Part

01

of one

Part

01

Farm Insecticide Market in the US

The Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) involves the implementation of a federal regulation with regard to the selling, distribution, and application of pesticides. As for the pesticide purchasing journey of farmers, one of the main considerations, before a farmer decides on the use of pesticides, involves the safety of the product that will be applied. Meanwhile, the increased adoption of green alternatives such as plant-based pesticides is one of the trends that is being supported by President Biden's Climate Plan. The rest of the available details and research strategies on the requested farm insecticide use insights were presented below.

Key Regulations Impacting U.S. Farmers' Insecticide Purchase

Federal Insecticide, Fungicide, and Rodenticide Act: 7 U.S.C. §136 et seq. (1996)

- The Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) involves the implementation of a federal regulation with regard to the selling, distribution, and application of pesticides.

- All pesticides that are available for purchase in the U.S. need a license from the EPA.

- Before a pesticide can be registered by EPA under FIFRA, there should be a justification that applying the pesticide in accordance with its specifications will not have an extremely negative impact on the environment.

- Based on this, farms are only allowed to purchase those pesticides that are on the approved list.

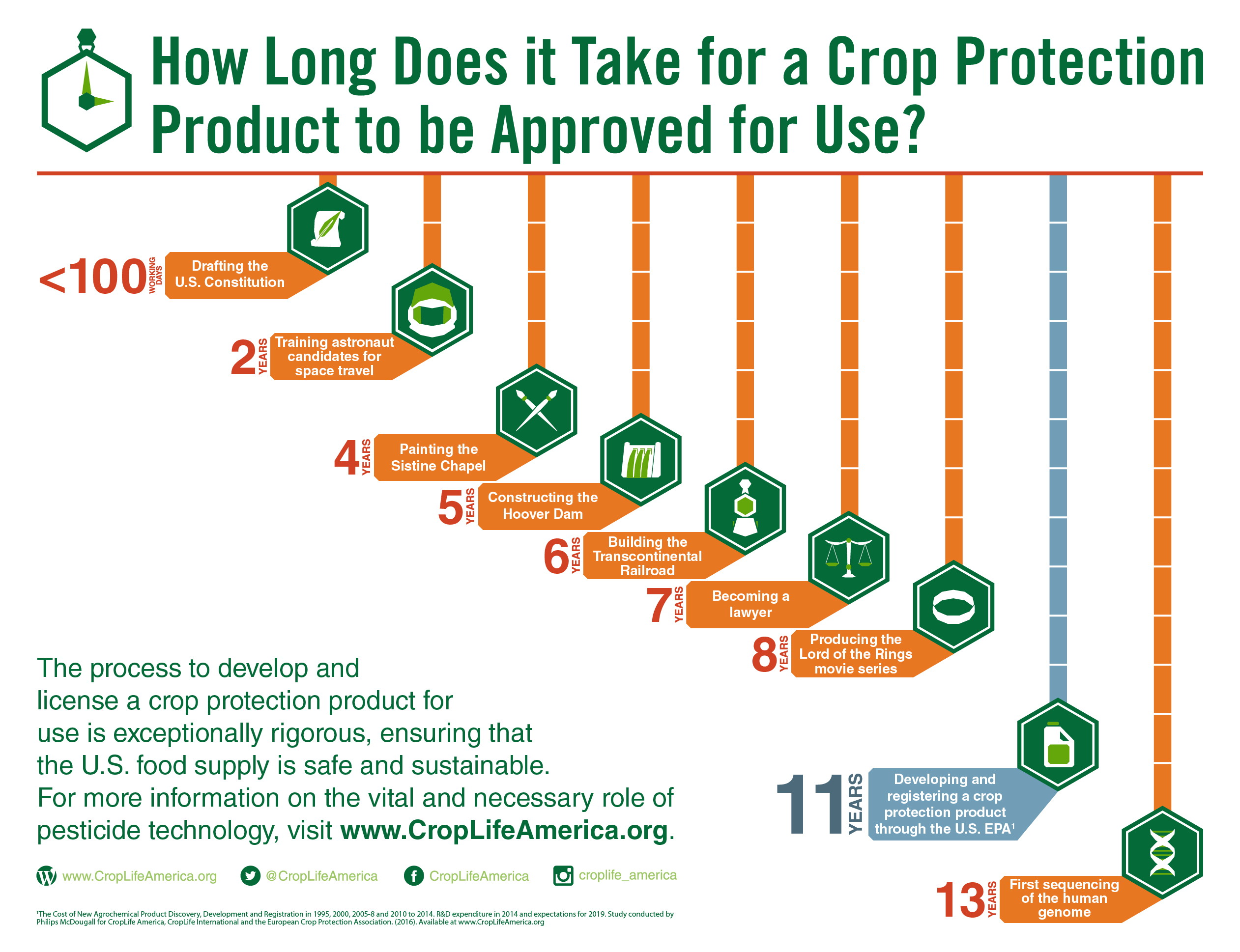

- Overall, it takes around 11 years before a crop protection chemical such as pesticides can be registered through the U.S. EPA.

- As an example, General Mills continuously monitors and ensures that its partner farmers adhere to the regulations on the sourcing of safe chemicals for its farms.

Methyl Bromide Phase-out Strategies: U.S. Policies Connected to the Montreal Protocol on Substances that Deplete the Ozone Layer (U.S. EPA 58 FR 65018)

- The Montreal Protocol aims to reduce or eliminate the use of substances that deplete the ozone layer such as methyl bromide. This chemical is being used as a pesticide by farmers in the U.S.

- Several countries such as the U.S. have already taken action to reduce the use of methyl bromide in farming activities.

- The 1990 Amendments to the Clean Air Act mandate the phase-out of ozone-depleting substances (ODS) with a potential of 0.2 or above within seven years of being classified as an OCS.

