Part

01

of one

Part

01

Finance/Tax Industry Audiences

Key Takeaways

- 70% of Americans who identify as Latino or Hispanic say "financial freedom" (defined as "independence and future security") is very/extremely important to them. Long-term financial goals include savings (46%), buying a home (45%), and debt reduction (38%).

- Overall, less than half of Latino households overall feel they are "adept at investing." Yet, affluent Latino/Hispanic households are more likely to describe themselves as "financially savvy."

- Non-financial motivators drive the self-employed, including schedule flexibility (78%), location flexibility (73%), and the ability to pursue meaningful work (72%). 77% of small business owners report using their own savings to start their business (49% claim to apply for small business loans) and 30% say student loan debt has impacted their ability to grow their business. Inflation is currently the leading financial concern among 48% of small business owners.

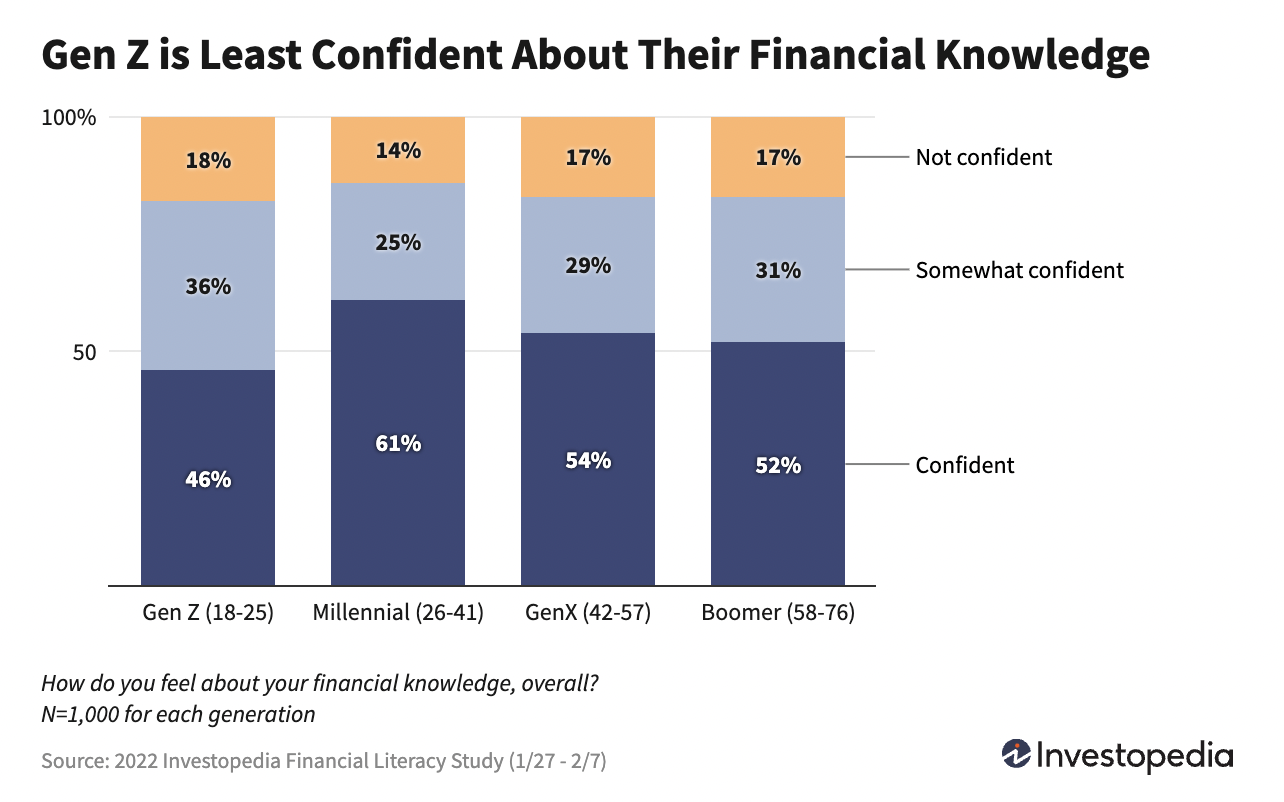

- 61% of millennials say they are confident about their overall financial knowledge and 63% claim to be more knowledgeable than their peers. Gen Z is less confident about its financial knowledge.

- 39% of millennials seek weekly investment advice. The most common media channels for millennial investors include internet searches (45%), financial information websites (40%), and YouTube videos (36%). Gen Z is most likely to leverage YouTube for investment information (39%).

Introduction

This research presents a profile of three financial/tax audiences, Latinx, self-employed, and millennial investor. Psychographics provided include financial attitudes and priorities, career and earnings, financial content interests, media habits, and non-financial interests. For the Latinx audience, we have also provided a separate section on financial challenges and barriers and for the millennial investor audience, we have provided financial behaviors. These additional areas were explored for these segments given more abundant information in-market for these groups.

1. Latinx

Attitudes and Priorities

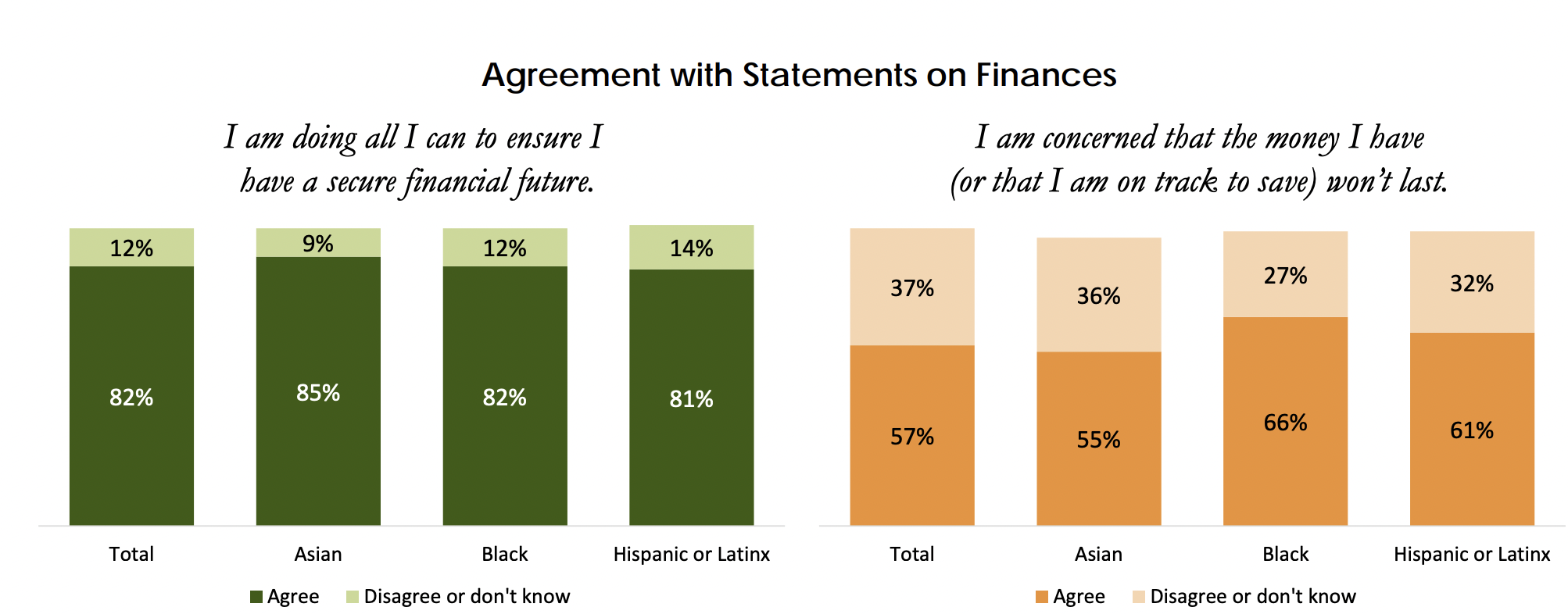

- 81% of Latinx consumers say they are doing all they can to "secure a financial future," though 61% are concerned that their money will not last.

- 70% of Americans who identify as Latino or Hispanic say "financial freedom" (defined as "independence and future security") is very/extremely important to them. Long-term financial goals include savings (46%), buying a home (45%), and debt reduction (38%).

- Latino households are less likely to talk about financial topics than are non-Latino households on topics including saving (35% versus 50%), investing (20% versus 35%), and budgeting (23% versus 35%).

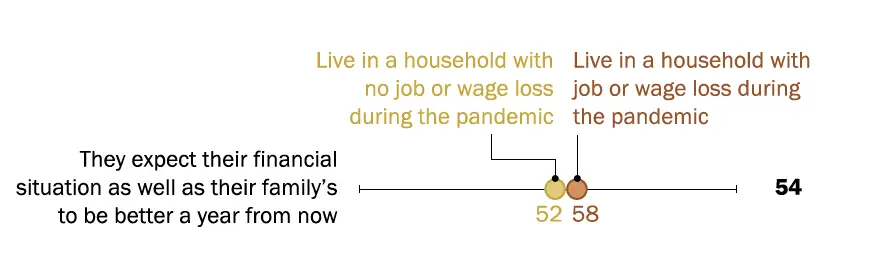

- Still, Latinos are generally optimistic about the future, with 54% of this group expecting their financial situation to improve over the upcoming year.

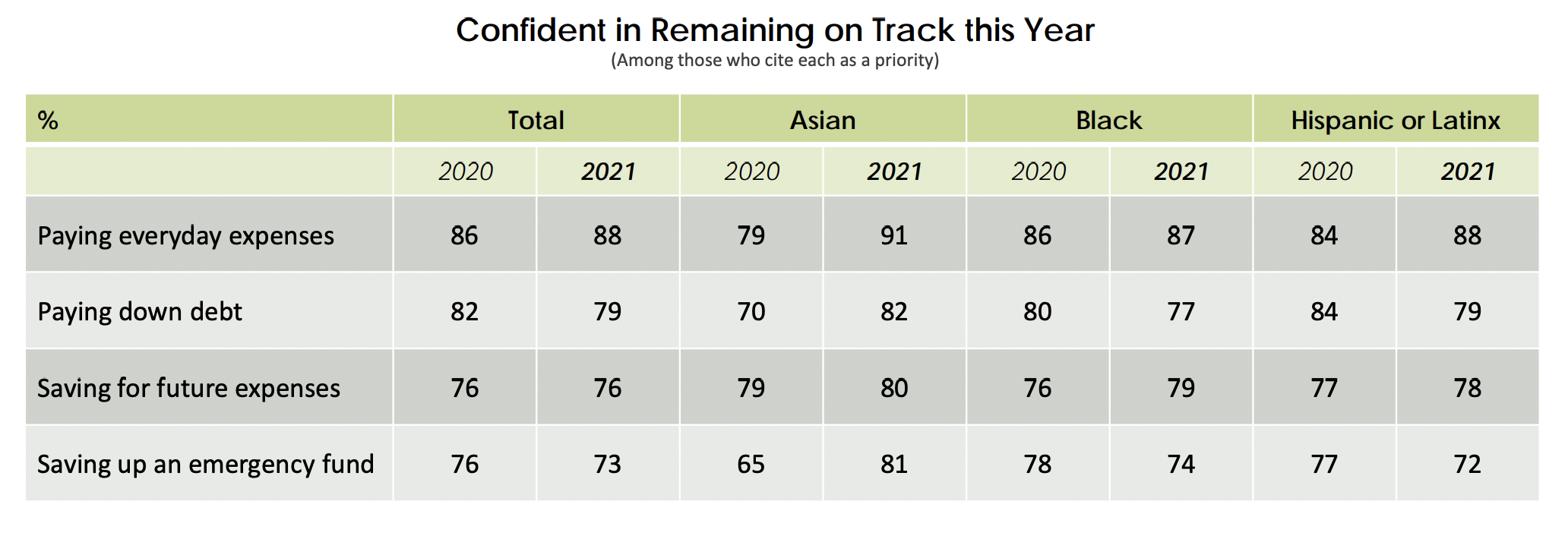

- Paying everyday expenses is considered a top priority for 47% of Latino consumers. 88% of those who prioritize everyday expenses express confidence they would "remain on track" to pay everyday expenses. 79% were confident they would "remain on track" in paying down debt.

