Part

01

of one

Part

01

Financial Planning/Pitch Deck

Key Takeaways

- 30% of consumers have a paid financial advisor. Those most likely to have a financial advisor are consumers with incomes of $100,000 or more (55%), a college graduate (41%), and male (35%).

- The amount of time it takes to settle probate depends on a variety of factors. Generally, it can take from a few months to more than a year, but in most cases, it should take less than a year. If the decedent had a will this simplifies the process. If they did not have a will the court must appoint an administrator for the estate.

- 95% of people use some form of the cloud each day. Surprisingly, not all of them even know they are using the cloud.

Introduction

The average income for those that use financial advisors, details on time frames for receiving multiple legal documents, the documents needed for estate planning, statistics on cloud usage, and an overview of the digital vault market have been provided below. Additional statistics have been provided in each section to give a comprehensive understanding of each process.

Average Income of People that Use Financial Advisors

The average income of a person who has a paid advisor is provided along with additional information about who uses a financial advisor.

Statistics

- 30% of consumers have a paid financial advisor. Those most likely to have a financial advisor are consumers with incomes of $100,000 or more (55%), a college graduate (41%), and male (35%).

- 60% of those that have a financial advisor hired them after a specific life event. For example, 22% of millennials got a financial advisor after a marriage or divorce. 22% of Gen Zers did so after a death in the family or receiving an inheritance. 23% of baby boomers hired on when they reached retirement age.

- 42% of people surveyed in a Magnify Money think that they typically cost more than they do.

- 82% would rather have a financial advisor than a robo-advisor.

- The rates for financial advisors by generation are as follows: Baby boomers (36%), millennials (31%), GenZ (29%), and GenX (24%).

- The most common reasons that people have an investment advisor is for investment management (60%), achieving financial goals (28%), general financial advice (36%), and creation of a comprehensive financial plan (30%).

- According to a Ramsey Solutions study, 44% of people that use a financial advisor have $100,000 or more saved for retirement.

- Of interest, when looking at wealth management specifically, it is recommended that one has $250,000 in investable assets.

Death Certificates

- The amount of time it takes to receive a death certificate varies greatly by state and by the type of death. On average, death certificates can take 10 days to complete, then they must be processed by the county vital statistics office. If there is an autopsy, this significantly lengthens the process and can take up to 6 weeks.

- Most often, laws dictate that a death certificate needs to be created within 72 hours of the death being reported and then submitted to the health department to complete. Once the death certificate is completely processed, (up to 10 days if there are no issues or an autopsy) then they are mailed out the appropriate recipient.

- A complete list of time frames for each individual state may be viewed here and is also shared in the graphic below.

Social Security Disability

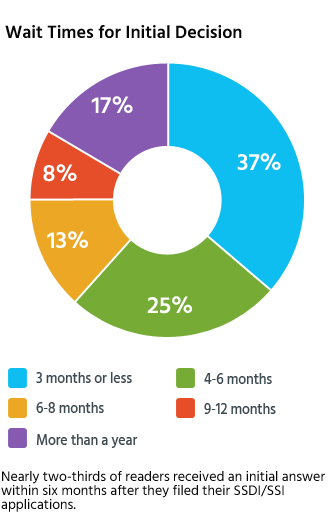

- On average it takes around 3-5 months to get a disability decision, according to the Social Security Administration. In 2021, there were 1,838,893 applications submitted for disability.

- During this time, according to the Social Security Administration, they will review current work status and the severity of the condition.

- A former disability examiner stated that one can generally expect to be denied at the application level and that they will need to file an appeal.

- According to a survey conducted by NOLO, 37% got their initial answer within 6 months, 37% within three months, and 38% had to wait longer than 6 months. These numbers were also corroborated by Citizens Disability.

- Once an appeal is filed, then the person must go through a reconsideration review with an examiner. This can take, on average, 109 days.

- If, after the reconsideration review, it is deemed that the applicant can proceed, then the case must be presented to a disability judge. 44% of the survey participants from NOLA waited between one and two years, 42% waited less than a year, with the average being 15.3 months. Of note, the survey conducted by NOLA was conducted over multiple years. According to the Social Security Administration, the wait time as of October 2020, was about 10 months.

- After the hearing before the judge, then the applicant must wait for the decision. The average wait time is 2 months.

- The average duration of a disability application that was not approved initially and had to go through appeal is 27 months.

- Location and individual circumstances can significantly affect wait times as some states are far more backlogged than others and more complicated cases that require significant amounts of medical evidence can make wait times longer.