- Under the coverage of this act, the U.S. Environmental Protection Agency also approved several regulations such as 58 FR 65018 to restrict the manufacture and purchase of methyl bromide.

- The agency also mandated the agriculture industry to decrease the usage of this pesticide to prevent further damage

- The Federal Insecticide Fungicide and Rodenticide Act (FIFRA) also released some guidelines on methyl bromide restrictions.

- FIFRA categorized methyl bromide as a "restricted use pesticide and a class I toxic material" that need the right labels, suitable training, protective equipment, and respiratory protection.

- FIFRA also released some guidelines on usage restrictions such as the type of crops where the substance can be applied and how it should be applied.

- The U.S. EPA also released several documents that indicate pesticides that can be purchased instead as alternatives to methyl bromide.

- For those who really need to procure the chemical, they can apply for critical use exemptions. The U.S. government will then review these requests for exemptions and obtain approval for those uses from the "Parties to the Montreal Protocol."

- Once approved for critical use, farms and other entities will no longer need to submit their purchase order certification forms for methyl bromide.

- California strawberry farms are not anymore procuring methyl bromide. They have been purchasing alternatives to this pesticide such as fumigants. Some have shifted to organic farming to avoid the use of pesticides and fumigants altogether.

Emergency Planning & Community Right-to-Know Act (EPCRA): 42 U.S.C. §11001 et seq. (1986)

- The Emergency Planning & Community Right-to-Know Act (EPCRA) was enacted in 1986 to address the concerns surrounding the safety and environmental dangers brought about by the presence of toxic chemical inventories in farms such as pesticides.

- To mitigate the hazardous risks that these chemicals can unleash, Congress has mandated several action steps with regard to emergency planning and "community right-to-know" reporting on these dangerous substances.

- Farms are then required to report the amount of hazardous substances that they procure to state and local planning authorities.

- A list of pesticides and other hazardous substances that are covered by this act has been released and continuously updated.

- The list will also include a threshold planning quantity on how much of these substances can entities such as farmers can procure.

- Farms and other entities are also required to report how much of these hazardous chemicals are present in their facilities.