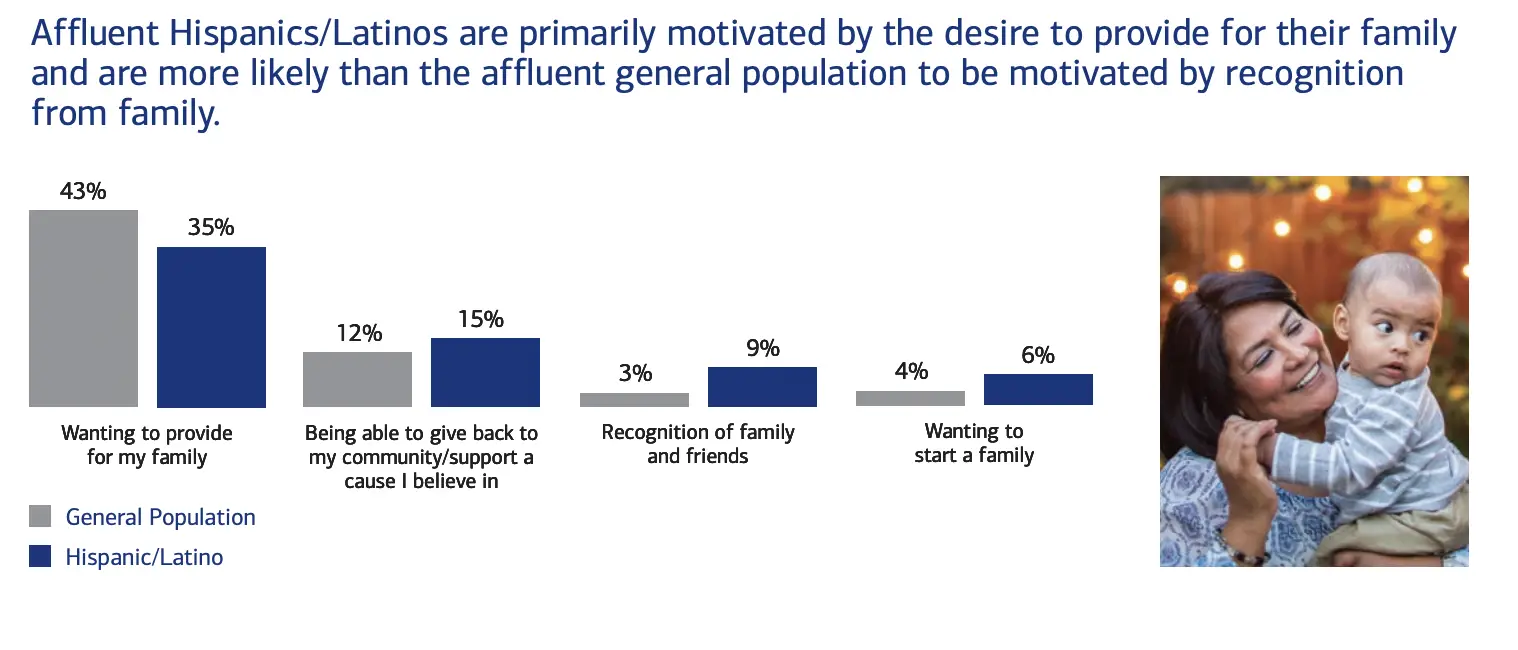

- Latinos also prioritize family support, with 44% of Latinos saying they had sent disposable income to help a family member. Further, 32% say they spend up to 30% of their income supporting family outside the US. 43% of affluent Latinos say that providing for their family is a leading motivator.

- COVID has accelerated the trend toward supporting family members and outside organizations, with 64% of Latinos saying they have sent money to friends, family, or charitable organizations since the pandemic began.

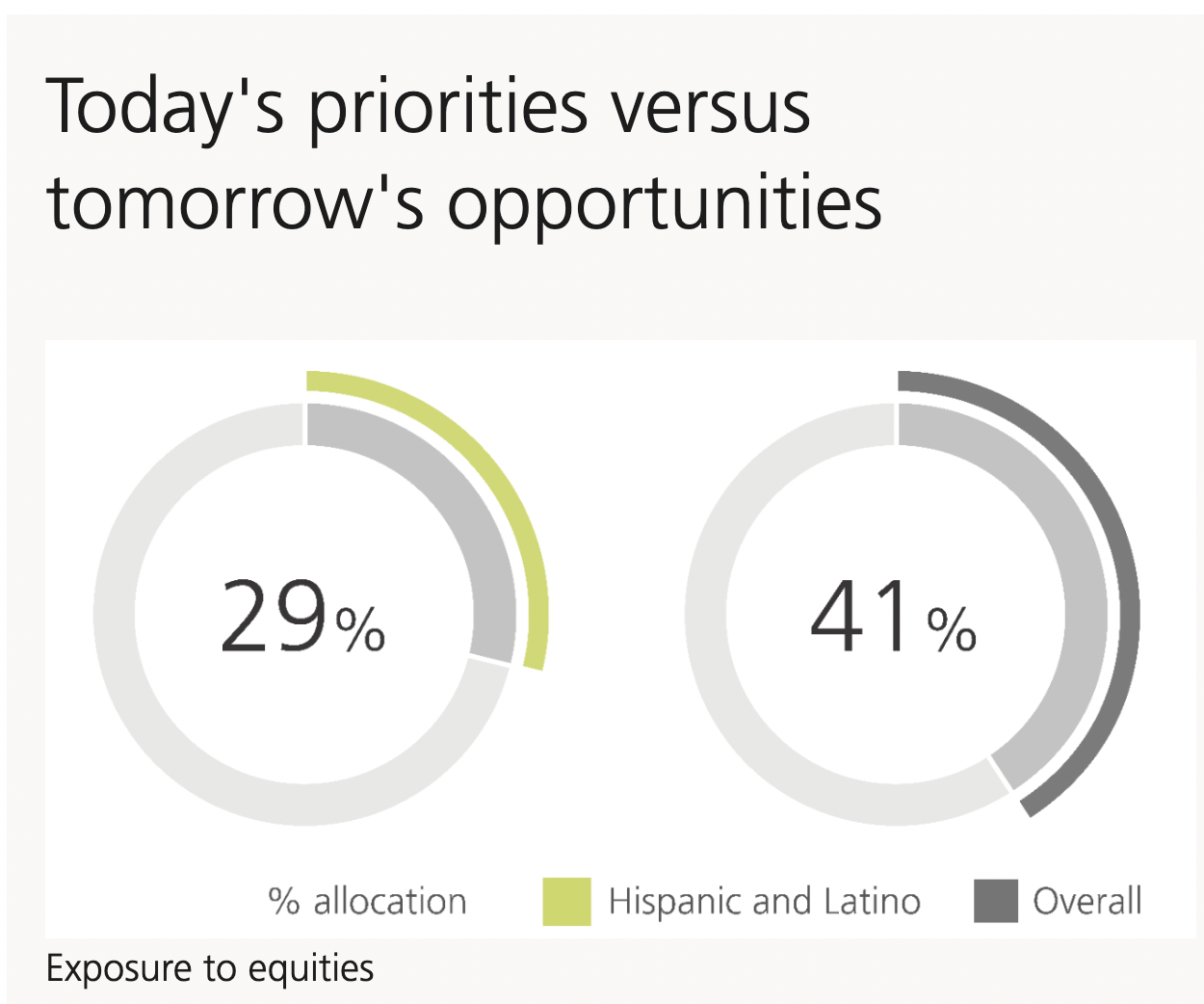

- UBS notes that the emphasis on supporting multigenerational households impacts how high net worth (HNW) Latinos approach investing, with a stronger focus among Latinos on capital preservation to ensure financial liquidity. The study found only 29% of HNW Latino investments were allocated to equities compared to 41% of all HNW investors.

- Overall, less than half of Latino households overall feel they are "adept at investing." Yet, affluent Latino/Hispanic households are more likely to describe themselves as "financially savvy."

Challenges and Barriers

- 31% of Latinx households are concerned about their ability to manage a financial emergency, leaning on cash (28%) or credit (29%) to handle any emergencies.

- Financial stressors among more affluent Latino households include saving for retirement (26%), healthcare (23%), and paying day-to-day expenses (17%).

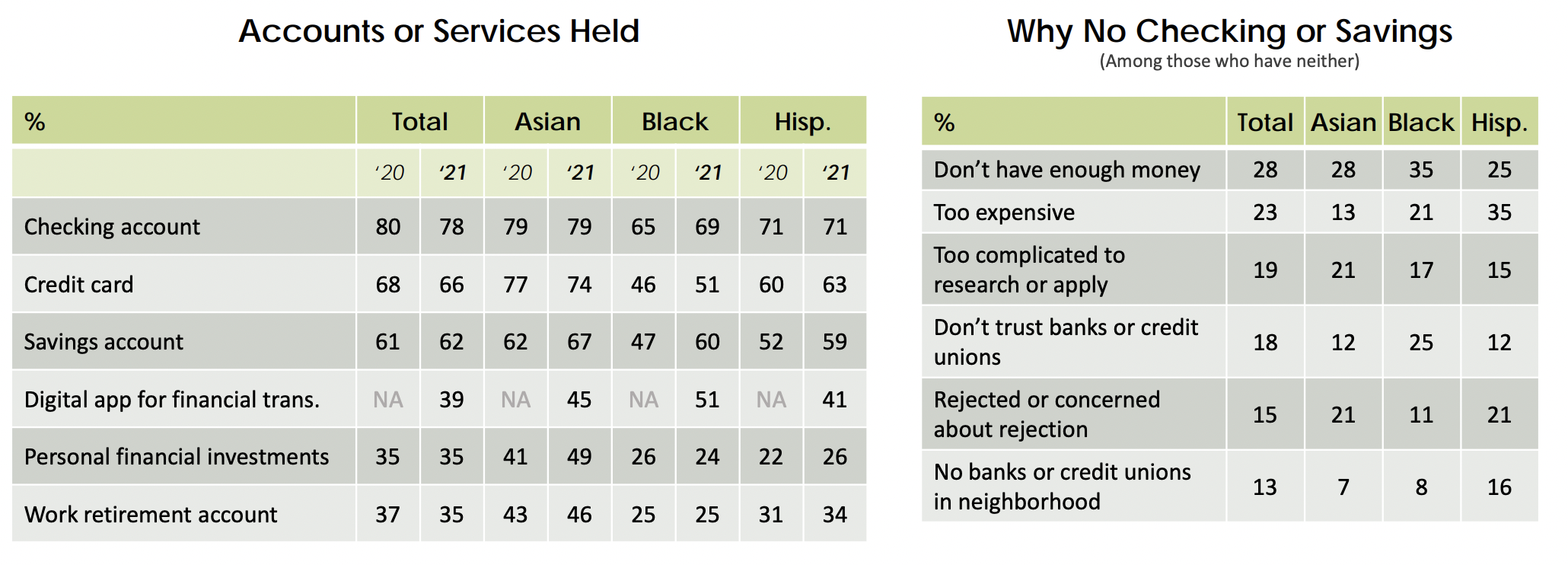

- Latinx and Hispanic Americans are less likely to own checking, savings, investment, or retirement accounts. Lack of funds, perceived complexity in applying, and lack of trust are primary reasons this group does not own a checking or savings account.