- If approved, benefits cannot be paid until five months after the initial claim is filed.

Birth Certificates

- Generally, it takes between 4 to 8 weeks to get a new birth certificate. According to Vital Records, the easiest way to get a duplicate birth certificate is to order it online. The quickest way to get a copy is to go to the vital records office where it was issued, although wait times in offices can be lengthy.

- Birth certificate processing times by each state are as follows:

- Alabama (2-3 weeks)

- Alaska (4-6 weeks, or Rush Order: 3-7 days)

- Arizona (1-2 weeks)

- Arkansas (10-17 days)

- California (5-6 weeks)

- Colorado (6-8 weeks)

- Connecticut (6-8 weeks)

- Delaware (2-5 weeks)

- District of Columbia (10-20 days)

- Florida (5-10 days, or Rush Order: 2-3 days)

- Georgia (8-10 weeks)

- Hawaii (6-8 weeks)

- Idaho (2-3 weeks)

- Illinois (4-6 weeks)

- Indiana (15-20 days)

- Iowa (4-6 weeks)

- Kansas (1-3 weeks)

- Kentucky (3-5 weeks)

- Louisiana (8-10 weeks)

- Maine (2-5 weeks)

- Maryland (2-4 weeks)

- Massachusetts (3-4 weeks, or Rush Order: 7-10 days)

- Michigan (4-5 weeks, or Rush Order: 2-3 weeks)

- Minnesota (4-6 weeks, or Rush Order: 5-10 days)

- Mississippi (3-5 weeks)

- Missouri (12-16 weeks)

- Montana (2-3 weeks)

- Nebraska (2-5 weeks)

- Nevada (4-6 weeks)

- New Hampshire (3-5 weeks)

- New Jersey (10-12 weeks)

- New Mexico (8-12 weeks)

- New York (12-14 weeks, or Rush Order: 2-4 weeks)

- New York City (18-20 weeks)

- North Carolina (6-8 weeks, or Rush Order: 1-2 weeks)

- North Dakota (5-10 days)

- Ohio (3-5 weeks)

- Oklahoma (8-12 weeks)

- Oregon (3-5 weeks)

- Pennsylvania (4-8 weeks)

- Rhode Island (6-8 weeks, or Rushed Order: 3-7 days)

- South Carolina (2-4 weeks)

- South Dakota (2-5 weeks)

- Tennessee (4-6 weeks)

- Texas (16-18 weeks, or Rush Order: 15-16 weeks)

- Utah (1-3 weeks)

- Vermont (10-20 days)

- Virginia (6-8 weeks)

- Washington (6-8 weeks)

- West Virginia (5-20 days)

- Wisconsin (1-2 weeks)

- Wyoming (5-15 days)

Marriage Licenses

- Wedding licenses are essentially an application to be married. These licenses are normally filled out in person at the appropriate county office. There is no waiting period to receive the license, although there might be a waiting period before the couple can officially marry. Once married and the officiant turns it back to the county, the couple then receives a marriage certificate. This process takes anywhere from a week to several weeks. Some states, such as Illinois, have the couple go to Vital Records and then request their marriage certificate.

- According to Vital Records, each state has their own processing timelines, but on average a person should plan to wait anywhere from 5 days to 16 weeks. Fees range between $5 to $34 depending on the state. Upon further research, the processing times for a marriage license was the same as for a birth certificate (shared above). This makes sense, as the processing procedures are identical.

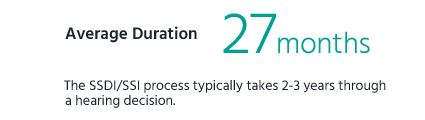

Probate

- The amount of time it takes to settle probate depends on a variety of factors. Generally, it can take from a few months to more than a year, but in most cases, it should take less than a year. If the decedent had a will this simplifies the process. If they did not have a will the court must appoint an administrator for the estate.

- Probate can be avoided entirely if all assets are in a living trust.

- Factors affecting probate timelines are shared below:

- All known creditors of the estate must be given notice.

- An inventory must be conducted of the estate's assets (probate property). This includes not only real property but stocks, bonds, and any other business interest. Complicated assets like business interest can take much longer to inventory than bank accounts, for example.

- All objections must be addressed then creditors paid. For example, if there are any will contests challenging the validity, this must be addressed.

- There are five different ways to probate a will, although not all of these options are available in every state:

- Formal probate is used when someone dies, and their estate has significant value.