- Farms such as Hollabaugh Bros., Inc. are using apps such as Croptracker to record and report their pesticide use.

U.S. Code 136 (c) - Importation of Pesticides and Devices: 19 C.F.R. §§ 12.110 - 12.117 and 40 C.F.R. § 152.30.

- The U.S. Customs and Border Protection (CBP) has deployed regulations with regard to the purchase of pesticides and devices from international sources.

- As part of the regulation, pesticides that are not registered may be brought into the country only if the product can adhere to the specific exception terms under 40 C.F.R. § 152.30.

- Those who import "FIFRA-regulated pesticides and devices (including unregistered pesticides)" need to adhere to the U.S. Customs and Border Protection (CBP) regulation surrounding the process.

- The imported pesticides should not be "adulterated, or misbranded." It should also adhere to the other provisions of the regulations.

- Key government officials such as the Secretary of Agriculture are also involved in ensuring that only those pesticides that adhere to the terms of the regulations are allowed to be imported and used in the U.S. agriculture industry.

- Croplife ensures that its members and farmer partners adhere to the regulations surrounding the import and export of pesticides.

Research Strategy - Insecticide Purchase Regulations

To determine the most important regulations affecting how farms purchase insecticides and the other requested details, we looked through the websites of various regulatory bodies such as the EPA, FIFRA, ECFR, FDA, USDA, and other entities. We also searched various industry studies and publications to determine which of the various regulations affect how farms purchase or use insecticides. Based on this search approach, we were not able to find a consolidated and comprehensive list of regulations that specifically impact how farms purchase insecticides. We did found some regulations that could impact the purchasing or stock acquisition of these pesticides. The regulation involving an approved list of pesticides could also impact procurement as only those found in the list can be purchased by farmers. Our findings also revealed that most regulations on pesticide farming involved the proper use and storage of these pesticides, the tracking of the environmental impact of the pesticides, and other similar matters. Although not stated directly, we came to the conclusion that some of these regulations could impact how farms purchase insecticides as they dealt with the pesticide inventories of farms. We then determined the most important regulations by the perceived impact on the inventory accumulation of these pesticides as this process implies procurement of these inventories. We also selected those regulations that are applicable across the U.S. Some regulations were also not specific to the farming industry but to all industries using pesticides in general. We also included these regulations as these are applicable as well to the farming sector. As most of the pesticide regulations that could impact pesticide procurement were enacted several years ago, some of the examples given were from slightly outdated reports. As for the individual examples, we mostly found farming groups that mention their adherence to the specified regulations.

Farmer's Pesticide Purchasing Journey

- Based on a report from the South Dakota Soybean Research & Promotion Council, one of the main considerations, before a farmer decides on the use of pesticides, include the safety of the product.

- Before using a pesticide, farmers need to obtain a certification from the Environmental Protection Agency (EPA) to prove that they are knowledgeable on pest management and the proper methods used for the storage, handling, and disposal of pesticides.

- Another factor that farmers consider when deciding on the use of pesticides is the type of pest, weed, or disease that they plan to tackle.

- Farmers typically inspect their crops to determine if any of these concerns need to be addressed by solutions such as the use of pesticides or other crop protection techniques. This is referred to as scouting.

- Determining the types of pests or other crop problems that they have in their farms enables them to arrive at the right decision with regard to pesticide use.

- When trying to decide on a pesticide to use, they also try to check first if they have used the same brand or type of pesticide in the past. Certain pesticides deal with target pests in various ways. If farmers apply the same crop protection chemical repeatedly, the target pest family can get used to the substance over several generations, making them resist that pesticide over time. Given this, farmers ensure that they don't use the same type or brand of pesticides repeatedly.

- Farmers also check the weather first before deciding on whether they will purchase or use pesticides. They usually avoid spraying pesticides if the temperature is around 90 degrees. They will also avoid using pesticides if the speed of the wind is more than 15 miles per hour. This is to avoid the substance from being blown into other areas where it is not needed.

