women, and kids, along with home products and makeup. It is known as a pioneer in "fast fashion," launching frequent innovations (such as the 2 collections seen below, launched in May).

H&M

- H&M is a fashion brand founded in Sweden in 1947, part of a larger portfolio of brands owned by H&M group. The brand focuses on its extensive assortment, designer collaborations, price, quality, and sustainability. H&M offers apparel for men, women, kids, and babies, as well as home products.

- The retailer recently initiated a global ad campaign with Pete Davidson focusing on elevating men's confidence through fashion.

- The COS brand is a higher-end brand within H&M Group's portfolio, offering "reinvented classics" and "wardrobe essentials."

Uniqlo

- Uniqlo is a brand under the Fast Retailing umbrella, with headquarters in Japan. The brand offers clothing for men, women, children, and babies.

- Uniqlo's "LifeWear" collection offers simplicity, practicality, and quality. Uniqlo prioritizes collaborations with individuals who share its values and focus on social commitments.

American Eagle

- American Eagle Outfitters (including the AEO and Aerie brands) is an American retailer offering clothing, accessories, and personal care.

- The brand emphasizes the high-quality, on-trend, affordable attributes of its products.

- Celebrating the "optimism of youth," the brand positions itself as "inclusive, optimistic, and empowering."

Abercrombie

- Abercrombie and Fitch is an American retailer with a portfolio of multiple brands, including Abercrombie and Fitch, Abercrombie Kids, Hollister, Gilly Hicks, and Social Tourist.

- Fran Horowitz, CEO, A&F Co. talks about the inclusivity principles as the current brand foundation: "Abercrombie isn’t a brand where you need to fit in—it’s one where everyone truly belongs. We lead with purpose, and that inclusive and equitable spirit is woven throughout all we do.”

- A&F's SVP and Head of Marketing Carey Collins Krug speaks to the brand turnaround: "We've doubled down on the fit, comfort, quality, size inclusivity, and style of our products. Our website, social media, campaigns, and the Abercrombie team are all more representative of the world around us. This is a new age for Abercrombie, and there's so much more to come."

- The brand recently launched a gender-inclusive collection, co-created with the Trevor Project, the world's largest suicide prevention program.

Forever 21

- Forever 21 is a fashion retailer with a focus on trendy apparel and accessible pricing.

- The brand highlights its digital innovation efforts to expand access to shoppers via e-commerce.

- The brand recently repositioned itself to build stronger engagement with Gen Z.

- Below is a sample post from its Facebook site.

Lululemon

- Competing with Gap's Athleta brand, Lululemon is a brand focused on "people around the world who want to live a healthy and active lifestyle." The products are designed "with and for athletes."

- The brand offers technically advanced products, a strong, connected culture, and is committed to "positive change for our people and the planet."

- Lululemon offers apparel, accessories, and at-home fitness technology (MIRROR).

Research Strategy

For this research on Gap Company Analysis, we leveraged Gap corporate content (website, investor presentations, annual reports, press releases, social media communication, CEO and senior leader interviews and commentary), articles providing a point of view on the brand (e.g., Retail Dive, Ad Week), and analyst commentary. To identify competitors, we leveraged multiple sources (e.g., Comparably, Statista, SimilarWeb). Competitors were selected largely based on their appearance in multiple sources, indicating the likelihood to compete with Gap; We also reviewed several lists summarizing the largest clothing manufacturers in the world (such as this resource), which also included Gap, to select competitors in this research.

We did not break out key highlights associated with digital strategy from the annual report separately largely because the company appears to be following its Power Plan 2023, which was outlined in detail in the 2020 investor presentation. Details surrounding the digital strategy component of the Power Plan were summarized within the broader section focused on strategic initiatives.

Gap Inc. is a portfolio of 4 brands: Gap, Old Navy, Athleta, and Banana Republic. While we attempted to provide as much detail as possible on each, particularly as the individual brand strategies relate to the overall corporate strategy, time limitations precluded us from providing a full deep dive on each individual brand.