Career and Earning

- Latinos are more likely than other racial or ethnic groups to start businesses in the US, with the number of Latino-owned companies growing by 12.5% annually. Latino-owned businesses are as likely to be in the tech industry as non-Latino-owned businesses.

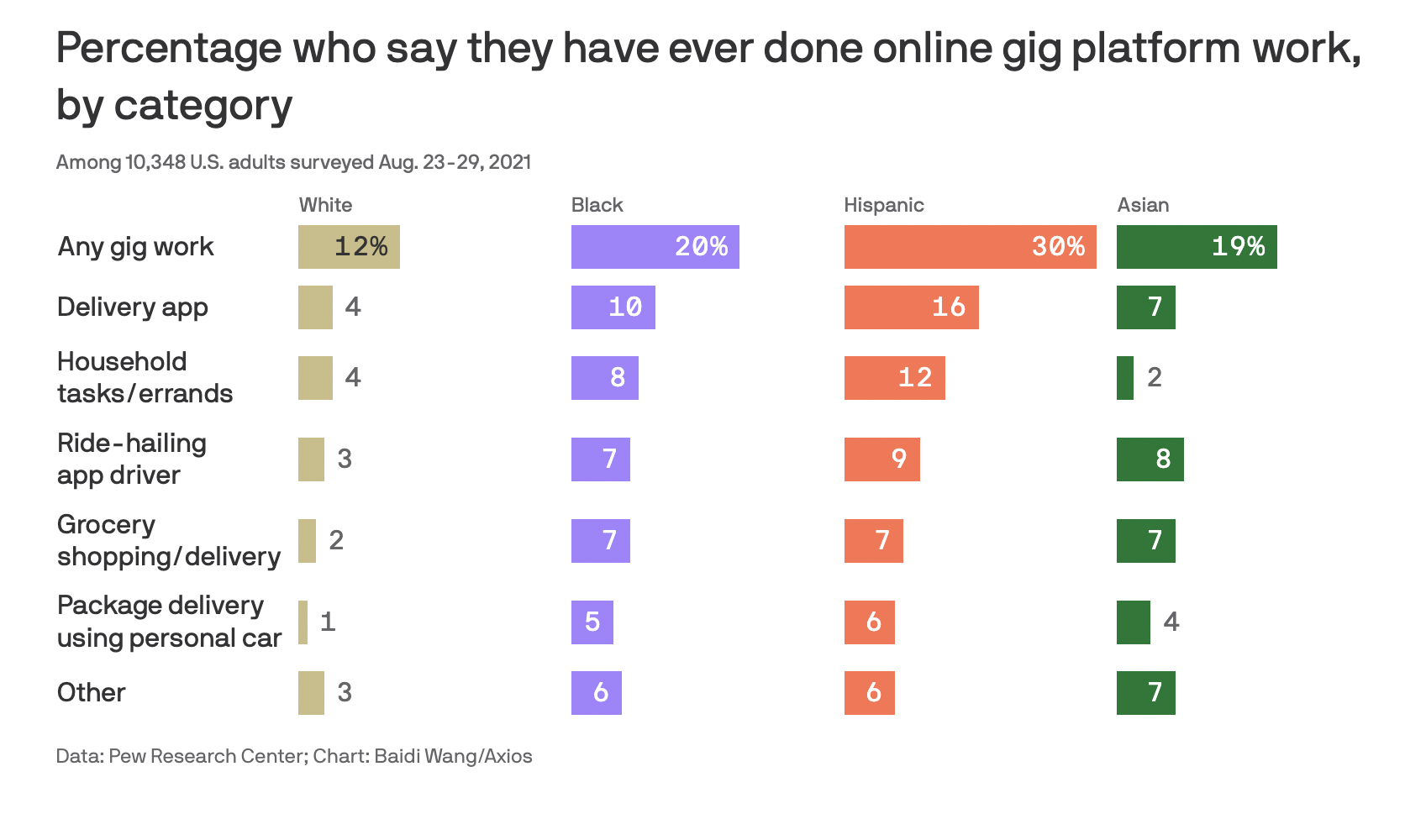

- Pew research found that Latinos have been more likely to engage in "gig work" compared to other groups.

- The fastest-growing jobs over a recent 4-year period for Latino and Hispanic Americans include couriers/messengers (+205%), pest control (+200%), investigators (174%), and information and security analysts (+173%).

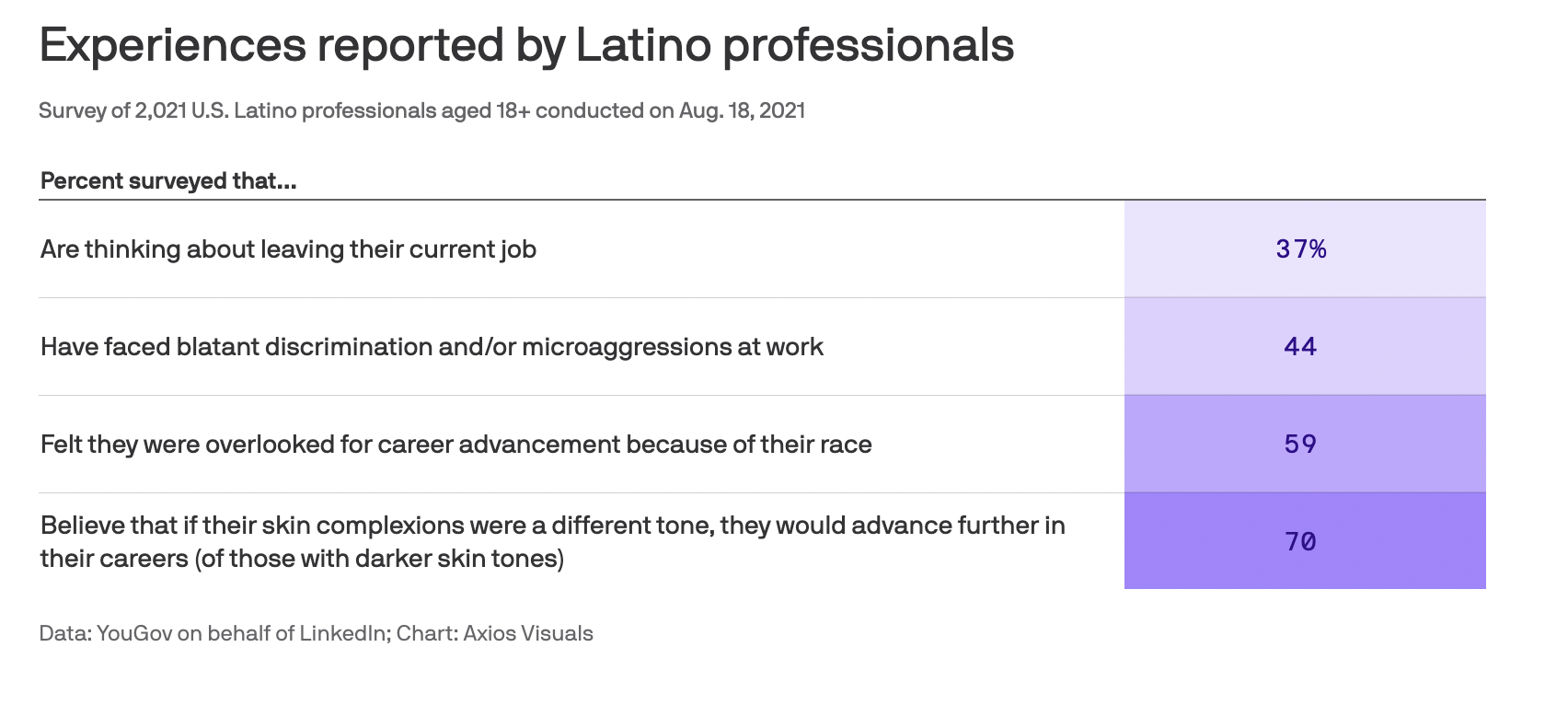

- Generally, Latinos do not perceive the workplace to offer a positive environment that encourages diversity. 37% are currently considering leaving their job due to a lack of recognition and opportunity. 59% say they were overlooked for a promotion because of their race.

Financial Content Interests

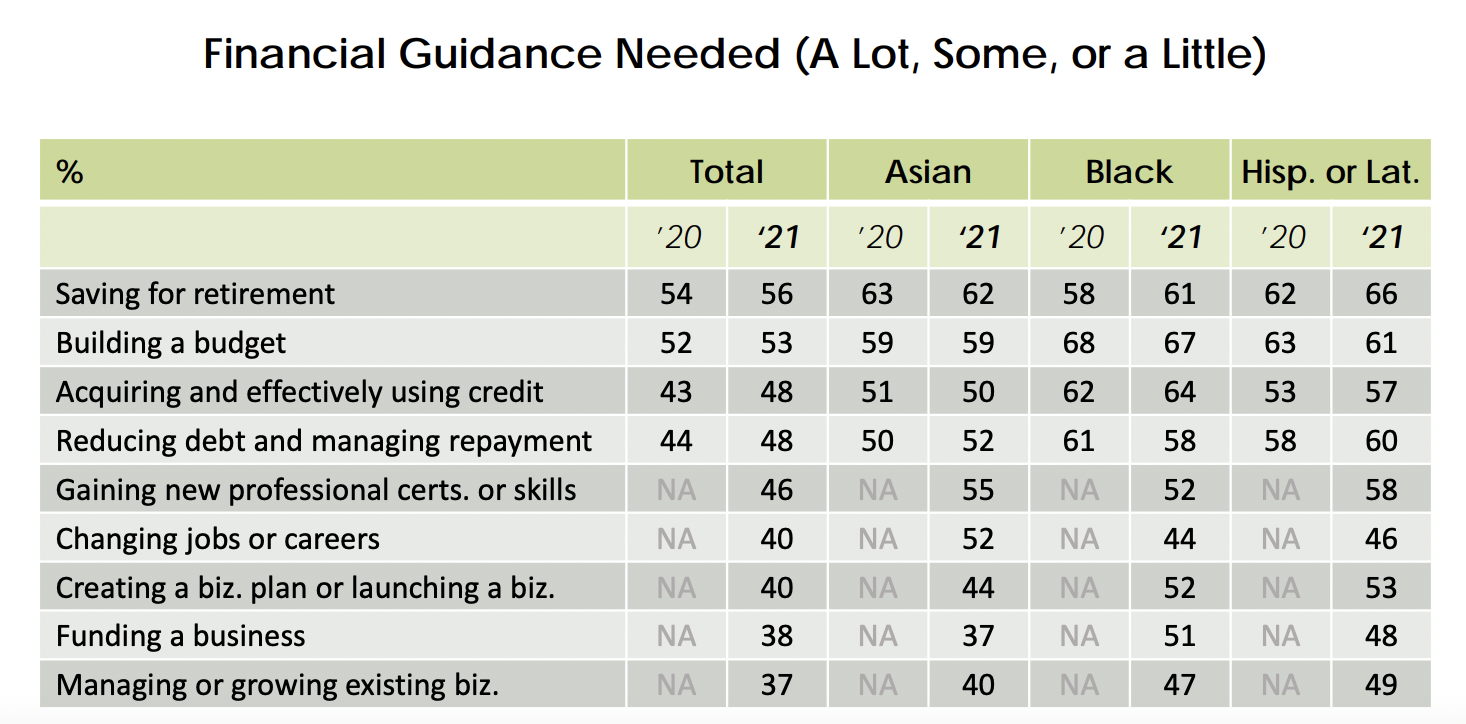

- Saving for retirement (66%), developing a budget (61%), managing credit (57%), and debt management (60%) are top areas of financial interest among Latinx households.