- They usually decide that they can already use the pesticide if the atmosphere is dry and the humidity level ranges from 50% to 60%. There should also be no impending rainy weather as pesticides just linger in the air if the humidity is very high instead of staying on the crops.

- Farmers also evaluate the right amount of pesticides needed before they use the substance. They check the product labels to make the right decision on the right amount to use.

- They also rely on updates from the EPA on the right amount of pesticides to use at which they are "safe and effective." The EPA reviews typically take 10 years to complete for each pesticide type. The findings are then reviewed every 15 years to ensure that these are updated and to ensure the safety of these chemicals.

- Farmers typically use only a small amount of pesticides on their farms.

- Farmers also decide to increase their use of pesticides when there is a significant demand for their produce.

- Farmers also rely on the decision of the manufacturers to keep or remove certain brands of pesticides from store shelves due to profitability levels.

- Farmers in the U.S. mainly purchase their crop protection needs such as pesticides from CropLife America (CLA) members.

- CLA is the national trade association that counts manufacturers, formulators, and distributors of pesticides as its members.

- The CLA supports methods and regulations that are grounded on scientific principles and best practices. The group also helps in helping its members and their partner farmers to maintain their competitive edge.

- CLA also provides resources on their websites and social media pages to help farmers in their decision to use pesticides.

- U.S. farmers also rely on public programs such as the Cooperative Extension Service and local higher education institutions to help them arrive at the right agronomic decision.

- Based on the survey that states the top pesticide companies in the U.S., Syngenta came out on top because of its complete crop protection solution offerings. The company also comes up with innovative products that benefit the farmers.

- Bayer came in second due to its premium pesticides that can increase crop yield.

- Other entries in the list mentioned that they collaborate closely with farmers to ensure that they can understand them better.

- As for Monsanto, farmers use its products due to these factors: product, price, place, and promotion.

Research Strategy - Farmers' Pesticide Purchasing Journey

To determine the consumer journey with regard to how farms in the US go about purchasing their insecticides, we looked through various agriculture industry publications and agriculture-related government websites. We also search market research reports, business publications, and other similar sources. Based on this search approach, we were able to find some reports that indicate the factors that affect their insecticide purchase. However, we were not able to find comprehensive or specific reports on the process that they use to arrive at their decision to purchase from a pesticide company and what they are looking for in a pesticide company. What we found are general insights on what the top pesticides companies have to offer that makes consumers patronize their pesticide products.

We also searched marketing sites, market studies, and other similar sources to obtain relevant insights on how pesticide companies are marketing to these farmers to discern the process that they use to arrive at their decision to purchase from a pesticide company and what they are looking for in a pesticide company. However, we were not able to obtain useful insights using this research path. What we found are general pesticide marketing strategies.

We then looked for surveys or interview excerpts from farmers to determine if there are relevant findings or answers from them that can provide some light on the process that they use to arrive at their decision to purchase from a pesticide company and what they are looking for in a pesticide company. What we found mainly are insights from farmers of other countries. We did not find comprehensive insights from farmers in the U.S. with regard to this particular subject. Most of the surveys found were also outdated.

We then presented these available findings and some helpful insights on this topic in the section above.

Green Trends

Increased Use of Plant-Based Pesticides

- Based on several studies and market research reports, procuring plant-based natural insecticides in farms is one of the promising trends in the agriculture industry. These environment-friendly pest control options were seen as safer substitutes for hazardous chemicals that are currently being used as farming pesticides.

- Plant-based insecticides such as those that are made of essentials oils are also capable of targeting specific pests.

- These plant-based pesticide alternatives were found to be effective in controlling pests even in small amounts. They can also decompose quickly, leaving no residues on the produce. These attributes make them safe for the environment as well.

- Some of these botanical pesticides may manifest as direct toxicants. Other types may serve as "antifeedant, repellent or behavior modifiers, morphogenetic agents, or phagostimulants."

- Plant-based insecticides were also found to be more affordable and sustainable.