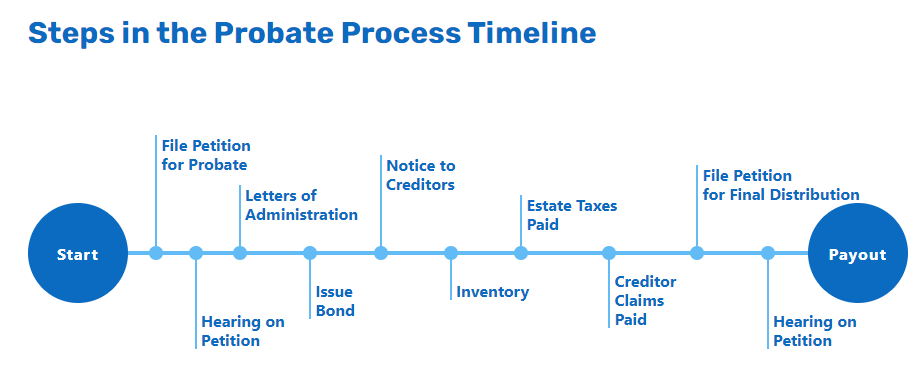

- Informal probate, which is available in 18 states (uniform probate code), is used to fast track the approval of the will and the distribution of assets. This is used when everyone agrees that the will is valid and can be used by any size estate. Informal probate does not have to go to court, instead the will is filed along with signed statements that all parties involved agree. This option is available in the following states:

- When an estate value falls under a certain limit, the executor can claim property via affidavit. These legal forms are signed in front of a notary and the probate court is not involved at all in the process. "Instead, the beneficiary completes an affidavit stating that they are legally entitled to the property. The affidavit is then sent to the institution holding the asset, such as a bank or brokerage house, and asks it to transfer the asset to the beneficiary. This method is not valid for real estate."

- 76% of estates are valued under $500,000. Probate is usually completed within 14 months. For estates over $500,000, the average is 16 to 42 months.

- Summary Estate Administration is used when the estate value is under a specific limit set by each state and there is no will. It goes through probate court but is faster. It is not available for a decedent that owned real property.

- In a few states Set Aside is available for the spouse or minor children. Again, the estate must be under a set amount and goes through probate court, but is normally resolved quickly.

- Costs of Probate:

- A probate attorney will need to be hired. These fees will vary depending on the lawyer. Some lawyers charge a flat fee, while others charge a percentage of the estate.

- An initial filing fee must be paid to the court. These generally range from $50 to $1,200.

- The certificate fee that authorizes a person as administrator range from $5 to $20 per certified copy.

- It is recommended that notifications to beneficiaries be sent through certified mail. This can range from $10-$300.

- While not always incurred, there could possibly be fees for appraisals, business valuations, notaries, storage, and estate sale fees.

- A breakdown of probate fees by state along with what is considered a small estate can be viewed below:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Estate Planning

As stated in the initial proposal, data availability for how long it takes to gather the required documents was low. Further research confirmed these numbers were not available. This is most likely due to the fact that different estates require different pieces of data to be gathered. For example, someone who does not own a home and does not have a 401K would have far less time involved than someone who owned multiple properties, vehicles, and has investments. Therefore, an overview of the documents needed for estate planning is shared below:

- First, inventory possessions that are tangible and intangible. Tangible assets can include home, land, other real estate, vehicles, collectibles, and personal possessions. Intangible assets include checking and savings accounts, certificates of deposit, stocks, bonds, mutual funds, life insurance policies, home insurance, retirement plans, health savings accounts, homeowner policies, auto policies, disability policies, health insurance, and any ownership in a business. Make sure to list all account numbers, contact information, and the physical location of the documents.

- Once the inventory is complete, the value needs to be estimated. The planner will need to locate any recent appraisals or use a home value calculator and statements from all financial accounts.

- A list of debts should also be assembled that includes all financial obligations.

- The third step is to make sure that the planner has enough life insurance, and has a named guardian for children along with wishes for their care (if necessary).

- Make membership lists. "If you belong to any organizations such as the AARP, The American Legion, a veteran's association, a professional accreditation association, or a college alumni group, make a list of them. In some cases, these organizations may have accidental life insurance benefits (at no cost) on their members, and your beneficiaries may be eligible to collect."

- Then, the planner must establish their directives. For this they would need to gather several important legal directives like a living trust, medical care directive, and a durable financial power of attorney or limited power of attorney.

- Next, it is time to review beneficiaries on retirement and insurance accounts to make sure they are up to date.