- A Merrill Lynch report found that affluent Latinos are more interested than other affluent consumers in learning how to invest (21% vs 17%), financially prepare for healthcare expenses (23% vs 18%), and develop a budget and manage debt (16% vs. 9%).

Media Habits

- Finance websites (32%) and financial advisors (33%) are top sources of financial information for Americans who identify as Latino or Hispanic.

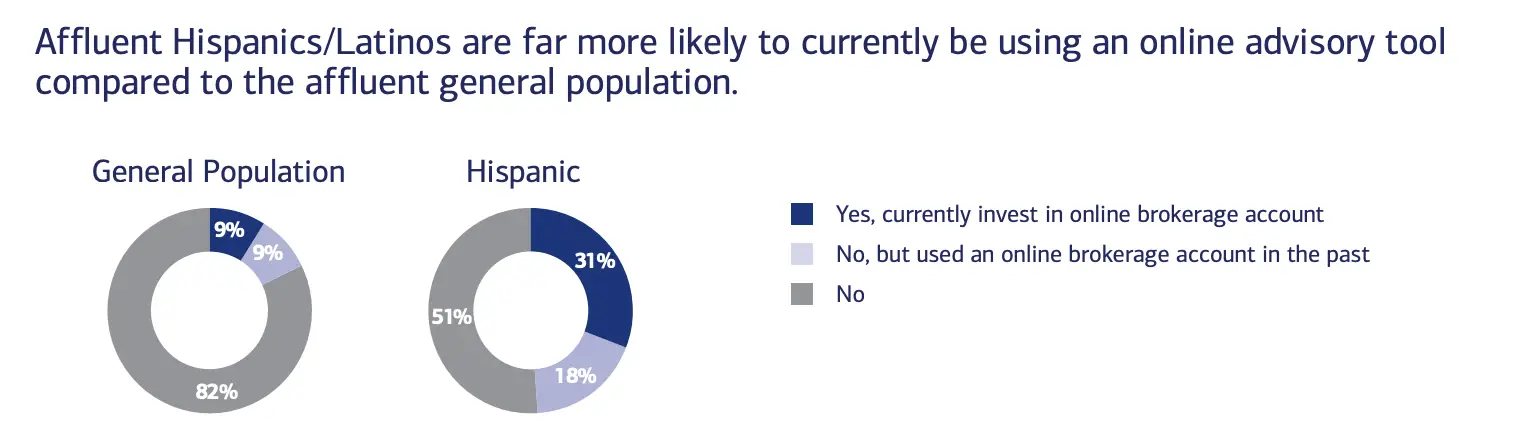

- 19% of affluent Latino/Hispanic households look to business executives for financial guidance and are more likely to use online advisory tools compared to other affluent Americans.

- Further, more Latino/Hispanic Americans leverage online advisory services compared to the general population.

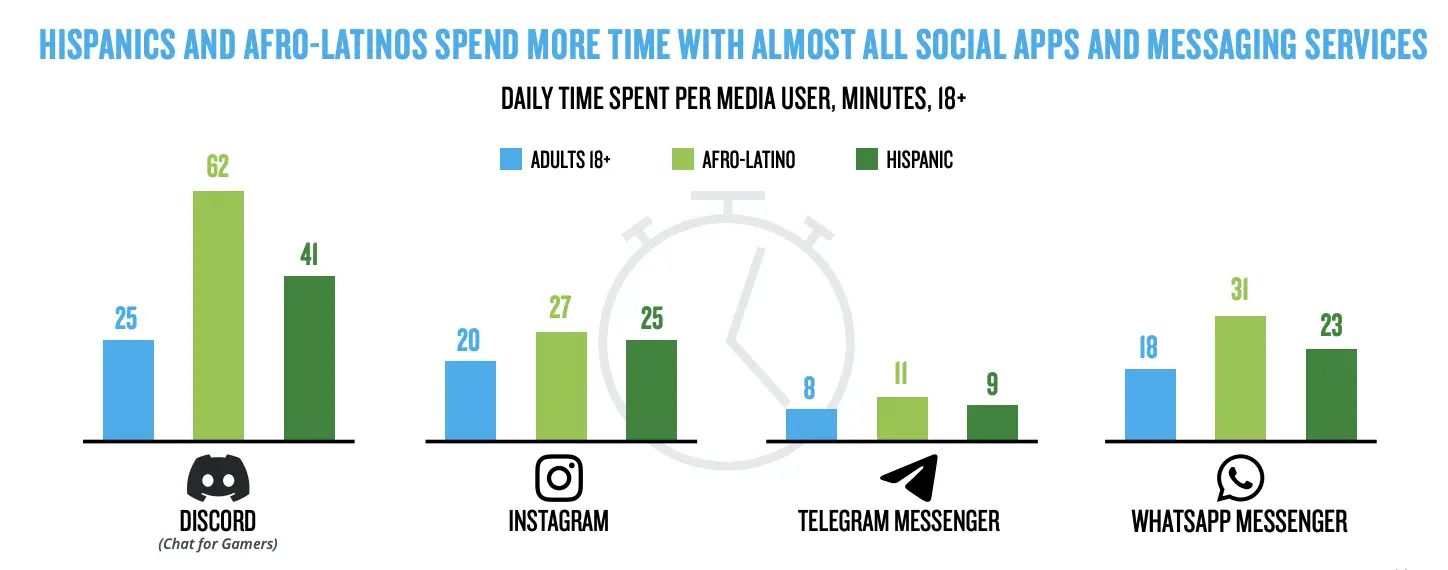

- More generally, Hispanic Americans spend more time on social media and messaging platforms given the "trust and intimacy" they provide as well as the ability to connect with family and friends outside the United States.

Non-Financial Interests

- The Latino/Hispanic community is interested in home-buying, buying or leasing a car, taking a vacation (71%) and dining out (70%).

- Hispanic consumers are more likely than other consumers to eat at fast-food restaurants.

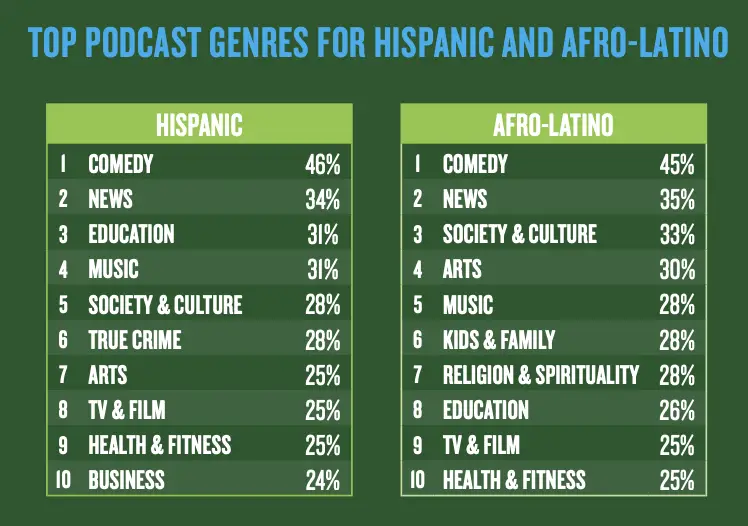

- Engagement with podcasts has tripled in 3 years among Hispanics. Top genres among Hispanics include comedy (46%), news (34%), education (31%), and music (31%). Among Afro-Latino Americans, comedy (45%), news (35%), society and culture (33%), and arts (30%) are the leading genres.

- In 2021, Hispanic consumers were looking to spend more on shopping, automotive, food and dining, household services, and home improvement.

- eMarketer notes that Hispanic/Latino consumers will account for 34% of the growth in apparel spending through 2025.

