Part

01

of four

Part

01

Men's Hair Health Market Size

Introduction

A deep search in the public domain could not provide the US men's hair health market size, including the value and the number of men utilizing the hair care products. Therefore, we shifted our search and provided the total US hair care market size and the number of US men using hair regrowth products and shampoo. Below are our helpful findings and a research strategy elaborating the logic used to search for data.

Men's Hair Health Market Size in the United States

[1] Market Size

- In 2021, the hair care market size in the US was worth US$13,287.77 million and is projected to grow at a CAGR of 2.18% from 2022-2027.

- In addition, the US market size for hair treatment and removal is valued at US$2,605.00 million in 2022.

- As per a Statista survey, the revenue generated in the hair care segment in the US totals US$12,910.00 million in 2022.

Additional Findings [Global Data]

According to an Allied Market Research report, the global market size for men's hair care and styling products in 2020 was worth US$40,430.00 million and is expected to hit US$54.555.10 million by 2030, registering a CAGR of 3.3% per year from 2021-2030.

[2] Number of Men in the US Using Men's Hair Health Products

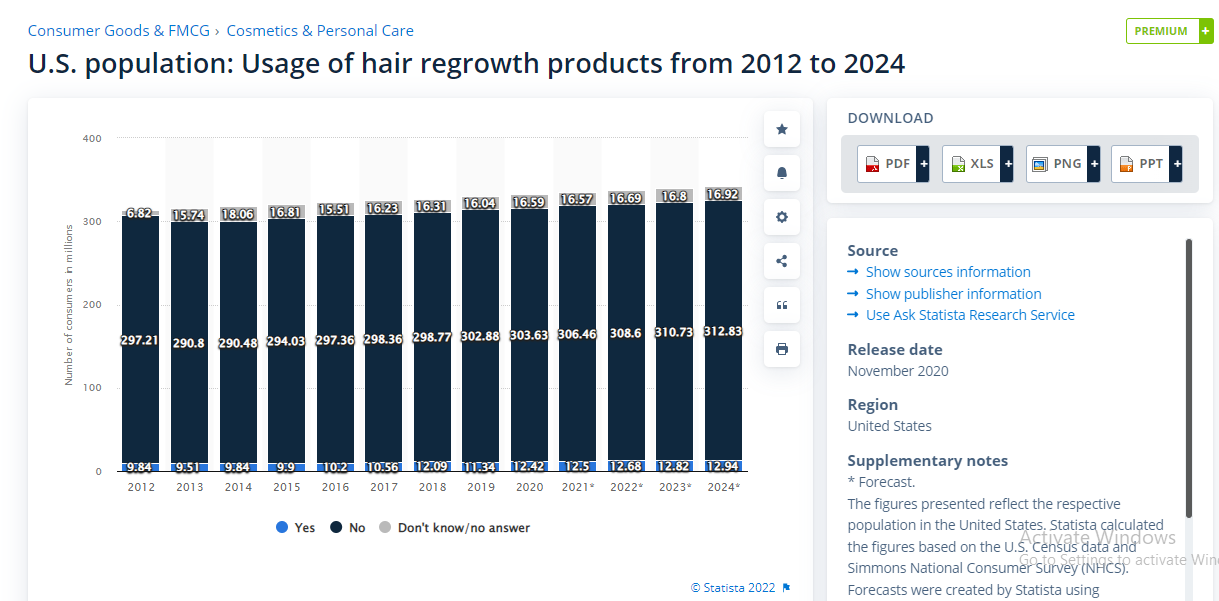

- In 2020, 12.42 million Americans used hair regrowth products. This number is expected to increase to 12.94 million in 2024.