- At this point, it is time to draft a will and select an estate administrator.

- The following personal records will need to be collected: social security number, legal residence, date and place or birth, names of spouse and children, birth, death, marriage, divorce, citizenship records, and military records.

- The following financial records will need to be collected: sources of income and assets, IRAs, 401 (k), interest forms, any other financial forms, Medicare/Medicaid information, all insurance documents, bank accounts, investment accounts, recent tax return, property tax bills, other liabilities, mortgages, deeds for home, car titles, registrations, credit card names and numbers, and locations of any safe deposit boxes.

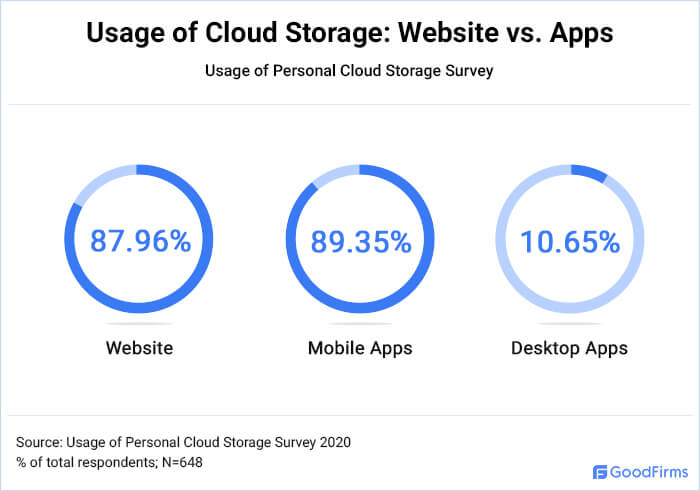

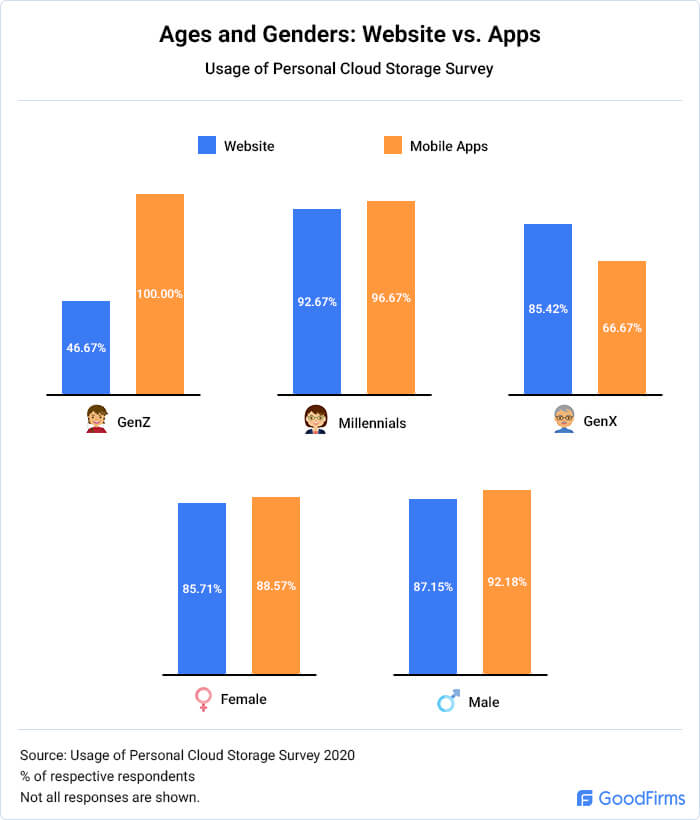

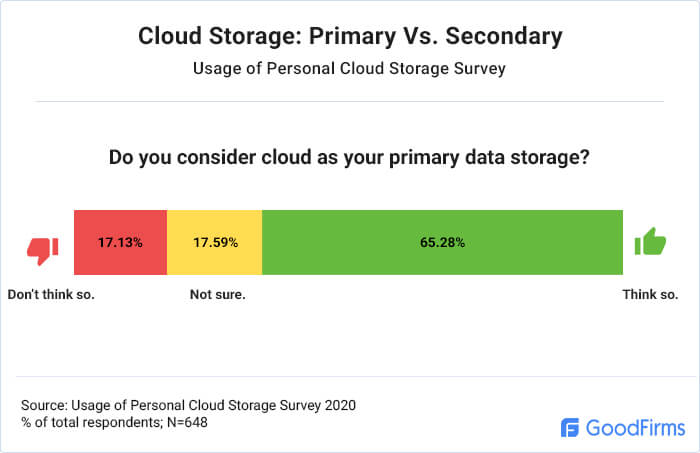

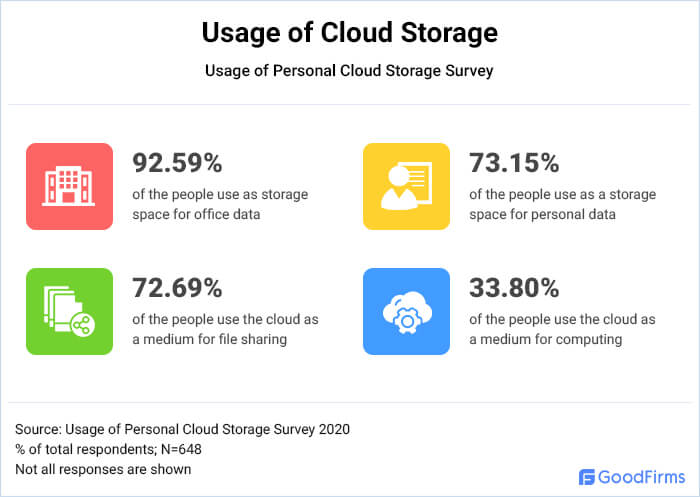

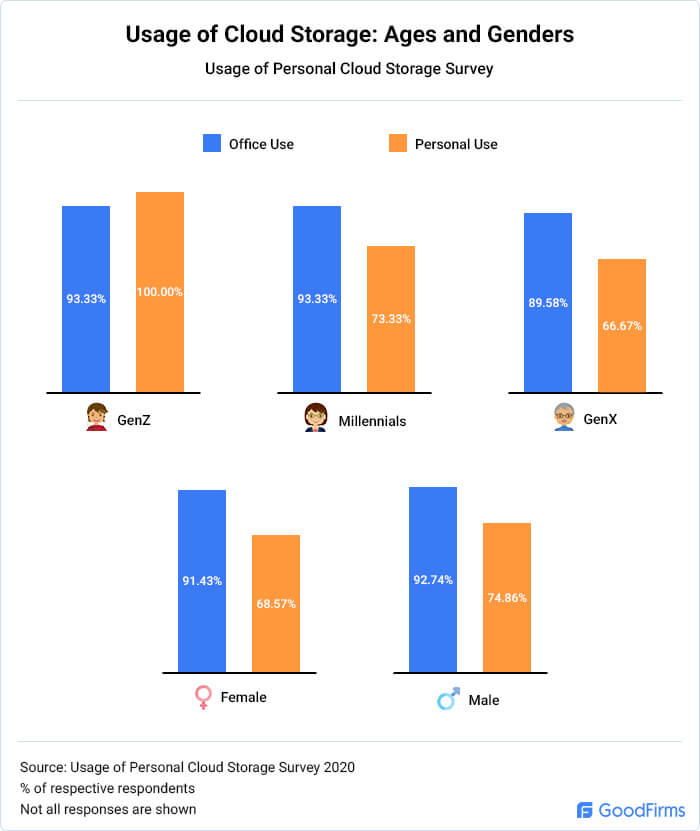

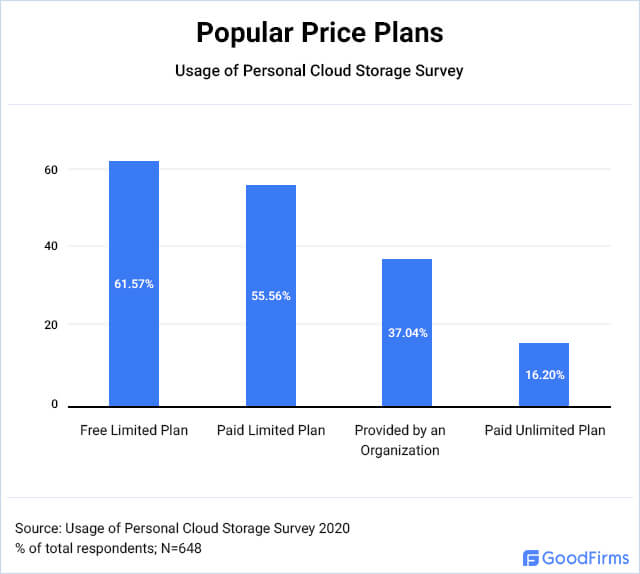

Cloud Based Storage Usage & Adoption- Personal

- 95% of people use some form of the cloud each day. Surprisingly, not all of them even know they are using the cloud.