2. Self-Employed

Attitudes and Priorities

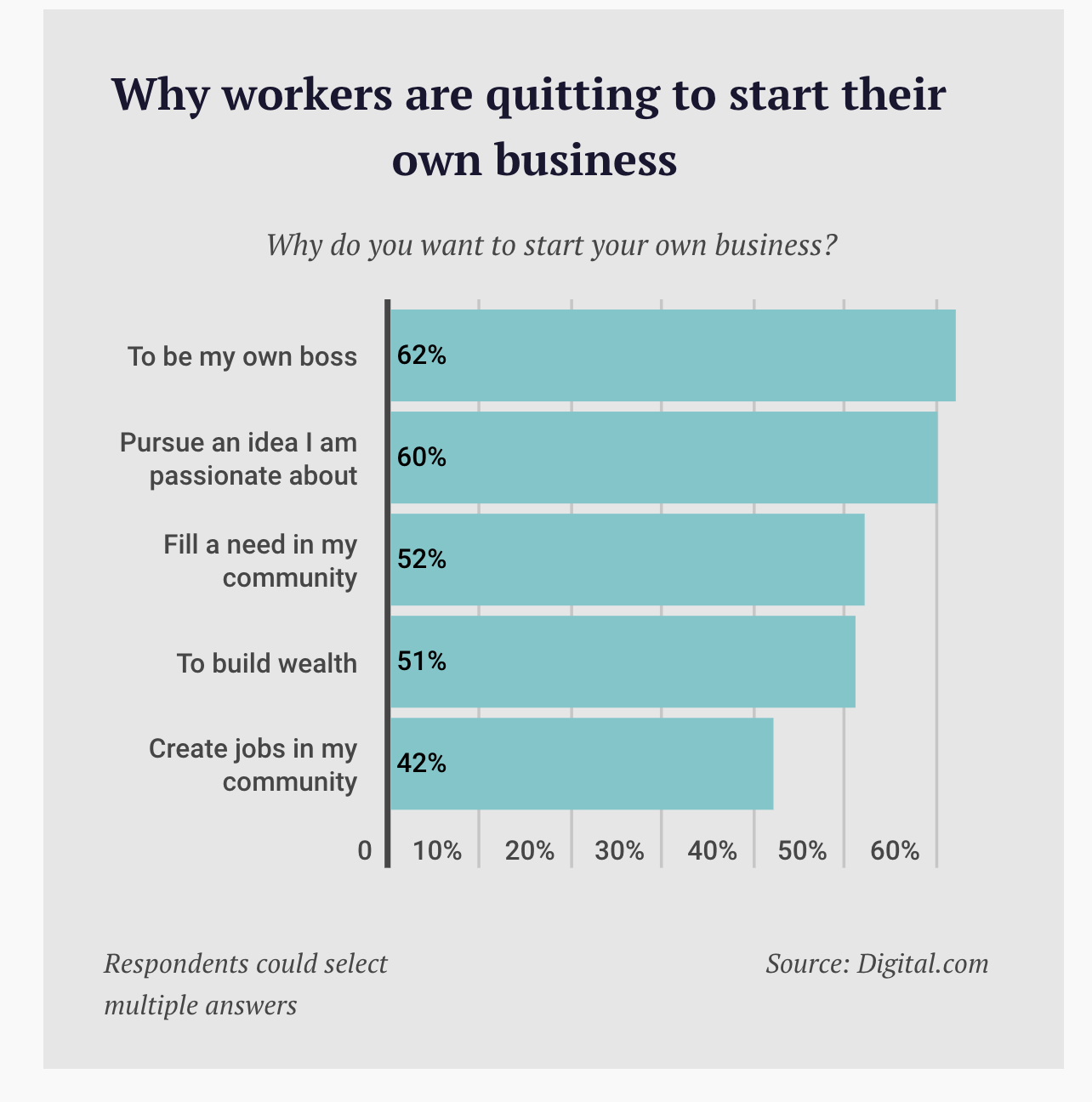

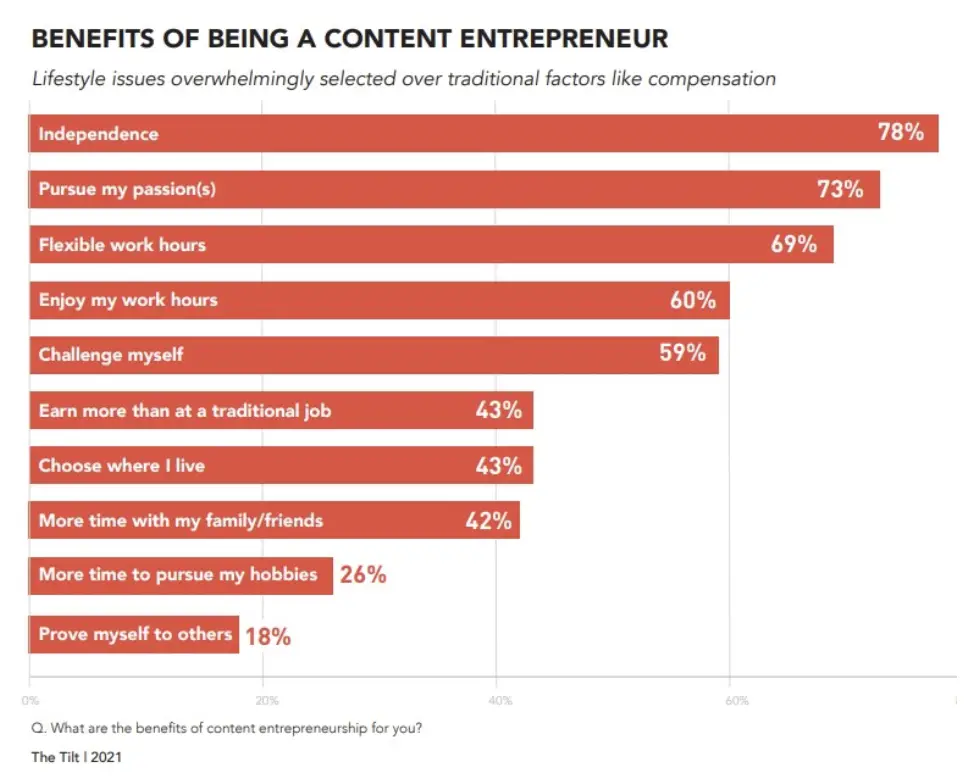

- Non-financial motivators drive the self-employed, including schedule flexibility (78%), location flexibility (73%), and the ability to pursue meaningful work (72%).

- 51% say "building wealth" is a key motivator to transition to self-employment.

- Content creators, another segment of the self-employed, express similar motivations for self-employment. 42% note the opportunity to earn more than a traditional job as a reason for self-employment, though independence and pursuit of a passion are leading motivators for this group.

- 67% of freelancers are optimistic about their future, corresponding with an increase in earnings over traditional employment (noted by 44% of freelancers).

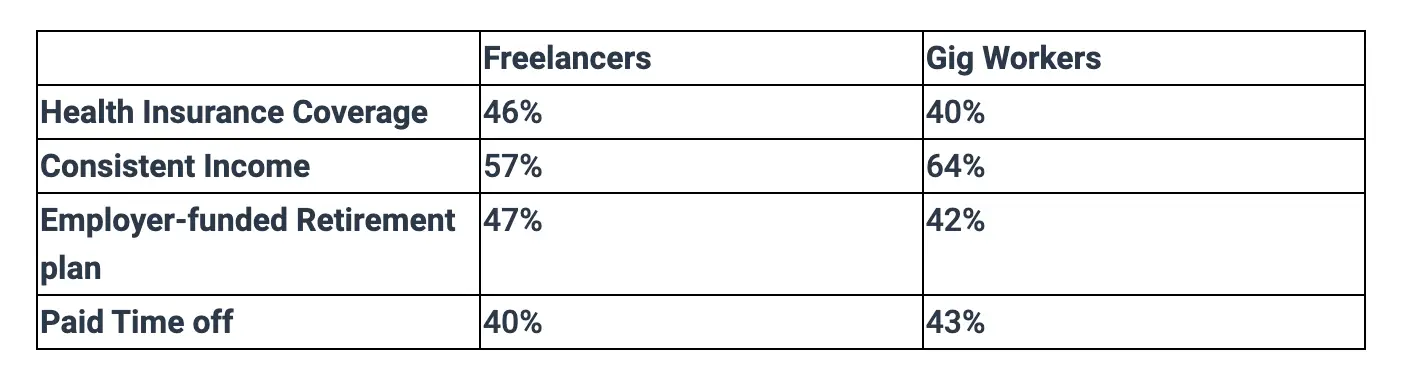

- Still, an Advantis survey found that 72% of freelancers and 66% of gig workers are concerned about financial instability.

- Financial benefits missed most by these groups include health insurance, a consistent income, and an employer-funded retirement plan.

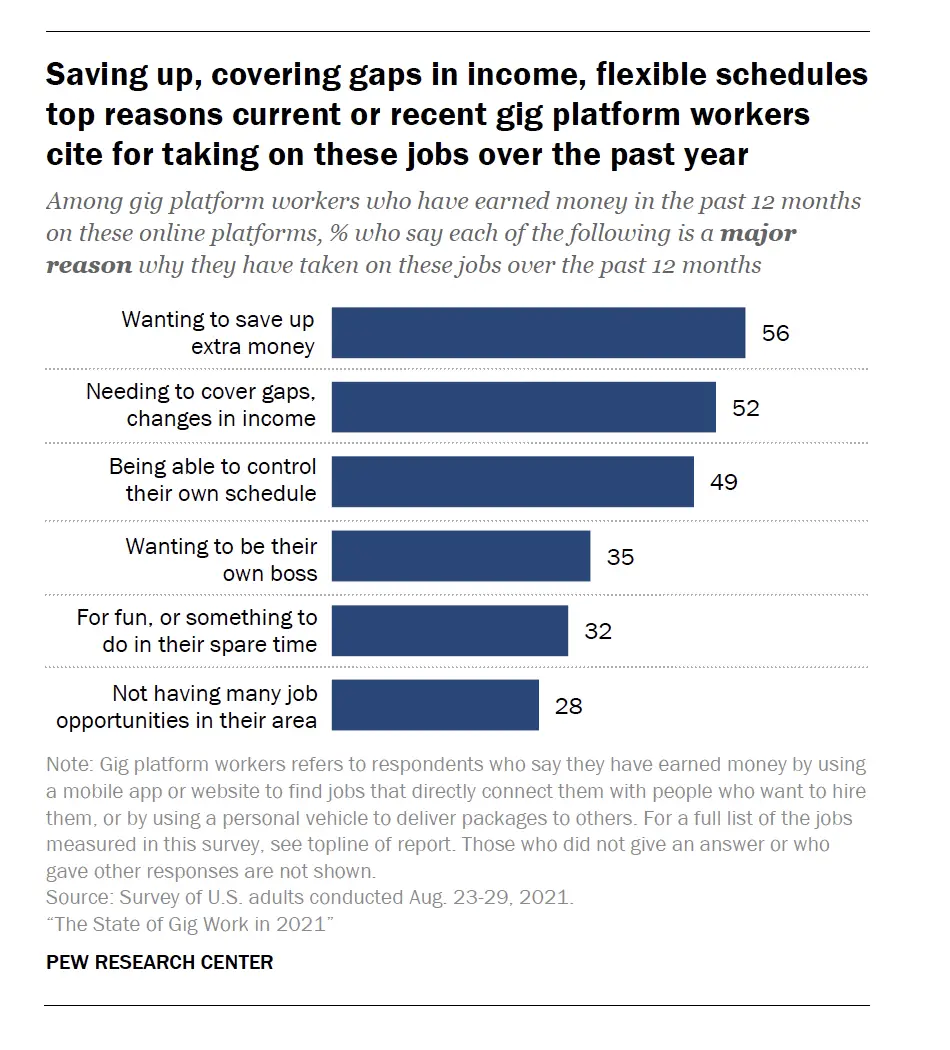

- Several financial factors motivate gig workers, including a desire to save extra money (56%) and cover gaps in income (52%).

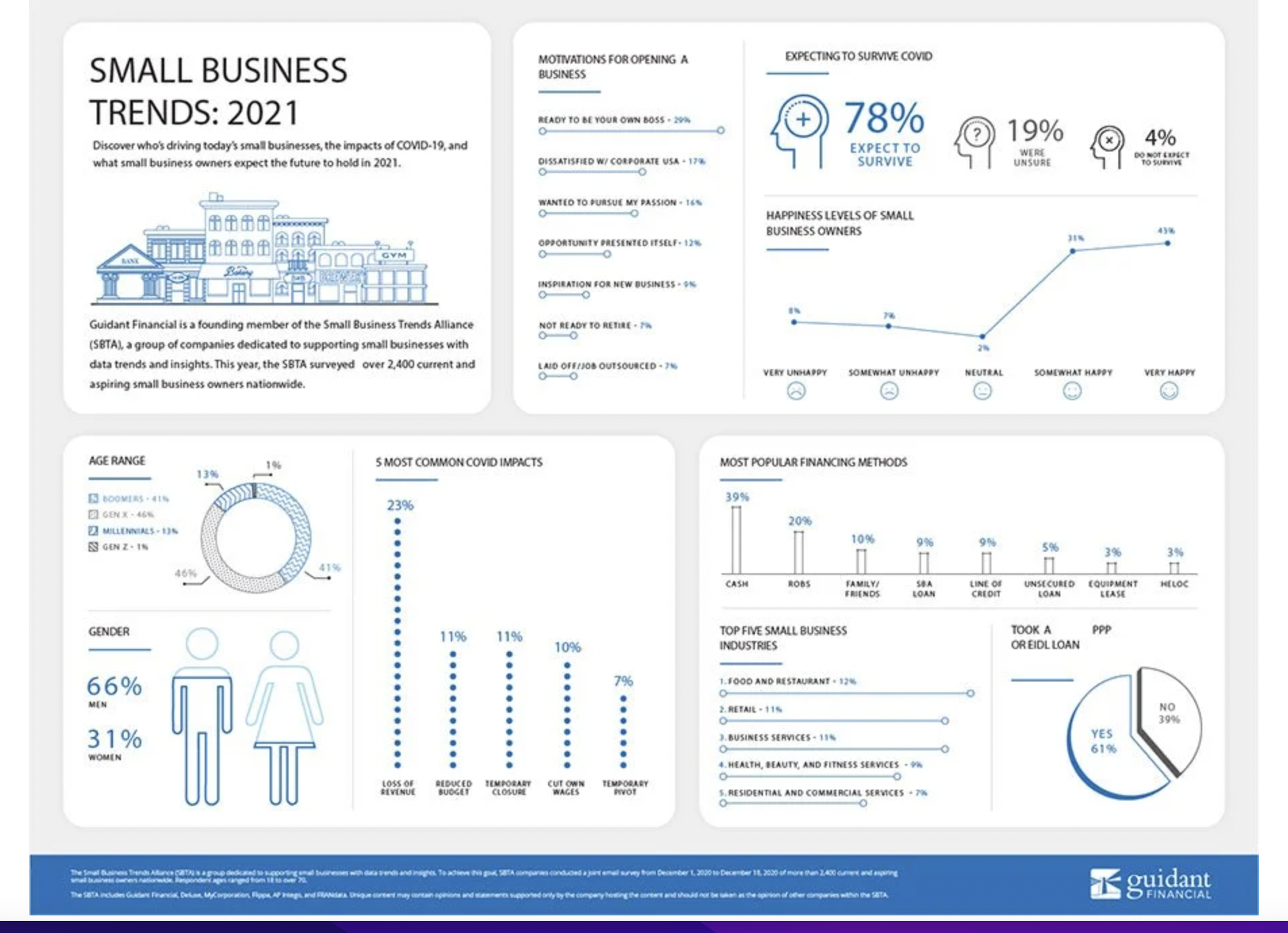

- 77% of small business owners report using their own savings to start their business (49% claim to apply for small business loans) and 30% say student loan debt has impacted their ability to grow their business. Inflation is currently the leading financial concern among 48% of small business owners.

