Part

01

of two

Part

01

How much do former US presidents make?

Key Takeaways

- The Former Presidents Act of 1958 stipulates that former US presidents are entitled to an annual pension that is worth the basic pay (as in effect from time to time) of the head of an executive department or cabinet secretary. Currently, the basic pay for the head of an executive department (Level I) is $226,300.

- The Former Presidents Act of 1958 also stipulates that former presidents, their spouses, and minors under the age of 16 are eligible for lifetime protection by the US Secret Service. However, the exact costs are not known, as the NTUF reports that the data is classified.

- If a former president was not receiving protection from the Secret Service, declines the benefits or the protection provided by the Secret Service expired at its designated time, "appropriations up to $1 million for the former president and up to $500,000 for the spouse can be made, each fiscal year, for security and travel related expenses," according to the Former Presidents Act of 1958.

Introduction

We have provided an overview of how much former US presidents make, including the annual pension, book and branding deals, and public appearances. It also presents the available data on the security costs of protecting them when they leave office.

Overview of How Much Former US Presidents Make and Security Costs

Pension

- The Former Presidents Act of 1958 stipulates that former US presidents are entitled to an annual pension that is worth the basic pay (as in effect from time to time) of the head of an executive department or cabinet secretary.

- Initially, the pension for former presidents was set at $25,000 per annum before it was amended to reflect the pay of a cabinet secretary, which stood at $221,400 in 2021 according to the National Taxpayers Union Foundation (NTUF), or $219,000 - according to an article published by Vox in 2021. Currently, the basic pay for the head of an executive department (Level I) is $226,300.

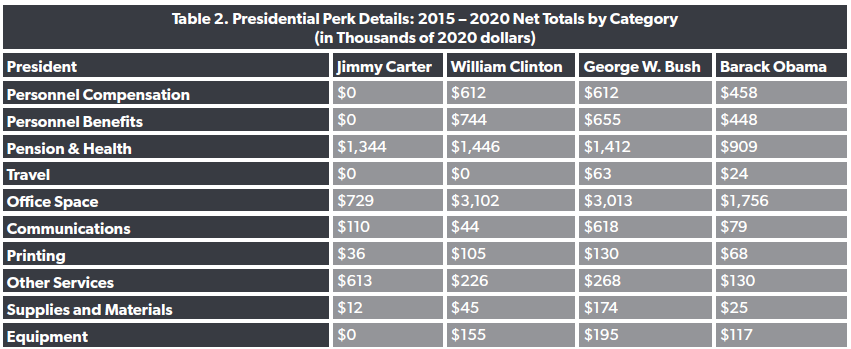

- The table below shows how much the government spent on various benefits and services for former presidents between 2015 and 2020, including the pension (under "Pension & Health").

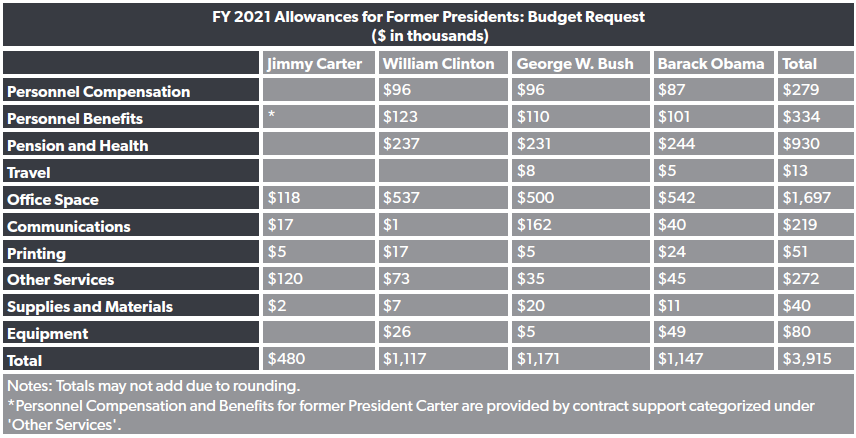

- The table below is the Request Budget document for former presidents in 2021, which shows the breakdown of all entitled allowances, including pension and health.

- It's important to note that "the pension allowance shall not be paid for any period during which such former President holds an appointive or elective office or position in or under the Federal Government or the government of the District of Columbia to which is attached a rate of pay other than a nominal rate."