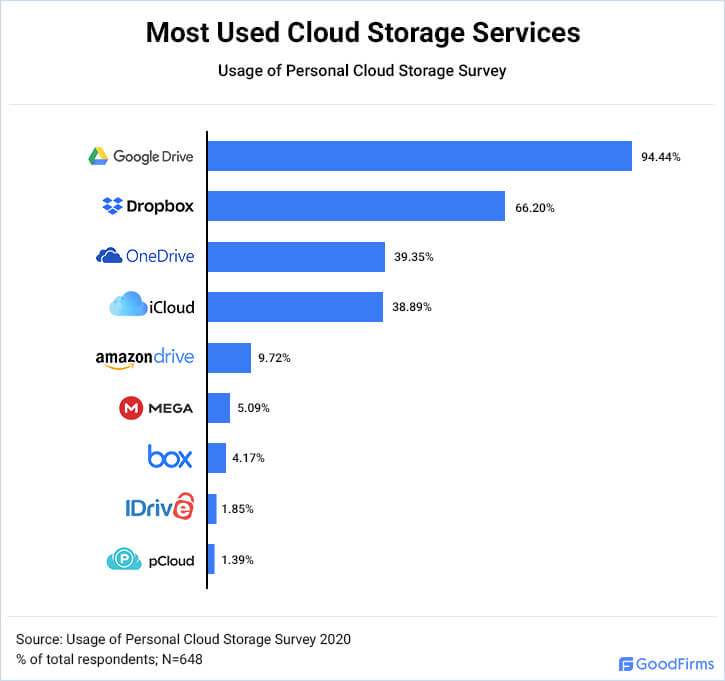

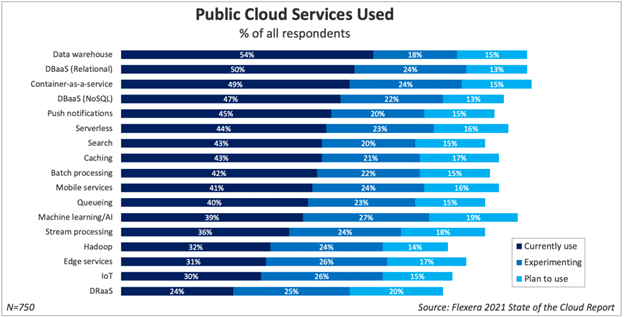

- According to Goodfirms, more than half of people (54.2%) use at least 3 different storage devices. Google Drive, Dropbox, and Microsoft OneDrive are the most used.

- The average person uses 36 cloud based services per day.