- Overall, small business owners are happy (49%) and expect to survive the pandemic (78%), suggesting relatively strong comfort with their financial situation.

Career and Earning

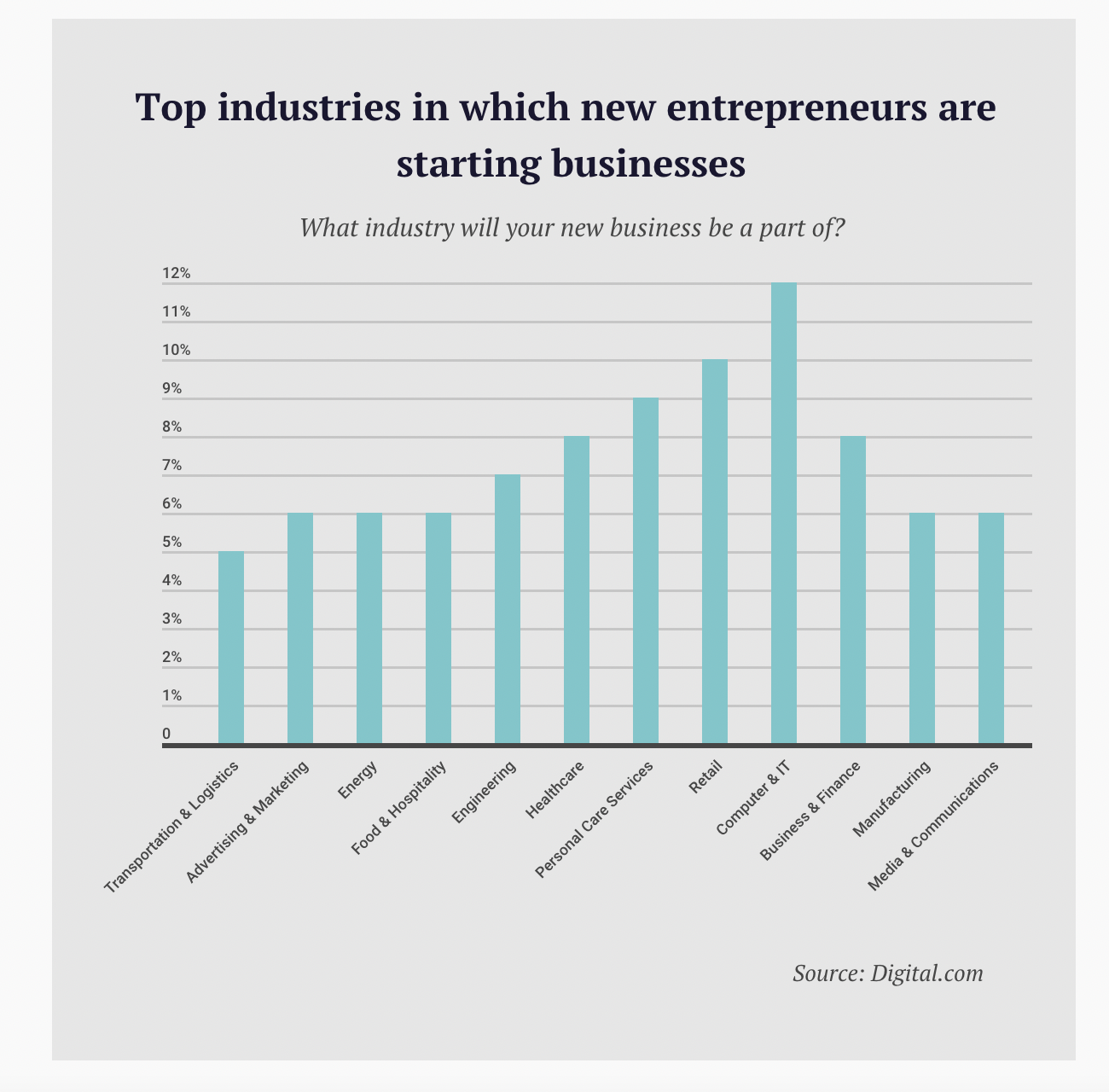

- IT (12%), retail (10%), and personal care services (9%) are the leading industries for newly self-employed, small business startups.

- High unemployment rates at the outset of the pandemic, broadband availability, "digital fluency," and a mature e-commerce market have driven growth in microbusinesses (defined as "businesses with a discrete domain name and an active website"). 39% of microbusinesses owners operate as a source of incremental income, with 67% of these microbusiness owners hoping to evolve their microbusiness into a full-time arrangement. Skills training, affordable broadband, and access to capital are identified as top priorities to grow these microbusinesses.

- 40% of traditionally-employed Americans are currently exploring a transition to self-employment, with a higher percentage of younger and more highly educated employees considering a transition to self-employment.

Financial Content Interests

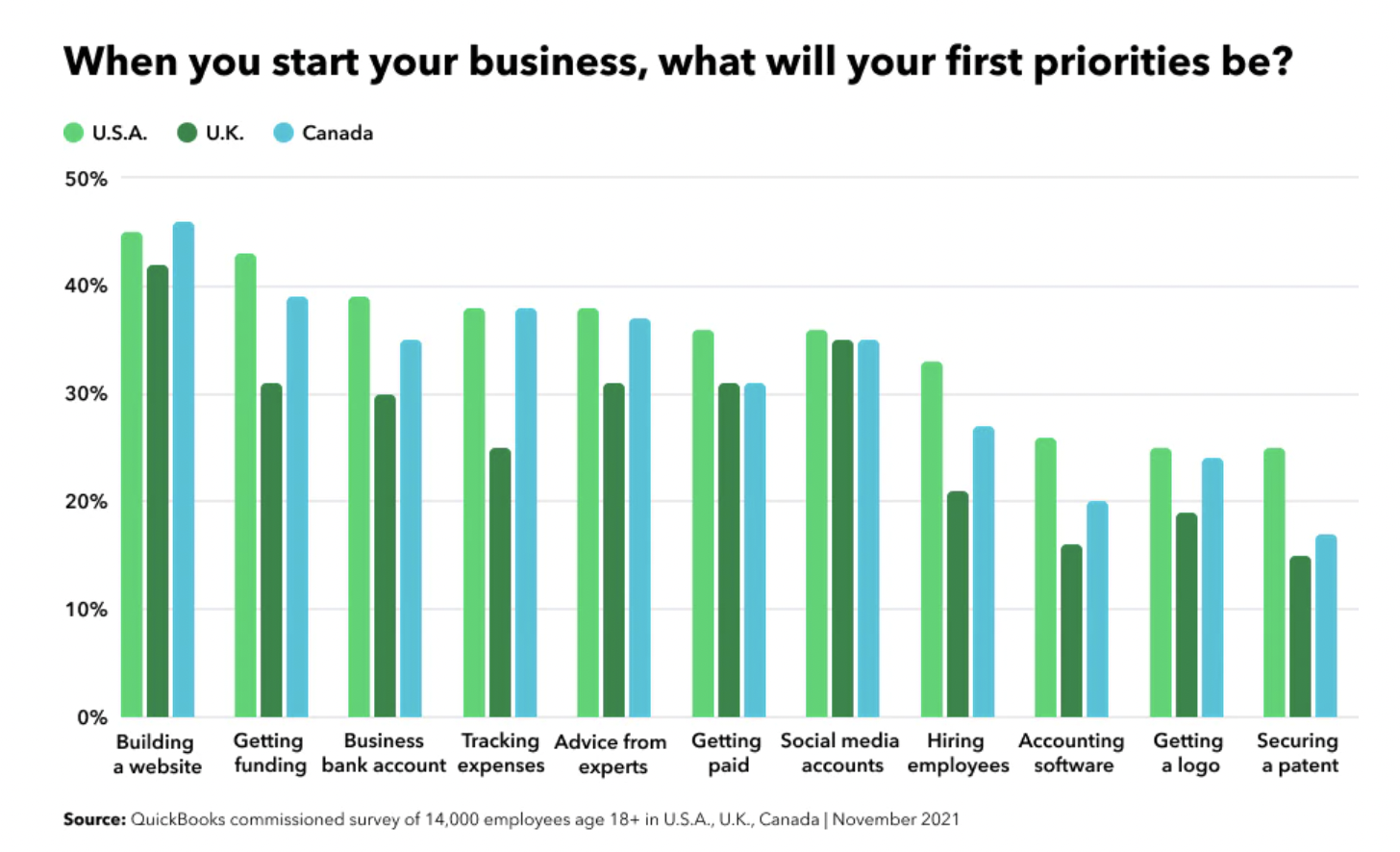

- A QuickBooks survey found that getting "advice from experts" was a top priority among nearly 40% of new business owners. Other financial priorities provide insight into relevant financial content for small business owners, including access to funding (nearly 45%), developing a business bank account (39%), tracking expenses (38%), and evaluating accounting software (25%).

- Gig workers, creators, and freelancers may have slightly different content needs. Leading financial services companies have begun to offer financial insights related to managing cash flow, saving, insurance, retirement, tax services, and wealth management services.

- Fintech startups have emerged to offer financial content and services relevant for the self-employed, including paycheck advances, support with cross-border payments, business credit cards, and auto-accounting.

Media Habits

- Media channels providing financial information to the self-employed are as diverse as the self-employed segment itself.

- Social media is relevant in general to freelancers and gig workers, to find work (85%), for content creation and consumption, brand building, and communication, and would therefore be considered a top channel for accessing financial content. This HBR article notes that the most successful freelancers have a strong online presence and engage in online communities. Content creators can be found on Tik Tok (30%), Instagram (22%), and YouTube (20%).

- Financial advisory websites, such as Charles Schwab, can be a resource for the self-employed, as well as topical experts, such as TurboTax for self-employed tax advice.

- Financial apps are also a source of support and information, such as Freshbooks or Xero.