- If a former president dies, the wife or widow is entitled to $20,000 per annum, which is payable monthly. The benefits hold unless the widow dies, remarries before she's 60 years, or has an appointive/elective office where she's entitled to a rate of pay other than a nominal rate.

- Since the pension of a former US president is dependent on the basic pay of the head of an executive department or cabinet secretary, the US congress sets the amount annually.

Security Costs

- The Former Presidents Act of 1958 also stipulates that former presidents, their spouses, and minors under the age of 16 are eligible for lifetime protection by the US Secret Service. However, the exact costs are not known, as the NTUF reports that the data is classified.

- However, if a former president was not receiving protection from the Secret Service, declines the benefits or the protection provided by the Secret Service expired at its designated time, "appropriations up to $1 million for the former president and up to $500,000 for the spouse can be made, each fiscal year, for security and travel related expenses," according to the Former Presidents Act of 1958.

- Towards the end of Trump's reign as the president of the US, he approved "Secret Service security protection to be extended for additional next six months to his adult children," a request which reporters revealed cost $1.7 million - because of the number of people to be protected and how frequent they travel.

- In 2021, after leaving office, reports show that the former president, Donald Trump, cost the US Secret Service over $1.3 million on hotel and transportation bills, as federal agents secured and traveled between South Florida and New Jersey - spending $788,286 on hotel rooms, $286,802 on rental cars, and $262,091 on air and rail travel.

- While that $1.3 million is only a fraction of the overall cost, the overall cost of protection is not publicly available.

Average Book Deal

- It is common for former presidents to publish books and/or presidential memoirs when they leave office. They earn millions of dollars by signing expensive and record-breaking book deals with publishers.

- "In 2017, Barack and Michelle Obama signed a joint book deal with Penguin Random House to the tune of over $60 million," which featured books and/or memoirs like "Dreams from My Father: A Story of Race and Inheritance" by Barack and "Becoming" by Michelle.

- Bill Clinton's post-presidency book deal was worth about $14 million (or about $21 million in today's currency). The Obamas' book deal and Bill Clinton's book deal still rank in the top 10 book deals ever.

- George W. Bush also signed his book deal to the tune of $10 million after he left office.

- Based on these book deals, the average book deal size that former presidents can get is about $28 million (i.e., ($60 million + $14 million + $10 million) / 3 = $28 million).

Additional Private Sources of Income

Public Appearances

- Former presidents are usually invited to deliver speeches and keynote addresses or make public appearances at events and ceremonies, which does involve hefty fees.

- Reports show that Former President Barack Obama charged up to $400,000 for a speaking engagement in 2017. This came after it was reported that he was paid $1.2 million for three separate speeches to Wall Street groups.

- "Former President Bill Clinton has made the most of any modern president on the speaking circuit. He gives dozens of speeches a year and each brings in between $250,000 and $500,000 per engagement, according to published reports, and earned $750,000 for a single speech in Hong Kong in 2011," according to ThoughtCo.

- Washington Post estimated that former President Bill Clinton earned at least $104 million in speaking fees from 2001 through 2012.

- Reports show that former President George W. Bush charged up to $200,00 for a speaking engagement.

Brand Deals

- Like celebrities, former presidents have earned significant income from brand deals.

- In 2018, the Obamas signed a deal with Netflix to produce content, such as the "American Factory" and "Crip Camp," which received positive reviews. "Crip Camp" also won an Oscar.

- While the size of the deal was not disclosed, CNN reported it was a high "a high 8-figure deal." Based on the size of similar multi-year deals with well-known names, Newsweek speculated that it could be in the range of $150-$300 million.

- They were also included in a deal signed by Spotify with Higher Ground Productions in 2019. "The deal included a 9-episode podcast that was hosted by Michelle Obama and featured guests including Barack," according to Business Insider.

- TechCrunch revealed that the deal was worth approximately $25 million, though the estimation was based on rumors.

- Bill Clinton also signed a deal with iHeartMedia - the second of his deals with the media company—to produce a podcast that premiered in 2021. The deal size was not disclosed.

Research Strategy

For this research, we leveraged credible resources that are publicly available, such as Business Insider, Yahoo Finance, and the NTUF, among others.