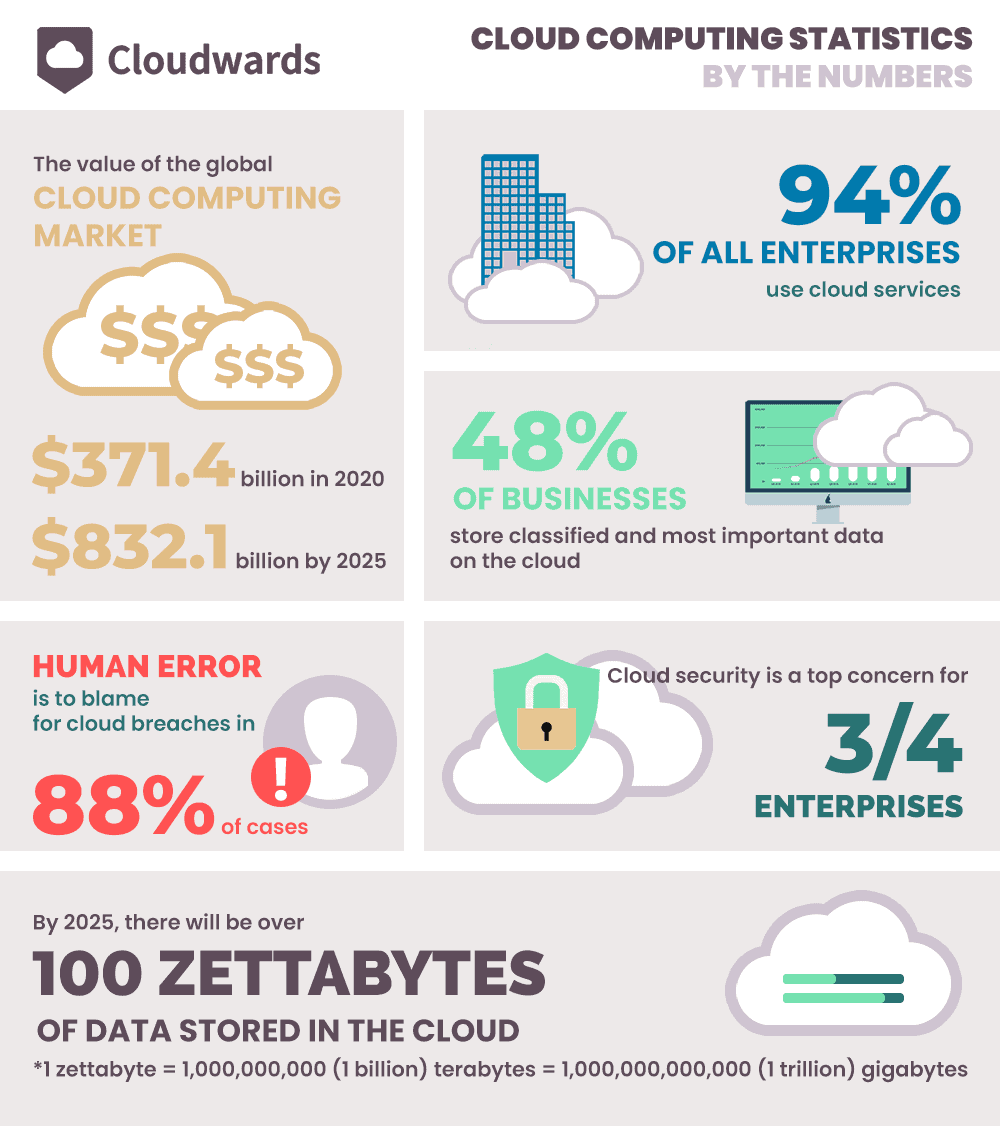

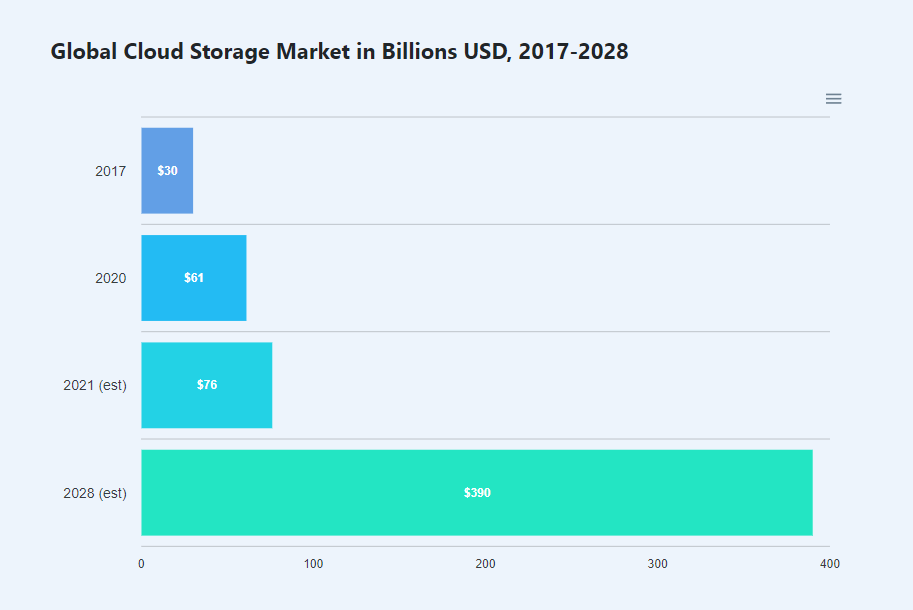

Cloud Based Storage & Adoption- Business

- 94% of enterprises use the cloud.

- As of 2020, 31% of businesses used the public cloud because it was cheaper, and 28% used a hybrid approach, 9% used an on-premise private cloud, and 6% used a hosted private cloud.

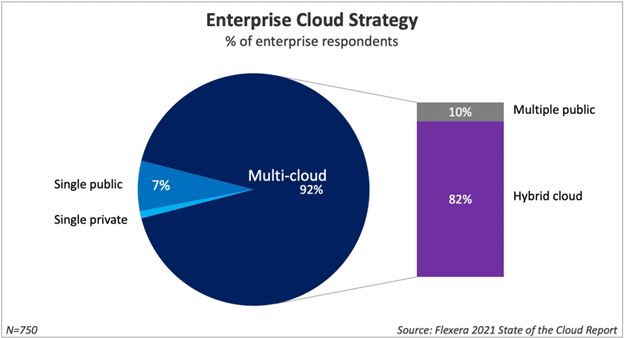

- On average, respondents in a Flexera survey, used 2.6 public and 2.7 private clouds.