- Top platforms and communities for entrepreneurs include Flipboard, LinkedIn, Twitter, Angel (to facilitate funding), Entrepreneurial Society, The Economist, Reddit Entrepreneur, and meetup.

Non-Financial Interests

- Flexjobs highlights eight traits associated with successful freelancers: flexibility, passion, responsibility, motivation, patience, practicality, and appreciation of work-life balance.

- Hobbies/interests of entrepreneurs are often developed into business ideas, with this article highlighting several examples of hobbies-turned-small businesses. These include beer brewing, pet services, cooking, photography, music, art, and television.

- Other interests associated with entrepreneurs are endurance events, video games, scuba diving, running, traveling, music, and gardening.

3. Millennial Investors

Attitudes and Priorities

- 61% of millennials say they are confident about their overall financial knowledge and 63% claim to be more knowledgeable than their peers. Gen Z is less confident about its financial knowledge.

- 41% of millennials feel they have an "advanced knowledge" of digital currency, with 39% saying they could explain cryptocurrency to another person and 25% expressing confidence they could explain NFTs to someone else.

- However, 74% of millennials claim to be stressed about finances, with the topics generating the most concern including savings, debt management, and retirement planning. While 70% of millennial investors say they are confident about retirement planning, 66% feel they may need to work longer than expected and 63% are concerned they won't be able to generate income.

- 70% of millennial and Gen Z investors are currently concerned about inflation.

- Millennials prioritize socially conscious investing. 69% expect to address public health through their investment decisions, 85% believe their investment decisions have the power to impact climate change, and 75% plan to modify investments based on racial justice movements. 89% of this group expects financial professionals to consider ESG factors prior to making an investment recommendation.

- 19% of Gen Z considers environmental, social, and governance (ESG) when making investment decisions. 72% of this group hopes responsible investing can have a positive impact on sustainability.

- 57% of Gen Z investors and 50% of millennial investors expressed regret with some aspect of their investment decisions, with the leading reason for regret being not investing more.

Financial Behaviors

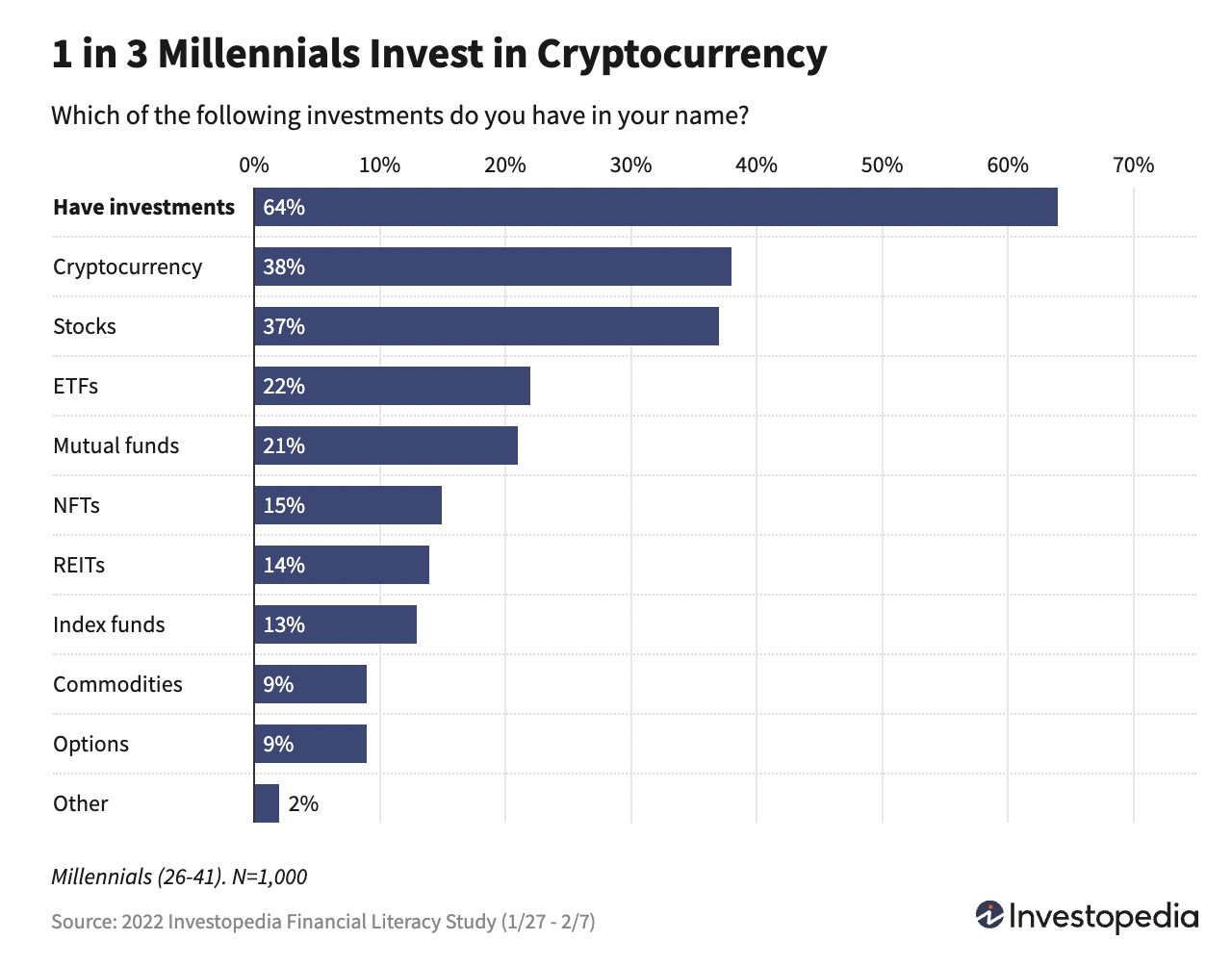

- 64% of millennials claim to be invested, with 38% invested in cryptocurrency and 37% in stocks. Of millennial and Gen Z investors, 60% claim to have invested in cryptocurrency within the past 12 months.

- 31% of millennials began investing prior to age 21 and 25% of millennials who save have over $100,000. 22% of Gen Z investors said they began investing before age 18.

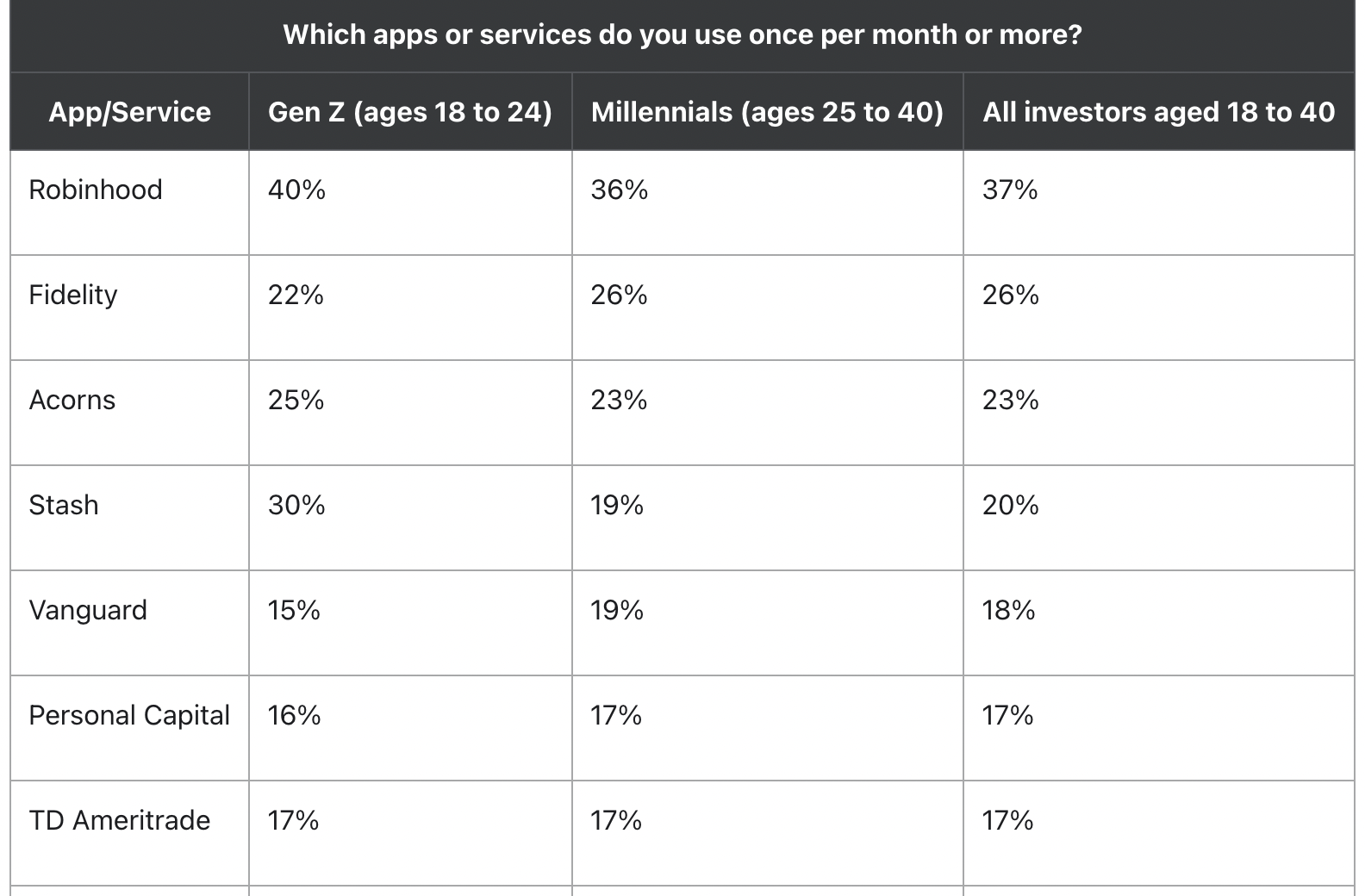

- 77% of young investors use online platforms or apps. Robinhood is the most used investment app among Gen Z and millennial investors.

- 39% of Gen Z use platforms without fees or commissions.

- 64% of millennial and Gen Z investors have withdrawn money from their investment accounts to purchase a car (30%) or a house (25%). 35% have withdrawn money from investments to pay off debt.