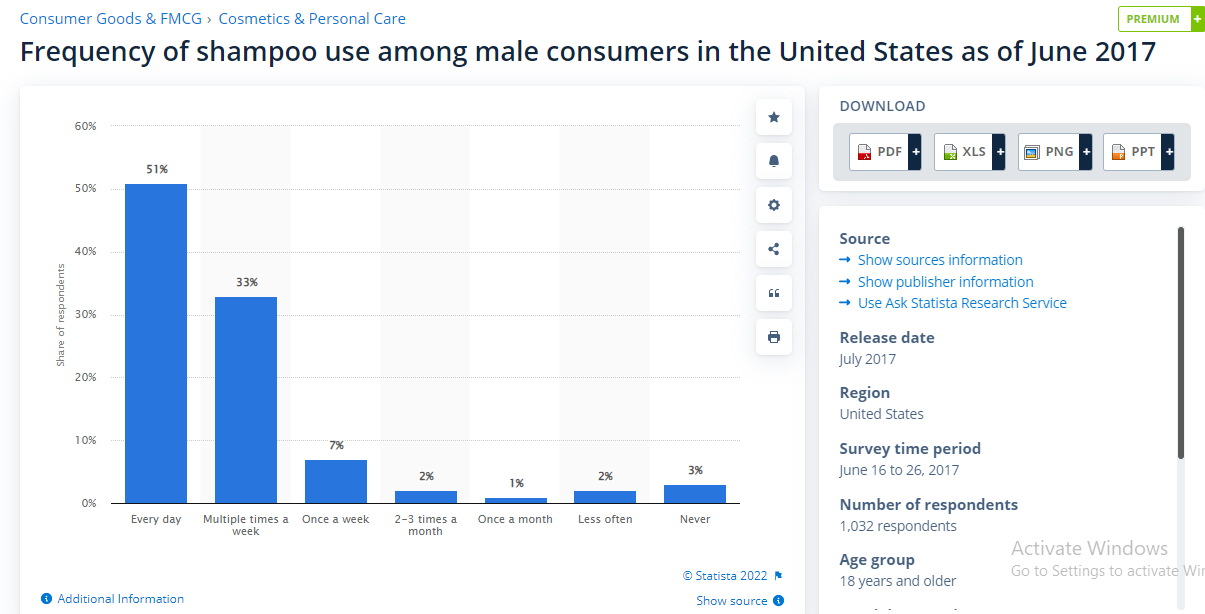

- According to a survey conducted by Statista in June 2017, 51% of men use shampoo every day, 33% - multiple times a week, 7% - once per week, 2% two to three times a month, 1% - once per month, 2% - less often, and 3% - never. Therefore, using these percentages, the estimated numbers of men who use shampoo in the US are: [Find the calculations in the research strategy section]

- 82,038,310 - The estimated number of men who use shampoo daily in the US, i.e., 51%

- 53,083,612 - The estimated number of men who use shampoo multiple times a week, i.e., 33%

- 11,260,160 - The estimated number of men who use the shampoo once per week, i.e., 7%

- 3,217,188 - The estimated number of men who use shampoo 2-3 times a month, i.e., 2%

- 1,608,594 - The estimated number of men who use the shampoo once per month, i.e., 1%

- 3,217,188 - The estimated number of men who use shampoo less often, i.e., 2%

- 4,825,782 - The estimated number of men who never use shampoo in the US, i.e., 3%

Research Strategy

For this research on men's hair health market size in the US, we commenced our search by going through market research reports by Allied Market Research, IBIS World, Mortor Intelligence, and Research and Markets. Also, we consulted statistical sources like Statista; and media and news articles published by Ein News and PR News Wire. However, these sources could only provide the following data: The global market size for men's hair care and styling products; the general market size for men's hair care in the US; the US market size for hair treatment and removal; the general number of Americans using hair regrowth products; and the percentage of US men who used shampoo in June 2017.

Next, we leveraged various beauty websites, articles, and statistics published by reputable industry sources, such as Grooming Louge, The Man Company, Men's Health, and others. However, none could provide the requested data. They only provide the hair care products men could use.

Lastly, we tried to triangulate the requested US data from the sources mentioned earlier by searching for the following information: The percentage of the US from the global men's hair care and styling products; and the percentage of the US men using hair regrowth products from the total number of Americans using the products. Unfortunately, none of the sources in the public domain had the data or figures to help us calculate the US men's hair health market size, including the value and the number of men utilizing the hair care products. The only relevant data we could find is the percentage of men who used shampoo in 2017 [Despite this information being sourced from a 2017 source, it helped us triangulate the estimated numbers of men who use shampoo in the US - check the calculations below]. Therefore, since the requested data could not be found in the public domain or triangulated, we have provided the general US data regarding hair care market size.

Calculations

- According to a survey conducted by Statista in June 2017, 51% of men use shampoo every day, 33% - multiple times a week, 7% - once per week, 2% two to three times a month, 1% - once per month, 2% - less often, and 3% - never.

- Therefore, to find an estimated number of men who use shampoo in the US. We calculated the numbers using the following formula:

- [(Percentage of men who use shampoo/100%) x 2017 men population] = number of men who use shampoo in the US

- However, in 2017, the population of men in the US was 160,859,432.

- Therefore:

- [(51/100)% x 160,859,432] = 82,038,310 - The estimated number of men who use shampoo every day in the US.

- [(33/100)% x 160,859,432] = 53,083,612 - The estimated number of men who use shampoo multiple times a week

- [(7/100)% x 160,859,432] = 11,260,160 - The estimated number of men who use the shampoo once per week

- [(2/100)% x 160,859,432] = 3,217,188 - The estimated number of men who use shampoo 2-3 times a month

- [(1/100)% x 160,859,432] = 1,608,594 - The estimated number of men who use the shampoo once per month

- [(2/100)% x 160,859,432] = 3,217,188 - The estimated number of men who use shampoo less often

- [(3/100)% x 160,859,432] = 4,825,782 - The estimated number of men who never use shampoo in the US.