- In 2020, more than 50% of organizations moved their workload to the cloud.

- By 2022, 90% of enterprises in the globe will be using multi-cloud. "It predicted more companies would prefer a mix of legacy platforms, multiple public, and on-premise private clouds in a bid to meet infrastructure requirements."

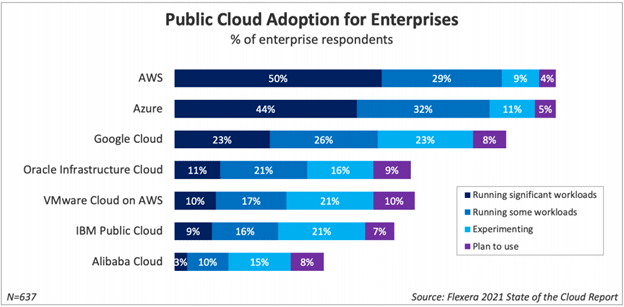

- The public cloud computing market will be worth $800 billion by 2025. The most popular cloud providers are AWS, Azure, and Google.

- "North America allocated 15% of its IT budget to online data restoration and recovery in the cloud". In Europe this number is only 10%.

- According to TechRepublic, over 50% of their survey participants plan to increase their hybrid cloud deployment.

- 81% of all enterprises have a multi-cloud strategy laid out or is in the works.

- PaaS grew in adoption to 56% in 2020.

- 67% of enterprise infrastructure is cloud based.

- "By 2025, the data stored in cloud data centers will exceed 100 Zettabytes".

- COVID-19 has fueled cloud adoption, with 53% stating they are accelerating implementation, and 31% are increasing investments in new applications.

Digital/Financial Vaults

As stated in the initial proposal, data availability for the utilization of digital/financial vaults was low in the public domain. A comprehensive search was conducted by first understanding the four companies provided by the client. Raymond James provides vault services for their client as does Goldman Sachs. FidSafe is for personal use, and EmoneyAdvisor is for use by finance professionals. They all either are or provide vault services but are very different in their offerings. During this process, the websites of the companies were scanned to see if they mentioned how many customers or users they had, but none did. The annual report of Raymond James was also scanned for any mention of their vault services, but there was no mention. Finally, market reports were located to see if they mentioned any specific numbers. No report mentioned an actual number of users, but other information of interest was located and presented as the alternative path presented in the initial proposal.

Helpful Information

- During research we did locate an interesting press release from October 11, 2021. Prisdio, a digital vault company, announced they have received an additional $3.5 million in seed funding from Chicago Ventures. They have now raised $6.85 million and will be launching in 2022.

- The average person under the age of 70 has more than 160 digital accounts.

Digital Vault Market

- In North America, the market generated $423.1 million in 2020 and is projected to reach $1.169 billion in 2028. They are the leading region in the market.

- By 2028, the global market will be worth $3.22 billion. "Revenues in the service sub-segment is expected to exceed $1,429.7 million by 2028, up from $489.8 million in 2020. The market is expected to expand as the services sub-segment provides applicants, intermediaries, beneficiaries, and guarantors with cost-effective services and secure access to the files and data. The deployment is further classified into on premise and cloud based. The cloud based sub-segment is expected to have a dominant market share of $2,096.1 million by 2028, up from $690.4 million in 2020. "

- The digital vault market is expected to have a 12% CAGR from 2021-2026, according to Mordor Intelligence. Marketwatch puts the CAGR at 15.7% from 2019-2027. Therefore, we can assume the estimated CAGR will be within 12%-15.7%.

- The General Data Protection Regulation has definitely been a positive driver and will drive European adoption.

- In India, Digital Locker is an initiative by the government to provide each citizen with 10MB of free online storage for important documents.

- Overall, the increase in digitization coupled and the need for data privacy will be chief drivers when it comes to personal use.

- The reduced costs associated with maintaining cloud storage will be a driver for businesses.

Additional Reading

Research Strategy

For this research on financial planning, we leveraged the most reputable sources of information that were available in the public domain, including the multiple sites from the US Government, VitalRecords, Investopedia, and Mordor Intelligence.