Career and Earning

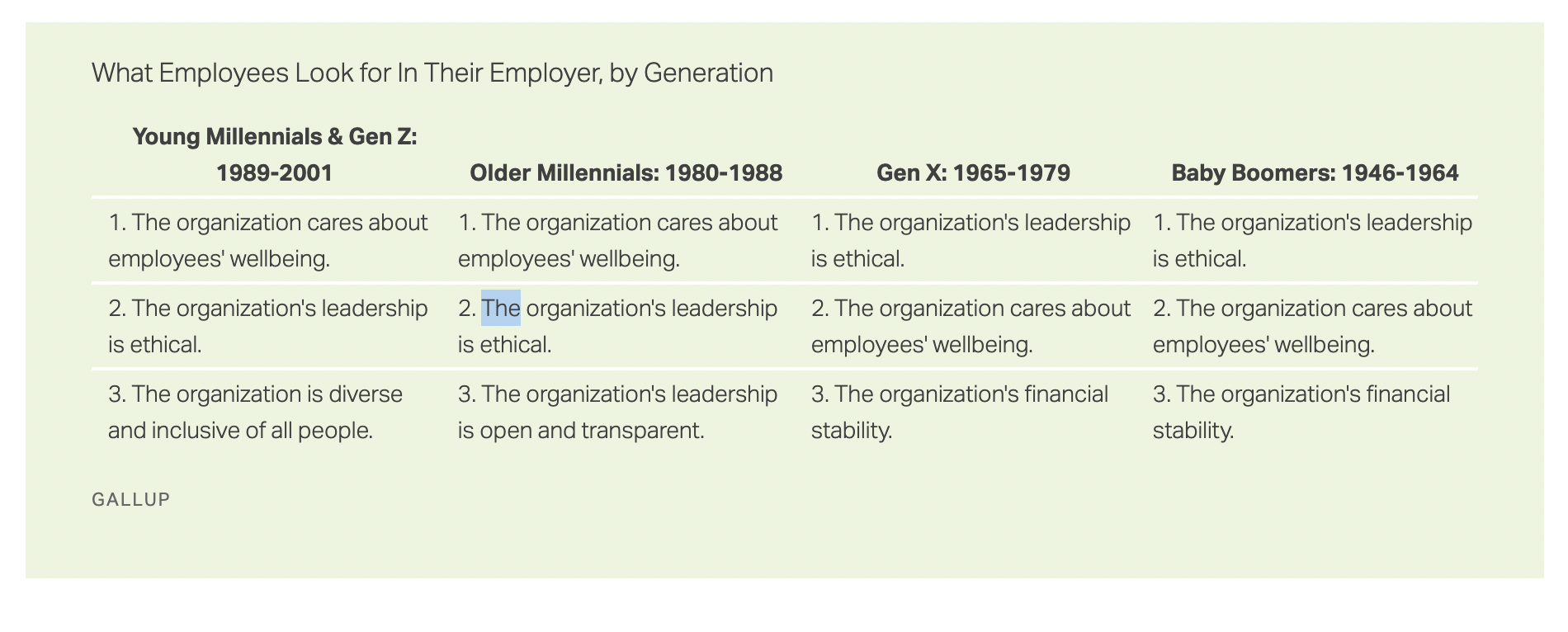

- Gen Z and millennials value a flexible workplace and seek companies that align with their values.

- 56% of Gen Z would quit a job that made them unhappy.

- 40% of Gen Z and millennials left a job that didn't "fit with their personal life."

- A 2021 Gallup poll found that concern about employee wellbeing was the leading employer attribute sought by millennials and Gen Z.

- A Deloitte survey notes that Gen Z and millennials are altering their work patterns, in part due to some financial unease. 43% of Gen Z and 33% of millennials say they have a second job in addition to their primary job.

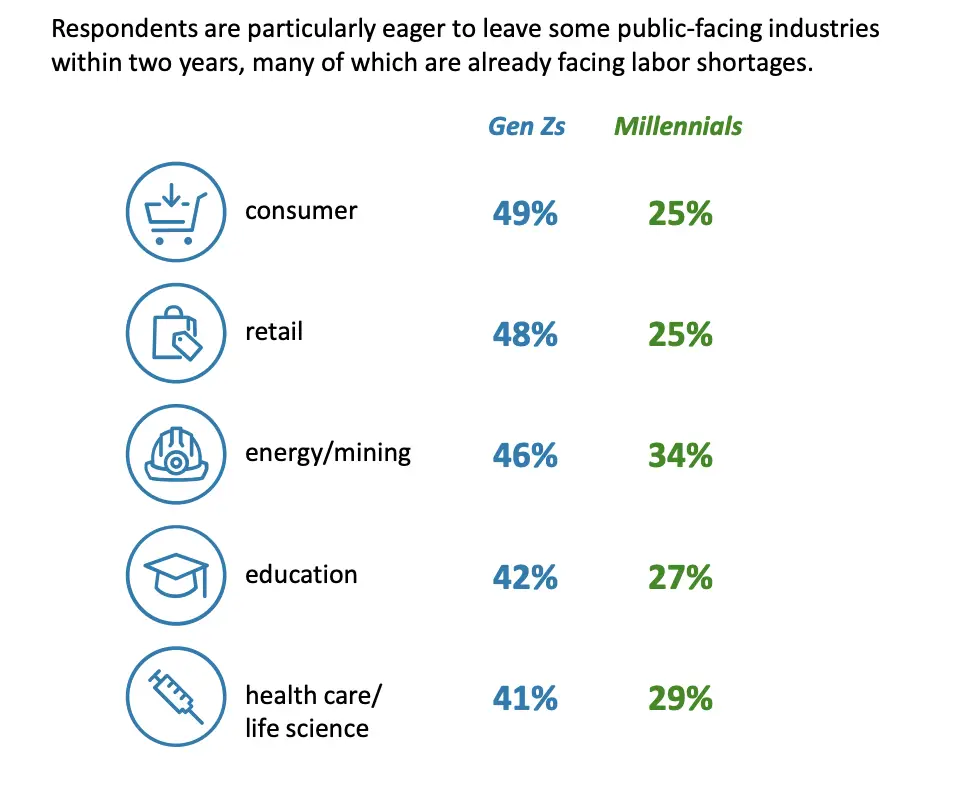

- Interestingly, Gen Z and millennials are more interested in leaving some specific industries, including consumer, retail, and energy.

Financial Content Interests

- Gen Z is looking to educate themselves on taxes (34%), debt reduction (31%), and improving credit scores (30%). Millennials would like information about building their credit scores (31%) and saving for retirement (29%).

Media Habits

- 39% of millennials seek weekly investment advice. The most common media channels for millennial investors include internet searches (45%), financial information websites (40%), and YouTube videos (36%). Gen Z is most likely to leverage YouTube for investment information (39%).

- An M1 Finance survey found that younger investors are most likely to leverage social media for investment information. Over 60% of Millennial and Gen Z investors said they had taken action based on investment advice on social media.

- 61% of Gen Z and millennial investors look to Reddit for trusted investment information.

- 49% of millennials and 34% of Gen Z use traditional investing websites for information.

- 65% of millennial investors are considering turning to financial advisors for advice in the next 2 years. 88% of millennial investors currently using a financial advisor express trust in the advice (compared to 48% trusting algorithms and 24% trusting advice via social channels).

Non-Financial Interests

- Gaming, music, sports, art, and reading are several non-financial Gen Z and millennial interests.

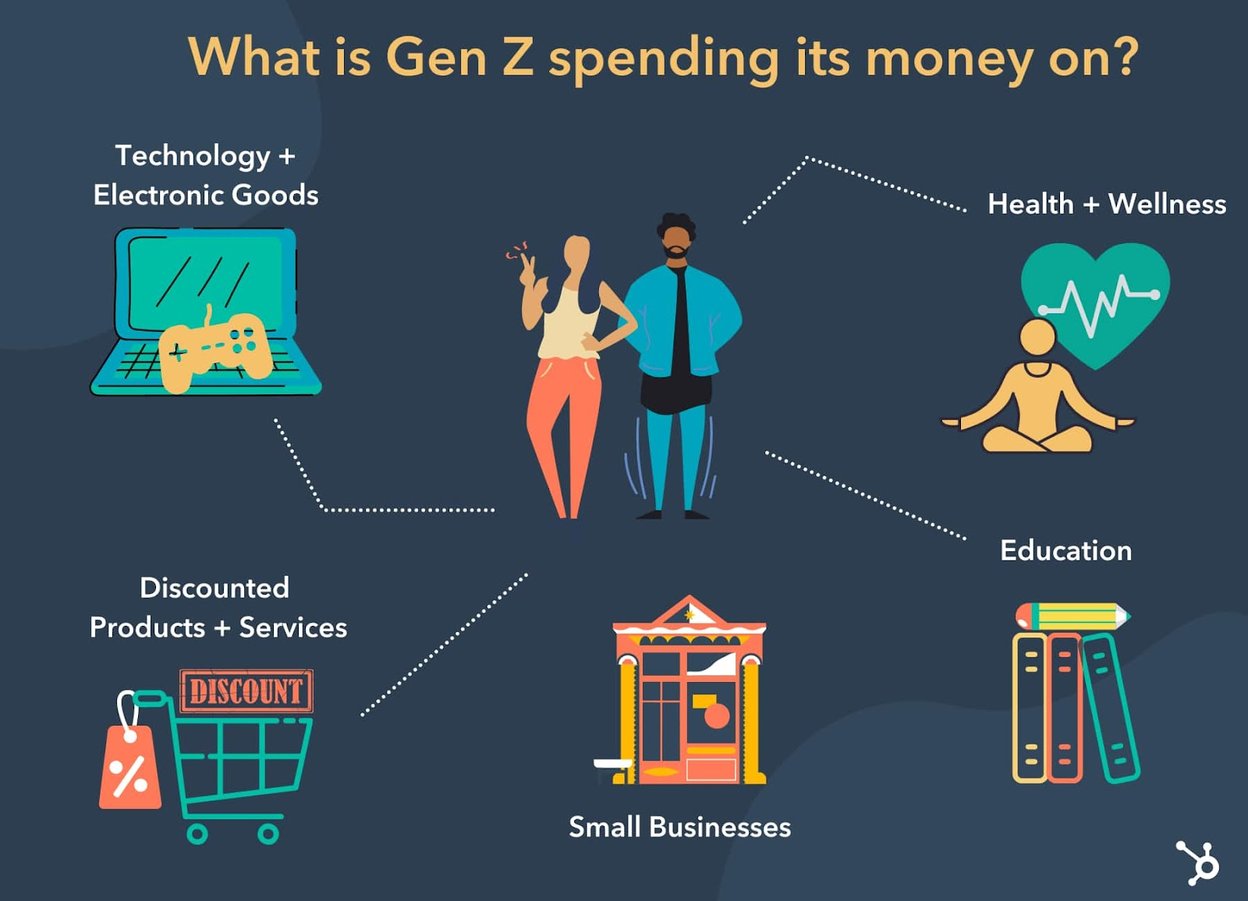

- Gen Z will spend on tech, health, and education-related products and services.

- Top brands among millennials in 2021 include Peloton, Amazon, Google, Netflix, Apple, Chik-Fil-A, and Costco.

- Millennials also place high importance on wellness pursuits.

Research Strategy

For this research on Finance/Tax Industry Audiences, we leveraged the most reputable sources in the public domain, including consultancy reports (e.g., Mckinsey, Deloitte), market research reports (e.g., Nielsen), surveys (e.g, Investopedia, Pew Research, Intuit), financial industry resources (e.g., Barrons, Motley Fool), and other news sources and publications (e.g., Forbes). The most recent sources were used for this research, largely from 2021 to 2022.

Latinx (Latino or Latina) was defined as a person of Latin American descent. While this is not technically the same as Hispanic, in many publications these terms were used interchangeably and we did the same when necessary, while still staying as close to the Latinx definition as possible. Self-employed were defined as individuals who earn money in addition to their primary job or as their primary job. The self-employed group encompasses a wide range of situations, from small business owners to freelancers, content creators, gig workers, and more. The diverse nature of this audience limited our ability to provide a singular defined psychographic profile; instead, we focused on common themes among this audience and provided insights on specific subgroups within this larger audience. Millennial investors were defined as younger consumers (also including Gen Z) who are interested in investing but have not yet amassed significant wealth. There was a considerable amount of information surrounding Gen Z and millennials and their financial and investing habits, attitudes, and behaviors. The definition of this group varied across sources and we generally leveraged the information that was available, noting when relevant whether a definition was Gen Z and Millennials or Gen Z and Millennial investors (or another notably different definition). Finally, the psychographics provided for each audience vary slightly; this is due to the availability of information for each segment.