- Botanical insecticides such as those derived from the neem tree were found to interfere with the reproduction and growth processes of insects such as "aphids, beetles, borers, caterpillars, whiteflies, mealy bugs, and weevils."

- Some organic farmers are also using safer pesticide alternatives such as plant-derived pyrethrum.

- President Joe Biden aims to implement the Biden-Harris Climate Plan to reduce the impact of current business and industry practices to the environment and to the climate.

- As part of the plan, Pres. Biden will engage with farmers and ranchers to improve their agriculture processes.

- As part of the plan, the president will deploy a comprehensive program to enable farmers to transition to more climate-favorable organic farming practices.

- This will include decreasing their dependency on pesticides that are derived from fossil fuels and transitioning to the procurement of organic options such as natural chemicals.

Creation and Adoption of More Nature-Friendly Pesticide Options

- Another trend based on a market study shows that the farming industry is also opting for more environment-friendly laboratory-made pesticide options.

- Several companies are now creating new types of pesticides with improved composition to reduce the negative impact on agricultural workers, the flora, and the soil.

- Each year, industry players are releasing new pesticides that target specific markets, pests, and sectors.

- This action results in modifications to the base composition, method of application, and residue levels of the insecticide.

- As an example, Marrone Bio Innovations, Inc. created Venerate CX, a "chemical user-friendly liquid microbial-based solution." The solution is now being used in integrated pest management (IPM) methods. The new composition requires only a minimum of a "four-hour re-entry interval (REI), and is under the MRL (maximum residue level) tolerance."

- This insecticide is not harmful to marine life, birds, and honeybees.

- Other companies in the sector are also putting in more investments in research and development to create more green pesticide options.

- Another example involved Zymergen partnering with FMC to develop effective pesticides that will have a reduced negative impact on the environment.

- President Biden mentioned that his $2 trillion environment plan will include providing financial incentives for those who will embrace new climate-friendly farming methods and technologies.

- The plan also include offering low-cost funding for the industry to adopt new equipment and practices and to increase research and development activities in precision agriculture.

Use of AI and Automation for More Efficient Pesticide Use

- Based on a study of various companies, one of the trends in the use of pesticides in the farming industry involves the application of automation and AI to create smarter systems that can deliver pesticides more efficiently.

- As an example, Blue River technologies has developed a "pesticide See & Spray system" that makes use of "computer sensors and artificial intelligence" to be more precise when detecting and managing pest problems.

- These smart sprayers are more precise and less wasteful when applying pesticides. This can then decrease the exposure of other plants to the insecticide.

- The company mentioned also that the use of AI and automation can reduce pesticide use by up to 90%.

- President Biden has released Executive Order 14008, "Tackling the Climate Crisis at Home and Abroad" or ("the Order").

- As part of this order, the U.S. government will engage with farmers and other agricultural players to take action in addressing the climate crisis.

- The Order mandates the U.S. Department of Agriculture (USDA) to collaborate with agriculture players to identify opportunities to help them embrace "climate-smart" agricultural methods. These practices include the development and use of various innovative technologies and regenerative farming techniques.

Research Strategy - Green Trends

To determine the green trends and other requested pieces of information, we looked through various agricultural publications (FBN Network, Farmers Weekly, Farm Together, AgWired, etc.), media publications (Forbes, CNBC, etc.), relevant government websites (USDA, etc.), and other sources. Based on this search approach, we were able to identify several recurring green trends as mentioned in various reports. We also looked through market research reports (Fortune Business Insights, Business Research Company, Persistence Market Research, etc.) to identify more trends based on these industry studies. We then compiled all the green trends we found. We determined that these are trends based on the findings and analysis from various studies and the discussions found in several reports.

As for the actions that the Biden administration is expected to take regarding these trends, we searched industry publications and government websites for specific actions. We then found the president's various plans that are focused on the agricultural sector. The action steps are more general as the president is still in the process of finalizing the details. We then included the details of the president's plans that are closest to the green trends we found.